Rare earth minerals stocks have surged 47% this year as global demand for electric vehicles and renewable energy infrastructure accelerates. China controls 85% of global rare earth processing, creating supply chain vulnerabilities that smart investors are watching closely.

We at Natural Resource Stocks have identified three standout companies positioned to capitalize on this $7.8 billion market opportunity.

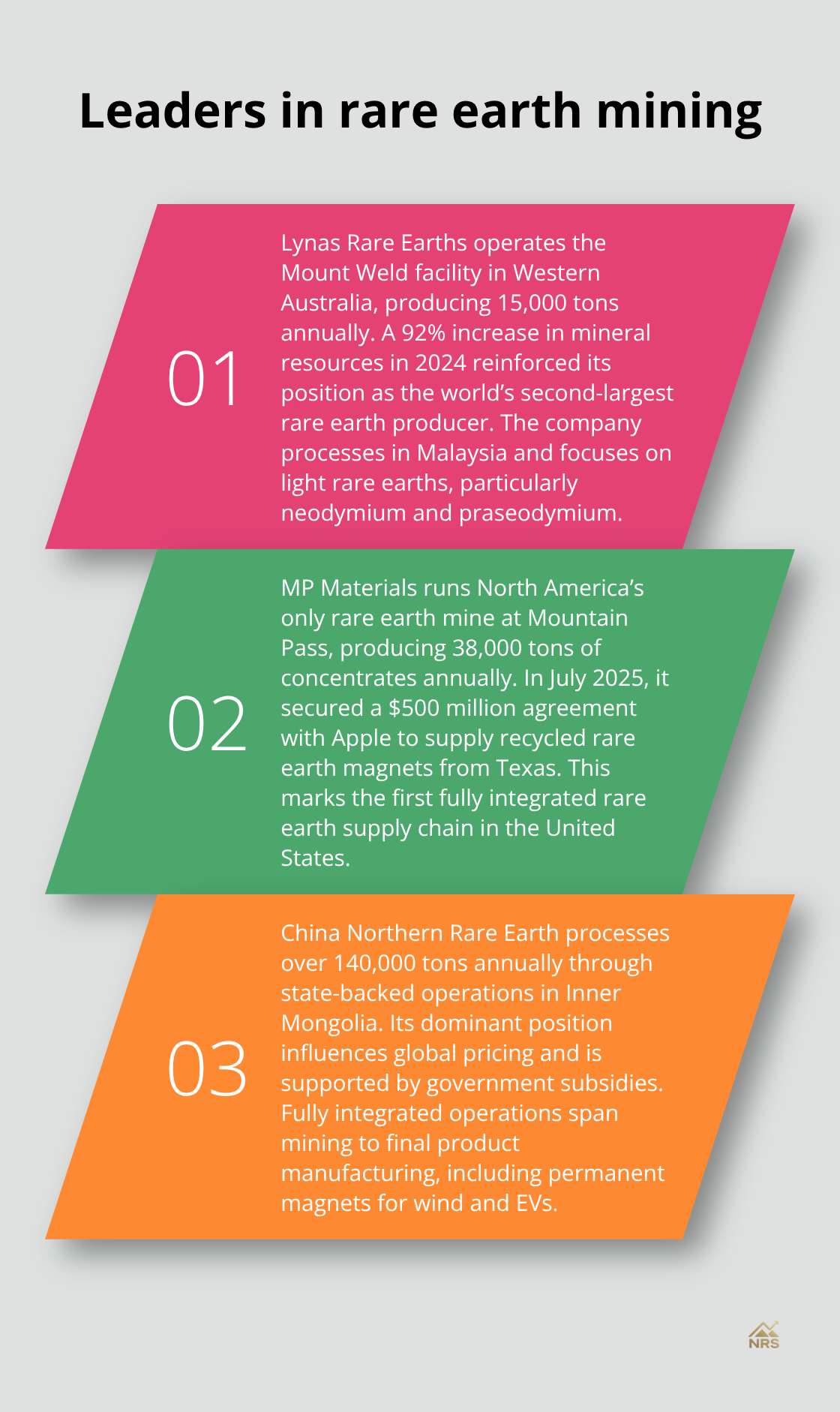

Which Companies Lead the Rare Earth Mining Sector

Lynas Rare Earths Dominates Outside China

Lynas Rare Earths controls the largest rare earth operation outside China, with its Mount Weld facility in Western Australia producing 15,000 tons annually. The company reported a 92% increase in mineral resources in 2024, which solidified its position as the world’s second-largest rare earth producer. Lynas processes materials at its Malaysian facility and focuses exclusively on light rare earth elements, particularly neodymium and praseodymium.

