Silver prices swing wildly based on industrial demand, geopolitical shocks, and currency movements. Predicting these swings requires more than gut instinct-it demands data, methodology, and discipline.

At Natural Resource Stocks, we’ve built this guide to show you exactly how to forecast future silver prices using real tools and proven approaches. You’ll learn what moves the market, which forecasting methods actually work, and the mistakes that derail most investors.

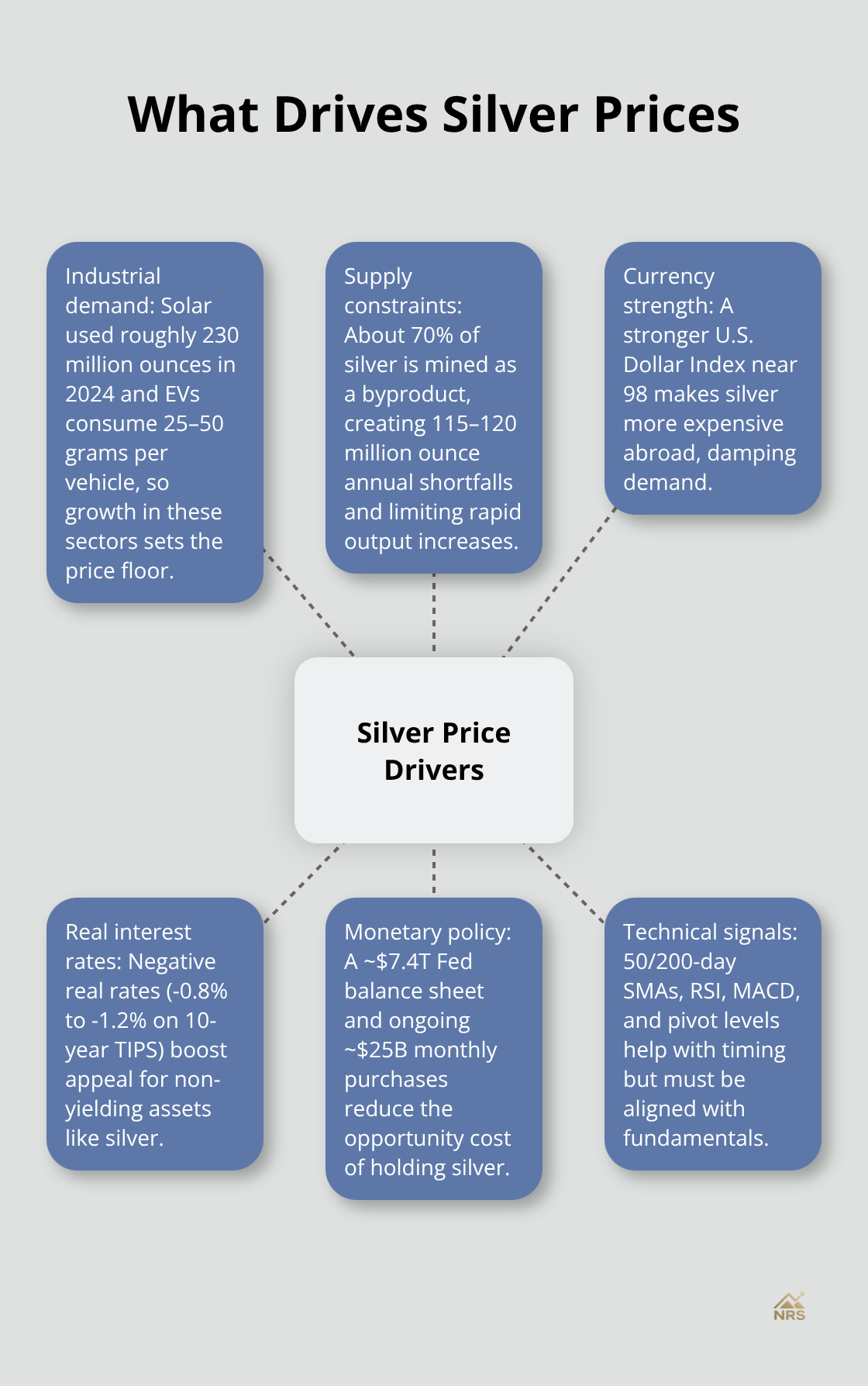

What Actually Moves Silver Prices

Industrial demand is the dominant force behind silver prices, and it’s far more predictable than most investors realize. Solar panel manufacturing consumed roughly 230 million ounces of silver in 2024, up more than 25% from the prior year. This matters because solar installations are growing at a 15-17% compound annual rate through 2026 per the International Energy Agency, which means silver demand from solar alone will keep climbing. Electric vehicles amplify this trend further, with each EV consuming 25-50 grams of silver in batteries, wiring, and electronics. Global EV production is expected to more than double by 2030, creating a structural floor under silver demand that won’t disappear during temporary price pullbacks. When you analyze silver prices, focus on solar capacity additions and EV production numbers rather than betting on supply shocks that rarely materialize as expected.

Supply Deficits Create Real Price Support

Silver production cannot keep pace with industrial consumption. The market faces a 115-120 million ounce shortfall in 2026, with cumulative deficits reaching 700 million ounces driven by inelastic supply and surging industrial demand. This structural imbalance exists because roughly 70% of silver production comes as a byproduct of mining other metals like copper and zinc. Mining companies cannot simply ramp up silver output when prices rise because they are constrained by their primary ore targets. This constraint matters when you forecast prices: supply cannot spike to meet demand spikes, which creates upside volatility in price movements. Track mining production reports from major copper and zinc miners to gain early warning signals about silver availability months in advance.

