Rare earth minerals used for technology power everything from smartphones to electric vehicles. China controls 80% of global production, creating supply chain vulnerabilities for tech companies worldwide.

We at Natural Resource Stocks see growing opportunities as nations scramble to secure alternative sources. This guide reveals where these critical materials hide and how investors can profit from the mining boom.

Where Are Rare Earth Deposits Found

China dominates global rare earth production with 140,000 metric tons annually, primarily from the Bayan Obo mine in Inner Mongolia which holds 70% of the world’s known rare earth reserves. Australia ranks second with 22,000 tons per year from Mount Weld, while the United States produces 43,000 tons from Mountain Pass in California. Myanmar emerges as a wild card and contributes 26,000 tons through illegal operations that flood Chinese markets with cheap heavy rare earths.

The Big Three Production Centers

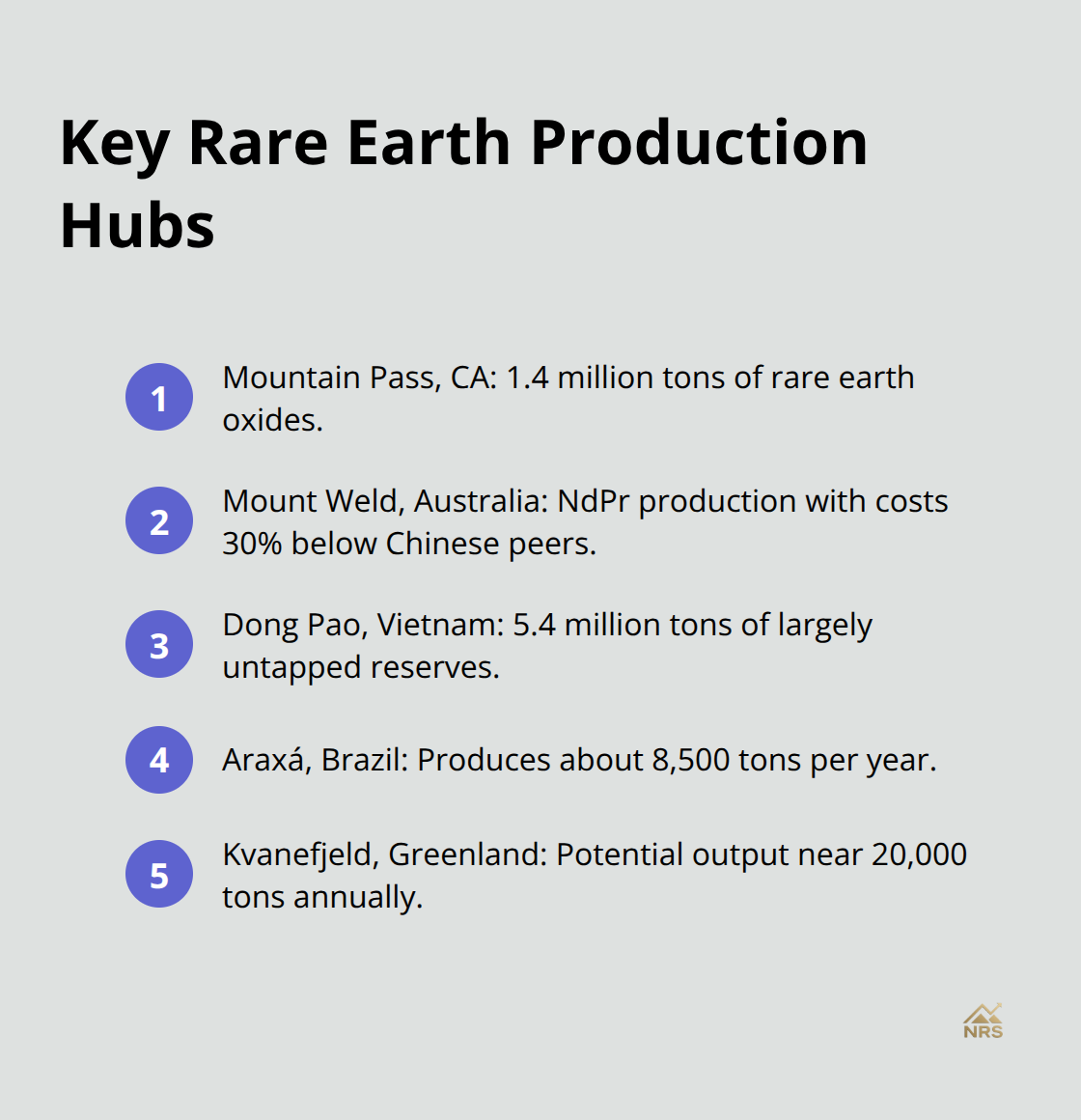

Mountain Pass in California contains 1.4 million tons of rare earth oxides and represents North America’s largest deposit. Lynas Corporation extracts neodymium and praseodymium from Mount Weld at costs 30% below Chinese competitors. Vietnam’s Dong Pao deposit holds 5.4 million tons of reserves but remains largely untapped due to complex extraction requirements.

