China controls over 80% of global rare earth minerals production, giving it unprecedented power over industries from smartphones to military defense systems.

We at Natural Resource Stocks have tracked how Beijing uses export restrictions and pricing strategies to maintain this dominance. The implications reach far beyond mining into geopolitics and technology supply chains.

How China Maintains Its Rare Earth Monopoly

China operates 21 major rare earth mines across Inner Mongolia, Sichuan, and Jiangxi provinces. These facilities produce 240,000 metric tons annually according to updated quotas. The Bayan Obo mine alone contains 40 million tons of rare earth reserves, which makes it the world’s largest deposit.

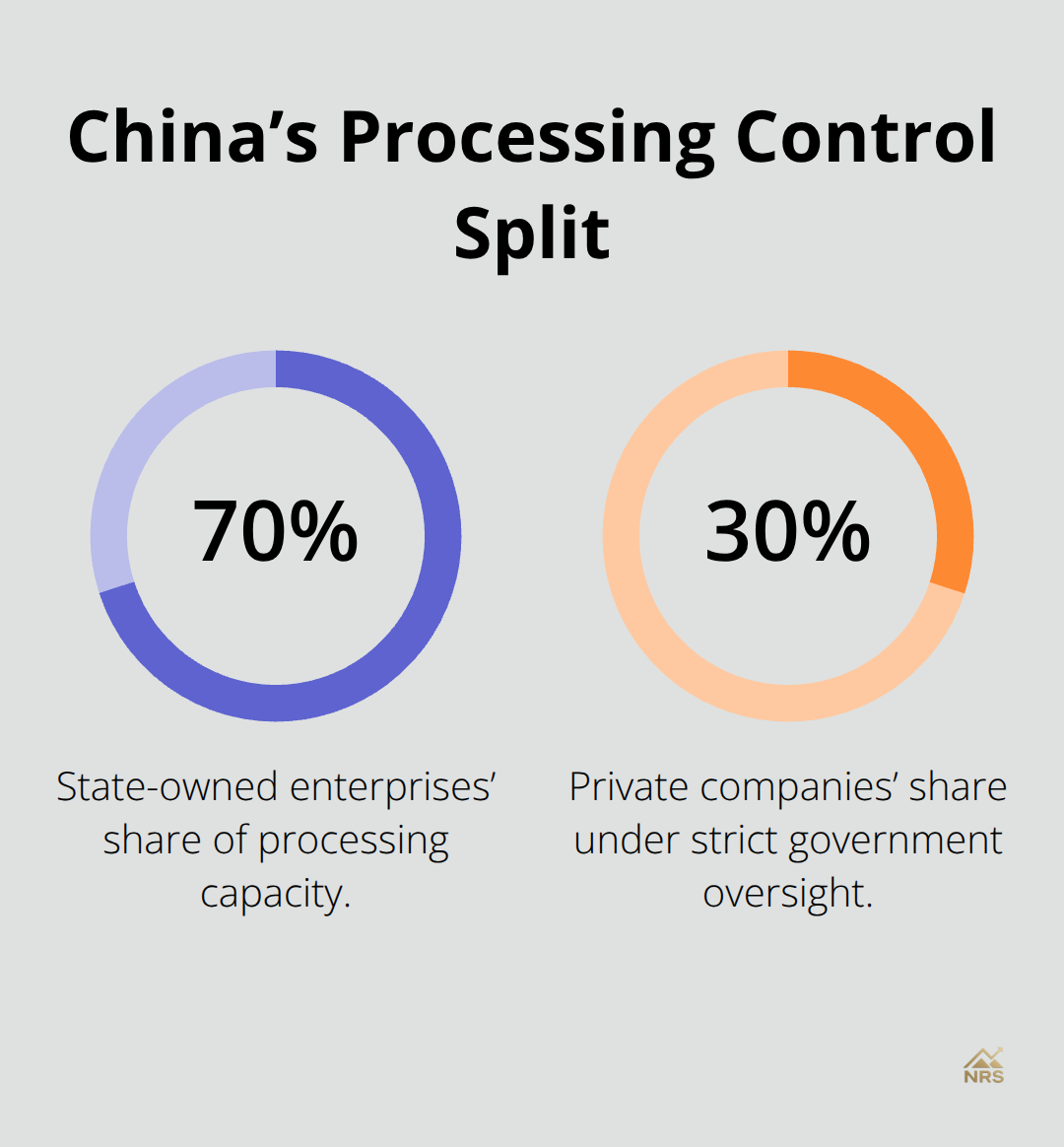

Beijing invested $30 billion in rare earth infrastructure since 2010. This investment built integrated supply chains from extraction to refined products. State-owned enterprises like China Minmetals control 70% of processing capacity, while private companies handle the remaining 30% under strict government oversight.

Processing Monopoly Creates Supply Bottlenecks

China processes 85% of global rare earth oxides despite controlling only 37% of known reserves. The country refined 230,000 tons of rare earth oxides in 2023, compared to just 15,000 tons from all other countries combined. Chinese facilities in Baotou and Ganzhou use hydrometallurgical processes that cost 40% less than Western alternatives.

