Silver prices have captured investor attention as market volatility continues to shape precious metals trading. Bloomberg’s silver forecast reveals compelling insights about future price movements and investment opportunities.

We at Natural Resource Stocks analyze these expert predictions to help you navigate the evolving silver market. Understanding Bloomberg’s analysis becomes essential for making informed investment decisions in today’s economic climate.

What Is Bloomberg Saying About Silver Right Now?

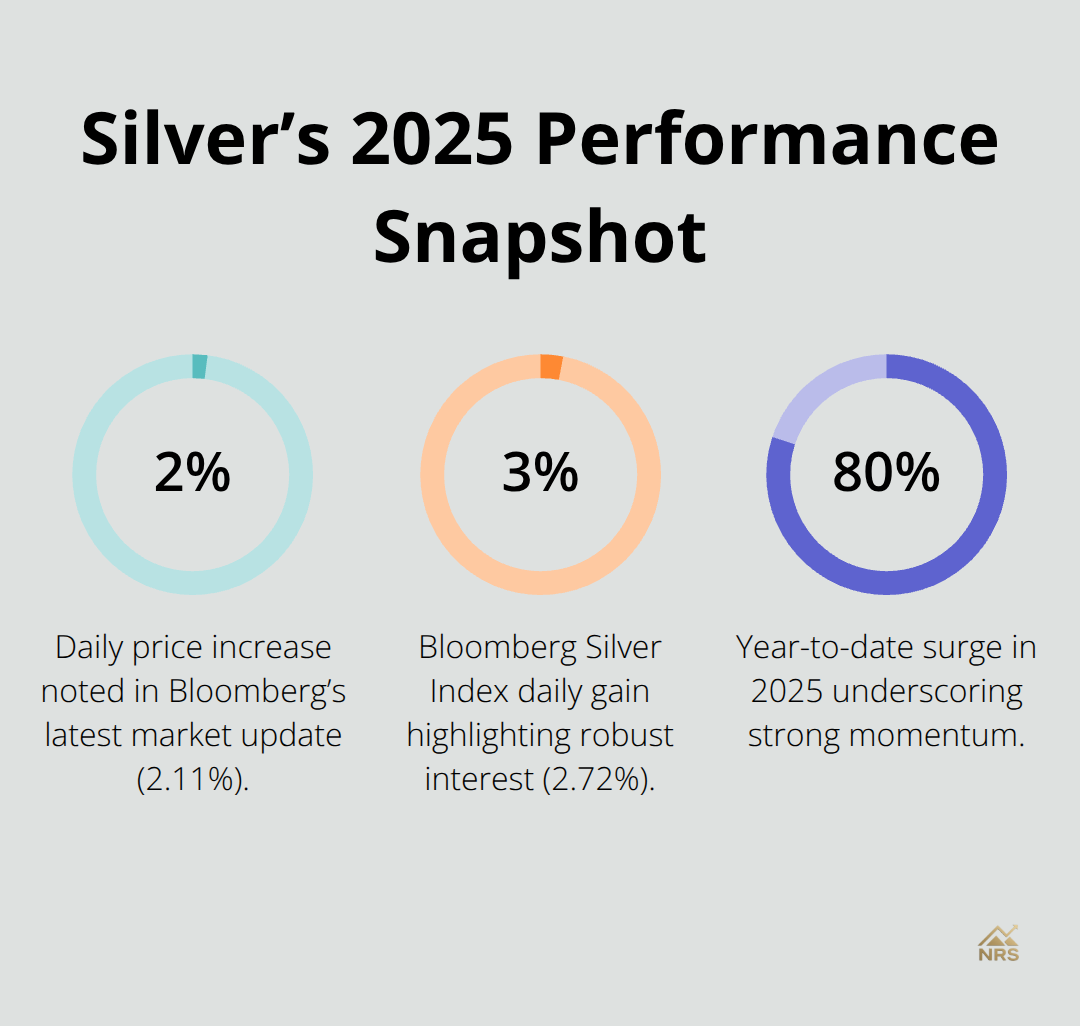

Bloomberg’s analysis shows silver trades at $58.34 per ounce as of December 5, 2025, with a 2.11% daily increase that reflects strong market momentum. The Bloomberg Silver Index closed at 442.18 with a substantial 2.72% gain, which demonstrates robust investor interest despite recent volatility. Silver has experienced an impressive 80% surge throughout 2025, reached an all-time high above $54 in October before current levels.

