Posted inDaily Update Dennis Leontyev

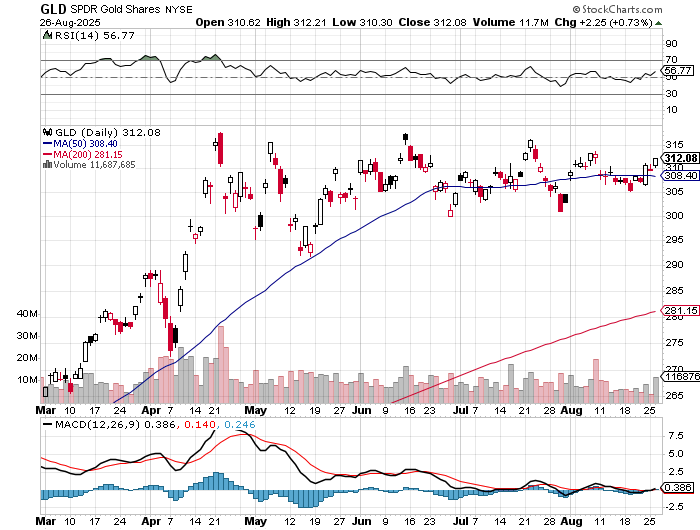

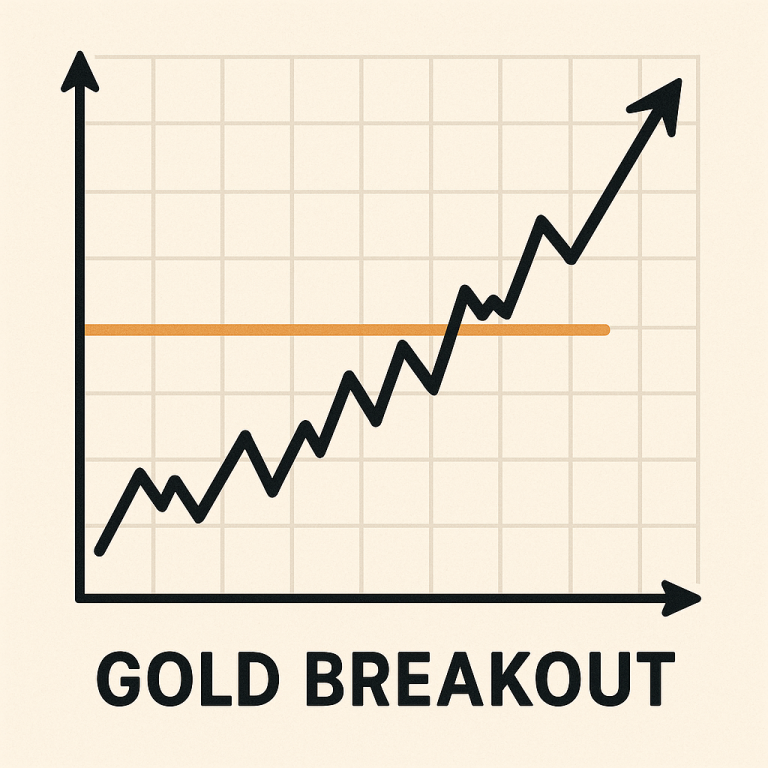

GLD Eyeing 316 Breakout

GLD is closely approaching a critical resistance zone around $316, a level that, if breached with conviction, could trigger a meaningful rally. This level has been a strong resistance since…