These elements command premium prices in the electric vehicle magnet market (neodymium trades at $65-70 per kilogram). The company’s vertical integration from mine to separated oxides provides significant cost advantages over competitors who depend on Chinese processing facilities.

MP Materials Leads North American Production

MP Materials operates North America’s only rare earth mine at Mountain Pass, California, where it produces 38,000 tons of rare earth concentrates annually. The company secured a transformative $500 million agreement with Apple in July 2025 to supply recycled rare earth magnets from their Texas facility. This deal represents the first fully integrated rare earth supply chain in the United States.

MP Materials stock jumped 356% over the past year as investors recognized their strategic position in Western supply chain independence. The company plans to complete its magnet manufacturing facility by 2025, which will process their own concentrates into finished products.

China Northern Rare Earth Controls Global Markets

China Northern Rare Earth maintains control over global supply chains through its state-backed operations in Inner Mongolia, processing over 140,000 tons annually. The company sets global pricing through its dominant market position and benefits from government subsidies that Western competitors cannot match. Their integrated operations span from mining to final product manufacturing (including permanent magnets for wind turbines and electric vehicles).

This market concentration creates both opportunities and risks that investors must evaluate when selecting individual stocks versus diversified approaches to rare earth exposure.

What Makes a Rare Earth Stock Worth Buying

Production Scale Determines Market Position

Production volume separates winners from speculation plays in rare earth investments. Companies that produce significant volumes like Lynas and MP Materials command pricing power and attract institutional investors. Smaller producers face higher per-unit costs and struggle during price downturns.

Processing capabilities matter more than raw output because separated rare earth oxides sell for 3-5 times the price of concentrates. MP Materials proved this when they secured premium contracts after they announced their Texas separation facility, while competitors who ship concentrates to China accept commodity prices.