Brazil’s Araxá mine produces 8,500 tons annually, while Greenland’s Kvanefjeld project could yield 20,000 tons per year once operational. These deposits contain different rare earth concentrations (light versus heavy elements) which affects their market value and applications.

Critical Processing Bottlenecks

Processing facilities create the real constraint in global supply chains. China controls 85% of rare earth refining capacity through companies like China Northern Rare Earth Group. Malaysia’s Lynas Advanced Materials Plant processes Australian ore and represents the only significant non-Chinese facility outside Asia.

Japan Metals & Chemicals stockpiles 60 days of supply, while Germany maintains strategic reserves worth $47 million. South Korea invested $24 billion in domestic processing capabilities after 2010 supply disruptions cost Samsung $19 million in production delays.

Geological Formation Patterns

Rare earth deposits form through specific geological processes that concentrate these elements in mineable quantities. Carbonatite complexes like Bayan Obo create the richest deposits through magmatic processes. Placer deposits in Myanmar and Malaysia concentrate heavy rare earths through weathering and erosion.

Ion-adsorption clays in southern China contain easily extractable rare earths but cause severe environmental damage. These geological differences determine extraction costs and environmental impact across different regions.

The next phase involves understanding how modern exploration techniques identify these hidden deposits before competitors stake their claims.

How Do Companies Find Rare Earth Deposits

Aeromagnetic surveys detect rare earth deposits through magnetic anomalies that indicate carbonatite intrusions. Helicopters fly systematic grid patterns at intervals while magnetometers measure magnetic field variations. Western Mining Corporation discovered the Steenkampskraal deposit in South Africa after this method detected magnetic anomalies.

Satellite hyperspectral imagery identifies rare earth minerals through their unique spectral signatures at wavelengths between 400-2500 nanometers. WorldView-3 satellite data costs $25 per square kilometer and detects neodymium concentrations above 500 parts per million across vast areas before ground teams arrive.

Laboratory Analysis Reveals Exact Concentrations

Portable X-ray fluorescence analyzers provide instant rare earth element readings with 95% accuracy in field conditions. These $40,000 devices detect cerium and lanthanum concentrations within 30 seconds but struggle with heavy rare earths below detection limits.

Inductively coupled plasma mass spectrometry remains the gold standard for precise analysis and measures individual rare earth elements down to parts per billion levels. SGS Minerals Services charges $180 per sample for complete rare earth analysis that takes 5-7 days to complete. Companies typically collect samples every 25 meters along drill cores to map deposit boundaries and calculate tonnage estimates.

