Commodity markets are sending clear signals about what’s ahead. Inflation, geopolitical tensions, and shifting central bank policies are reshaping demand across oil, metals, and rare earth elements in ways that directly impact your portfolio.

At Natural Resource Stocks, we’re tracking the global macro commodity trends that matter most in 2026. This guide breaks down the opportunities emerging from these shifts and how to position yourself accordingly.

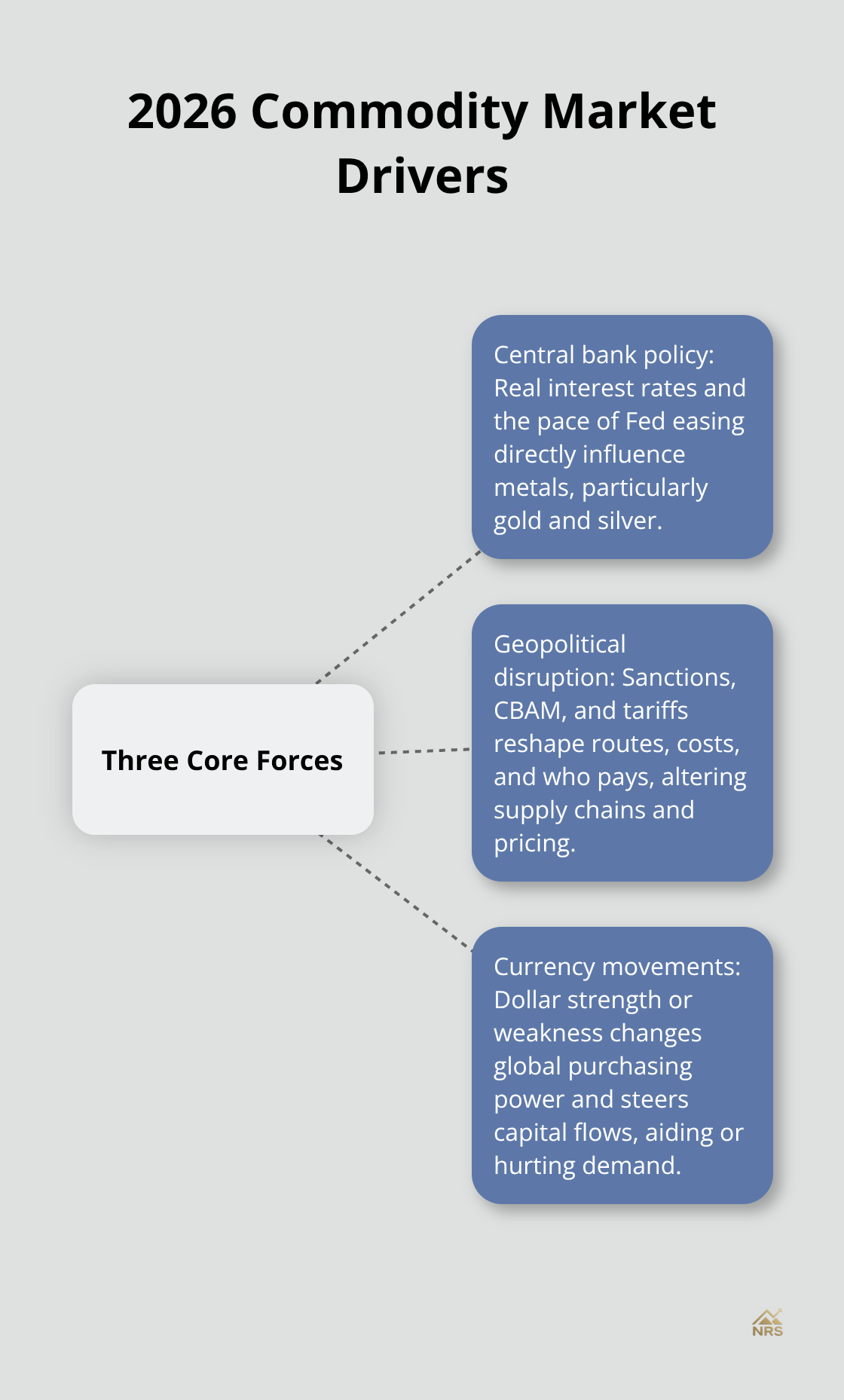

What’s Driving Commodity Price Swings in 2026

Central Bank Policy and Real Interest Rates

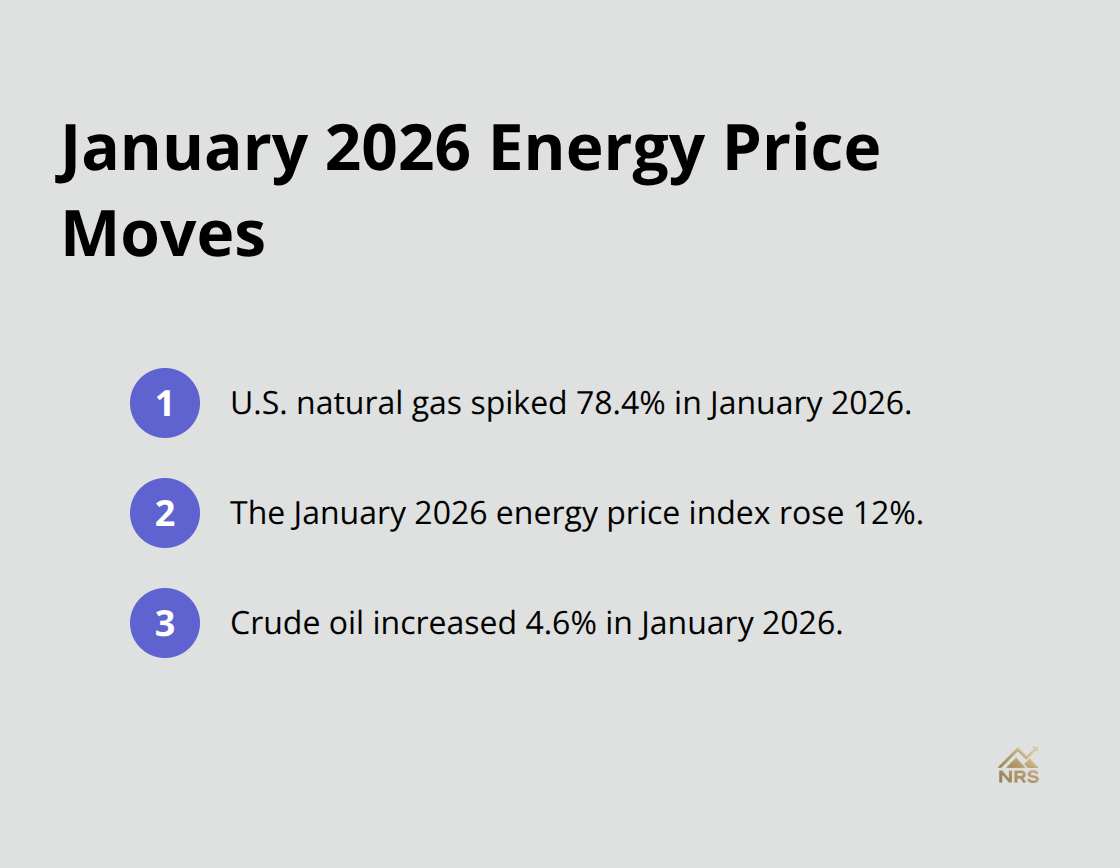

Central bank policy shifts reshape commodity demand right now. The Fed will ease toward a roughly 3% neutral rate in 2026, but inflation staying above trend creates timing uncertainty. Global commodity prices are projected to fall to their lowest level in six years in 2026, marking the fourth consecutive year of decline. This deflationary pressure stems from weak global economic growth, a growing oil surplus, and persistent policy uncertainty. However, the January 2026 energy price index surged 12%, led by a 78.4% spike in U.S. natural gas and a 4.6% increase in crude oil, signaling extreme near-term volatility despite the longer-term downtrend.

This contradiction matters for your portfolio because central bank guidance alone won’t determine commodity performance. You need to monitor real interest rates specifically. Gold appreciates when real interest rates fall, and central bank purchases have more than doubled since 2022 versus pre-2020 averages, providing fundamental support. Silver follows similar patterns but with greater volatility. For metals investors, the practical takeaway is straightforward: watch the Fed’s real rate trajectory, not just nominal rates. If the Fed cuts while inflation remains sticky, real rates could decline sharply, triggering metal outflows.

Geopolitical Disruption and Supply Chain Shifts

Geopolitical disruption now affects energy and metal supply chains in ways that won’t reverse quickly. Sanctions on Russia and Venezuela create permanent routing changes and longer shipping distances, which raised oil-on-water costs and tanker demand as Americas exports rise and Russian flows reorient to Asia. The EU’s Carbon Border Adjustment Mechanism moved into a definitive phase in January 2026, raising carbon costs and forcing supply-chain reshaping. These structural shifts reshape where commodities flow and who pays what price. The U.S. doubled steel and aluminum tariffs, affecting Canada and Mexico and altering global supply chains with knock-on effects for China.