Geographic Risk Concentration Destroys Returns

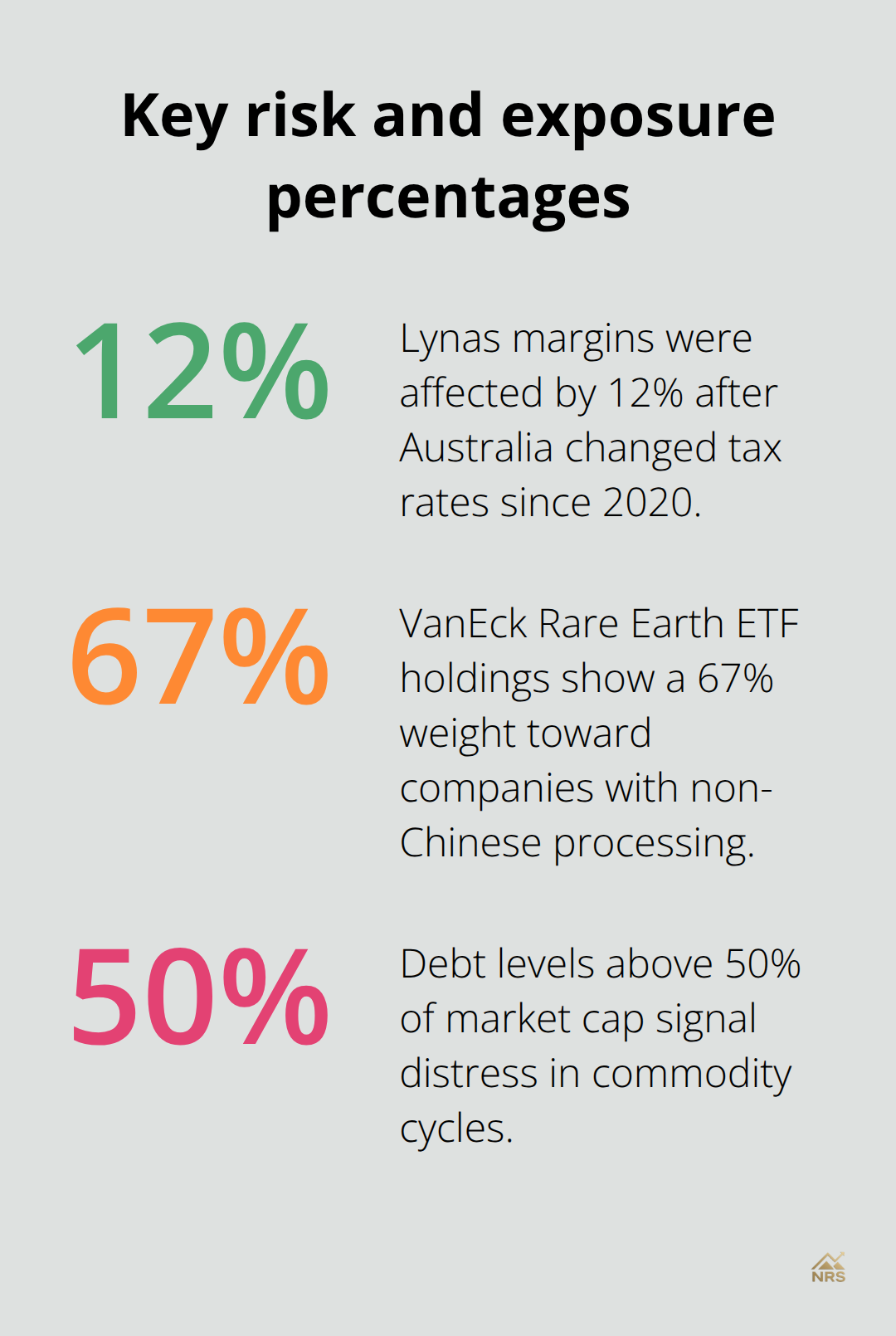

Single-country operations expose investors to regulatory changes and resource nationalism. Australia changed tax rates twice since 2020, which affected Lynas margins by 12%. Companies with operations across multiple jurisdictions like Energy Fuels spread political risk effectively.

Supply chain independence from China adds 15-20% valuation premiums as Western governments prioritize domestic processing. The VanEck Rare Earth ETF holdings show 67% weight toward companies with non-Chinese processing facilities.

Financial Strength Predicts Survival

Cash flow stability requires strong balance sheets and operating margins above 20% during normal market conditions. Lynas maintained 23% operating margins through 2023 price volatility while smaller producers averaged 8% margins.

Debt levels above 50% of market cap signal distress during commodity cycles. MP Materials carries minimal debt with $400 million cash reserves (which positions them for acquisitions during downturns). Companies that burn more than $50 million annually without revenue growth face dilution risks that destroy shareholder value.

Free cash flow generation separates sustainable businesses from capital-intensive projects that require continuous financing. These financial metrics become even more important when you consider the market trends that drive rare earth demand across multiple industries.