Advanced Detection Technologies Cut Exploration Costs

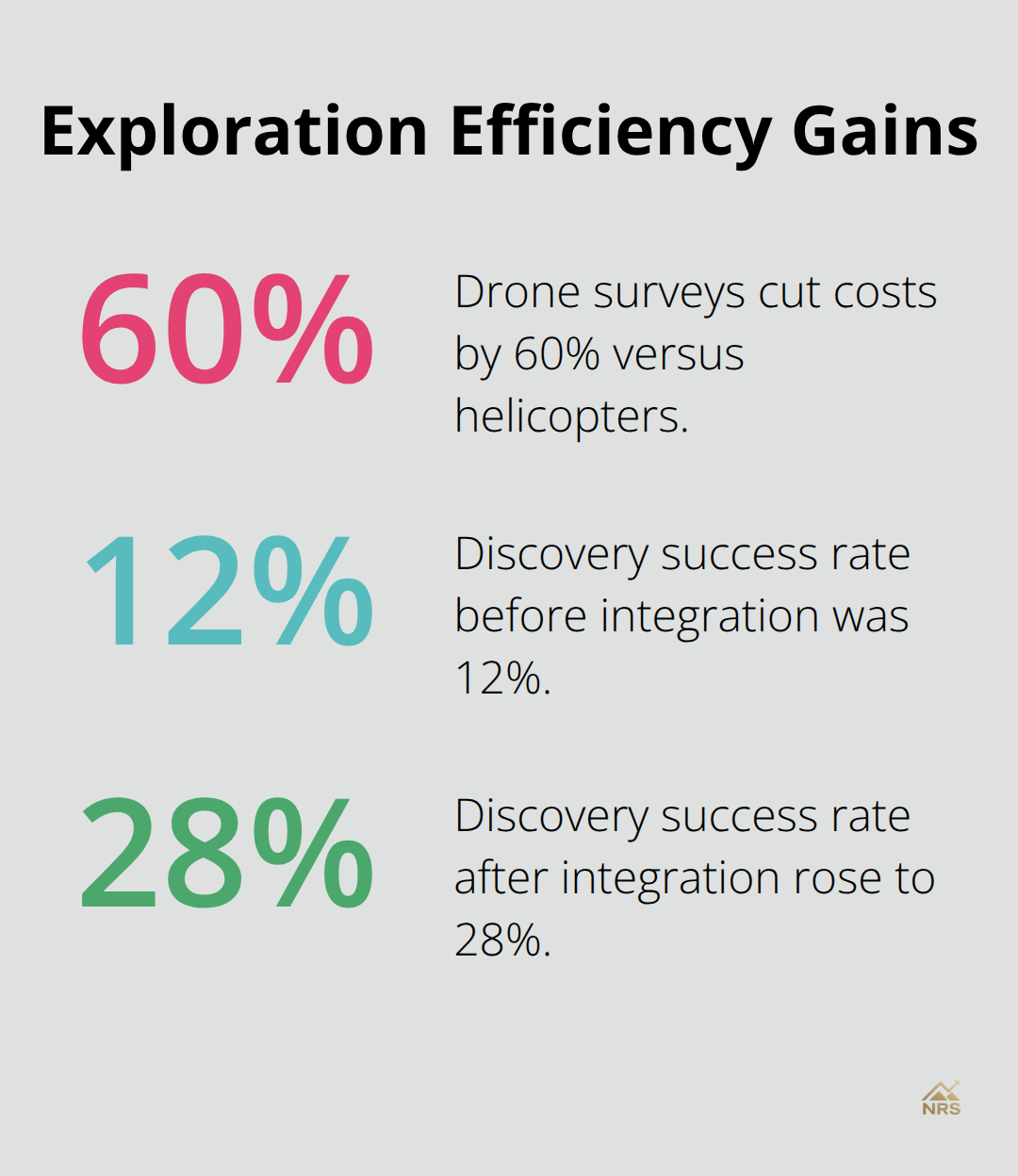

Drone-mounted gamma ray spectrometers identify near-surface hydrothermal alteration zones and uranium systems at survey costs 60% below traditional helicopter methods. Geotech Ltd developed the RESOLVE airborne system that combines electromagnetic and magnetic sensors to penetrate 500 meters underground.

This technology located the Strange Lake deposit in Quebec after conventional methods missed the 1.7 million ton resource. Ground-penetrating radar maps subsurface geology to 50-meter depths and guides drill programs that cost $300 per meter. Companies that use integrated exploration approaches reduce discovery costs from $15 million to $8 million per deposit while they increase success rates from 12% to 28%.

These exploration breakthroughs create investment opportunities for companies that master the technology (and the capital requirements that come with it).

Where Should You Invest in Rare Earth Mining

Lynas Rare Earths trades at $6.40 per share and generates 22% gross margins from its Mount Weld operations in Australia. The company processes rare earth materials outside Chinese control and benefits from Pentagon contracts. MP Materials operates the only active rare earth mine in North America and produces 43,000 tons yearly at cash costs of $4,200 per ton.

Their stock price jumped 340% between 2020 and 2021 as supply chain concerns peaked, then dropped 75% by 2023 when Chinese exports resumed.

Direct Stock Investments Beat ETF Performance

VanEck Rare Earth ETF charges 0.59% annual fees and holds 25 companies across the supply chain, but 60% of holdings are Chinese firms subject to geopolitical risks. Individual rare earth stocks outperformed the ETF by 180% during the 2021 bull market because focused companies captured more upside than diversified funds.

Rainbow Rare Earths owns the Gakara project in Burundi and trades at 12 pence per share with 8.4 million tons of resources. Their production costs average $28 per kilogram compared to Chinese competitors at $35 per kilogram.

Private Equity Targets Processing Infrastructure

Blackstone invested $400 million in MP Materials before its IPO and generated 4.2x returns within three years. Private investors focus on processing facilities rather than mining operations because refining creates higher margins and strategic value.

Malaysia’s Lynas processing plant cost $800 million to build and generates $200 million annual EBITDA from Australian ore. Joint ventures between Western mining companies and Asian processors reduce political risks while they share capital requirements.