Currency and Monetary Policy Set the Macro Floor

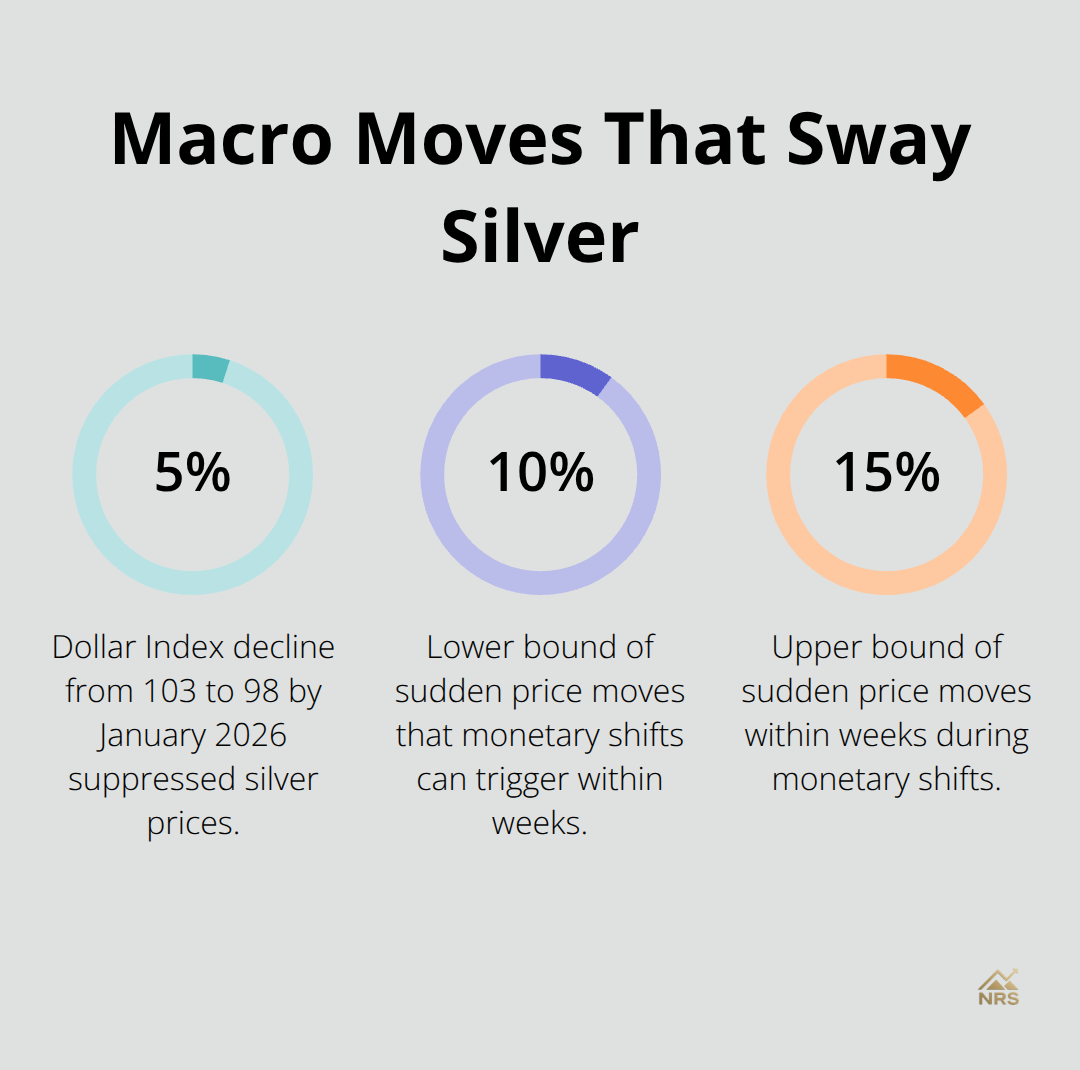

The US Dollar Index near 98.00 directly suppresses silver prices because the metal trades in dollars globally. When the dollar strengthens, international buyers face higher prices in their local currencies, which reduces demand. Real interest rates matter equally because silver generates no yield, making negative real rates (currently negative 0.8-1.2% on 10-year TIPS) a powerful incentive to hold physical metal instead of bonds. The Federal Reserve’s balance sheet sits around 7.4 trillion dollars as of December 2024, down from the 8.9 trillion peak in 2021, but the central bank continues monthly reserve management purchases at approximately 25 billion dollars. This ongoing monetary expansion reduces the opportunity cost of holding non-yielding assets. Monitor the Dollar Index, real yield trends from TIPS markets, and Federal Reserve balance sheet changes as leading indicators. These macroeconomic factors explain why silver can remain weak even when industrial demand is strong, and why sudden monetary shifts can trigger 10-15% price moves within weeks.

Why Technical Signals Fail Without Fundamentals

Many forecasters rely exclusively on price charts and momentum indicators, but this approach misses the structural forces that actually move silver. A chart pattern might signal a breakout, yet a strengthening dollar or rising real rates can reverse that move in days. The reverse also holds true: weak technical signals often precede sharp rallies when industrial demand accelerates or central banks shift policy. This is why you need to combine technical analysis with the fundamental drivers outlined above. Silver’s price reflects both short-term sentiment and long-term supply-demand realities, and ignoring either one leaves your forecast incomplete. The next section shows you exactly which forecasting methods work and which ones lead investors astray.

