Iridium remains one of the most volatile precious metals in the market, with prices swinging dramatically based on supply constraints and industrial demand. We at Natural Resource Stocks track these movements closely to help investors understand what’s driving the iridium metal price forecast.

This guide breaks down the current market dynamics, the key factors reshaping prices, and what we expect to see in the years ahead. Whether you’re evaluating iridium stocks or considering exposure to this rare metal, the insights here will sharpen your perspective.

Where Iridium Stands Today

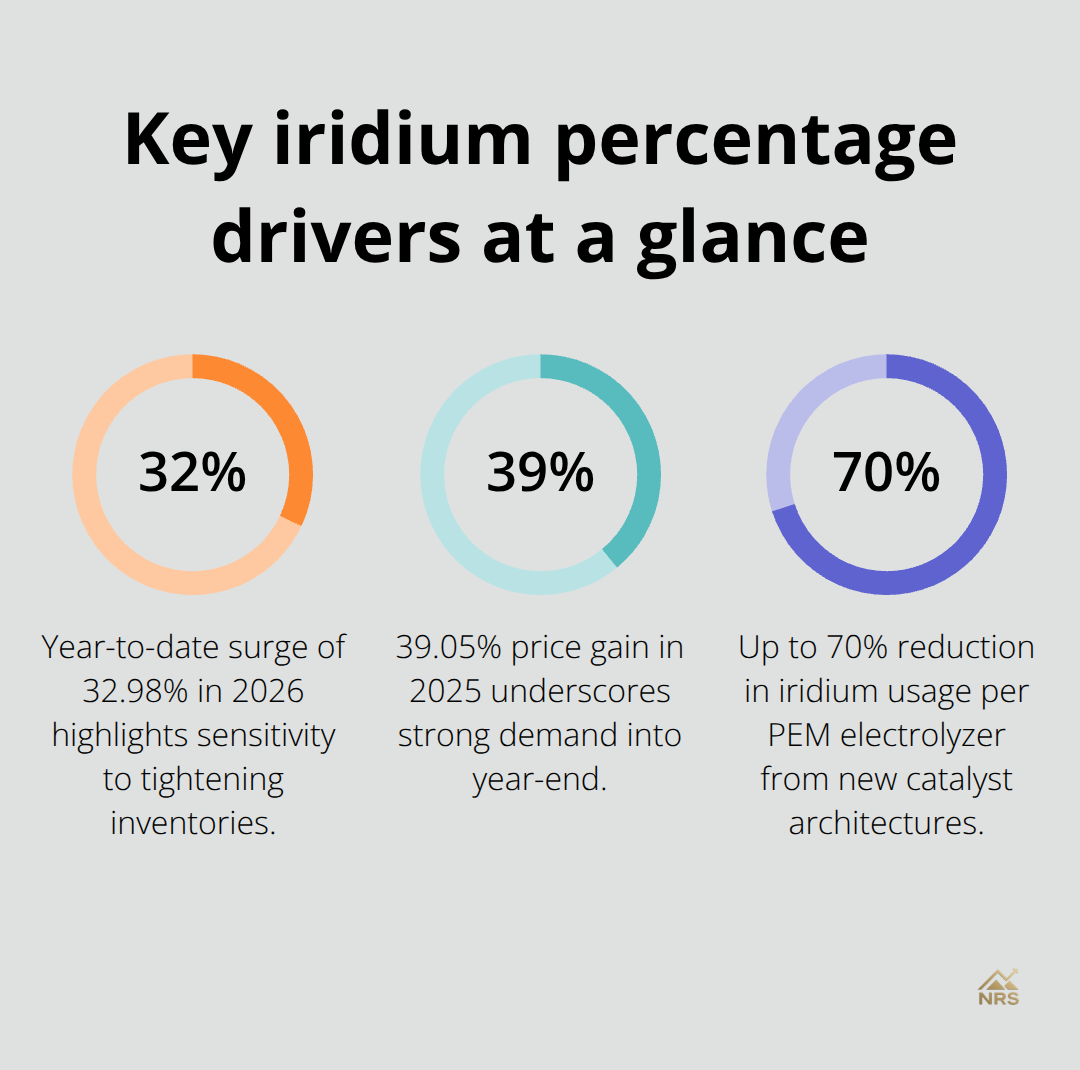

Global iridium production hovers around 7 tons annually, with South Africa dominating output as the primary source, while Russia and Canada contribute meaningful volumes and smaller deposits exist in Alaska, Brazil, and Australia. Iridium cannot be mined independently-producers extract it solely as a by-product of platinum mining, which means supply growth remains fundamentally inelastic regardless of price movements. Johnson Matthey data cited by Statista shows 2024 global iridium supply rose by approximately 10,000 ounces year-over-year, a modest increase that underscores how tightly supply remains controlled. The December 2025 global iridium price reached 166,162.11 USD per kilogram according to IMARC, though retail prices have since climbed to 217.32 USD per gram as of January 15, 2026. Year-to-date iridium has already surged 32.98% in 2026 alone, while the metal gained 39.05% throughout 2025 and roughly 531.89% since January 2018-a trajectory that reflects both supply scarcity and accelerating industrial demand.

