Natural gas pipeline companies generate steady cash flows through long-term contracts and regulated operations. These infrastructure giants transport energy across North America while paying attractive dividends to shareholders.

We at Natural Resource Stocks see strong fundamentals driving the best natural gas pipeline stocks in 2025. Rising industrial demand and power generation needs create compelling investment opportunities for income-focused investors.

Which Pipeline Giants Dominate the Market

Kinder Morgan’s Infrastructure Empire

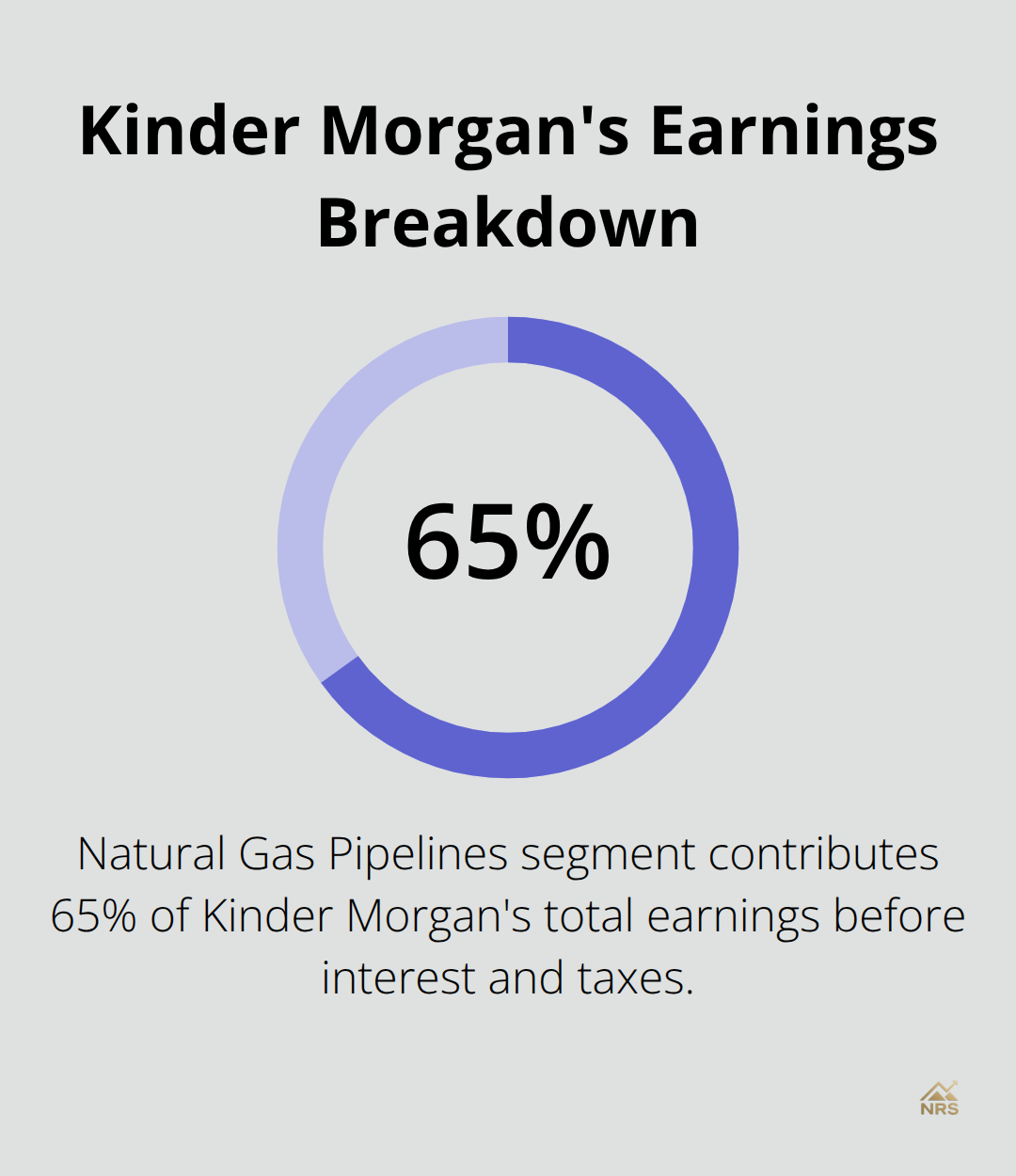

Kinder Morgan controls North America’s largest natural gas pipeline network with 70,000 miles of infrastructure across 40 states. The company delivered $7.2 billion in revenue during 2023 while it maintained a debt-to-EBITDA ratio of 4.2x. Their Natural Gas Pipelines segment produces 65% of total earnings before interest and taxes, which positions KMI as a pure-play infrastructure investment. The company’s interstate pipelines transport 40% of all natural gas consumed in the United States (according to their latest annual report).

