Recorded on December 11, 2025

Jeff Phillips is President of Global Market Development and a long-time activist investor in the junior resource sector. In this interview with host Andy Millette, Jeff explains why a short-term gold pullback doesn’t automatically mean the cycle has topped, and why he believes the next leg of the resource bull market will be driven by geopolitics, supply chains, and “security of supply.”

Key topics include:

- Gold pullbacks vs. real cycle tops

- Why this resource cycle is different (geopolitics + supply chains)

- Security of supply and critical minerals

- How Jeff sizes junior positions (risk control)

- What he looks for in people, structure, and assets in junior deals

Guest links

Website: https://globalmarketdevelopment.com

Host / channel links

Natural Resource Stocks website: https://naturalresourcestocks.net

YouTube (full interviews): https://www.youtube.com/@naturalresourcestocks

YouTube (clips): https://www.youtube.com/@NaturalResoureStocksClips

X: https://x.com/theandymillette

LinkedIn: https://www.linkedin.com/in/andymillette

Chapters

00:00 Intro

01:13 Gold pullback context

01:27 “Was that the top?”

01:42 Bull market cycle setup

01:59 Geopolitics + security of supply

02:34 Rare earths / critical minerals angle

06:24 “Small slice of your pie” (position sizing)

08:47 “There’s some luck involved” (process + realism)

13:16 What matters most: people, structure, assets

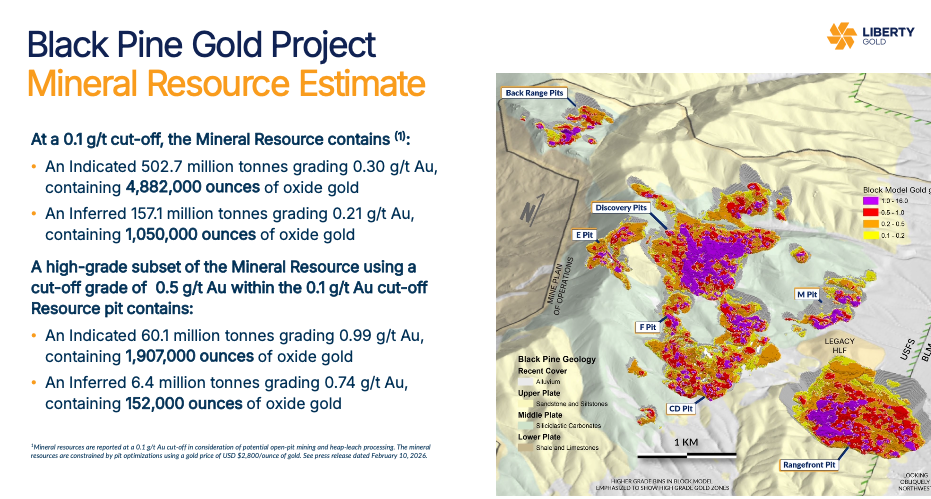

21:59 Valuation / leverage talk (Revival mentioned)

28:37 Closing thoughts

Natural Resource Stocks #Millettian

Financial Disclaimer for Galt Consulting Group dba NaturalResourceStocks.net:

The information in this video is for general informational purposes only and is not investment advice. Viewers should do their own due diligence and consult a licensed professional before making any investment decision. All investing involves risk, including loss of principal.