Why Aerospace, Electronics, and Green Energy Drive Demand

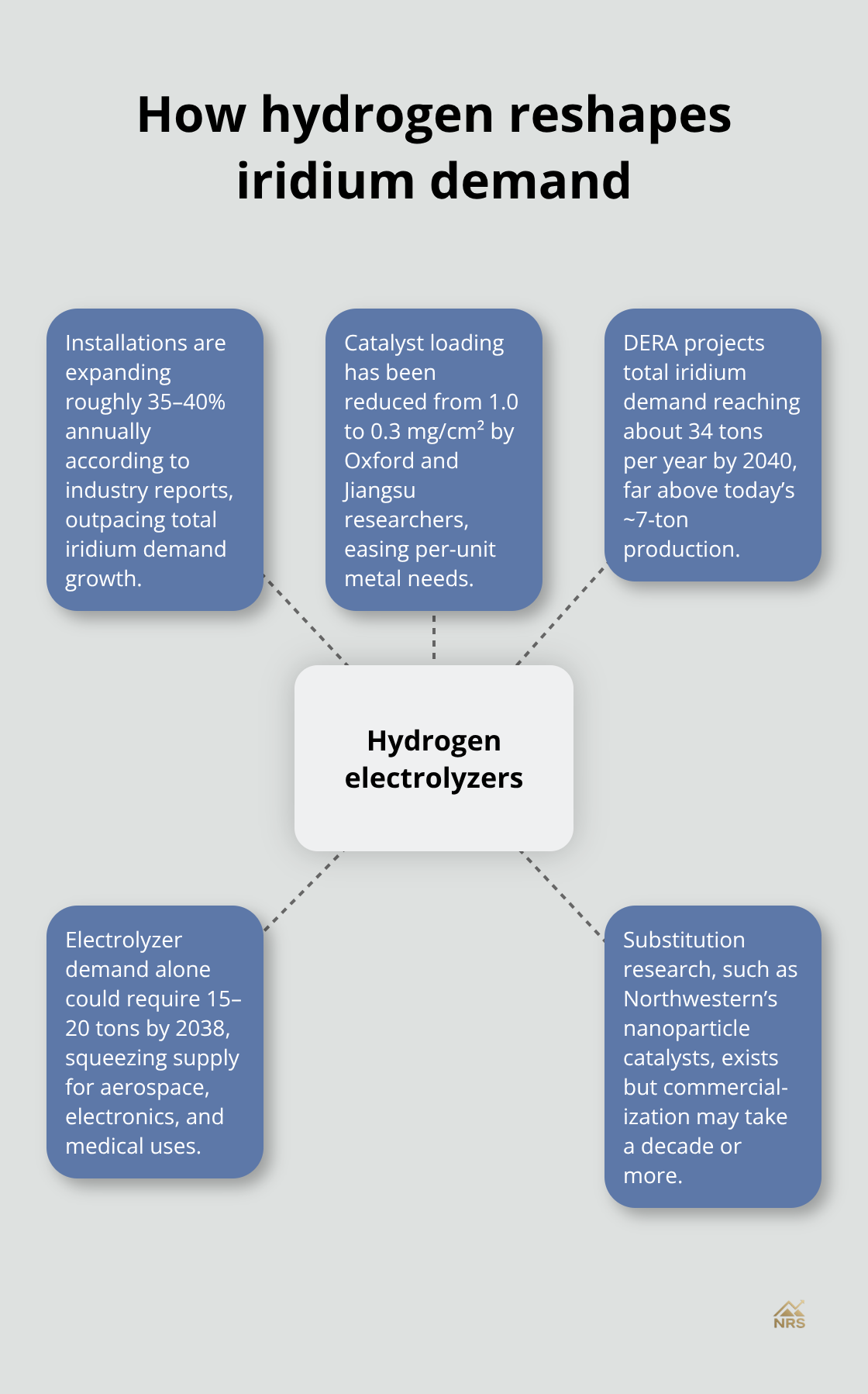

Aerospace, electronics manufacturing, and medical device production remain the traditional demand pillars, but emerging applications in organic light-emitting diodes (OLEDs) and green hydrogen production through PEM electrolyzers reshape the market fundamentally. Hydrogen production represents the most significant growth vector because PEM electrolyzers rely on iridium catalysts, and as decarbonization accelerates globally, electrolyzer deployment expands rapidly. Recent breakthroughs from the University of Oxford and Jiangsu Industrial Technology Research Institute achieved up to 70% reduction in iridium usage in these electrolyzers through new catalyst architectures, cutting requirements from 1.0 mg/cm² to 0.3 mg/cm². If adoption scales, this efficiency gain could ease supply pressure considerably. The German raw materials agency DERA projects iridium demand reaching approximately 34 tons per year by 2040, more than quadruple current production levels-a gap that cannot close through supply increases alone. IMARC forecasts the iridium industry will expand from 7.43 tons in 2025 to 11.0 tons by 2034, representing a compound annual growth rate of 4.28%, but this projection assumes substitution technologies and efficiency gains temper demand growth substantially.

Supply Rigidity Meets Surging Demand

Q3 2025 illustrated iridium’s vulnerability to demand shocks when prices declined as weaker industrial demand weighed on sentiment, particularly in automotive and electronics sectors that experienced procurement slowdowns. Yet this weakness proved temporary because the fundamental supply-demand imbalance remains unresolved-production cannot scale meaningfully to meet rising consumption. Geopolitical concentration in South Africa, Russia, and Zimbabwe creates additional vulnerability; any production disruption in these regions would immediately tighten an already constrained market. The metal’s rarity, combined with its extreme density (surpassed only by osmium) and exceptional corrosion resistance at high temperatures, makes substitution difficult across most applications, which means price support remains structural rather than cyclical. IMARC tracks regional price variations across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, enabling investors to identify geographic arbitrage opportunities and anticipate demand shifts by region. Elevated above-ground inventories have pressured spot prices recently, but this inventory buffer will deplete as industrial demand accelerates, particularly if hydrogen production scales faster than current forecasts assume.

What Comes Next

The tension between constrained supply and accelerating demand sets the stage for the price movements ahead. Understanding which factors will dominate-whether efficiency breakthroughs reduce iridium intensity or whether green hydrogen deployment outpaces substitution-determines whether prices climb steadily or spike sharply. The next section examines the specific forces that will shape iridium prices in the coming years.