Enbridge’s Cross-Border Dominance

Enbridge operates its 14,000-mile Mainline system that moves 3 million barrels of crude oil daily between Canada and the United States. The pipeline giant has raised dividends for 29 consecutive years and currently yields 6.2% with a payout ratio of 60%. This track record demonstrates management’s commitment to shareholder returns even during volatile energy markets.

TC Energy’s Recovery Potential

TC Energy faces significant headwinds after the Keystone XL cancellation but maintains strong fundamentals through its NGTL system in Alberta. The company’s $24 billion project backlog includes the Coastal GasLink pipeline, which should generate $1.5 billion in annual EBITDA once operational. TC Energy’s current enterprise value of $65 billion trades at 10.5x EBITDA, which presents attractive valuation metrics for patient investors.

These market leaders benefit from different factors that drive their stock performance and dividend sustainability. For investors seeking broader exposure to the energy sector, natural gas stocks offer additional opportunities beyond pipeline infrastructure.

What Forces Move Pipeline Stock Prices

Industrial demand for natural gas creates significant opportunities for pipeline operators who charge transportation fees based on volume throughput. The Energy Information Administration tracks comprehensive natural gas data including consumption patterns across industrial sectors. Power generation facilities continue shifting from coal to natural gas as older plants shut down across multiple states. This demand surge creates pricing power for pipeline operators.

Companies like Kinder Morgan benefit directly from increased utilization rates on their interstate systems, which typically operate under long-term contracts with built-in escalation clauses. Higher volumes translate to immediate revenue growth without additional infrastructure investment.

