At Natural Resource Stocks, we recently attended the International Rare Earths Conference, where industry leaders gathered to discuss the latest developments in this critical sector.

The event shed light on global production trends, technological breakthroughs in extraction methods, and the geopolitical landscape shaping the rare earth element market.

This blog post will highlight key insights from the conference, offering valuable information for investors and industry professionals alike.

Global Rare Earth Production Landscape

Shifting Paradigm in Global Reserves

The International Rare Earths Conference presented a comprehensive overview of the current state of global rare earth element (REE) production. The United States Geological Survey (USGS) estimated global reserves of rare earth elements at 99 million tons in 2009. However, recent explorations have dramatically altered this picture. Rare earth deposits now exist in approximately 34 countries across five continents, suggesting a much broader resource base than previously understood.

Brazil may soon surpass China in terms of rare earth deposits. This shift could significantly impact the global supply chain, potentially reducing the world’s dependence on Chinese production. Investors should monitor Brazilian mining developments, as they could present lucrative opportunities in the coming years.

Current Production Leaders

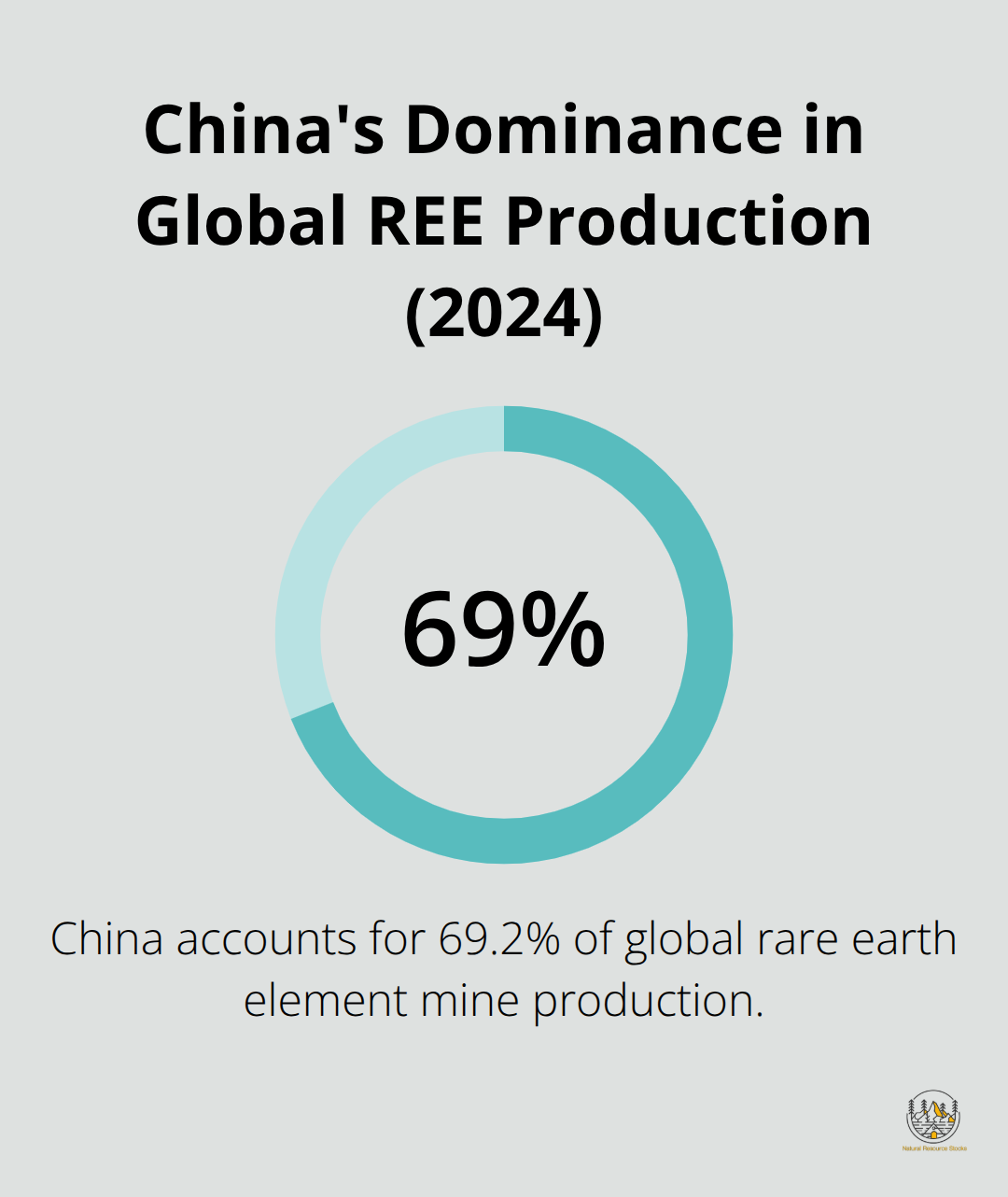

China continues to dominate the rare earth market, accounting for 69.2 percent of the world’s total REE mine production in 2024. However, this dominance faces challenges. Australia, through companies like Lynas Corp, has emerged as a key player. Lynas’ processing facility in Malaysia (with plans to increase production capacity to 21,000 tons) represents a significant step towards diversifying the global supply.

