Gold prices in 2025 are shaped by forces far beyond simple inflation metrics. Geopolitical tensions, central bank buying, real interest rates, and mining constraints are all competing to move the needle on gold valuations.

At Natural Resource Stocks, we’ve identified the gold price drivers 2025 that matter most for investors. Understanding these dynamics helps you position your resource stock portfolio ahead of market shifts.

Why Central Banks Are Reshaping Gold Markets in 2025

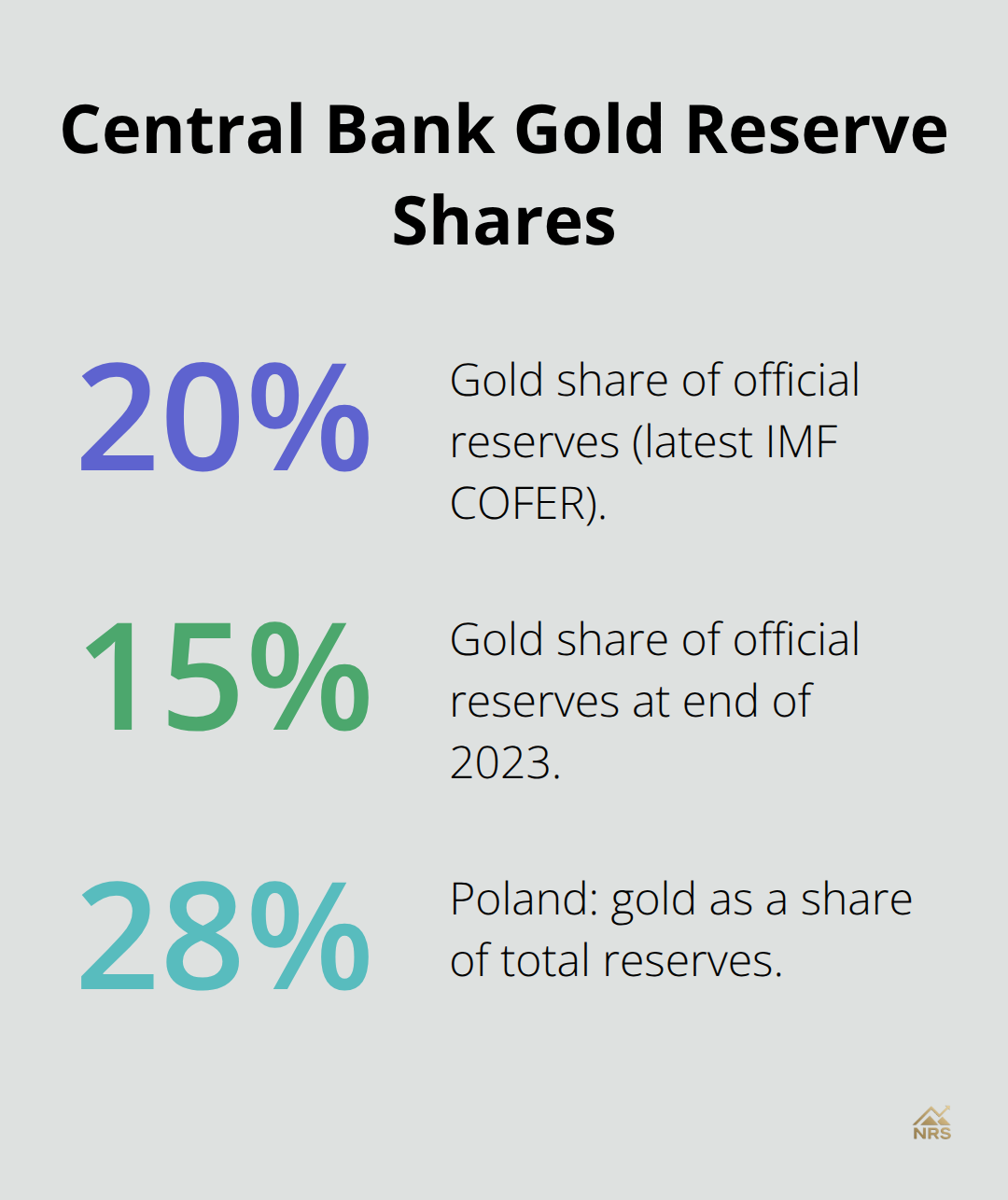

Central banks purchased 297 tonnes of gold year-to-date through November 2025, according to World Gold Council data, signaling an unmistakable shift in how reserve managers view the metal. This isn’t random buying-it’s strategic diversification away from dollar holdings amid geopolitical fractures and currency debasement concerns. Poland led the charge with 95 tonnes purchased in 2025, nearly doubling Kazakhstan’s 49 tonnes, while Brazil added 43 tonnes over three months alone. These aren’t marginal moves; they represent deliberate reserve reallocation that directly anchors gold prices higher. When central banks buy at these volumes, they remove physical supply from markets and signal confidence in gold’s role as a non-yielding hedge against currency risk. The data from IMF COFER shows central banks now hold roughly 36,200 tonnes of gold, accounting for about 20% of official reserves, up from 15% at the end of 2023. This rising share matters because reserve managers with gold allocations under 10% theoretically need to accumulate around 2,600 tonnes to reach 10% at current price levels. That’s enormous structural demand sitting in the pipeline, and it floors gold prices at elevated levels regardless of inflation headlines.

Trade Tensions Accelerate Reserve Diversification

The 2025 surge in central bank gold buying correlates directly with escalating trade uncertainty and sanctions-driven concerns about dollar dominance. Emerging-market central banks, particularly in Asia, treat gold as insurance against geopolitical isolation and currency volatility. Brazil’s steady accumulation reflects Latin American anxiety over sanctions and trade leverage, while Poland’s aggressive buying signals Eastern European hedging against