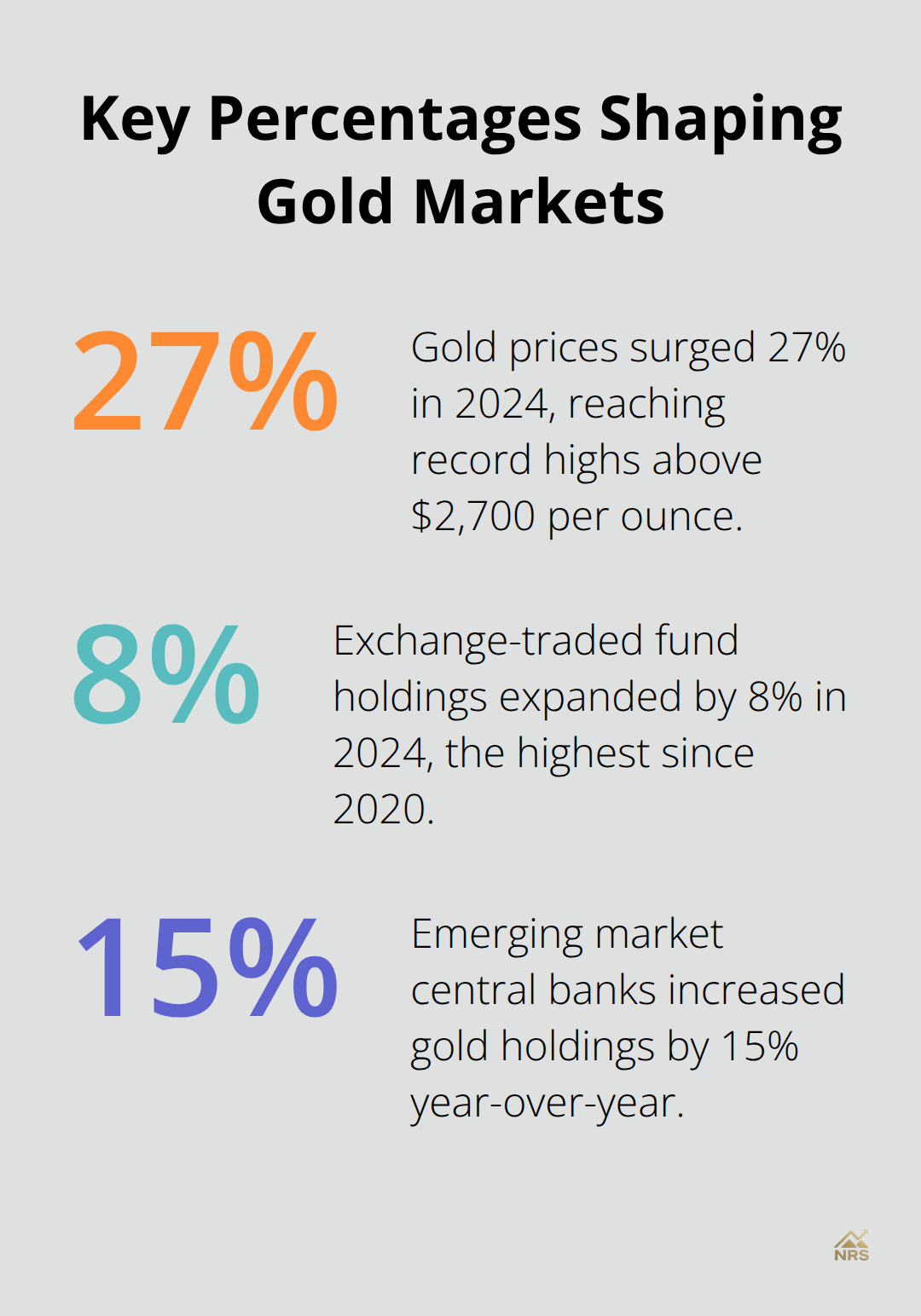

Gold prices surged 27% in 2024, reaching record highs above $2,700 per ounce. Central bank purchases hit 1,037 tons through September, marking the strongest buying streak since 2010.

We at Natural Resource Stocks analyze the key drivers shaping our gold price outlook 2025. Federal Reserve policy shifts and mounting geopolitical tensions will determine whether this bull run continues into the new year.

What Drove Gold’s Record Breaking Year

Gold delivered exceptional returns in 2024, climbing from $2,070 in January to peak above $2,790 in October. This 35% surge represents the strongest annual performance since 2020, driven by three primary catalysts that smart investors tracked throughout the year.

