Silver markets are moving fast, and Gatos Silver sits at a critical juncture heading into next year. We at Natural Resource Stocks are tracking how production costs, commodity prices, and expansion plans will shape this stock’s trajectory.

This Gatos Silver stock forecast examines the forces that matter most to investors right now. Understanding these dynamics gives you the clarity needed to make informed decisions.

Where Gatos Silver Stands Right Now

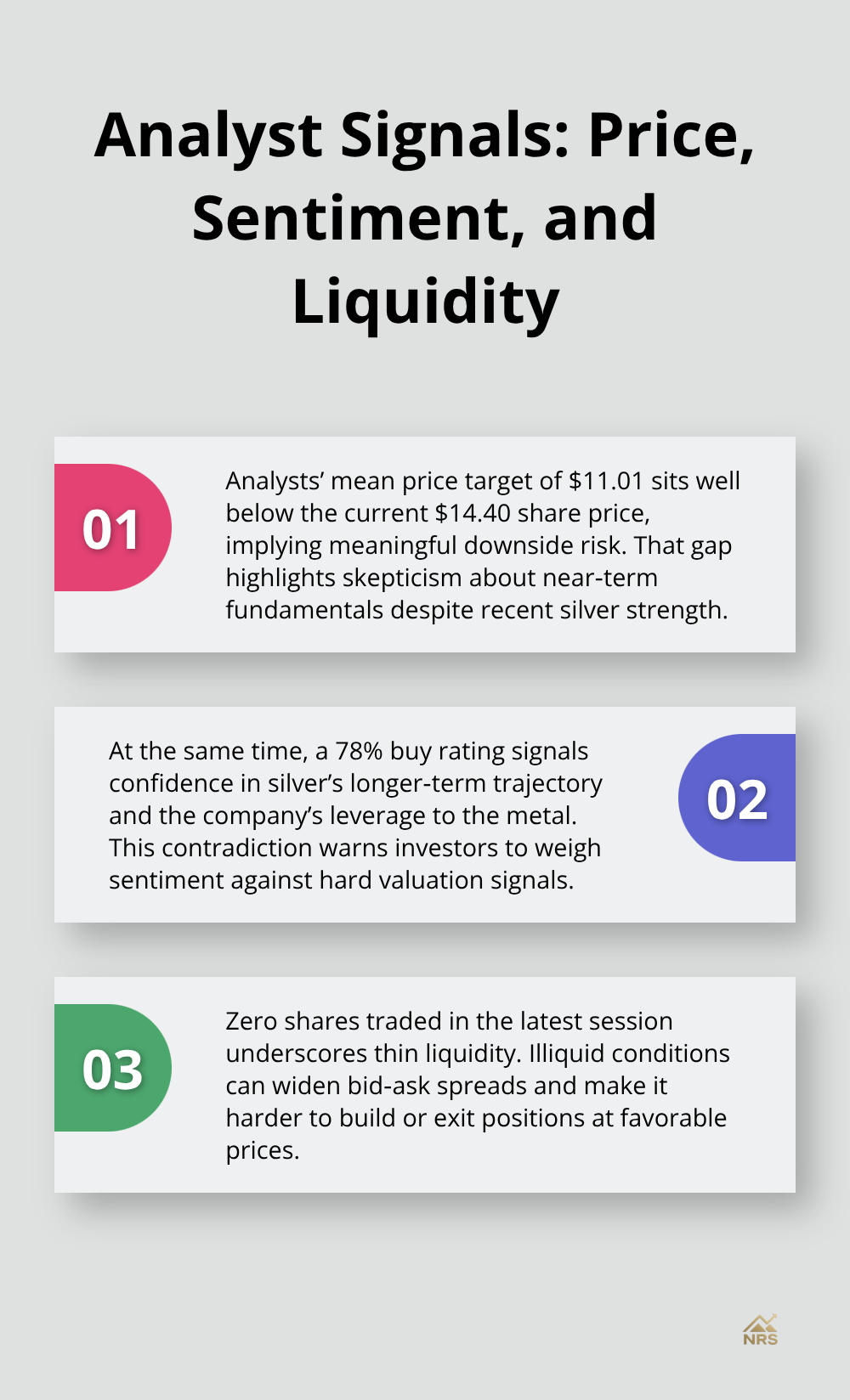

Stock Price and Analyst Sentiment

Gatos Silver trades at $14.40 per share on the NYSE, yet nine analysts project a mean price target of $11.01, implying a 23.56% downside over the next year. This bearish consensus conflicts sharply with the 78% buy rating from the same analyst group, revealing fundamental disagreement about the stock’s near-term direction. The contradiction between bullish sentiment and bearish price targets suggests investors should approach near-term forecasts with caution. Liquidity presents another obstacle-zero shares traded in the latest session indicates minimal trading activity, making it difficult to execute positions without widening bid-ask spreads significantly.