regional instability. These aren’t hypothetical scenarios-they represent active reserve management responses to real policy risks. Institutions like the National Bank of Poland, which lifted its reserves to 543 tonnes with gold representing roughly 28% of total reserves, publicly signal that gold ranks above traditional currency reserves in their risk hierarchy. This philosophical shift transforms gold from a residual reserve asset into a primary diversification tool, and that mentality change sustains higher prices indefinitely. Geopolitical tensions are reshaping how resource allocation decisions unfold, with emerging-market reserve managers acting on principles that prioritize gold protection against foreign exchange risk.

Physical Demand Compounds Price Support

Central bank accumulation pairs with surging investor and bar-coin demand to create a two-tier support system for gold prices. J.P. Morgan Global Research projects quarterly central bank purchases averaging 190 tonnes in 2026, while bar and coin demand alone could exceed 1,200 tonnes annually. That’s roughly 1,390 tonnes of demand from these two categories alone each quarter, against global annual mine production of only 2–3% of above-ground stock. The math is unambiguous: demand vastly outpaces new supply, and that supply-demand imbalance is structural, not cyclical. Gold’s share of total investor assets under management reached about 2.8% as of September 2025, with potential to rise toward 4–5% in coming years according to J.P. Morgan, meaning retail and institutional portfolios still have significant room to increase allocations. Growth in gold ownership expands from non-traditional buyers, including Chinese insurance companies and participants from the crypto sphere, which widens the buyer pool beyond traditional reserve managers. This broadening demand means any geopolitical flare-up or currency concern immediately translates into physical gold accumulation rather than price discovery alone.

What Drives the Next Phase of Gold Strength

The structural forces reshaping gold markets in 2025 extend well beyond central bank reserve management. Real interest rates, dollar strength, and mining constraints all play critical roles in determining where gold prices move next.