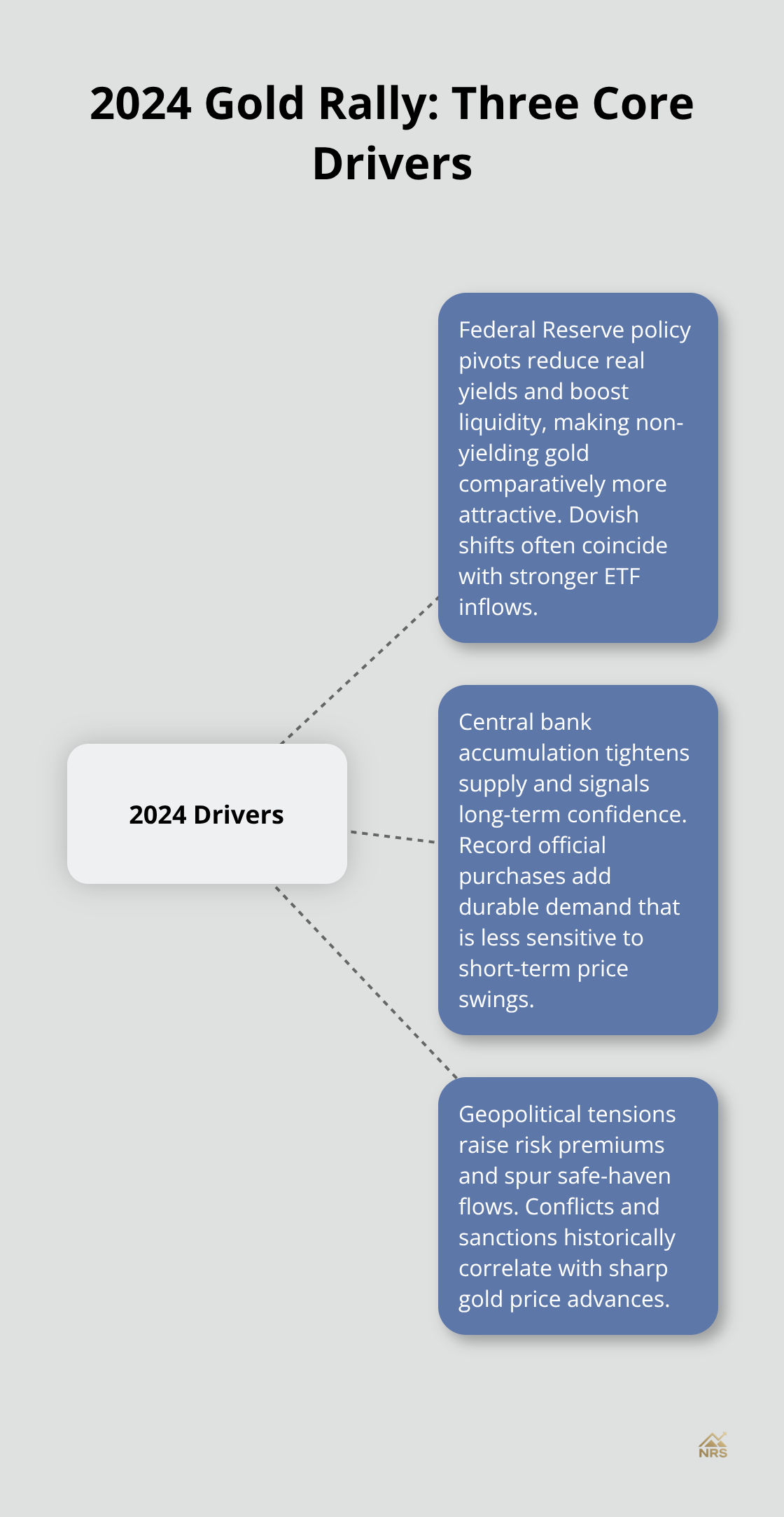

Federal Reserve Policy Shifts Trigger Massive Flows

The Federal Reserve’s dovish pivot in September triggered massive ETF inflows, with SPDR Gold Shares adding 1.2 million ounces in Q4 alone. Real interest rates turned negative in major economies throughout 2024, which made non-yielding gold increasingly attractive compared to bonds. U.S. inflation expectations jumped from 2.1% to 2.8% between March and November, while 10-year Treasury yields remained below 4.5%. This environment historically favors gold, as investors witnessed during similar periods in 2008-2011 when prices surged from $730 to $1,825.

Central Banks Lead the Charge

Central bank gold purchases dominated market dynamics in 2024, with official sector purchases reaching 1,037 tonnes in 2023 according to the World Gold Council.