Cash Flow and Profitability Disconnect

Gatos Silver generated $83.19 million in free cash flow on a trailing twelve-month basis, or $1.17 per share, compared to $47.48 million in fiscal 2023. Net income reached $33.9 million TTM with earnings per share of $0.49, representing a 542.81% year-over-year increase. These figures show the company produces real cash and profits rather than operating at a loss. However, the underlying operational picture tells a different story.

The EBITDA Problem

The company’s EBITDA sits at negative $21.87 million TTM and negative $22.31 million in fiscal 2023, meaning the core mining business loses money before interest and taxes. Operating expenses total $21.89 million TTM while interest and investment income of $3.86 million props up the bottom line, along with $6.71 million in other non-operating gains. This reliance on non-operating income to show profitability indicates the Cerro Los Gatos mine in Chihuahua, Mexico operates at a cost structure that management has not yet optimized. The company’s 69 million basic shares outstanding create vulnerability to commodity price swings that larger competitors absorb more easily.

Silver Prices and Market Skepticism

Silver prices climbed to roughly $64 per ounce as of December 16, 2025, a gain of about 120% year-to-date, yet Gatos Silver stock remains under pressure from analysts. This disconnect suggests investors question whether current silver prices will hold or whether the company can maintain margins at these levels. Larger silver producers benefit from economies of scale that Gatos Silver cannot match with a single-mine operation, putting the company at a structural disadvantage as commodity cycles shift.

These operational and market realities shape how investors should evaluate Gatos Silver’s prospects heading into 2026. The next section examines the specific factors that will determine whether the company can close the gap between its cash generation and its core mining profitability.

