Traditional retirement accounts leave your savings vulnerable to inflation and market crashes. Gold and Silver IRAs offer a proven alternative that protects your wealth through economic uncertainty.

We at Natural Resource Stocks have seen investors lose decades of savings in market downturns. Precious metals provide the stability and growth potential your retirement deserves.

How Do Gold and Silver IRAs Actually Work

Self-Directed Precious Metals Account Structure

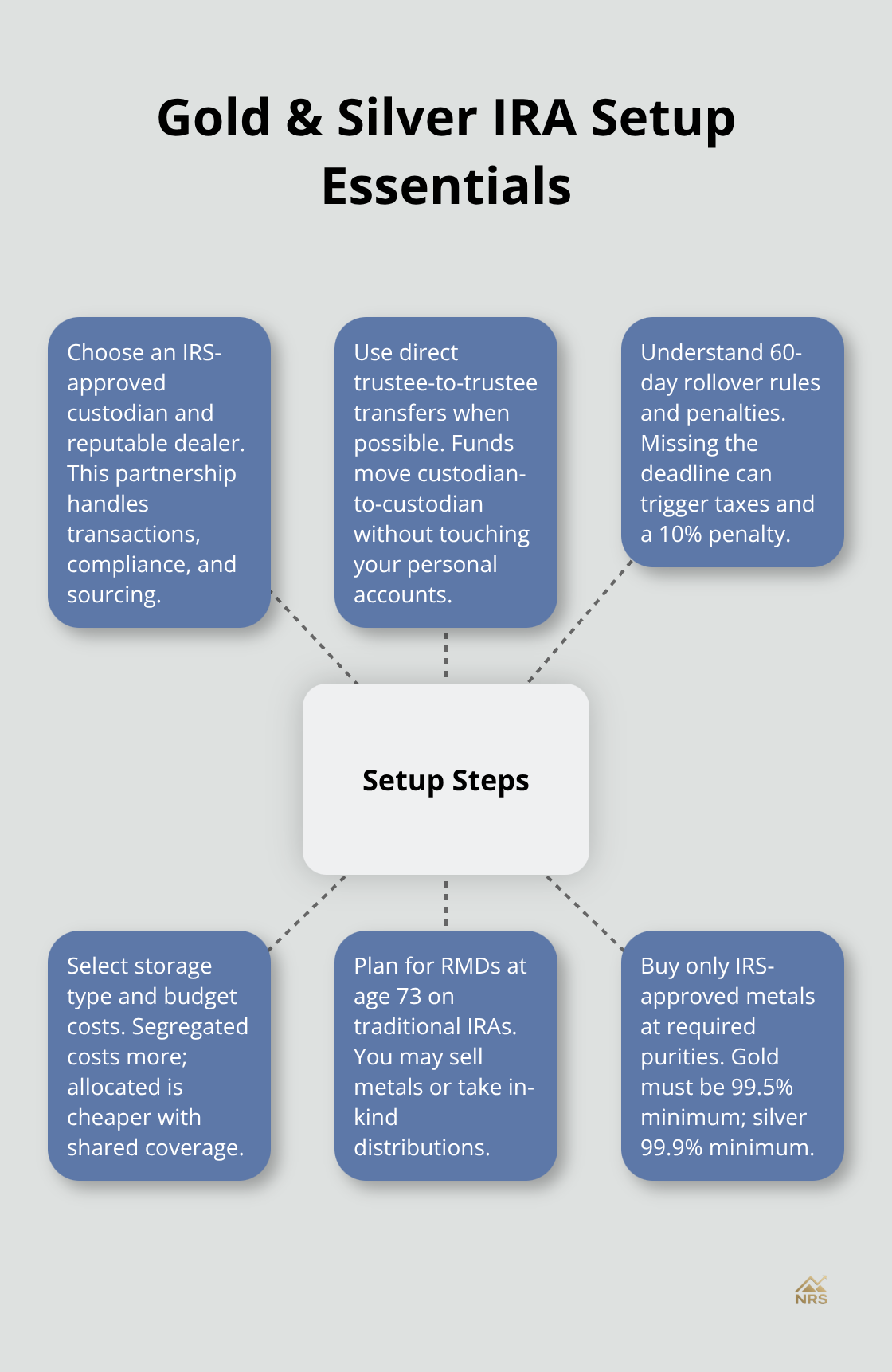

A Gold and Silver IRA functions as a self-directed individual retirement account that holds physical precious metals instead of traditional paper assets. The IRS mandates these accounts work through approved custodians who handle all transactions and compliance requirements. Your metals must meet strict purity standards – gold at 99.5% minimum and silver at 99.9% minimum according to IRS regulations.