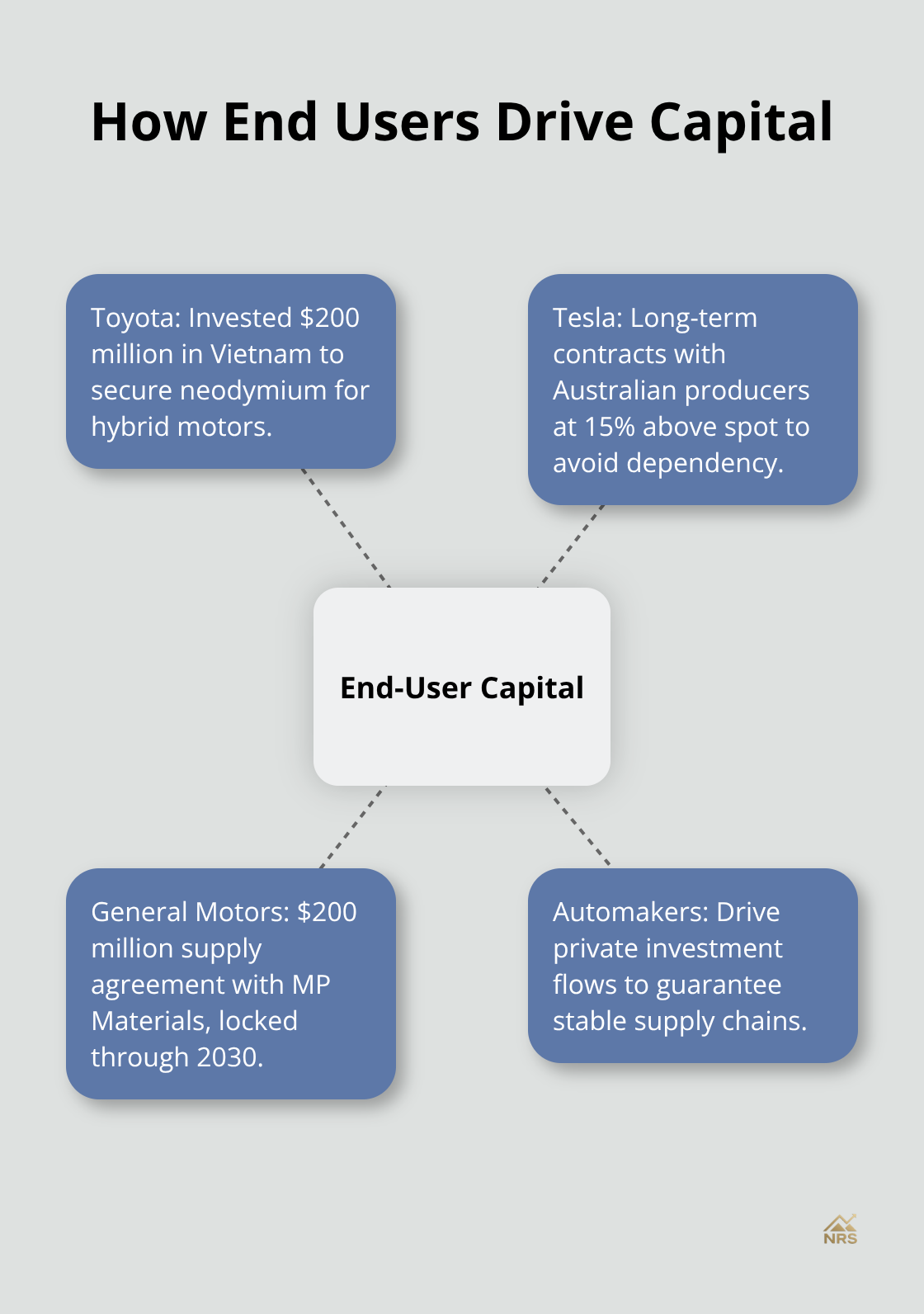

End Users Drive Investment Flows

Toyota invested $200 million in Vietnamese rare earth projects to secure neodymium supplies for hybrid vehicle motors. This demonstrates how automotive manufacturers drive private investment flows when they need guaranteed supply chains. Tesla signed long-term contracts with Australian producers at premium prices (15% above spot rates) to avoid Chinese dependency for battery materials.

General Motors partnered with MP Materials through a $200 million supply agreement that locks in pricing through 2030. These strategic partnerships provide mining companies with guaranteed revenue streams while manufacturers secure critical materials outside Chinese control.

Final Thoughts

China controls 80% of rare earth minerals used for technology, which creates massive investment opportunities as global demand surges. Electric vehicle sales reached 14 million units in 2023 and drove neodymium consumption up 23% annually. Smartphone production requires 17 different rare earth elements, with global shipments hitting 1.2 billion devices yearly.

Supply diversification accelerates as governments invest $47 billion in non-Chinese sources. Australia will triple production capacity to 66,000 tons by 2027, while U.S. processing facilities receive $2.9 billion in federal funding. These shifts create profit potential for investors who position early in Western rare earth companies.

Technology demand shows no signs of slowing (wind turbine installations need 600 kilograms of rare earths per megawatt, with 77 gigawatts planned globally through 2025). Defense spending on rare earth-dependent systems reaches $89 billion annually across NATO countries. Visit Natural Resource Stocks for comprehensive market analysis and investment strategies across metals and energy sectors.