What Reshapes Iridium Prices Most

Geopolitical Risk and Supply Concentration

Geopolitical concentration in South Africa, Russia, and Zimbabwe poses the single largest threat to iridium prices, and any disruption in these regions triggers immediate upward pressure on spot prices. South Africa alone accounts for the majority of global iridium output as a by-product of platinum mining, meaning labor strikes, political instability, or regulatory changes there ripple through the entire market within weeks. Russia’s production capacity remains significant despite sanctions, and Zimbabwe holds meaningful reserves, but supply from these regions faces heightened uncertainty. If South Africa experienced a mining strike lasting even 60 days, global iridium supply would tighten enough to push prices higher based on historical precedent from platinum market disruptions. Investors should monitor South African labor negotiations closely and watch for any policy shifts affecting platinum mining permits, since iridium follows directly.

How Industrial Demand Reshapes the Market

Industrial demand shifts determine whether prices sustain gains or retreat, and the hydrogen economy represents the inflection point for the next decade. PEM electrolyzers currently consume iridium catalysts in standard designs, but recent breakthroughs reduce catalyst loading, signaling that efficiency gains will suppress iridium intensity across new installations. However, electrolyzer deployment accelerates globally faster than efficiency improvements can offset the gains, meaning total iridium demand for hydrogen production still climbs even as per-unit consumption falls.

Economic slowdowns in manufacturing hubs like Europe or China directly reduce electronics and aerospace demand, which together still represent substantial consumption even as green hydrogen expands. Demand projections for iridium continue to evolve as iridium utilisation needs to improve significantly by 2050 to meet hydrogen economy growth targets.

Currency and Economic Pressures

Currency fluctuations amplify price movements because iridium trades in USD globally, so a strengthening dollar makes iridium more expensive for European and Asian buyers and dampens demand precisely when supply tightens. A weaker dollar conversely attracts international buyers and supports prices during supply crunches. Economic conditions in key manufacturing regions directly influence how much iridium buyers procure, with recessions cutting orders sharply while expansions accelerate consumption. Investors should track electrolyzer installation rates quarterly and monitor currency movements versus the dollar, since both move iridium prices independently of supply news. These forces interact constantly, and understanding their interplay reveals where prices head next.

Iridium Price Targets and Market Outlook

IMARC’s price data through December 2025 and forward projections provide the clearest framework for understanding where iridium heads in the near term. The metal reached 166,162 USD per kilogram in December 2025, but retail prices have already climbed to 217.32 USD per gram as of mid-January 2026, signaling that spot markets are pricing in scarcity faster than wholesale benchmarks reflect. The year-to-date surge of 32.98% in just two weeks of 2026 reveals how sensitive iridium becomes to supply news and demand signals once inventories tighten. SFA Oxford, the only firm modeling iridium supply directly from platinum group metal mine production and end-use consumption, publishes a five-year price forecast to 2029 that incorporates scenario analysis around hydrogen deployment rates and substitution technology adoption. Their quarterly reports include live analyst commentary from Dr. Jenny Watts addressing the latest price movements and risk factors.

Baseline Forecasts and Price Scenarios

The baseline scenario assumes iridium demand grows at 4.28% annually through 2034 as IMARC projects, reaching 11.0 tons by that year from 7.43 tons in 2025. This growth trajectory requires prices to remain elevated enough to ration demand and suppress consumption below what would occur at lower price levels. Conservative forecasts suggest iridium averages 180 USD per gram through 2027, while bullish scenarios push above 250 USD per gram and depend entirely on hydrogen electrolyzer deployment outpacing efficiency improvements. The critical inflection point arrives between 2028 and 2030 when cumulative electrolyzer installations determine whether iridium demand accelerates sharply or moderates as per-unit catalyst loading continues declining.