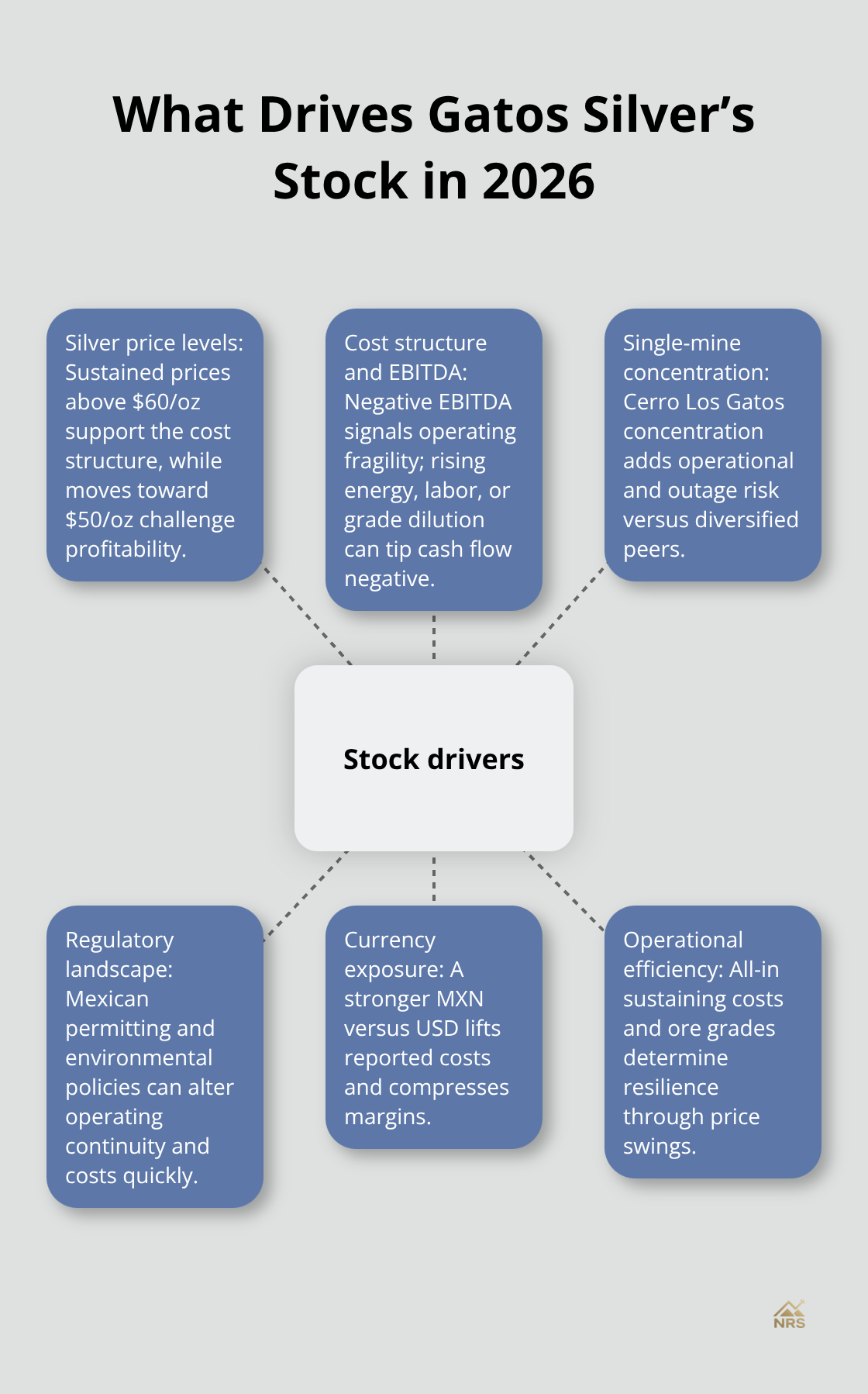

What Drives Gatos Silver’s Stock Price

Silver Prices and the Profitability Threshold

Silver prices remain the dominant force shaping Gatos Silver’s stock trajectory, but the relationship is far more nuanced than a simple one-to-one correlation. Gatos Silver’s negative EBITDA of $21.87 million TTM means the company needs silver prices to remain elevated just to cover core operating costs. At $64 per ounce in mid-December 2025, prices sit near the upper end of the past decade’s range, yet the stock trades below analyst targets. This reveals a critical market concern: investors doubt whether Gatos Silver can sustain profitability if silver retreats toward $50 per ounce or lower.

The company’s single-mine operation at Cerro Los Gatos offers no diversification buffer that larger producers like Vale or Rio Tinto enjoy. Production costs matter intensely here. With SG&A expenses at $21.65 million TTM and operating expenses matching that level, Gatos Silver operates with minimal margin for error. A 10% drop in silver prices could erode cash flow by millions without corresponding cost reductions, pushing the company back into cash burn territory.

Operational Cost Pressures

Monitor the all-in sustaining cost per ounce at Cerro Los Gatos closely. If management reports cost increases due to energy prices, labor inflation, or ore grade declines, the stock faces immediate downside pressure regardless of silver price strength. These operational metrics directly determine whether the company survives commodity price weakness.