The practical action here is to track OPEC+ inventory levels and policy decisions monthly. The World Bank’s Commodity Markets Outlook updates provide monthly price data and forward guidance. Oil markets began 2026 with a sizable supply surplus, but demand will tighten in the second half as global growth rebounds. Non-OPEC+ supply growth dominates the first half but tapers as prices stay low and investment slows.

Currency Fluctuations and Commodity Valuations

Currency fluctuations amplify these pressures across commodity markets. The U.S. dollar will remain rangebound in 2026 unless more aggressive Fed easing emerges, shaping global capital flows and commodity demand. A weaker dollar makes dollar-denominated commodities cheaper for foreign buyers, supporting demand. A stronger dollar does the opposite. Emerging markets benefit from USD weakness, which acts as a tailwind for their commodity exports and equity performance.

This creates a clear trading window: position defensively in the near term, then rotate into energy exposure as the second half approaches. Understanding these three forces-central bank policy, geopolitical disruption, and currency movements-positions you to anticipate which commodity markets will outperform. The next section examines specific commodity markets where these macro trends translate into concrete investment signals.

The Three Commodity Markets Reshaping 2026

Oil: A Two-Phase Year Ahead

Oil markets start 2026 with a sizable supply surplus, but this surplus masks a critical timing shift. Non-OPEC+ supply growth dominates the first half of 2026 but tapers as prices stay low and investment slows, according to the EIA and Macrobond analysis. Demand will tighten in the second half as global growth rebounds, creating a two-phase year where near-term weakness gives way to strength. OECD inventories will rise through 2026, keeping downward pressure on prices in Q1 and Q2.

Geopolitical risk from sanctions on Russia and Venezuela remains an upside factor, though the base case assumes no major additional export losses. For investors, this means rotating into oil exposure in Q3 2026 when demand tightens. The practical action is clear: treat the first half as a positioning phase and prepare to increase exposure when inventory levels peak and demand signals strengthen in the second half.

Natural Gas: Volatility as the Defining Feature

Natural gas presents a starkly different picture. The January 2026 energy price index saw U.S. natural gas spike 78.4%, the largest move among all energy commodities. This extreme volatility reflects supply-demand imbalances and geopolitical routing changes that make natural gas far more responsive to short-term shocks than oil. Europe’s gas security strategy, including storage targets and alternative supply sources, remains a central driver of macro commodity prices and risk in the near term.

For investors, treat natural gas as a tactical hedge rather than a core holding. Its price swings can amplify portfolio volatility without providing the structural demand support that oil or metals offer. Monitor Europe’s winter storage levels and LNG capacity additions to anticipate price moves, but size positions accordingly to your risk tolerance.

Precious Metals: Structural Demand Meets Central Bank Support

Gold is positioned for further gains in 2026, continuing a multi-year rally driven by geopolitical tensions, policy uncertainty, USD weakness, and inflation risks, with ETF inflows reaching their strongest levels since 2020 according to the LBMA and Macrobond data. Central banks have become dominant buyers with over 3,100 tonnes purchased from 2022-2024, with annual acquisitions now equal to approximately one-third of global mining output, providing a floor under prices.

Silver follows gold’s momentum but with greater volatility, making it suitable only for investors with higher risk tolerance. The practical action is straightforward: allocate to gold as a core defensive position, then size silver exposure based on your volatility threshold. This two-tier approach lets you capture precious metals’ upside while managing downside risk.

Base Metals and Rare Earths: Supply Constraints Meet Energy Transition Demand

Rare earth elements face supply constraints driven by technology demand, particularly from AI infrastructure capex, which is forecast to surge over the next two years according to Bloomberg and Macrobond data tracking hyperscaler investment. EV production remains robust, with over 20 million EVs expected to sell in 2025, expanding demand for metals critical to battery and motor production. Copper, aluminum, and nickel face resilient demand into 2026 as global renewable energy investment reaches record levels, with the IEA projecting two-thirds of the projected $3.3 trillion energy sector investment directed to clean energy technologies.

Base metals offer more stable returns than rare earth elements because their supply chains are more diversified and less concentrated. If you must choose between rare earth exposure and base metal exposure, base metals offer better risk-adjusted returns in 2026 given fewer geopolitical supply constraints and steadier demand visibility from the energy transition. This distinction matters because it shapes which commodity exposures will weather volatility and which will amplify it.

The commodity markets sending these signals also reveal where investment capital is flowing and which sectors will capture the most growth. Understanding these flows positions you to identify which resource stocks will benefit most from these macro trends.