Hydrogen Electrolyzers as the Primary Price Driver

Hydrogen production capacity additions matter more than any other single variable for iridium pricing over the next five years. PEM electrolyzer installations globally expand at roughly 35 to 40 percent annually according to industry reports, far exceeding the 4.28 percent annual demand growth that IMARC forecasts for total iridium. This discrepancy exists because efficiency breakthroughs from Oxford and Jiangsu researchers reduce catalyst requirements from 1.0 to 0.3 mg/cm², offsetting higher unit volumes. However, the German raw materials agency DERA projects iridium demand reaching 34 tons annually by 2040, a figure that dwarfs current 7-ton production. If DERA’s projection proves accurate, electrolyzer demand alone would consume 15 to 20 tons of iridium per year by 2038, leaving no supply for aerospace, electronics, or medical devices unless primary production triples or substitution technologies mature faster than expected. Northwestern University researchers have identified nanoparticle catalysts matching iridium performance in water splitting, but commercialization timelines remain uncertain and mass adoption could take a decade or longer.

Tracking Electrolyzer Deployment for Investment Signals

Monitor quarterly electrolyzer installation announcements from major manufacturers like Siemens Energy, ITM Power, and Plug Power, since their capacity additions directly signal iridium demand acceleration independent of broader economic conditions. These announcements reveal whether hydrogen deployment accelerates faster than efficiency improvements can suppress per-unit iridium consumption. Regional electrolyzer capacity additions in Europe, Asia, and North America vary significantly based on local hydrogen policy support and industrial demand, so tracking regional installation rates separately provides earlier signals than waiting for global aggregate data. Companies that publish quarterly capacity additions offer the most transparent view into near-term iridium demand trajectories.