Mexican Regulatory and Political Risk

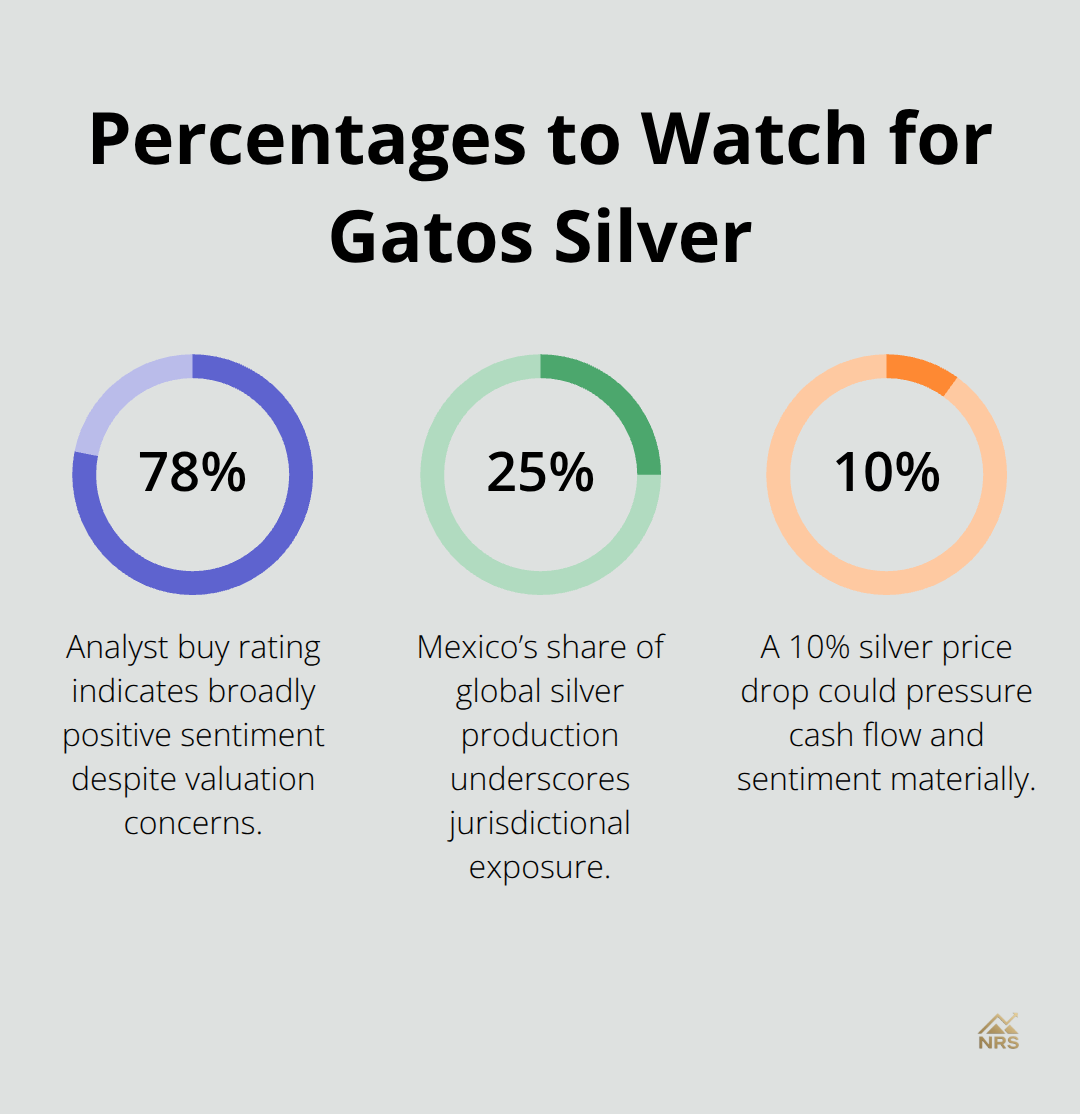

Geopolitical risk compounds this vulnerability. Mexico accounts for roughly 25% of global silver production, and regulatory changes affecting mining permits, environmental standards, or labor laws could force Gatos Silver to idle operations or reduce output. The 2024 Mexican government shift toward stricter mining oversight created uncertainty around permit renewals and operational continuity.

Mexico’s faster mining approvals, with environmental clearance timelines of 6-12 months, demonstrate the regulatory environment’s evolving pace. Track Mexican political developments and mining regulation announcements, particularly any changes to water usage policies or environmental compliance requirements affecting Chihuahua operations.

Currency Exposure and Financial Constraints

Currency exposure adds another layer of complexity. Gatos Silver reports earnings in USD but operates in Mexico with costs in Mexican pesos. A weaker USD against the peso increases operating expenses when converted to reporting currency, compressing margins even if silver prices hold steady. The company’s capital structure of 69 million basic shares means limited financial flexibility to hedge currency risk through derivatives or other instruments that larger producers routinely employ.

Setting Investment Thresholds

The intersection of commodity price volatility, operational leverage, and geopolitical exposure creates a high-stakes environment for Gatos Silver investors. Silver prices above $60 per ounce support the current cost structure, but any sustained retreat below $55 per ounce triggers serious profitability questions. Production efficiency improvements at Cerro Los Gatos could provide upside surprise, but management has not signaled major cost reduction initiatives in recent quarters. Mexican regulatory stability remains a wildcard that could shift sentiment quickly.