The custodian purchases approved coins and bars on your behalf, then stores them in IRS-approved depositories. You cannot store these metals at home or in personal safety deposit boxes without severe tax penalties and account disqualification.

Tax Benefits and Annual Limits

Traditional Gold and Silver IRAs offer immediate tax deductions on contributions, while Roth versions provide tax-free withdrawals in retirement. For 2025, investors under 50 can contribute $7,000 annually, while those 50 and older receive an additional $1,000 catch-up contribution (total of $8,000).

Required minimum distributions begin at age 73 for traditional accounts, which means you must sell metals or take in-kind distributions. Rollover transfers from existing 401(k)s or IRAs into precious metals accounts avoid taxes and penalties when executed properly within 60 days.

Storage Requirements and Approved Metals

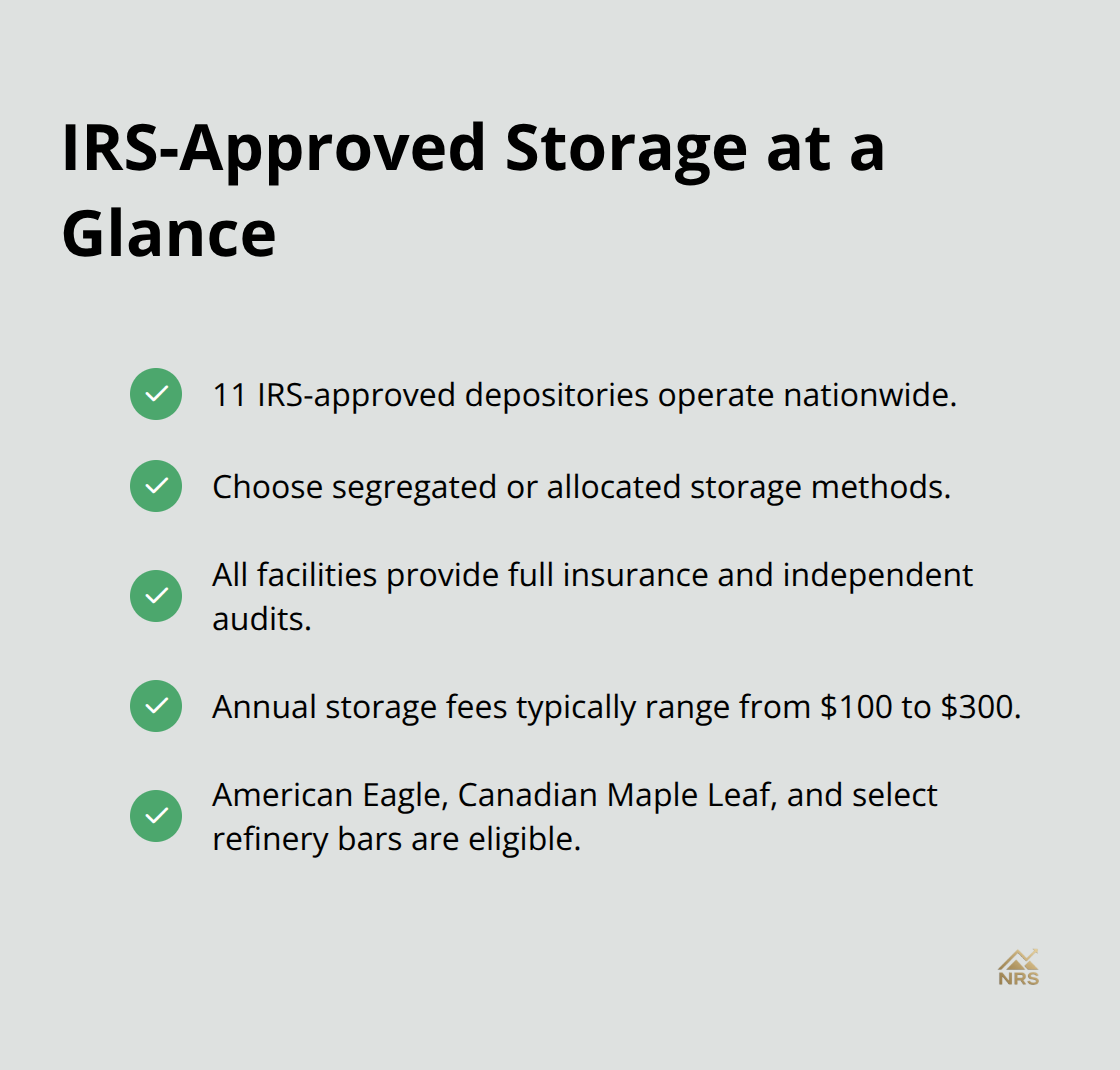

There are currently 11 IRS-approved depositories that provide segregated or allocated storage options with full insurance coverage and regular independent audits. American Eagle coins, Canadian Maple Leafs, and select bars from approved refiners qualify for inclusion. Storage fees typically range from $100 to $300 annually depending on the depository and storage method chosen.