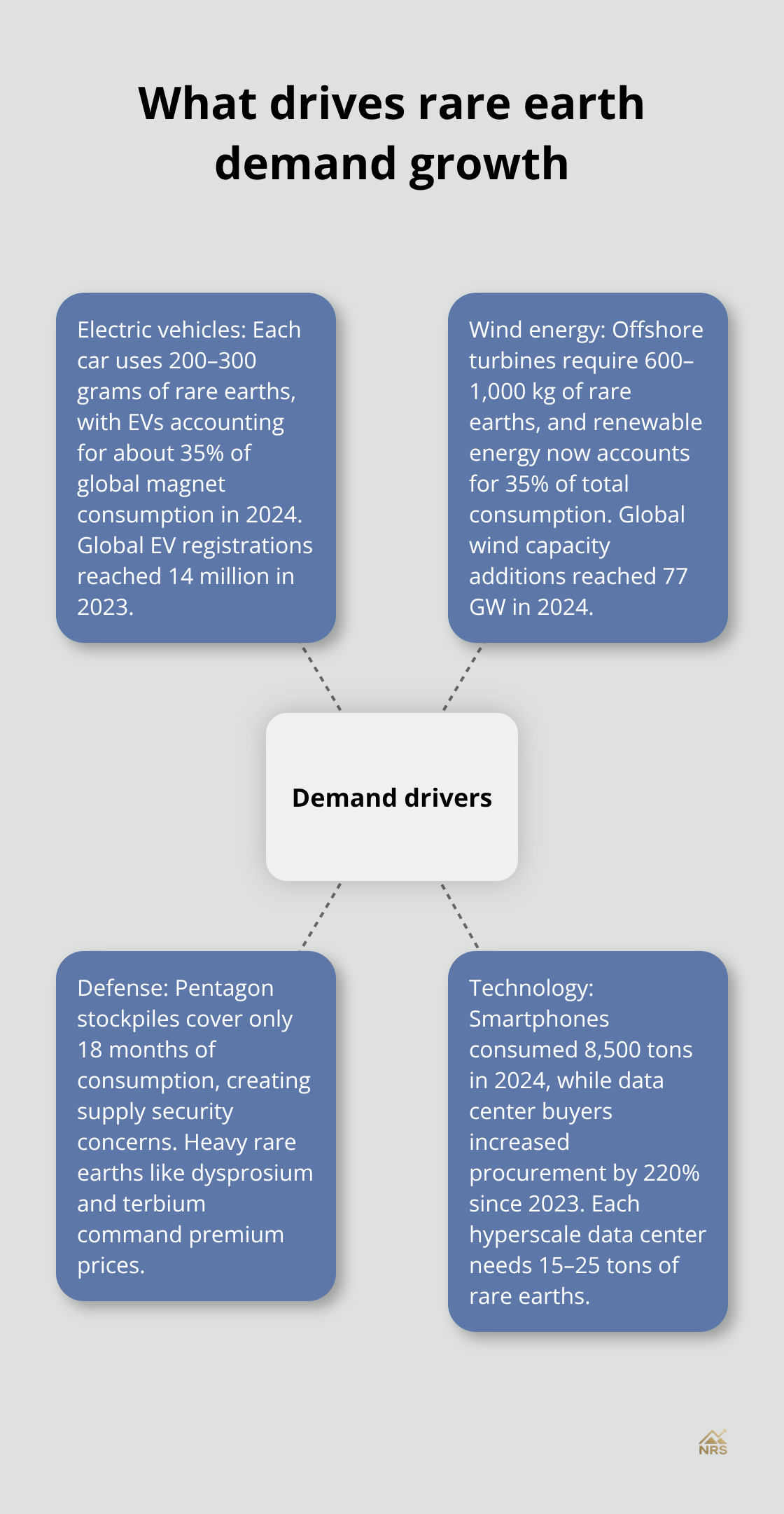

What Drives Rare Earth Demand Growth

Electric Vehicle Production Accelerates Consumption

Electric vehicle production demands 200-300 grams of rare earth elements per car, with neodymium and dysprosium commanding $65-85 per kilogram for permanent magnet motors. The electric vehicle sector consumed approximately 12,000 metric tons of rare earth permanent magnets in 2024, representing 35% of total global consumption, while 14 million new electric cars were registered globally in 2023. Each EV requires six times more rare earth content than traditional vehicles, which creates structural demand that will hit 85,000 tons annually by 2030.

Battery manufacturers like CATL and BYD signed exclusive supply agreements with Western producers to avoid Chinese export restrictions that affected 15% of global lithium-ion production in 2024. Major automakers now compete for long-term contracts as supply constraints tighten across the industry.

Wind Turbines Create Massive Industrial Demand

Offshore wind installations consume 600-1,000 kilograms of rare earths per turbine, with neodymium prices jumping 40% when Europe accelerated renewable targets. General Electric and Vestas increased rare earth procurement by 180% over two years as wind capacity additions reached 77 gigawatts globally in 2024.

Each gigawatt of wind power requires approximately 200 tons of rare earth permanent magnets, which makes wind energy the fastest-growing industrial application. The renewable energy sector now accounts for 35% of total rare earth consumption, surpassing traditional electronics applications.

Defense Applications Drive Premium Pricing

Defense contractors like Lockheed Martin and Raytheon depend on dysprosium and terbium for radar systems and precision-guided munitions. Pentagon stockpiles cover only 18 months of consumption at current usage rates, which creates supply security concerns for military applications.

Heavy rare earth elements command premium prices in defense contracts (dysprosium trades at $400-450 per kilogram). Military specifications require higher purity levels than commercial applications, which limits supplier options and increases pricing power for qualified producers.

Technology Sector Amplifies Overall Demand

Smartphone manufacturers consumed 8,500 tons of rare earths in 2024, with Apple securing dedicated supply through its MP Materials partnership while Samsung diversified across four non-Chinese suppliers. Data center expansion drives yttrium demand for fiber optic cables, with Microsoft and Amazon increasing rare earth procurement by 220% since 2023.

Each hyperscale data center requires 15-25 tons of rare earth elements for servers, cooling systems, and network equipment. This industrial demand now exceeds consumer electronics consumption and continues to grow as cloud infrastructure expands globally.

Final Thoughts

Rare earth minerals stocks present strong opportunities as global demand hits 85,000 tons annually by 2030, with electric vehicle production and renewable energy expansion as primary drivers. MP Materials and Lynas Rare Earths hold the strongest positions outside Chinese control, backed by proven production capabilities and strategic Western partnerships. Portfolio allocation should cap rare earth exposure at 5-10% of total holdings due to price volatility and geopolitical risks.

Companies with integrated processing facilities command 15-20% valuation premiums over concentrate producers, while strong balance sheets with minimal debt provide survival advantages during commodity cycles. The sector experiences supply chain transformation as Western governments invest $12 billion in domestic processing capabilities to reduce Chinese dependency (creating new opportunities for established producers). Defense applications and technology infrastructure maintain sustained premium prices for heavy rare earth elements, particularly dysprosium and terbium.

We at Natural Resource Stocks provide comprehensive analysis of natural resource investments across metals and energy sectors. Our expert market insights help investors navigate macroeconomic factors and geopolitical impacts that affect resource prices. This analysis empowers informed investment strategies in this dynamic sector.