For investors evaluating Gatos Silver, the practical approach involves setting price thresholds that trigger position reviews. Establish a mental stop if silver breaks below $50 per ounce or if Mexican mining regulations tighten measurably. Conversely, if silver rallies above $70 per ounce and sustains that level through 2026, Gatos Silver could see margin expansion that supports stock appreciation toward analyst upside scenarios. The 78% buy rating from analysts reflects belief in silver’s long-term demand trajectory, but near-term execution risk remains real. Understanding these price sensitivities and operational constraints positions you to evaluate whether Gatos Silver fits your portfolio strategy as silver demand patterns shift in the coming year.

What Could Accelerate or Derail Gatos Silver

The Absence of Growth Projects

Gatos Silver operates without announced major expansion projects or new mine developments in its pipeline. The Cerro Los Gatos mine remains the sole operating asset, and management has not disclosed capital allocation toward greenfield exploration or acquisition targets that would diversify revenue streams. This matters because single-asset mining companies face existential risk during downturns. Investors seeking exposure to silver production need to accept that Gatos Silver offers no operational cushion when commodity cycles turn negative.

Industrial and Investment Demand Dynamics

Industrial demand for silver accelerated in 2025 as renewable energy installations drove photovoltaic panel manufacturing, with solar capacity additions reaching record levels globally according to the International Energy Agency. Investment demand surged alongside, with silver ETF inflows climbing sharply as investors hedged inflation concerns and geopolitical uncertainty. These demand tailwinds currently support prices above $60 per ounce, but they are fragile. If renewable energy subsidies decline, if inflation moderates faster than expected, or if recession fears grip markets, silver demand could contract rapidly and leave Gatos Silver exposed to the full force of a commodity downturn without operational diversification to cushion the blow.

Ore Grade Decline and Mining Efficiency

Ore grade decline represents the silent killer at single-mine operations. If Cerro Los Gatos encounters lower silver grades in deeper ore bodies, processing costs per ounce spike without corresponding revenue increases, compressing margins directly. Watch quarterly production reports that flag grade trends or mining efficiency metrics. These operational metrics determine whether the company maintains profitability as silver prices fluctuate. Management has not signaled major cost reduction initiatives in recent quarters, leaving investors dependent on stable ore quality and consistent production rates.

Water Scarcity and Regulatory Risk

Mexican regulatory tightening around water usage poses genuine risk given that Chihuahua state faces severe water scarcity. Any new environmental restrictions on mining water consumption could force capital expenditures for treatment systems or reduce operating capacity. Currency volatility compounds these operational pressures, as a stronger Mexican peso increases USD-denominated costs without higher metal prices to offset them. The stock’s extreme sensitivity to silver price movements means a 10% decline from current levels could trigger a 20-30% equity loss given the operational leverage embedded in Gatos Silver’s cost structure.

Volatility as Risk and Opportunity

This volatility presents both a risk and an opportunity. Investors with conviction on silver’s 2026 trajectory and willingness to tolerate sharp drawdowns could position accordingly, but those seeking stability should recognize that Gatos Silver amplifies commodity moves in both directions. Track monthly production data, cost per ounce metrics, and Mexican regulatory announcements with equal intensity, as operational execution now determines whether the company reaches 2027 with financial flexibility intact. A 10% silver price decline could force the company to reassess its cost structure and capital allocation priorities, potentially triggering operational adjustments that reshape investor sentiment.

Final Thoughts

Gatos Silver stock forecast depends on whether silver prices remain elevated enough to cover the company’s operational costs. At $14.40 per share with nine analysts projecting an $11.01 mean target, the market reflects deep skepticism about near-term profitability despite the 78% buy consensus. The contradiction between bullish sentiment and bearish price targets reveals that investors are divided on whether current silver prices will hold through 2026.

Gatos Silver’s negative EBITDA of $21.87 million TTM means the company survives on non-operating income and commodity tailwinds, not core mining strength. A single-mine operation in Chihuahua, Mexico offers no diversification buffer when silver retreats or regulatory pressure intensifies. The company’s 69 million shares outstanding amplify volatility, so a 10% silver price decline could trigger a 20-30% equity loss given the operational leverage embedded in the cost structure.

Track monthly production data and all-in sustaining costs per ounce at Cerro Los Gatos, monitor Mexican mining regulation announcements, and watch silver prices against the $55-$60 threshold where profitability shifts. Currency movements between the USD and Mexican peso matter equally, as a stronger peso increases operating expenses without corresponding revenue gains. Visit Natural Resource Stocks to access expert analysis and market insights that help you evaluate whether Gatos Silver fits your portfolio strategy as silver demand patterns evolve in 2026.