Infrastructure Spending Accelerates Returns

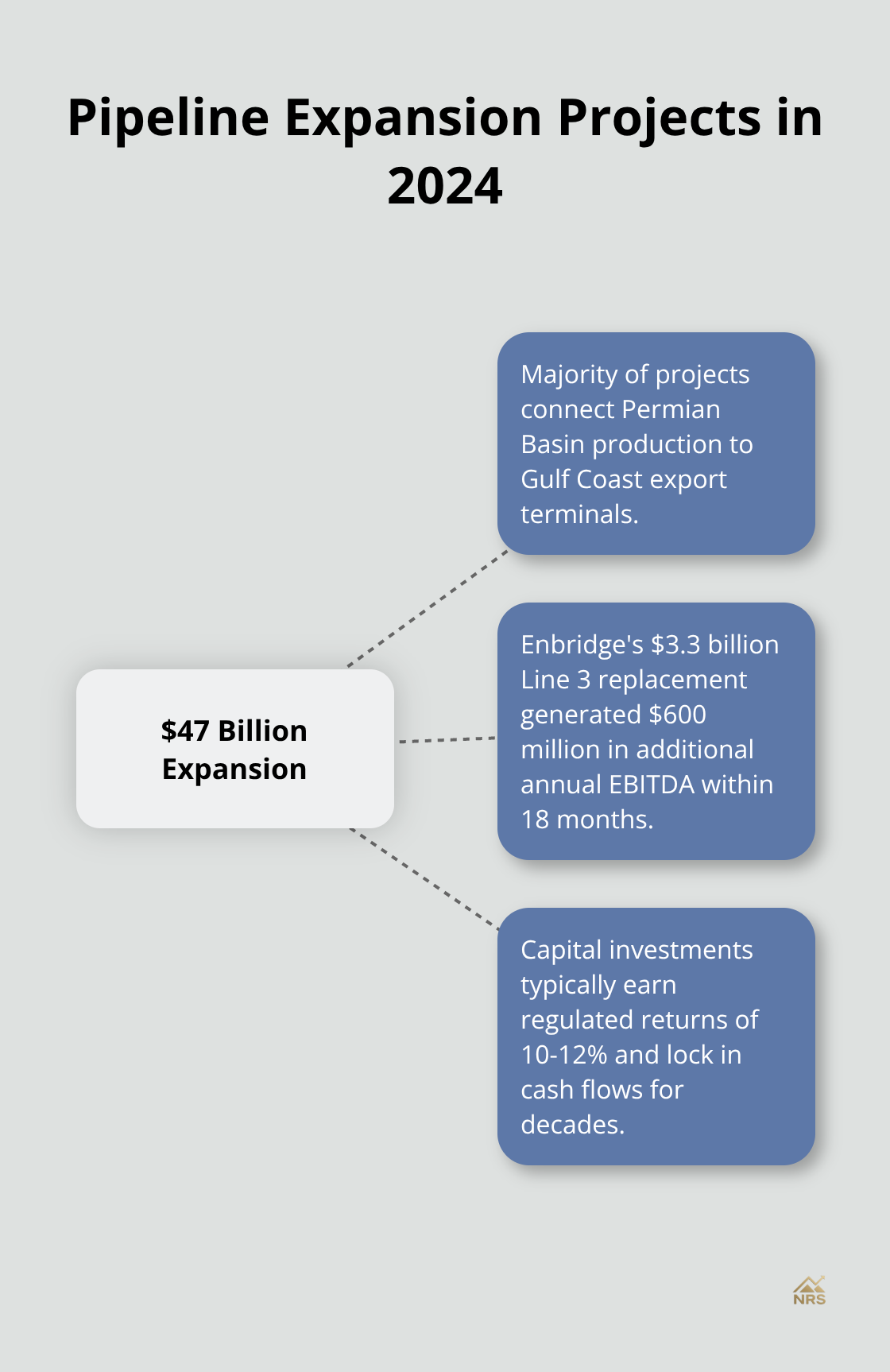

Pipeline companies committed $47 billion to expansion projects in 2024, with the majority focused on connecting Permian Basin production to Gulf Coast export terminals. Enbridge’s $3.3 billion Line 3 replacement generated $600 million in additional annual EBITDA within 18 months of completion.

These capital investments typically earn regulated returns of 10-12% and lock in cash flows for decades through take-or-pay contracts. Smart investors track project announcements and construction timelines because completed infrastructure drives immediate earnings growth (often within 12-24 months of project completion).

Regulatory Approval Patterns Create Competitive Moats

Federal Energy Regulatory Commission data shows pipeline permit approvals dropped 31% between 2021 and 2023, creating bottlenecks that benefit existing operators. Companies with established rights-of-way face fewer regulatory hurdles when they expand capacity along existing routes.

TC Energy’s NGTL system expansion received approval in 8 months versus 24 months for greenfield projects. This regulatory environment favors incumbent pipeline operators with extensive existing networks over new market entrants who attempt to build competing infrastructure.

The permit approval process becomes even more complex when projects cross state lines or require environmental impact assessments (which can add 6-18 months to project timelines). These regulatory advantages help explain why established pipeline companies maintain such strong market positions and why investors should focus on evaluation strategies that account for both financial metrics and operational advantages.