China’s People’s Bank added 225 tonnes to reserves, while emerging market central banks collectively increased holdings by 15% year-over-year. This massive accumulation reflects strategic diversification away from dollar-denominated assets, particularly as global reserves now hold approximately 36,200 tonnes of gold (nearly 20% of official reserves). Poland and Singapore emerged as surprise buyers, each adding over 100 tonnes to strengthen their monetary foundations against currency volatility.

Geopolitical Tensions Fuel Safe-Haven Demand

Escalating tensions in Eastern Europe and the Middle East pushed institutional money into safe-haven assets at unprecedented rates. Exchange-traded fund holdings expanded by 8% in 2024, reaching their highest levels since 2020 as both institutional and retail investors positioned for prolonged monetary accommodation. The combination of trade uncertainties and geopolitical risks created perfect conditions for gold’s rally.

These powerful forces that drove 2024’s exceptional performance now set the stage for what promises to be an equally dynamic year ahead, as new economic challenges emerge.

Economic Forces That Will Drive Gold in 2025

Federal Reserve Policy Creates Perfect Storm

The Federal Reserve’s monetary policy decisions will dominate gold price movements in 2025, with current fed funds rates creating a delicate balance between inflation control and economic support. J.P. Morgan Research projects gold prices will average $3,675 per ounce in Q4 2025, driven primarily by expectations of three quarter-point rate cuts throughout the year. Inflation remains above the Fed’s 2% target at 2.8%, while real interest rates hover near zero. This environment creates favorable conditions for gold ownership as the central bank adopts a more dovish stance when unemployment rises and GDP growth slows.

Currency Devaluation Accelerates Gold Demand

Currency devaluation risks accelerate as the U.S. dollar index faces pressure from massive fiscal deficits that create substantial budget shortfalls annually. China and Russia continue to reduce dollar reserves in favor of gold, with emerging market central banks purchasing around 900 tonnes in 2025 according to J.P. Morgan projections. The dollar’s inverse correlation with gold prices intensifies as foreign buyers capitalize on currency weakness. Stagflation fears drive institutional investors toward precious metals as traditional assets lose appeal.

Recession Risks Support Safe-Haven Flows

Global recession probability reaches 35% according to Goldman Sachs economists, which creates ideal conditions for gold’s traditional safe-haven role. Smart investors monitor the 10-year Treasury yield closely, as sustained levels below 4% historically trigger significant gold rallies that exceed 20% annually. Economic uncertainty pushes both institutional and retail investors toward assets that preserve wealth during market volatility.

These monetary and economic pressures build momentum for gold prices, but geopolitical tensions add another layer of complexity that could amplify these trends even further.

Which Geopolitical Risks Will Drive Gold Higher

Trade wars and military conflicts create the most powerful catalysts for gold demand in 2025, with specific flashpoints already triggering institutional repositioning. The Russia-Ukraine conflict continues to drain Western gold reserves as sanctions force alternative payment systems, while China’s military exercises near Taiwan push Asian central banks toward precious metals diversification. J.P. Morgan analysts identify three critical risk zones that will determine gold’s trajectory: U.S.-China trade relations, Middle Eastern energy security, and European monetary stability. Smart investors track these developments through the VIX volatility index, which correlates directly with gold spikes above $2,800 per ounce during crisis periods.

Political Upheaval Accelerates Safe-Haven Flows

Political instability in major economies creates sustained demand pressure that traditional metrics underestimate. France’s pension reform protests and Germany’s coalition government challenges weaken the euro, which drives European investors toward gold at rates that exceed 15% quarterly allocation increases. U.S. debt ceiling debates scheduled for mid-2025 historically trigger 8-12% gold price jumps within 30-day periods, as witnessed during 2011 and 2023 standoffs. Election cycles in emerging markets where currency devaluation risks exceed 20% annually create optimal conditions for precious metals accumulation.

Crisis Demand Patterns Signal Major Moves

Professional traders recognize that crisis-driven gold demand follows predictable patterns that retail investors miss entirely. Central banks show increased activity in actively managing their gold reserves, with 44% of respondents actively managing reserves in 2025 compared to 37% in 2024. Safe-haven flows accelerate when equity markets decline more than 10% in 30-day periods (historically pushing gold prices 15-25% higher within six months). Military conflicts that involve major oil producers consistently drive gold above historical resistance levels, as energy price shocks create broader inflationary pressures that force monetary policy accommodation.

Energy Security Threats Multiply Gold Appeal

Energy supply disruptions amplify gold’s safe-haven status as oil price volatility creates cascading economic effects, with IMF data showing positive correlation between oil price volatility during Middle Eastern conflicts and gold prices. Middle Eastern tensions that threaten major shipping routes through the Strait of Hormuz historically correlate with 20-30% gold price increases within 90 days. Russia’s energy export restrictions force European nations to diversify reserve holdings away from traditional currencies toward precious metals. Natural gas supply concerns in Asia push central banks to increase gold allocations as insurance against energy-driven inflation that could exceed 5% annually.