Direct Investment Paths and Execution Challenges

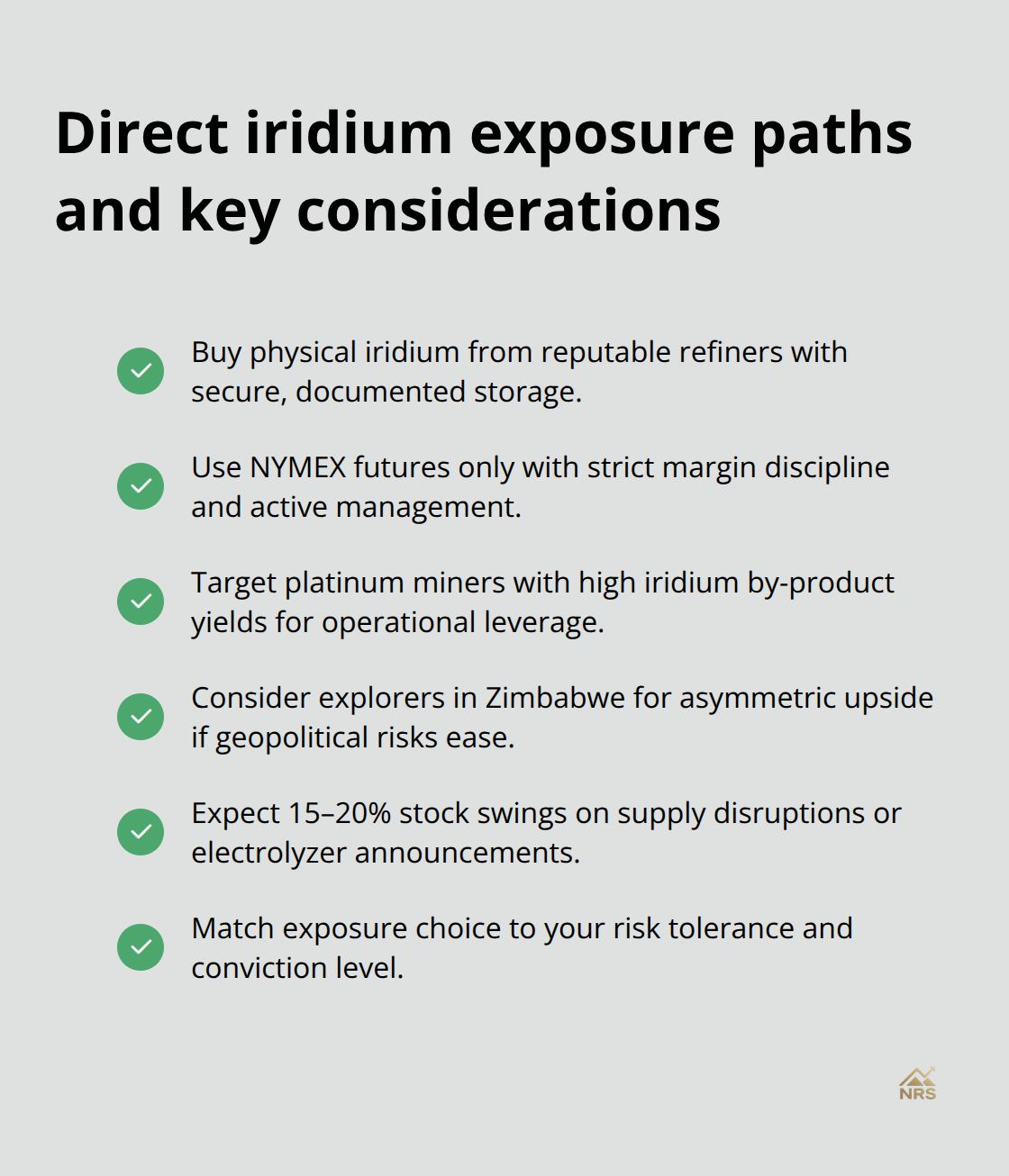

Physical iridium and futures contracts represent the two most direct exposure paths, but both carry execution challenges that matter. Physical iridium requires sourcing from reputable refiners, verifying purity through assay, and maintaining secure storage with documented chain-of-custody, all of which add 2 to 5 percent to acquisition costs. Futures contracts on NYMEX offer leverage and liquidity but demand active management and margin discipline that most retail investors lack.

The real opportunity lies in identifying platinum mining companies with highest iridium by-product yields, since these firms capture the full margin between iridium prices and their platinum-focused production costs. Companies extracting iridium as a high-yield by-product from platinum operations in South Africa benefit directly from iridium price appreciation without needing to increase mining volume. Smaller explorers with platinum-palladium deposits in emerging jurisdictions like Zimbabwe offer asymmetric upside if geopolitical risks ease and their projects reach production. The volatility in iridium stocks means they can swing 15 to 20 percent in response to single supply disruption rumors or electrolyzer deployment announcements. This volatility creates tactical entry points for investors with conviction about supply scarcity and hydrogen acceleration, but requires discipline to avoid buying peaks driven by temporary sentiment shifts rather than fundamental demand changes.

Final Thoughts