How to Pick Winners in Pipeline Stocks

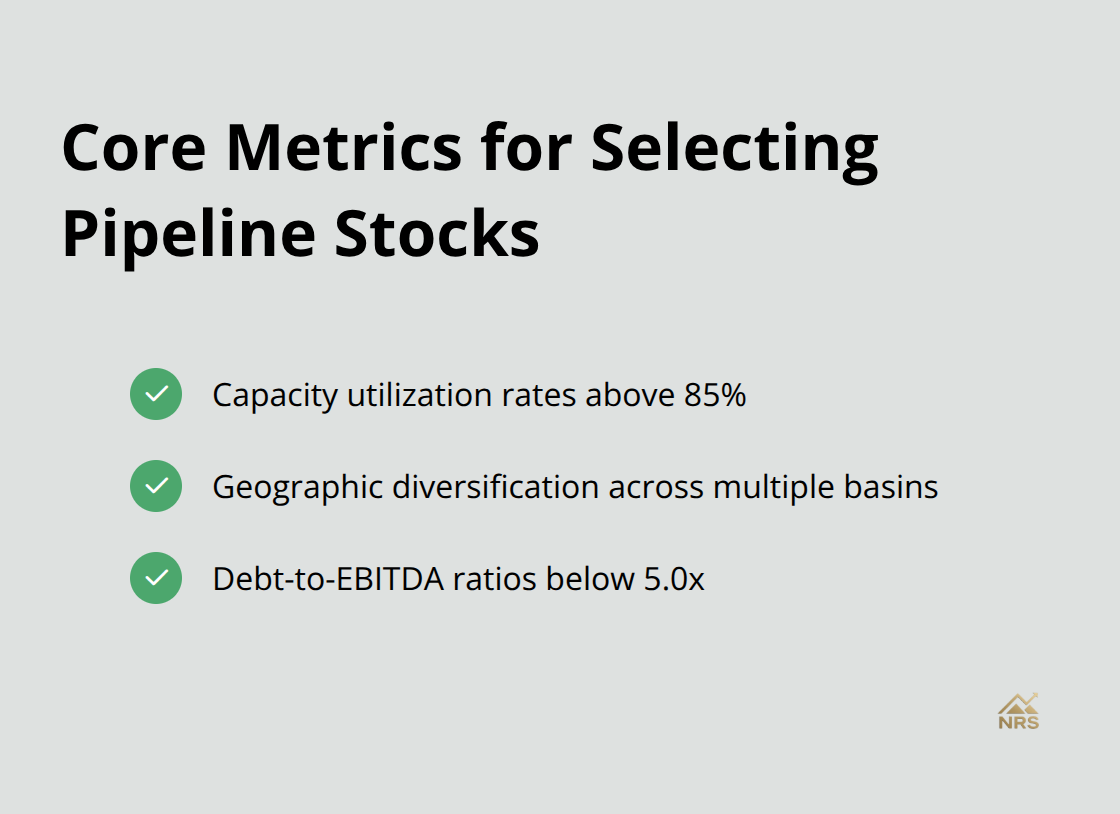

We recommend three core metrics when you select pipeline stocks: capacity utilization rates above 85%, geographic diversification across multiple basins, and debt-to-EBITDA ratios below 5.0x. Companies that meet these criteria generate predictable cash flows even during commodity price volatility. Kinder Morgan’s 90% utilization rate on its interstate system demonstrates this principle, while TC Energy’s concentrated Alberta exposure created vulnerability during the Keystone XL cancellation.

Geographic Diversification Beats Concentration

Pipeline operators with networks that span multiple production basins outperform single-region players over five-year periods. Enbridge’s diversified footprint across the Permian, Bakken, and Canadian oil sands provides revenue stability when individual basins face production declines. Smart investors avoid companies with more than 60% revenue exposure to single geographic regions because local regulatory changes or production disruptions create outsized risks.

Cash Flow Coverage Ratios Predict Dividend Safety

Sustainable pipeline dividends require distributable cash flow coverage ratios above 1.2x, with the strongest operators that maintain 1.4x coverage or higher. Enterprise Products Partners achieved 1.7x coverage in 2023 while it maintained its quarterly distribution through multiple energy downturns. Companies with coverage below 1.1x face dividend cuts within 18 months based on historical patterns from 2015-2020 energy sector stress periods.

Market Entry Points During Sector Rotations

Energy sector volatility creates exceptional entry points when pipeline stocks trade below 11x EBITDA multiples. The sector reached 8.5x EBITDA during March 2020 and again in October 2022, which generated 35% returns for investors who purchased quality operators during these windows. Monitor the Alerian MLP ETF as a sector indicator – purchases during 15% monthly declines historically produce superior three-year returns compared to dollar-cost average approaches.

Final Thoughts

Natural gas pipeline stocks provide consistent dividend income while they position investors for America’s energy transition. These infrastructure companies produce predictable cash flows through long-term transportation contracts that stay profitable regardless of commodity price swings. The best natural gas pipeline stocks combine strong balance sheets with strategic growth projects that expand capacity along high-demand corridors.

Kinder Morgan’s 70,000-mile network, Enbridge’s 29-year dividend growth streak, and TC Energy’s $24 billion project backlog show how established operators maintain competitive advantages through scale and regulatory expertise. Successful pipeline investment requires you to monitor three key factors: industrial demand growth, infrastructure spending cycles, and regulatory approval patterns. Companies with debt-to-EBITDA ratios below 5.0x and geographic diversification across multiple basins outperform concentrated operators during market volatility.

We at Natural Resource Stocks track these market fundamentals through comprehensive analysis of energy sector trends and macroeconomic factors (including regulatory changes that affect pipeline operations). Our platform provides expert insights into natural resource investments and helps investors navigate complex energy markets. Visit Natural Resource Stocks for detailed market analysis and investment strategies across the energy sector.