The government subsidizes electricity costs for rare earth smelters. This reduces operational expenses by $2,000 per ton compared to US facilities. This processing advantage forces even countries with their own rare earth mines to ship raw materials to China for refinement.

Strategic State Control Eliminates Market Competition

Beijing classifies rare earths as strategic resources under direct Communist Party supervision. The Ministry of Industry controls production quotas and sets 2024 limits at 120,000 tons for light rare earths and 26,500 tons for heavy rare earths. State planners coordinate prices through the China Rare Earth Industry Association, which includes all major producers.

Environmental regulations exempt state-owned rare earth companies while they restrict private miners. This consolidates control among six approved groups. The centralized system allows China to manipulate global prices and supply availability based on geopolitical objectives rather than market forces.

These control mechanisms extend beyond domestic production into international trade policy, where China wields export restrictions as economic weapons.

How China Weaponizes Rare Earth Trade

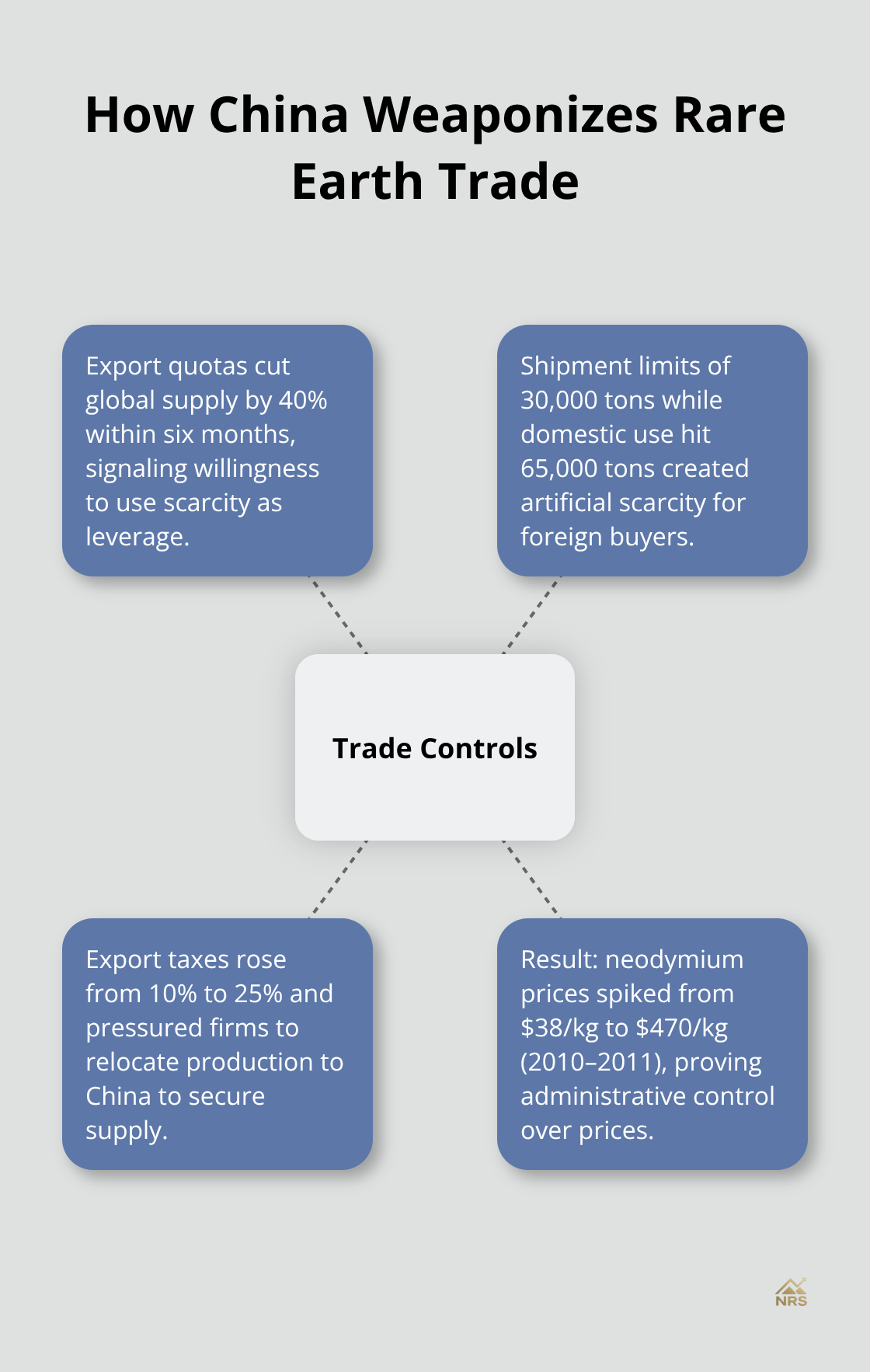

China imposed export quotas on rare earth elements in 2010 and cut global supply by 40% within six months. Beijing restricted shipments to 30,000 tons annually while domestic consumption reached 65,000 tons, which created artificial scarcity for foreign buyers. The government raised export taxes from 10% to 25% on processed rare earths and forced international companies to relocate production to China or face supply shortages. These restrictions pushed neodymium prices from $38 per kilogram to $470 per kilogram between 2010 and 2011, which demonstrated China’s ability to manipulate global markets through administrative controls.