Final Thoughts

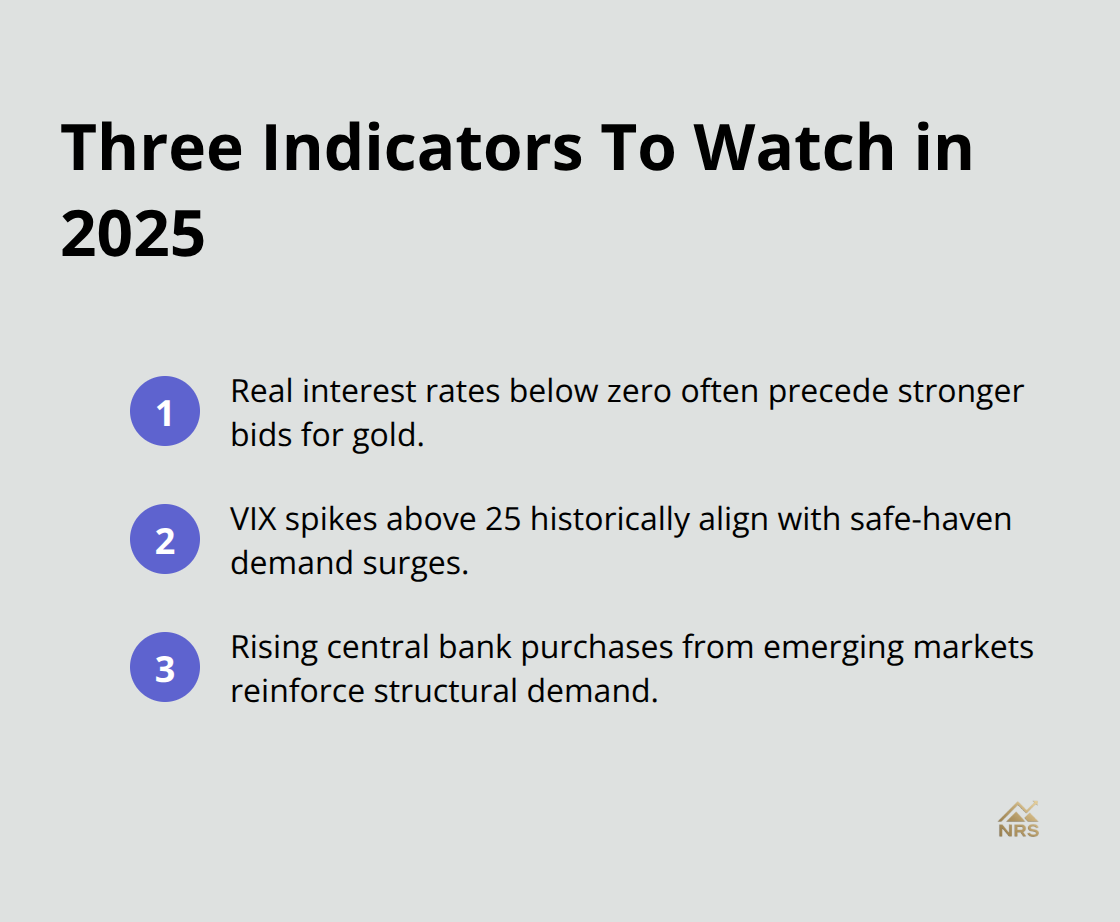

Our gold price outlook 2025 points to continued strength, with J.P. Morgan projecting prices will average $3,675 per ounce by Q4. Central bank purchases of 900 tonnes and persistent inflation above 2.8% create powerful tailwinds that support higher valuations throughout the year. Smart investors should allocate 5-10% of portfolios to gold through ETFs or physical holdings, particularly during Federal Reserve rate cuts expected in Q2 and Q3.

Dollar weakness and geopolitical tensions in Eastern Europe and Asia will likely trigger additional safe-haven flows that push prices toward $4,000 per ounce. Three critical indicators deserve close attention: real interest rates below zero, VIX spikes above 25, and central bank purchases from emerging markets.

These metrics historically precede major gold rallies that exceed 20% within six-month periods (as witnessed during the 2008-2011 financial crisis).

We at Natural Resource Stocks provide comprehensive analysis of precious metals markets through expert commentary and research. Our platform offers insights into macroeconomic factors that affect gold prices, which helps investors navigate volatile conditions. Natural Resource Stocks delivers the market intelligence needed to capitalize on gold’s continued bull market momentum in 2025.