Precious metal stocks offer real portfolio protection when inflation rises and geopolitical risks spike. At Natural Resource Stocks, we’ve identified the best precious metal stocks across gold, silver, and rare earth elements that deserve your attention right now.

Macroeconomic shifts in 2026 are reshaping which miners deliver returns. This guide walks you through the producers, explorers, and diversification strategies that match your risk tolerance.

Which Gold Stocks Deliver Real Returns Right Now

The Gold Rally Creates Genuine Tailwinds for Producers

Gold hit a record around $4,307 per ounce and gained roughly 26% over the past three months, according to Investing.com. This rally stems from central bank purchases led by India, Turkey, and Poland, plus weakening U.S. dollar pressure and three Federal Reserve rate cuts in 2025. The World Bank forecasts gold prices will stay elevated at roughly 80% above the 2015-19 average through 2025-26, meaning the environment for gold stocks remains structurally supportive.

Established Producers Offer Stability Over Speculation

Hecla Mining ranks second among precious metal stocks by Zen Ratings with a B grade and delivered a 290.84% return over the past year. The company maintains a sustainable 0.08% dividend yield and 8.2% payout ratio, signaling disciplined capital allocation. Its growth momentum scores an A, though its value rating sits at C, suggesting current pricing reflects much of the near-term upside.

Integra Resources tops the rankings with an A grade and a stunning 360.92% one-year return, but its Safety score drops to F-a clear warning that explosive gains come with serious operational and exploration risk. Large-cap producers like Rio Tinto and BHP Group offer diversified metal exposure and dividend yields of 4.66% and 3.64% respectively, though they represent less pure-play gold exposure than single-commodity miners.

The number 0% seems to be not appropriate for this chart. Please use a different chart type.

Mid-Tier Miners Require Careful Stock Selection

Buenaventura Mining ranks third with a B rating and 141.58% annual return, yet analyst consensus is Hold with a minimal 2.98% downside to the one-year price target. This suggests the stock may have already priced in near-term gains. The InvestingPro screener identified 11 undervalued metals and mining stocks with market caps over $50 million and bullish potential exceeding 10%, with valuations underpriced by 10.1% to 43% relative to fair value.

Building a watchlist using InvestingPro’s screening framework works better than betting on single names. The sector’s average price-to-earnings multiple sits around 8.87x across the broader precious metals and mining industry, offering reasonable entry points for quality operators.

Junior Explorers Demand Deep Due Diligence

Junior explorers like Integra Resources offer asymmetric upside but require rigorous analysis. Its InvestingPro score of 49 passed 16 of 33 checks, meaning fundamentals exist but risks remain material. Bank of America forecasts gold could reach $5,000 per ounce by year-end next year, which would amplify returns for leveraged exploration plays, though volatility will spike sharply.

Focus on miners reporting low all-in sustaining costs, hedged against price swings, and backed by contracts securing future silver or gold sales. These operational metrics matter far more than exploration upside alone. Silver demand patterns and industrial applications now shape which gold producers capture the most value from the broader precious metals rally.