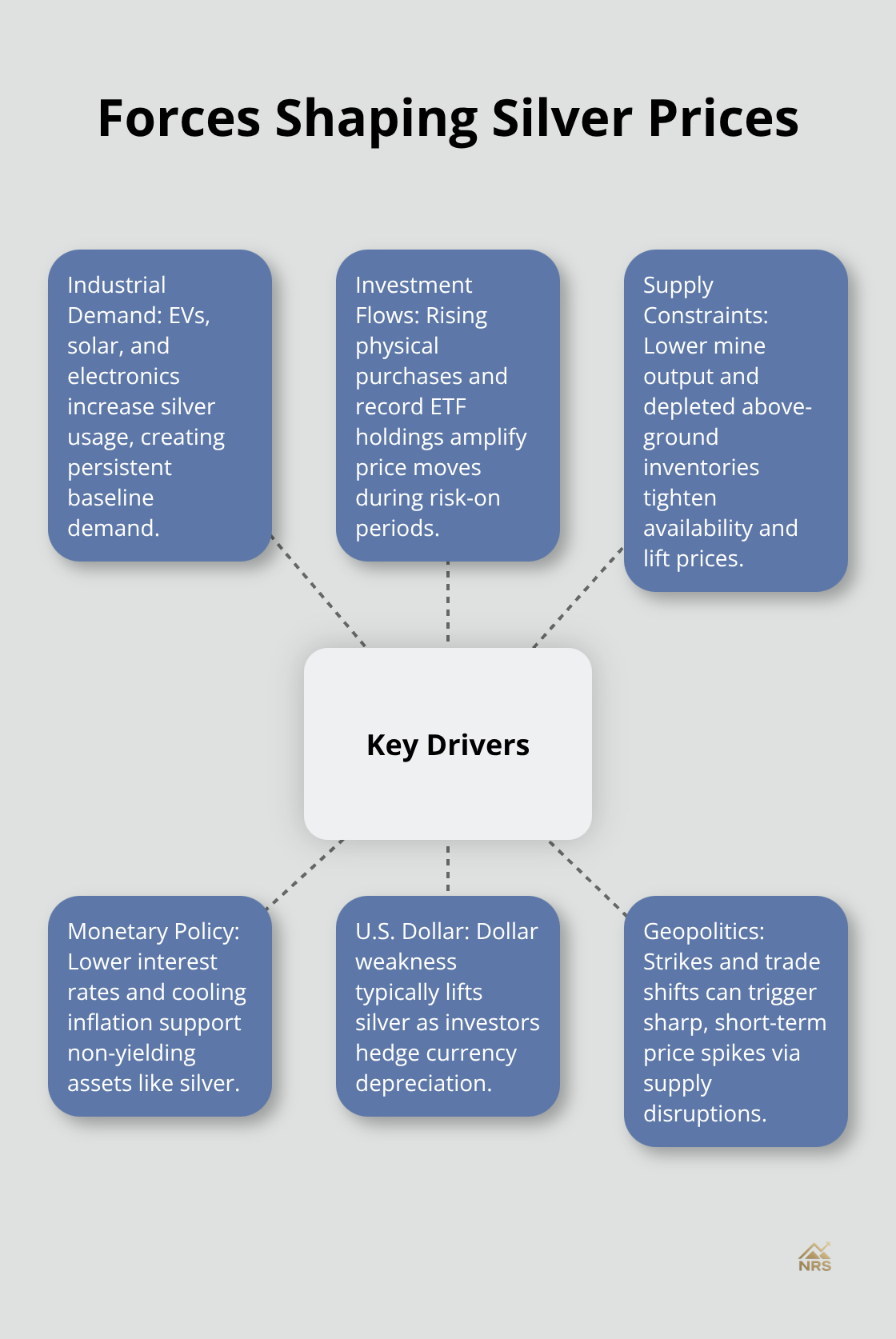

Industrial Demand Powers Market Growth

The Silver Institute projects global silver demand will drop by 4% in 2025, driven by various market factors. Solar panel production alone consumes massive quantities of silver, with McKinsey forecasts that demand will reach 800 million ounces by 2030. Electric vehicle production requires significant silver amounts for components, which creates sustained industrial pressure on supply. Electronics demand grows over 10% annually through 2027, while technological applications continue to expand across renewable energy sectors. This industrial consumption creates price floors that investment demand alone cannot establish.

Investment Flows Reshape Market Dynamics

Physical silver investment demand surged 20% year-over-year according to the World Silver Survey, while silver ETF investments reached record highs in 2025. Maria Smirnova from Sprott Asset Management reports above-ground silver inventories decreased by nearly 500 million ounces recently.

Bank of America forecasts silver will reach $65 per ounce by 2026 despite an expected 11% drop in demand, while supply shortfalls persist. The current gold-silver ratio sits around 90:1 compared to the mining ratio of approximately 7:1 (which suggests silver remains undervalued relative to gold). Smart money recognizes these fundamentals and positions for significant price appreciation as supply deficits widen.

Supply Constraints Create Price Pressure

Silver production faces significant challenges as several major mines report lower output due to regulatory hurdles. Dana Samuelson from American Gold Exchange emphasizes that silver becomes particularly vulnerable to supply shocks due to a significant reduction in physical silver supplies. The Silver Institute indicates that readily accessible stockpiles have been largely exhausted at current prices (making new supply discoveries more expensive). These supply constraints occur precisely when industrial demand accelerates, which creates a perfect storm for price appreciation that expert forecasts consistently highlight.