How Real Rates and Dollar Moves Drive Gold Higher

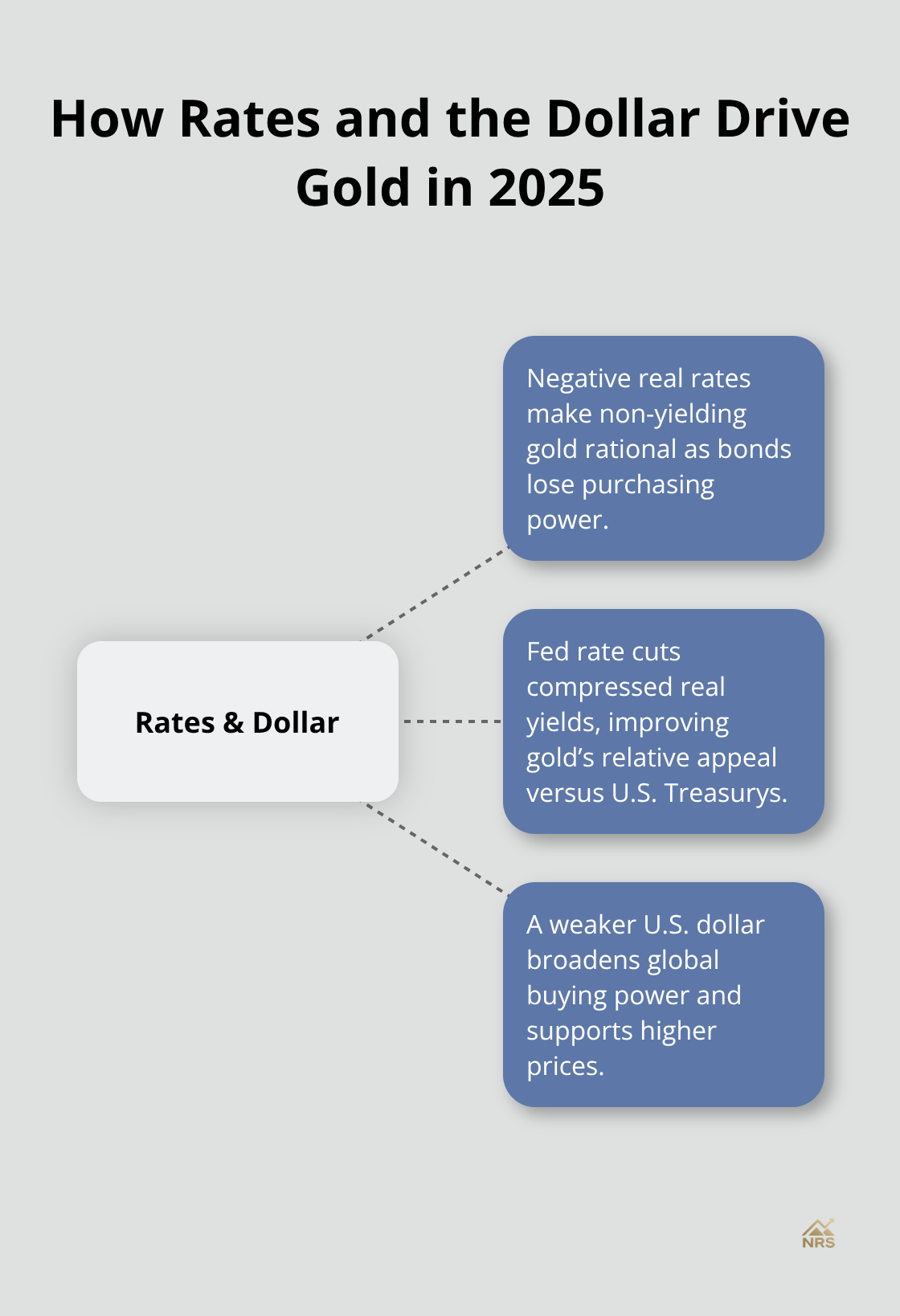

Negative Real Rates Make Gold Rational

Negative real interest rates power gold’s 2025 rally, and the math is straightforward: when government bond yields fall below inflation, holding non-yielding gold becomes rational rather than speculative. J.P. Morgan Global Research emphasizes that a weaker dollar and lower U.S. interest rates boost gold’s appeal as investors flee depreciating currency and eroding purchasing power. The Federal Reserve’s rate-cut cycle in 2024 and early 2025 compressed real yields, making gold’s zero yield suddenly attractive compared to Treasury bonds offering negative real returns.

When real rates turn negative, investors face a choice between losing money slowly in bonds or holding an asset that historically preserves value during currency debasement-gold wins that calculation every time, and central banks understand this dynamic better than most.

Treasury Yields Signal Gold Price Direction

The relationship between Treasury yields and gold prices moves inversely with predictable consistency: as bond yields fall, gold typically rises within months. This pattern holds across multiple Fed cycles: when the Fed signals easing, gold initially dips on expectations of lower inflation, then rallies strongly in the following months as real rates compress further. Monitoring the 10-year Treasury yield relative to core inflation expectations provides a reliable signal for gold price direction. If real yields remain anchored in negative territory through 2026, gold maintains a structural floor that keeps prices elevated regardless of near-term volatility.