Silver Stocks and Rare Earth Plays Demand Different Strategies

Industrial Demand Reshapes Silver Investment Logic

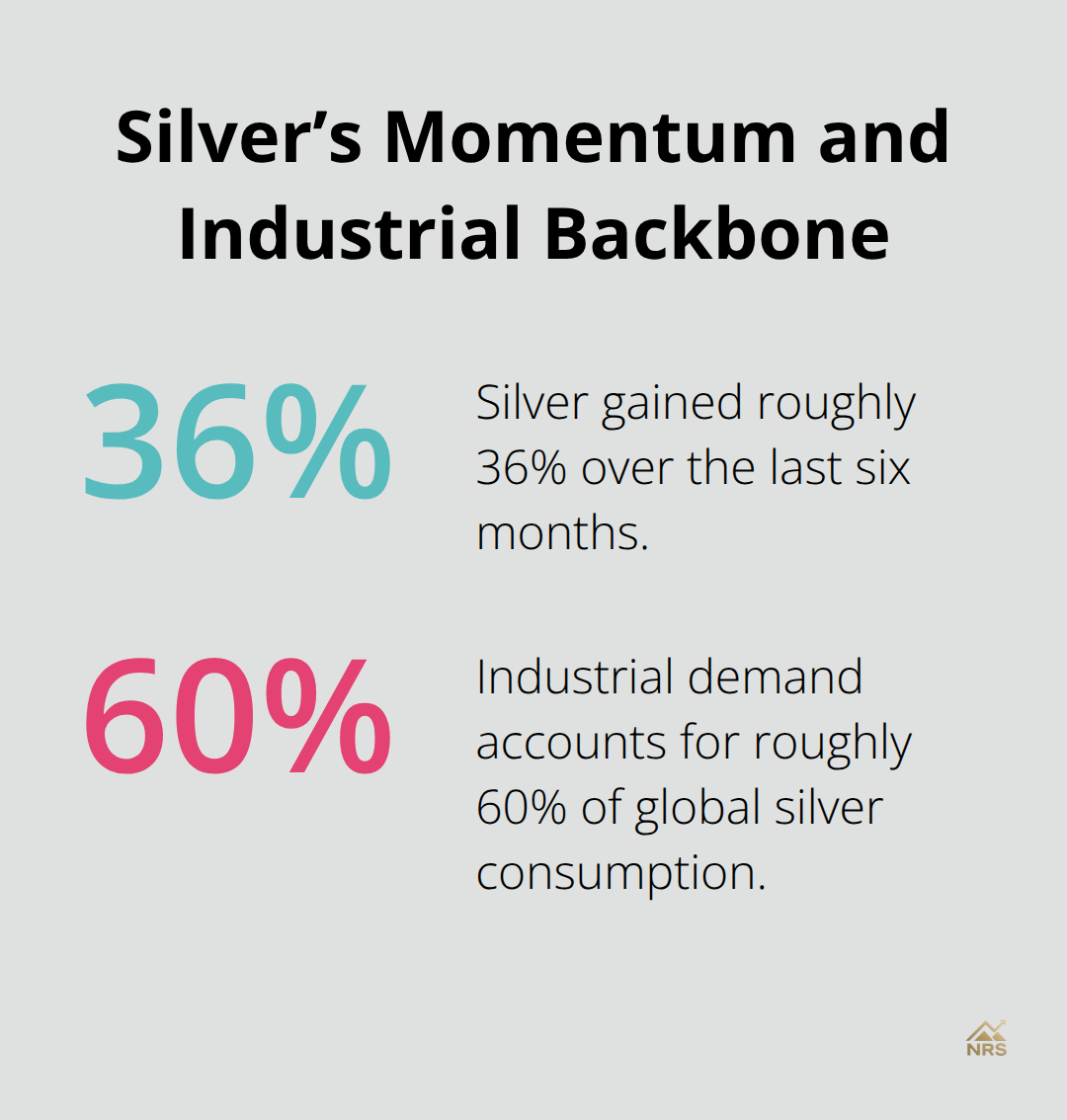

Silver surged to a record near $52.86 per ounce, up roughly 36% over the last six months according to Investing.com, yet this rally masks a critical split in where money actually flows. Industrial demand accounts for roughly 60% of global silver consumption, driven by solar panels, data centers, and electric vehicle components.

This structural demand differs fundamentally from gold’s safe-haven narrative. China’s decision to restrict silver exports starting January 1, 2026 tightens supply precisely when industrial users face rising needs. Samsung signed a $7 million deal to secure future silver supply from a Mexican mine, signaling how seriously manufacturers treat supply security.

Why Supply Contracts Matter More Than Spot Prices

Silver stocks tied to producers serving industrial contracts outperform those betting on speculative price moves. Hecla Mining and Buenaventura Mining both hold silver exposure, yet their analyst price targets suggest limited upside from current levels. Instead, focus on miners with long-term supply contracts, low production costs below $5 per ounce, and geographic diversification away from China-dependent supply chains. Wheaton Precious Metals operates a streaming model that locks in fixed silver prices at $5.75 per ounce through 2029, providing a hedge against price volatility while capturing 40% portfolio expansion by 2028. This structure appeals to risk-averse investors seeking silver exposure without direct mining operational risk.

Rare Earth Elements Create Government-Backed Demand

Rare earth elements represent an entirely different investment thesis. MP Materials operates the only fully integrated rare-earth magnet producer in North America at Mountain Pass, mining, refining, and manufacturing magnets on-site. Apple committed $500 million to a magnets partnership sourcing recycled rare earths, while the U.S. Department of Defense invested $400 million to support a second magnet facility, signaling government-backed demand that transcends commodity cycles. MP Materials also collaborates on a rare-earth refinery venture with Saudi Arabia, broadening supply-chain footprint beyond U.S. borders. These partnerships create multi-year revenue visibility that spot prices cannot replicate.