Building a Silver Price Forecast That Actually Works

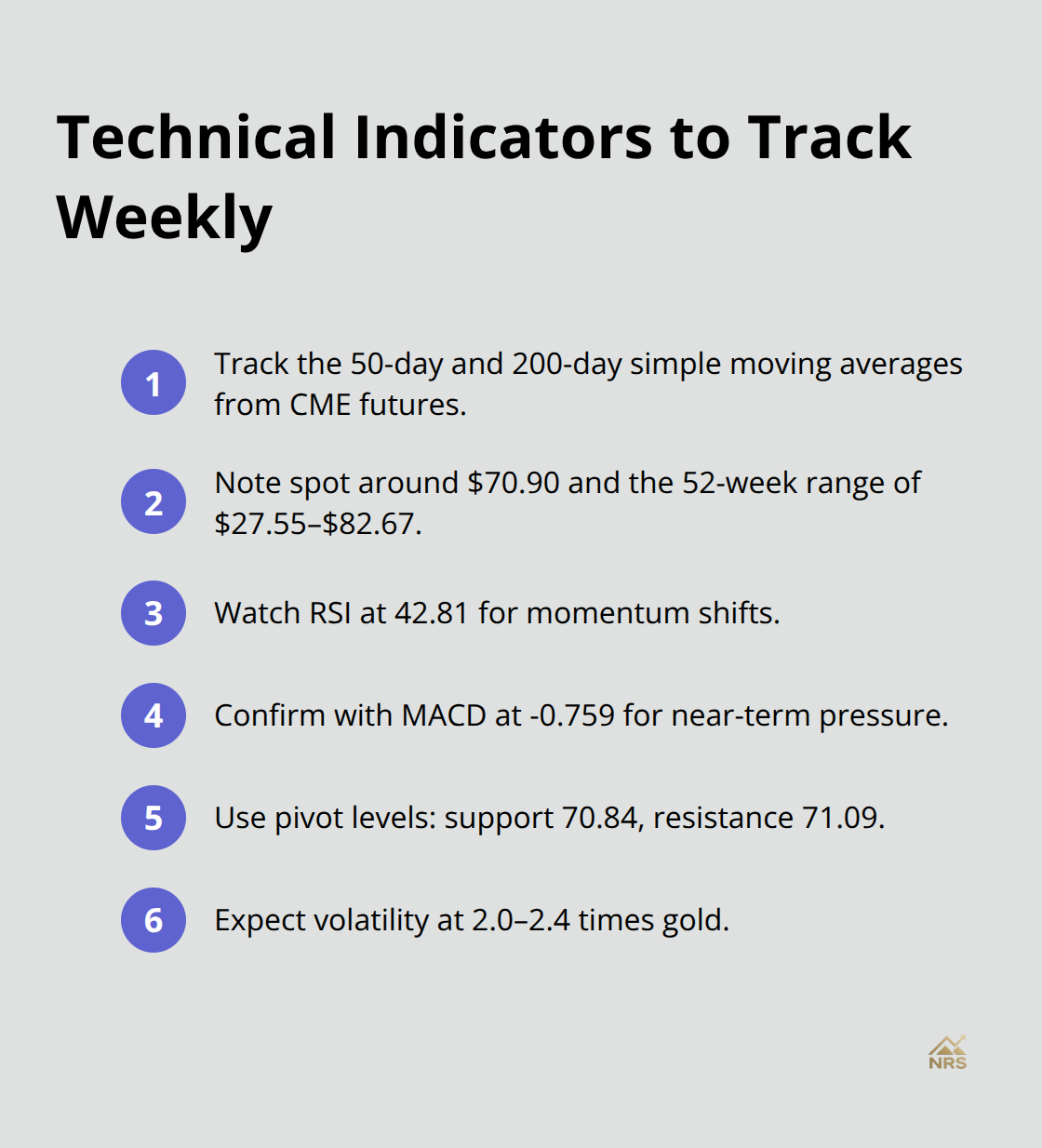

Combine Technical Signals with Fundamental Data

Technical analysis alone will mislead you, but combined with supply-demand fundamentals and macroeconomic data, it becomes a practical forecasting tool. Start by tracking the 50-day and 200-day simple moving averages from CME silver futures data to identify trend direction. Silver futures currently trade around 70.90 per ounce with a 52-week range spanning 27.55 to 82.67, which tells you the metal has already moved substantially from its lows but still sits below the year’s peak. The relative strength index (RSI) at 42.81 signals weakening momentum, while the MACD at negative 0.759 confirms near-term selling pressure. These technical signals matter most when combined with fundamental shifts: if solar installations accelerate or the dollar weakens, a negative RSI often precedes sharp reversals upward.

Check pivot levels daily using the classic framework (support at 70.84, resistance at 71.09) to set realistic entry and exit points, but treat these as tactical guides rather than price predictions. The intraday volatility around 2.0 to 2.4 times gold’s volatility means silver moves fast, so technical levels matter for timing but not for direction.

Track Industrial Demand with Precision

Fundamental analysis demands that you track industrial demand with precision because this is where silver’s price floor originates. Monitor quarterly solar capacity additions from the International Energy Agency and EV production numbers from vehicle manufacturers like Tesla and BYD to measure structural demand trends. The supply deficit of 148.9 million ounces projected for 2025 means every percentage point of demand growth translates into tighter market conditions. Pull mining production reports from major copper producers like Codelco and Antofagasta because these firms produce most of the world’s silver as a byproduct, and their quarterly output directly affects silver availability. The Federal Reserve balance sheet data, available weekly through the central bank’s website, shows whether monetary expansion accelerates or contracts, which determines whether real interest rates will push silver higher or lower.

Build a Data-Driven Spreadsheet Model

Compare the current Dollar Index level around 98.00 against its 12-month average to understand whether currency headwinds are temporary or structural. Create a simple spreadsheet that tracks silver spot price trends, solar demand growth, EV production, mining output, Fed balance sheet changes, and dollar strength on a monthly basis. This approach eliminates guesswork and forces you to make forecasts based on measurable variables rather than sentiment. When one variable shifts, your spreadsheet immediately shows which direction silver should move and by roughly how much. The real power emerges when you layer these fundamental inputs across multiple time horizons-what looks weak on a 30-day chart often aligns with strengthening 12-month demand trends, and vice versa. This tension between short-term technicals and long-term fundamentals is where most forecasters stumble, but your data model resolves it by showing you which force currently dominates the market.