These facilities maintain strict security protocols and detailed record-keeping to satisfy IRS compliance requirements. The next step involves selecting the right custodian and dealer to execute your precious metals retirement strategy effectively.

Why Precious Metals Outperform Traditional Retirement Assets

Protection Against Dollar Debasement and Rising Prices

Gold prices have seen significant fluctuations, ranging from around $35 per ounce in the early 1970s to over $2,000 per ounce in recent years, during periods when the dollar lost significant purchasing power. The Federal Reserve’s money printing policies since 2008 created massive currency devaluation that traditional retirement accounts cannot withstand. Silver jumped from $4.95 to over $30 per ounce during the same timeframe, proving precious metals maintain wealth when paper currencies fail.

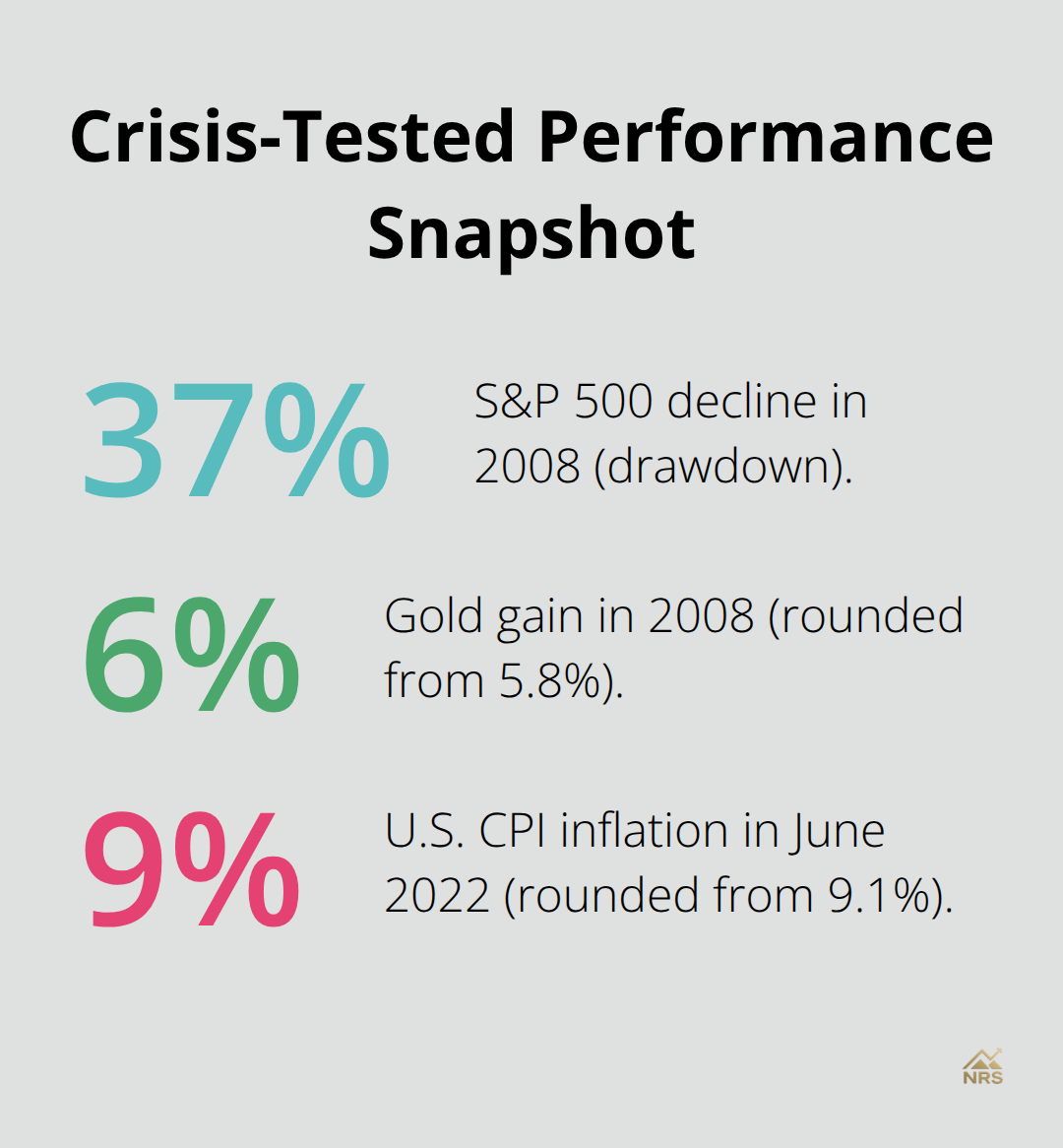

Traditional 401(k)s and IRAs hold stocks and bonds denominated in dollars, making them vulnerable to currency collapse. When inflation hit 9.1% in June 2022 (the highest rate in 40 years), gold and silver provided the only reliable hedge against rising costs while stock portfolios suffered massive losses.