Contracted Production Beats Exploration Upside

The metals and mining sector has benefited from recent U.S. government investments in rare metals and rare earth elements, yet most investors miss the distinction between exploration upside and contracted production. Analysts forecast roughly 10.25% upside across precious metal stocks over the next year, but rare earth plays capture geopolitical tailwinds that extend far beyond annual price targets. Diversifying across gold producers, silver-exposed miners with industrial contracts, and rare earth manufacturers reduces exposure to single-commodity price swings while positioning portfolios for structural shifts in EV demand and government supply-chain security spending. This multi-metal approach sets the stage for evaluating which macroeconomic forces will drive returns in 2026 and beyond.

What Actually Moves Precious Metal Prices in 2026

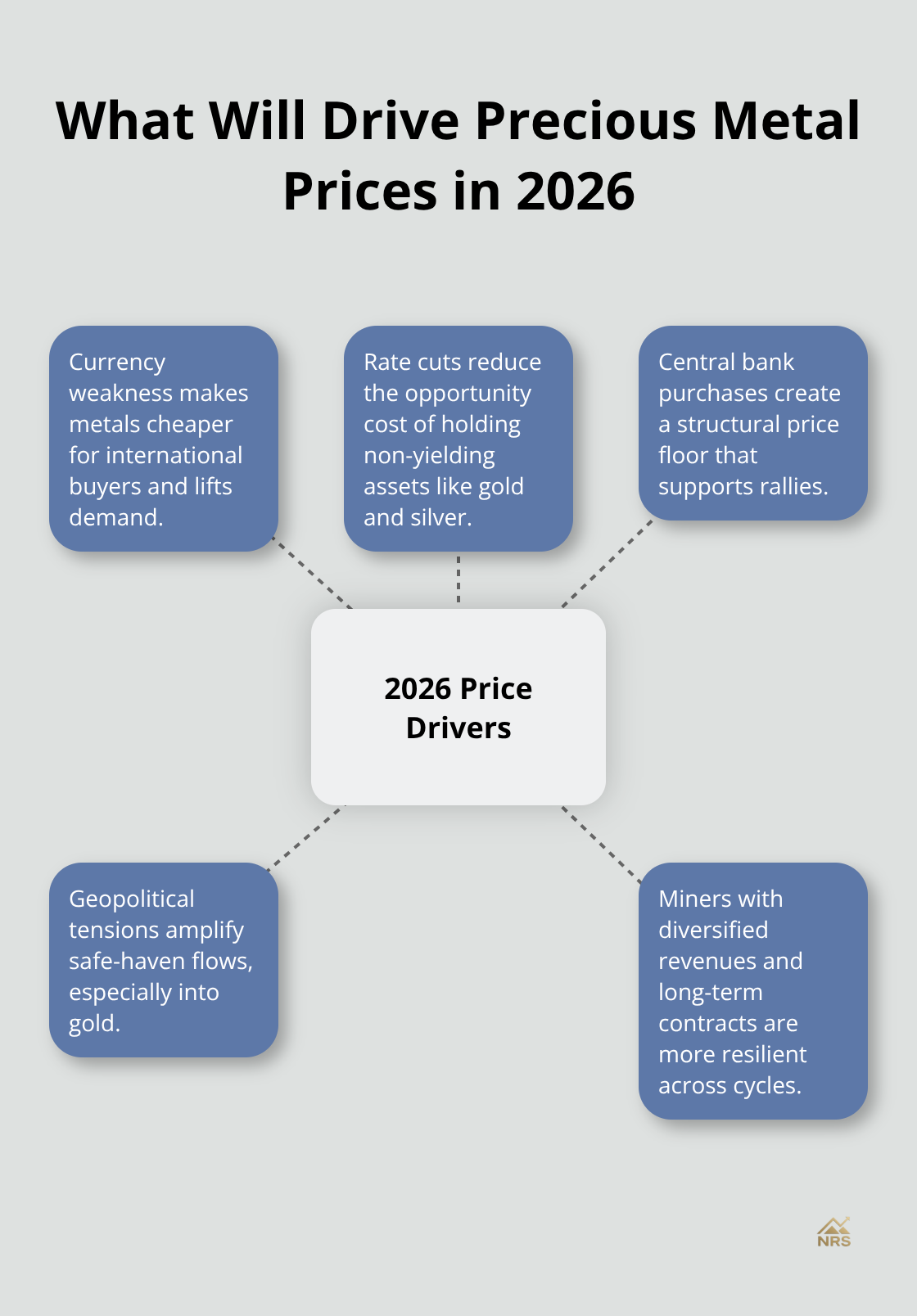

Currency Weakness and Rate Cuts Drive the Core Rally

The U.S. dollar weakened roughly 10% in 2025, and this currency movement alone explains more about precious metal rallies than most investors realize. A weaker dollar makes gold and silver cheaper for international buyers, directly boosting demand from central banks and institutional investors. The Federal Reserve cut rates three times in 2025, removing the opportunity cost of holding non-yielding precious metals. These two forces-currency weakness and lower rates-will remain the primary price drivers throughout 2026.

Watch the Fed’s January and March meetings closely, because forward guidance on rates will swing precious metal stocks by 10% to 15% in single days.

Central Bank Demand Creates a Structural Price Floor

Central banks stockpile metals at record pace, with India, Turkey, and Poland leading purchases. This geopolitical demand for reserves transcends normal commodity cycles and creates a structural floor beneath prices that speculation cannot easily shake. The trend shows no signs of slowing, which means sustained institutional buying will support prices even if retail investors lose interest.

How Geopolitical Risk Splits Winners from Losers

Geopolitical tensions amplify safe-haven flows into precious metals, but this benefit flows unevenly across mining stocks. Gold benefits most from escalating geopolitical risk, yet silver faces headwinds from industrial demand uncertainty if global manufacturing slows. China’s decision to restrict silver exports starting January 1, 2026 tightens supply precisely when solar panel manufacturers and EV producers need it most, creating a bullish squeeze for miners with non-Chinese supply chains. Bank of America’s forecast of gold reaching $5,000 per ounce by year-end assumes geopolitical tensions persist, yet this scenario also pressures industrial metals like copper and silver if economic activity contracts.