Dollar Weakness Expands the Global Buyer Pool

The U.S. dollar’s strength or weakness determines gold’s international competitiveness, and emerging-market central banks actively exploit this dynamic. A stronger dollar makes gold more expensive for foreign buyers and reduces demand, while dollar weakness immediately expands the buyer pool globally. J.P. Morgan projects gold averaging around $5,055 per ounce in the fourth quarter of 2026, with continued support from anticipated dollar depreciation as large U.S. deficits accumulate. The IMF COFER data tracking official reserve compositions show ongoing diversification away from USD holdings, with gold filling the gap as reserve managers reduce their dollar exposure.

Foreign Exchange Risk Anchors Long-Term Demand

This shift toward gold isn’t temporary-a BIS study from 2020 suggests emerging-market central banks benefit from holding more than 20% of reserves in gold as protection against foreign exchange risk, establishing a long-term structural demand driver. For investors monitoring gold prices, watch the U.S. Dollar Index closely: when it breaks below key support levels, gold typically accelerates higher as international demand surges. The combination of negative real rates and anticipated dollar weakness creates a two-factor tailwind for gold that extends well beyond 2026, anchoring prices in elevated ranges.

Mining Constraints Complete the Picture

Supply-side pressures now compound the demand tailwinds that real rates and currency movements create. Global mining output faces mounting constraints that prevent new supply from matching the structural demand emerging from central banks and investors worldwide.

Why Mining Can’t Match Gold Demand

Global gold mining production adds only 2–3% annually to the above-ground stock, while central banks and investors accumulate at rates that far exceed new supply. This supply deficit reflects structural challenges in bringing new mines online and expanding existing operations. Future mine supply faces higher extraction costs and regulatory constraints that limit growth potential, meaning the supply-demand imbalance persists through 2026 and beyond.

Energy Costs Squeeze Mining Margins

Energy costs represent the largest variable expense in gold extraction, and elevated electricity and fuel prices compress mining margins without increasing output. When energy prices spike, marginal producers shut down operations rather than expand capacity, tightening supply further. A mining company operating at $1,200 per ounce production cost with gold trading at $4,500 generates strong returns, but that same operation becomes unprofitable if energy costs surge 40% and gold falls to $3,200. The incentive structure discourages new mine development during uncertain periods.

Recycling Provides Limited Relief

Recycling and secondary gold supply supplement primary mine production rather than replace it. Recycling accelerates during price rallies when scrap sellers liquidate jewelry and industrial components, yet this supply source remains highly elastic and unreliable for reserve planning. Central banks and major investors cannot depend on recycling volumes to meet their accumulation targets, so they continue purchasing primary mine output at whatever price clears the market.

Low-Cost Producers Command Premium Valuations

Mining companies with low-cost operations and accessible reserves will command premium valuations as the supply-demand gap widens. Producers with reserves in stable jurisdictions and sub-$1,000 per ounce all-in sustaining costs see margins expand as gold prices remain elevated by structural demand forces. Conversely, higher-cost producers or those facing regulatory delays experience margin compression despite rising gold prices, making selective exposure critical.

Monitor Production Trends Against Accumulation

Track World Gold Council data on quarterly mine production trends and compare those figures against central bank accumulation rates. When the gap widens, mining stocks typically appreciate as investors recognize that scarcity drives valuations. Energy cost inflation remains a wildcard that can either constrain supply further or force consolidation among weaker producers, both scenarios favoring established mining companies with operational efficiency and financial reserves to weather cost pressures.

Final Thoughts

Gold price drivers in 2025 converge around three structural forces that persist well into 2026 and beyond: central bank reserve diversification, negative real interest rates, and mining supply constraints. These factors form a foundation that supports elevated gold prices regardless of near-term market noise, and they represent fundamental shifts in how reserve managers allocate capital, how investors view currency risk, and how mining economics function at higher price levels. Resource stock investors who recognize these dynamics position portfolios to capture outsized returns as the supply-demand gap widens.

Gold mining companies with low-cost operations and reserves in stable jurisdictions will capture the most value as structural demand outpaces new supply. Producers generating sub-$1,000 per ounce all-in sustaining costs see margins expand dramatically when gold trades above $4,500, translating into stronger cash flows and shareholder returns. Higher-cost operators face margin compression despite rising gold prices, making selective exposure critical to portfolio performance.

We at Natural Resource Stocks track these gold price drivers 2025 continuously and translate them into actionable insights for investors positioning portfolios in natural resource stocks. Access our platform to stay informed on the factors reshaping gold markets and identify mining opportunities before broader market recognition drives valuations higher.