Trade Restrictions Target Strategic Competitors

Beijing halted rare earth exports to Japan for two months in 2010 during territorial disputes over the Senkaku Islands. This embargo cost Japanese manufacturers $200 million in lost production and forced Toyota to redesign hybrid vehicle components. China currently maintains export licenses that create three-month delays for approved buyers while domestic companies receive immediate access. The Ministry of Commerce reviews all export applications and routinely rejects orders to countries that pursue independent rare earth development programs. These selective restrictions serve geopolitical objectives rather than commercial interests.

Defense Industries Face Critical Vulnerabilities

Each F-35 fighter jet requires significant amounts of rare earth materials, while Virginia-class submarines need 9,200 pounds (according to Pentagon assessments). China supplied about 70% of the U.S.’ rare earth imports in 2023, which creates strategic dependence that Beijing exploits through supply disruptions. American defense contractors stockpile 90 days of inventory compared to 18 months for Chinese competitors, and this leaves US production vulnerable to export bans. The Pentagon identified rare earth shortages as the primary threat to weapons production timelines, with new procurement cycles that extend from 24 months to 48 months when Chinese supplies become unavailable.

Price Manipulation Destabilizes Global Markets

China floods international markets with cheap rare earths when competitors attempt to establish alternative sources. The government subsidizes domestic producers through tax breaks and low-interest loans, which allows them to sell below production costs. This strategy forced the closure of Mountain Pass mine in California (2002-2012) and Lynas Corporation’s initial operations in Australia. Chinese producers coordinate price drops through state-controlled associations and target specific rare earth elements that new mines depend on for profitability.

These economic warfare tactics have prompted major economies to develop comprehensive strategies for supply chain independence and alternative sourcing arrangements.

How Countries Break China’s Rare Earth Stranglehold

Major economies invested significant amounts in alternative rare earth projects between 2020 and 2024 to reduce dependence on Chinese supplies. The United States allocated $3.1 billion through the Defense Production Act for domestic operations, while the European Union committed $2.8 billion to Critical Raw Materials Act initiatives. Australia expanded funds for Lynas Corporation operations in Malaysia and received $1.4 billion in government support to increase capacity from 22,000 tons to 35,000 tons annually.

Canada launched the Critical Minerals Strategy with $958 million for rare earth development and targets 15% of global production by 2030. These investments focus on heavy rare earths like dysprosium and terbium, where China controls 95% of global supply.

Strategic Stockpiles Create Supply Buffer

The Pentagon maintains a 12-month inventory of critical rare earths through the Defense Logistics Agency (valued at $400 million as of 2024). Japan stockpiles 60 days of rare earth imports through the Japan Oil, Gas and Metals National Corporation, which purchased 8,200 tons in 2023. South Korea established a 90-day strategic reserve through Korea Resources Corporation and spent $180 million on neodymium and praseodymium.

Germany created the Federal Institute for Geosciences stockpile program with 45-day supplies of europium and gadolinium. These reserves cost governments $2.3 billion annually but provide power against Chinese export restrictions.

Advanced Recovery Technologies Cut Import Needs

Honda recovers rare earths from hybrid vehicle batteries at its Ohio facility and processes 10,000 units annually while it extracts 2.4 tons of neodymium. Apple recycles rare earths from 9 million devices yearly through its Daisy robot system and recovers 1.8 tons of rare earth elements per facility. European plants operated by Solvay and Rhodia process 4,500 tons of rare earth-waste annually and achieve 85% recovery rates.

These operations reduce virgin rare earth demand by 12,000 tons globally and cost 30% less than new projects while they eliminate Chinese supply chain risks.

Final Thoughts

China’s control over rare earth minerals remains formidable despite international resistance. Beijing holds an 80% production share and 85% processing monopoly that creates structural advantages competitors cannot match quickly. The $30 billion infrastructure investment and state subsidies give Chinese producers cost advantages of $2,000 per ton over Western facilities.

Cracks appear in this dominance as alternative projects emerge. Projects in Australia, Canada, and the United States will add 50,000 tons of annual capacity by 2027. Strategic stockpiles worth $2.3 billion provide governments with power during supply disruptions (while recycling technologies now recover 12,000 tons annually).

We at Natural Resource Stocks expect China’s market share to drop to 65% by 2030 as diversification efforts mature. The transition creates investment opportunities in non-Chinese rare earth projects, recycling technologies, and processing facilities outside China. Companies that develop heavy rare earth alternatives and magnetic recycling systems offer the strongest growth potential as governments prioritize supply chain security. Natural Resource Stocks provides expert analysis and investment insights across metals and energy sectors to help investors navigate these market dynamics.