Why Diversified Revenue Streams Matter More Than Spot Prices

Focus on miners with diversified revenue streams across gold and silver, contracted industrial supply agreements, and exposure to rare earth elements where government spending remains immune to recession fears. Inflation readings matter only insofar as they trigger Fed policy shifts; the actual inflation rate ranks as a secondary driver compared to currency movements and central bank actions. Miners holding long-term contracts at fixed prices outperform those betting on spot price appreciation alone, since contracts lock in margins regardless of whether prices spike or retreat.

Final Thoughts

Precious metal stocks thrive when you match your portfolio structure to the actual price drivers shaping 2026. Currency weakness, Federal Reserve policy, and central bank demand create the foundation for returns, not speculation on spot prices alone. The best precious metal stocks combine three elements: contracted production at fixed costs, diversified revenue streams across gold and silver, and exposure to government-backed demand in rare earth elements. Hecla Mining and Buenaventura Mining deliver established production, while Wheaton Precious Metals locks in silver prices through 2029, and MP Materials captures geopolitical tailwinds from Apple and Department of Defense partnerships that transcend commodity cycles.

Building a diversified natural resource portfolio means avoiding concentration in single metals or single-commodity miners. Pair large-cap producers like Rio Tinto and BHP Group, which offer 3.64% to 4.66% dividend yields, with silver-exposed miners holding industrial supply contracts and rare earth specialists positioned for multi-year government spending. The InvestingPro screener identified 11 undervalued metals and mining stocks with valuations discounted 10% to 43% relative to fair value, providing concrete entry points rather than guessing on price targets. Try focusing on miners reporting all-in sustaining costs below $1,000 per ounce for gold and $5 per ounce for silver, since cost discipline separates winners from losers across commodity cycles.

Your next step involves building a watchlist using quantitative screening rather than chasing recent winners. Track gold and silver spot prices as leading indicators, monitor Federal Reserve guidance on interest rates, and watch central bank purchase announcements as signals of institutional demand. We at Natural Resource Stocks provide expert video and podcast content plus in-depth market analysis on macroeconomic factors affecting resource prices, helping you evaluate which stocks align with your risk tolerance and time horizon.