Where Capital Flows in Energy Transition Markets

LNG and Natural Gas Infrastructure Capture Long-Term Investment

Energy transition investments reshape where capital deploys across oil and gas markets, and the flows reveal which segments will capture real growth. The IEA projects $3.3 trillion in global energy sector investment for 2025, with roughly two-thirds directed to clean energy technologies like renewables, grids, and energy storage. This capital reallocation does not eliminate oil and gas demand-it redirects it. Oil markets will tighten in the second half of 2026 as global growth rebounds, but the growth comes from developing economies with rising energy consumption, not from advanced economies building new fossil fuel infrastructure. For investors, this means abandoning the narrative that oil is dying and instead recognizing that oil demand shifts geographically while LNG and natural gas play a role in the energy transition.

Europe’s winter storage requirements and Asia’s energy security needs drive LNG capacity expansion and infrastructure investment. New LNG terminals and regasification capacity across Asia and Europe represent concrete investment opportunities tied to long-term contracts and government backing. These infrastructure projects offer stability that spot commodity trading cannot match.

Copper and Aluminum Anchor Industrial Metal Demand

Industrial metals face a sharply different opportunity set anchored in EV production and grid modernization. Over 20 million electric vehicles will sell in 2025 alone, expanding demand for copper, nickel, cobalt, and lithium critical to battery and motor production. The World Bank notes base metal strength, with prices rising through 2025 and solid demand expected into 2026. Copper demand remains particularly resilient because its applications span EVs, renewable energy systems, and grid infrastructure simultaneously. Solar power investment alone reaches around $450 billion annually according to the IEA, driving robust demand for copper and aluminum in PV manufacturing and balance-of-system components.

This triple-demand scenario-EVs, renewables, and grid upgrades-creates a structural floor under copper prices that geopolitical disruption or policy uncertainty cannot easily break. Aluminum follows similar patterns but with additional tailwinds from aerospace and EV lightweighting trends.

Nickel and Cobalt: Higher Risk, Higher Reward

Nickel and cobalt face tighter supply constraints, making them more volatile, but their scarcity supports longer-term price appreciation for investors willing to tolerate near-term swings. These metals concentrate in fewer producing regions than copper or aluminum, amplifying both upside potential and downside risk. Supply disruptions in key producing countries translate directly into price spikes that benefit holders of physical exposure or mining equities.

Rare Earth Elements and AI Infrastructure Demand

Rare earth elements present the highest-risk, highest-reward opportunity because AI infrastructure capex will surge over the next two years according to Bloomberg data tracking hyperscaler investment. Data center buildouts require rare earth magnets for cooling systems and rare earth elements for semiconductor manufacturing, concentrating demand in a handful of suppliers. This concentration creates supply bottlenecks that translate into price premiums, but also regulatory and geopolitical risk if China restricts exports.

Base Metals Offer Superior Risk-Adjusted Returns

Base metals offer more stable risk-adjusted returns than rare earth exposure because their supply chains are more diversified and demand visibility from the energy transition remains clearer. If your risk tolerance limits exposure to rare earths, allocate capital to copper and aluminum instead and capture the energy transition upside with lower volatility. Copper’s multiple demand drivers and aluminum’s industrial applications provide steadier returns across different macro scenarios than concentrated rare earth plays.

Final Thoughts

The global macro commodity trends shaping 2026 converge around three core realities: central banks ease while inflation remains sticky, geopolitical disruption becomes permanent, and capital flows decisively toward energy transition infrastructure. These forces interact to create distinct opportunities across oil, natural gas, precious metals, and industrial metals that reward investors who understand the timing and magnitude of each shift. Oil deserves tactical exposure weighted toward the second half of 2026 when demand tightens and inventory peaks, while natural gas belongs in smaller allocations as a volatility hedge rather than a core holding.

Gold anchors your defensive positioning given central bank demand and real rate dynamics, while base metals like copper and aluminum capture energy transition upside with lower volatility than rare earth elements. Monitor real interest rates, track OECD inventory levels monthly, and watch Europe’s LNG storage targets to signal when you should rotate between defensive and growth-oriented commodity exposures. The World Bank publishes monthly commodity price updates and forward guidance that provide the data you need to stay ahead of price moves.

We at Natural Resource Stocks track these macro commodity trends and translate them into actionable investment signals through expert video and podcast content, in-depth market analysis, and insights into the geopolitical and policy impacts reshaping resource prices. Our platform helps you navigate the complexity of commodity markets by connecting global trends to specific investment opportunities in metals and energy stocks. Visit Natural Resource Stocks to access the analysis and community insights that position your portfolio for 2026 and beyond.