Where Will Silver Prices Go Next

Goldman Sachs and Bank of America Lead Bullish Forecasts

Goldman Sachs analysts forecast silver prices could reach $65 per ounce within the next 12 months due to tight supply constraints. Bank of America projects the same $65 target by 2026 with ongoing supply deficits as the primary driver. These investment banks base their predictions on fundamental supply-demand imbalances that show no signs of resolution.

JPMorgan Chase expects silver to remain volatile but overall bullish amid increased industrial uses and investment flows. Keith Neumeyer from First Majestic Silver presents the most aggressive outlook and predicts silver could exceed $100 per ounce. Mike Maloney from GoldSilver.com suggests silver could easily top $200 if gold reaches $10,000 under current economic conditions.

Silver Outpaces Gold in Expert Projections

The current gold-silver ratio generally oscillates between 50:1 and 80:1 in the modern era, indicating potential silver undervaluation that experts expect to correct. Neumeyer specifically notes that silver will eventually become uncoupled from gold and transform from a precious metal into an industrial commodity. FX Empire emphasizes that inflation fears could drive substantial investment into silver and elevate prices beyond traditional precious metal correlations.

Expert analysis shows silver’s unique industrial applications in technology and renewable energy sectors create price dynamics independent of gold movements. This fundamental shift positions silver for potentially explosive price appreciation as markets recognize its dual nature as both investment asset and industrial necessity.

Strategic Entry Points and Risk Management

Market analysts recommend strategic entry points during price dips while investors monitor global economic signals that influence silver demand. The Federal Reserve’s interest rate changes significantly impact silver prices (with lower rates generally favoring higher silver demand according to multiple expert sources). Analysts observe that market dynamics have shifted and cause silver to perform independently of gold in recent sessions.

Expert recommendations focus on diversification strategies that incorporate silver’s unique position in both investment and industrial portfolios. Particular attention goes to emerging market demands from Asia that could drive prices higher. These global economic conditions and industrial applications create the foundation for the next phase of silver’s price movement.

What Drives Silver Price Movements

Economic Fundamentals Shape Price Direction

Core PCE inflation recently cooled to 2.8%, which creates monetary policy support that favors silver prices according to FX Empire analysis. The Federal Reserve’s interest rate decisions directly impact silver demand since lower rates make non-yielding assets like silver more attractive to investors. A weaker U.S. Dollar Index benefits precious metals as investors seek alternatives to currency depreciation. The inverse relationship between dollar strength and silver prices means every percentage point drop in the dollar typically drives silver prices 2-3% higher. Economic uncertainty pushes institutional investors toward silver as portfolio diversification, with JPMorgan noting increased allocation strategies among major funds.

Technology Sector Drives Unprecedented Demand

Electric vehicle production requires approximately one troy ounce of silver per vehicle, with global EV sales projected to reach 30 million units by 2027. Solar panel production consumes 20% of total silver demand, while the renewable energy transition accelerates this consumption rate.

Electronics production grows 10% annually through 2027, which creates sustained industrial pressure on silver supplies that investment demand cannot offset. The Silver Institute reports that recycling provides only 15% of annual silver supply (making primary mining output critical for meeting demand). Maria Smirnova from Sprott Asset Management confirms that above-ground inventories dropped 500 million ounces, which creates supply shortfalls that drive prices higher regardless of investment flows.

Geopolitical Tensions Amplify Price Volatility

China’s economic slowdown concerns recently caused an 8% silver price decline over four weeks, which demonstrates how geopolitical events create immediate market reactions. Mining strikes in major producing countries like Peru and Mexico can reduce global supply by 15-20% within months (creating price spikes that exceed $5 per ounce). Trade policy changes between major economies affect silver demand patterns, particularly when solar panel tariffs impact renewable energy adoption rates. Keith Neumeyer from First Majestic Silver emphasizes that regulatory hurdles at mining operations reduce output precisely when demand peaks, which amplifies supply-demand imbalances that geopolitical tensions often trigger.

Final Thoughts

Bloomberg silver forecast data reveals compelling investment opportunities as silver trades at $58.34 per ounce with strong momentum indicators. Expert predictions from Goldman Sachs and Bank of America target $65 per ounce by 2026 and reflect fundamental supply-demand imbalances that create significant upside potential. The 80% price surge in 2025 demonstrates silver’s capacity for explosive growth when market conditions align.

Natural resource portfolios benefit from silver’s dual nature as both industrial commodity and investment asset. The projected 800 million ounce solar demand by 2030 combined with electric vehicle growth creates sustained price floors that traditional precious metals lack. Supply constraints from reduced output and depleted above-ground inventories (down 500 million ounces) support long-term price appreciation.

Strategic silver investors should focus on entry points during market dips while they monitor Federal Reserve policy changes that influence precious metal demand. The current gold-silver ratio of 90:1 versus the ratio of 7:1 suggests significant undervaluation that markets will eventually correct. We at Natural Resource Stocks provide comprehensive analysis and expert insights to help investors navigate these market dynamics through our natural resource investment platform.