The United States, once a major producer, now makes efforts to revitalize its rare earth industry. Mountain Pass mine in California, operated by MP Materials, has resumed production and works towards full-scale operations. The company expects to begin commissioning a new facility in 2028, which will increase their total U.S. rare earth magnet manufacturing capacity.

Emerging Producers Reshape the Market

Several countries position themselves as emerging rare earth producers, potentially reshaping the global market. Vietnam and Malaysia develop their rare earth industries, with Vietnam’s reserves estimated to be substantial. These new entrants could help meet the growing global demand (currently around 50,000 tons per year and expected to rise significantly).

India and Russia also ramp up their rare earth production capabilities. India focuses on developing its beach sand mineral deposits, which contain significant amounts of rare earth elements. Russia’s Tomtor deposit in Yakutia (considered one of the world’s largest and richest rare earth deposits) has plans for large-scale development in the coming years.

The conference highlighted approximately 200 rare earth projects currently underway globally. These projects project a total production capacity exceeding 170,000 tons after 2015, potentially leading to a more diversified and stable supply in the future.

Investors should note that while these emerging producers offer new opportunities, they also face challenges. Environmental concerns (particularly regarding the presence of radioactive elements like thorium in most deposits) remain a significant hurdle. Additionally, the recovery rate for rare earth mining typically hovers around 20-30%, emphasizing the need for efficient extraction methods to ensure economic viability.

As we move forward, the focus shifts to the technological advancements that will shape the future of rare earth extraction. These innovations promise to address the challenges of efficiency and environmental impact that currently face the industry.

How Are Rare Earth Extraction Methods Evolving?

Breakthrough in Solvent Extraction

The International Rare Earths Conference showcased impressive advancements in extraction technologies. These innovations will revolutionize the industry and address long-standing challenges of efficiency and environmental impact.

Recent studies have reviewed extraction and characterization techniques for rare earth elements (REEs), Gallium (Ga), and Germanium (Ge) from coal fly ash (CFA) and red mud. This research summarizes the progress in solvent extraction methods, which could potentially improve the efficiency of rare earth element recovery.

Bioleaching: Nature’s Helping Hand

Bioleaching has emerged as an environmentally friendly alternative to conventional acid leaching. Scientists have been exploring the use of bacteria to extract rare earth elements from ore samples. This innovation could transform operations for companies aiming to minimize their environmental footprint.

Urban Mining: Tapping into E-Waste

Urban mining has moved from theory to practice. Companies have been developing processes to recover rare earth elements from discarded electronics. This approach reduces reliance on primary mining and addresses the growing global e-waste problem.

Impact on Market Dynamics

As these technologies mature, we expect a shift in the rare earth element market. Companies that adopt these innovative methods will likely gain a competitive edge (both in terms of cost-efficiency and environmental stewardship). Investors should monitor firms investing in these technologies, as they may be well-positioned for future growth in the rare earth sector.

The advancements in extraction and recycling technologies reshape the rare earth industry landscape. However, these technological breakthroughs represent only one piece of the puzzle. The geopolitical implications of rare earth resources continue to play a significant role in shaping market dynamics and investment opportunities. Understanding these complex geopolitical factors (and their potential impact on supply chains) will be essential for investors navigating this evolving sector.

Rare Earth Geopolitics Reshaping Global Markets

China’s Dominance in Rare Earth Supply

China currently dominates global rare earth production, accounting for over 69% in 2024. This control results from years of strategic investments and less stringent environmental regulations. However, Beijing’s recent export restrictions and production quotas have disrupted international supply chains, prompting a worldwide search for alternative sources.

Global Efforts to Diversify Supply Chains

Countries and companies actively pursue supply chain diversification to counter China’s market influence. The United States has labeled rare earths as critical minerals and allocated $156 million in 2025 for domestic rare earth projects. Australia’s Lynas Corporation secured a $120 million contract with the U.S. Department of Defense to construct a heavy rare earths processing facility in Texas (scheduled for completion in 2027).

Japan, a major rare earth consumer, has formed a partnership with Vietnam to develop new mines. This collaboration includes a $130 million investment in joint exploration projects. These initiatives aim to reduce reliance on Chinese exports and stabilize supply for critical industries.