Independent Performance During Market Crashes

The S&P 500 dropped 37% in 2008 while gold gained 5.8%, demonstrating precious metals move independently from traditional assets. During the 2020 pandemic crash, gold reached record highs above $2,000 while retirement accounts lost trillions in value.

This inverse correlation makes precious metals the ultimate portfolio insurance policy.

Financial advisors recommend 5-10% precious metals allocation specifically because they perform when stocks and bonds fail. The 2000-2002 dot-com crash saw gold rise 12% while the NASDAQ fell 78%, protecting investors who owned physical metals.

Historical Outperformance During Economic Uncertainty

Geopolitical tensions consistently drive precious metals prices higher while traditional assets suffer. The 1979 Iranian hostage crisis pushed gold from $226 to $850 per ounce within 18 months. Recent conflicts in Ukraine and the Middle East have similarly boosted gold prices above $2,400 per ounce in 2024.

Central bank gold buying hits record highs, reshaping global demand and supporting long-term gold prices amid geopolitical uncertainty. This institutional demand creates a floor under precious metals prices that stocks and bonds lack.

Smart retirement planning requires assets that thrive during economic chaos rather than collapse with everything else. The next step involves understanding exactly how to transition your existing retirement funds into this proven wealth preservation strategy.

How Do You Actually Set Up a Gold and Silver IRA

Choose Your Custodian and Dealer Partnership

The custodian selection process determines your entire Gold and Silver IRA experience. IRS regulations require specialized custodians who handle precious metals transactions, not traditional brokers like Fidelity or Vanguard. Priority Gold earned recognition as the Most Trusted Gold Company by Forbes in 2025, while U.S. Money Reserve offers zero first-year fees for new accounts.

These custodians must maintain proper licenses, insurance coverage, and established relationships with approved dealers and depositories. Avoid companies that pressure immediate purchases or promise guaranteed returns. Legitimate custodians focus on education over aggressive sales tactics. Customer ratings and Better Business Bureau accreditation provide reliable indicators of custodian quality and service reliability.

Execute Your Rollover Without Tax Penalties

The rollover process from your 401k or IRA accounts requires precise timing and documentation to avoid taxes and penalties. Direct trustee-to-trustee transfers represent the safest method. Your current custodian sends funds directly to your new precious metals custodian without the money touching your personal accounts.

The alternative 60-day rollover method gives you temporary possession of funds, but you face immediate taxes plus 10% penalties if you miss the deadline. Complete all paperwork accurately and maintain detailed records throughout the process. Most reputable custodians handle rollover documentation and coordinate with your retirement account provider to streamline the transfer.

Understand Storage Costs and Security Options

IRS-approved depositories charge annual storage fees from $100 to $300 (depending on segregated versus allocated storage methods). Segregated storage keeps your specific metals separate from other investors at higher costs, while allocated storage combines metals with shared insurance coverage at lower fees.

Delaware Depository, Brinks, and International Depository Services represent the most established facilities with comprehensive insurance and regular independent audits. Transportation and handling fees add $25 to $50 per transaction when you purchase gold or sell metals. These storage costs remain minimal compared to potential losses from inflation and market crashes that threaten traditional retirement accounts.

Final Thoughts

Gold and Silver IRAs protect retirement wealth against inflation, currency devaluation, and market volatility more effectively than traditional accounts. Recent crashes destroyed trillions in conventional portfolios while precious metals preserved purchasing power and provided stability. The setup process demands an IRS-approved custodian, proper rollovers, and secure storage facilities with annual costs of $100-$300 (minimal compared to potential losses from economic downturns).

Current economic conditions favor precious metals more than ever before. Record government debt, persistent inflation concerns, and geopolitical tensions create ideal conditions for gold and silver appreciation. Central banks worldwide accumulate gold at unprecedented rates, which signals institutional confidence in precious metals over paper assets.

Your Gold and Silver IRA positions retirement savings ahead of the next financial crisis. The 2008 crash proved that traditional diversification fails when investors need protection most. Natural Resource Stocks offers expert analysis and insights into precious metals markets, which helps investors navigate resource investment complexities with professional guidance and market intelligence.