Iridium’s price trajectory hinges on three interconnected forces: constrained supply that cannot expand meaningfully, accelerating demand from hydrogen electrolyzers and traditional aerospace and electronics sectors, and geopolitical concentration in South Africa and Russia that creates persistent disruption risk. The iridium metal price forecast for the coming years depends almost entirely on whether electrolyzer deployment outpaces efficiency improvements in catalyst loading. If hydrogen production scales as rapidly as current policy support suggests, iridium demand could exceed 20 tons annually by 2035, far surpassing the 7-ton production baseline.

Supply rigidity creates a structural floor under prices because iridium production depends entirely on platinum mining economics, not iridium prices themselves. This inelasticity protects investors from sharp declines unless a major substitution breakthrough suddenly eliminates demand across multiple applications simultaneously. The 531.89 percent price gain since January 2018 reflects this supply-demand imbalance, and the 32.98 percent year-to-date surge in 2026 signals that markets are pricing in scarcity faster than production can respond.

For investors, the strategic priority involves identifying which exposure path matches your conviction level and risk tolerance. Direct physical iridium ownership captures full price appreciation but requires careful sourcing and storage management, while platinum mining companies with highest iridium by-product yields offer operational leverage without execution complexity. Track electrolyzer installation announcements quarterly to identify demand acceleration signals before prices spike, and visit Natural Resource Stocks to access in-depth market research on the factors reshaping iridium prices and investment opportunities in this space.