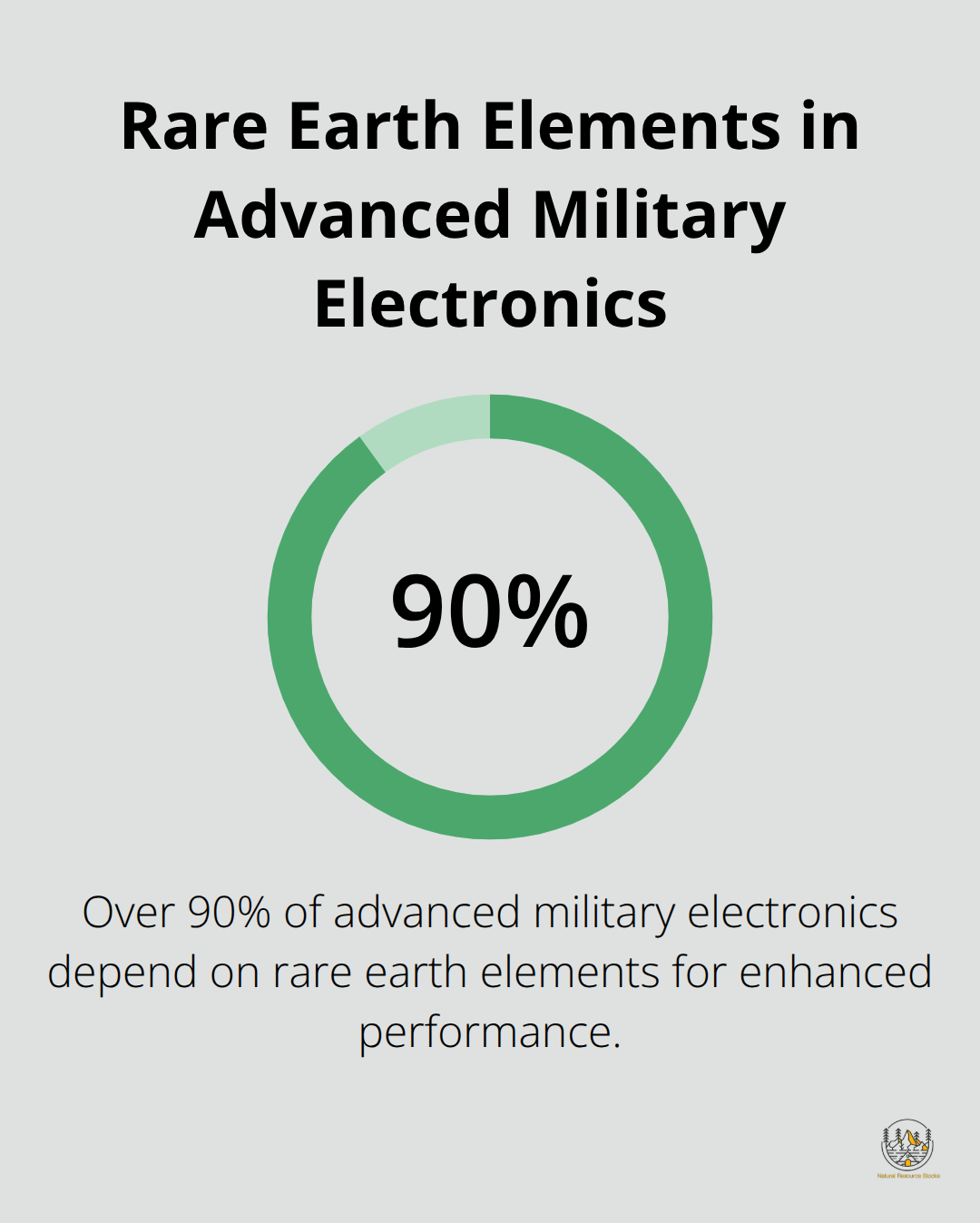

Strategic Importance in Technology and Defense

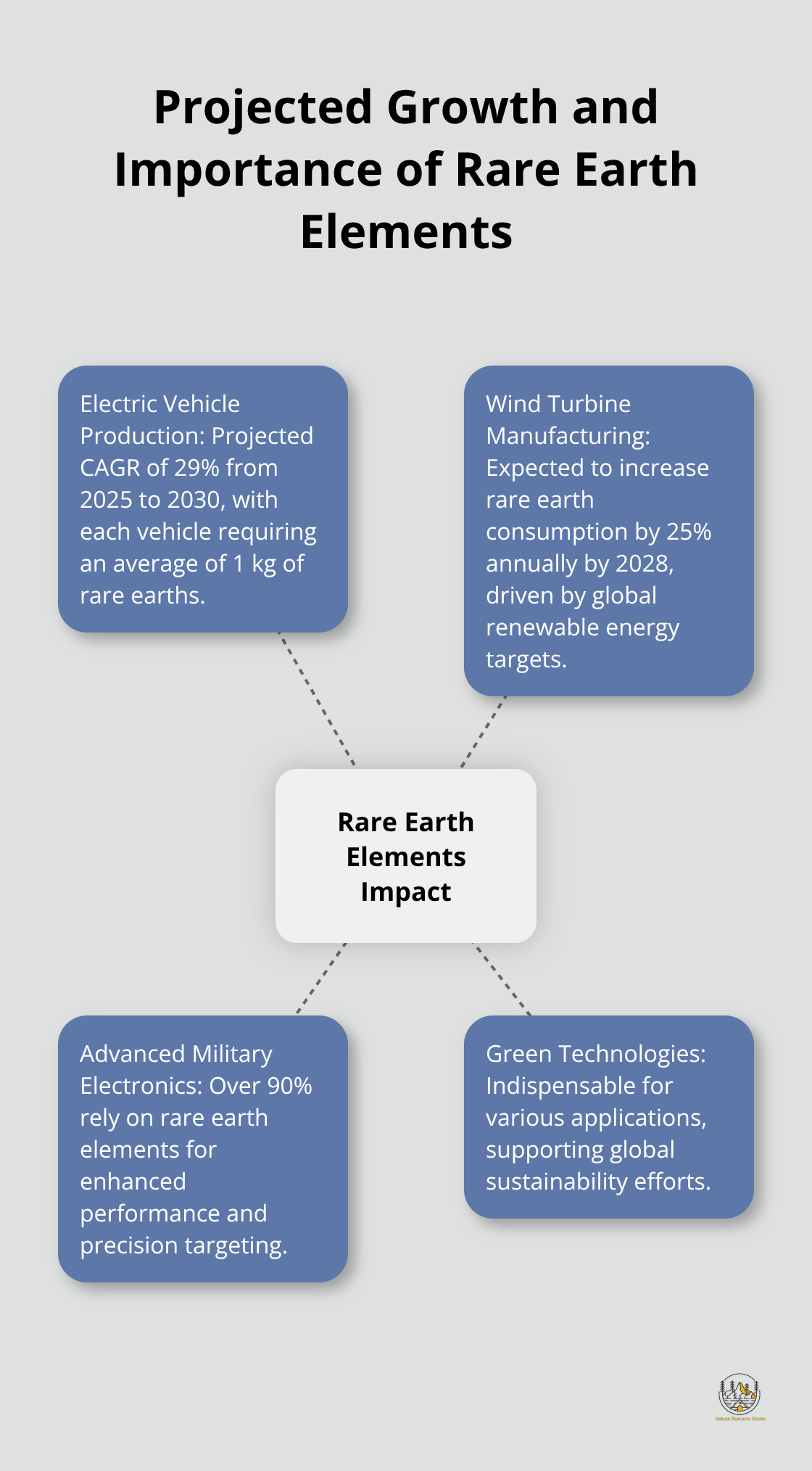

Rare earth elements hold significant strategic value beyond economic considerations. These materials play a vital role in advanced military technologies, including precision-guided missiles, radar systems, and night-vision equipment. Over 90% of advanced military electronics rely on rare earth elements for enhanced performance and precision targeting.

In the civilian sector, rare earths prove indispensable for green technologies. Electric vehicle production (which requires an average of 1 kg of rare earths per vehicle) is projected to grow at a CAGR of 29% from 2025 to 2030. Wind turbine manufacturers are expected to increase their rare earth consumption by 25% annually by 2028, driven by global renewable energy targets.

Investment Implications

Investors should focus on companies developing rare earth projects outside China, as well as those innovating in recycling and substitution technologies. These firms will likely benefit from increased government support and growing demand from technology and defense sectors.

The shifting geopolitical dynamics of rare earths reshape investment landscapes and industrial strategies globally. As supply chains evolve and new players emerge, understanding these changes will prove essential for making informed investment decisions in the natural resources sector.

Final Thoughts

The International Rare Earths Conference highlighted significant shifts in the global rare earth element industry. Brazil’s potential to surpass China as the leader in rare earth deposits signals a more diversified future for the sector. Technological advancements in extraction methods promise to address efficiency and environmental challenges, reshaping market dynamics in favor of innovative companies.

Geopolitical implications remain a critical factor in the rare earth industry. While China maintains its dominant position, global efforts to diversify supply chains gain momentum. The growing demand from green technologies and advanced military applications ensures a robust market, with electric vehicle production and wind turbine manufacturing set to drive significant growth.

Natural Resource Stocks offers comprehensive insights to help you navigate these complex market dynamics. Our platform provides expert commentary on geopolitical factors, policy impacts, and emerging market opportunities in the natural resources sector (including rare earth elements). We equip investors with the knowledge needed to make strategic decisions in this critical and evolving industry.