Where Silver Forecasts Go Wrong

Most silver forecasters fail because they treat the metal as a standalone asset instead of a product shaped by three independent forces that rarely move in sync. The dollar strengthens while solar demand accelerates, creating conflicting price signals that break simple models. Real interest rates turn negative just as a copper mining slowdown tightens silver supply, yet the currency headwind overwhelms both fundamental improvements. Technical indicators flash buy signals while the Federal Reserve balance sheet contracts, which means momentum will fail. These misalignments happen constantly, and forecasters who ignore the broader economic context get whipsawed repeatedly.

Macro Conditions Override Isolated Signals

The mistake is treating silver price movements as isolated events rather than outcomes determined by macroeconomic conditions. When you build a forecast without understanding whether the dollar is strengthening or weakening, whether real rates are rising or falling, and whether central banks are expanding or contracting monetary policy, you are essentially guessing. The dollar moved from 103 in mid-2024 down to 98 by January 2026, a 5% shift that directly suppressed silver prices despite strong industrial fundamentals. If you had ignored this currency movement and relied only on solar demand growth or supply deficit data, your forecast would have been dangerously wrong.

Track the Dollar Index weekly, monitor 10-year TIPS yields daily, and check the Federal Reserve balance sheet every Thursday when new data releases occur. These three metrics determine whether industrial demand tailwinds will actually push prices higher or whether macro headwinds will pin them down. The tension between currency strength and industrial demand growth explains why silver can stall even when solar installations accelerate and EV production ramps up. Understanding macroeconomic conditions that shape precious metals becomes essential for accurate forecasting.

Short-Term Noise Masks Structural Demand

The second critical error is obsessing over short-term price movements while ignoring the structural demand that actually supports silver valuations. A 2-3% daily price swing triggers panic selling or euphoric buying, yet this noise masks the reality that industrial applications now account for over half of global silver demand. You see silver drop from 71 to 69 dollars per ounce and assume the trend has broken, but meanwhile global solar capacity additions continue accelerating and the supply deficit persists at 115-120 million ounces annually.

The Silver Institute data shows industrial demand now accounts for over half of global silver consumption, which means every quarterly earnings report from copper miners and every solar installation forecast from the International Energy Agency matters far more than whether the price closed above or below the 200-day moving average. Silver’s price volatility typically runs two to three times higher than gold on any given day, creating constant noise that lures forecasters into short-term trading mindsets, but this noise destroys discipline.

Build Forecasts on Longer Horizons

Try a 12-month or 24-month horizon instead, updating your model monthly with new supply and demand data rather than daily with price ticks. The forecasters who consistently outperform are those who ignore the daily chaos and focus relentlessly on whether solar capacity is accelerating, whether EV production is ramping, and whether mining byproduct output is declining. These variables determine where silver trades in six months or two years, not where it trades today. When you separate the structural forces from the daily price noise, your forecasts become far more reliable and your conviction in your positions strengthens considerably.

Final Thoughts

Accurate silver price forecasting requires monitoring three independent forces that often contradict each other: industrial demand, macroeconomic conditions, and technical signals. Your job is not to pick the strongest signal but to track all three simultaneously and identify which one currently dominates market behavior. Build a monthly tracking system that captures solar capacity additions, EV production numbers, mining output, the Dollar Index level, 10-year TIPS yields, and Federal Reserve balance sheet changes-this data foundation transforms your silver prices future forecast from guesswork into a disciplined process grounded in measurable variables.

Resist the urge to trade daily price movements because most forecasters fail when they confuse short-term noise with structural trends. Silver’s volatility runs two to three times higher than gold, which means daily swings of 2-3% are normal and meaningless. Update your model monthly with fresh supply and demand data, then let the structural forces work-this approach eliminates the emotional whipsaw that destroys most forecasting efforts.

No forecast remains valid indefinitely because policy shifts, technological breakthroughs in solar efficiency, or unexpected mining disruptions can alter the fundamental picture within weeks. Policy changes and geopolitical events affect resource prices constantly, so subscribe to expert analysis on how these shifts impact silver valuations and stay informed when conditions change. The forecasters who outperform are those who build robust models, monitor multiple data sources consistently, and adapt when new information emerges.