As the global financial landscape continues to shift, Michael Oliver, a seasoned expert in Momentum Structural Analysis (MSA), has been making waves with his predictions about the future of precious metals, particularly gold and silver. Oliver, a staunch believer in the power of real money over fiat currencies, offers unique insights into how gold and silver will perform amidst a growing global debt crisis and the potential downfall of fiat currencies. His analysis provides crucial insights for investors looking to secure their portfolios in an uncertain future.

Gold’s Parabolic Rise and What’s Driving It

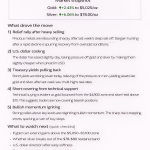

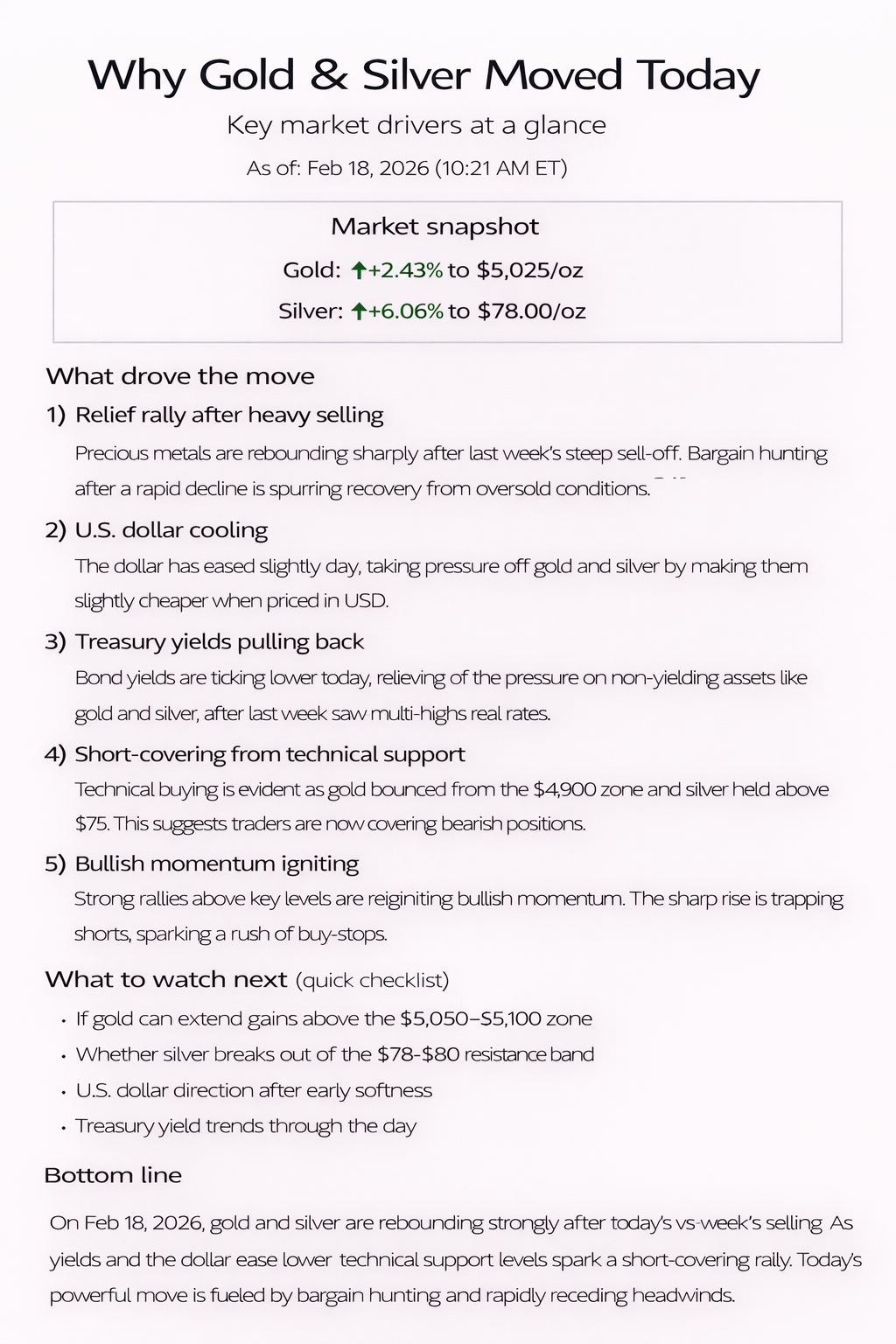

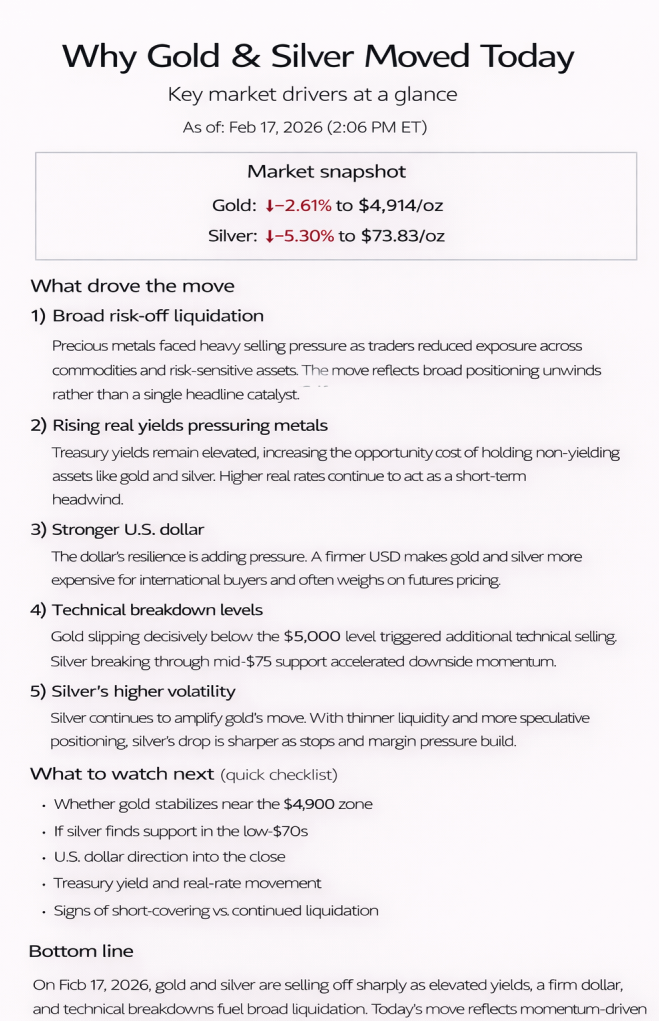

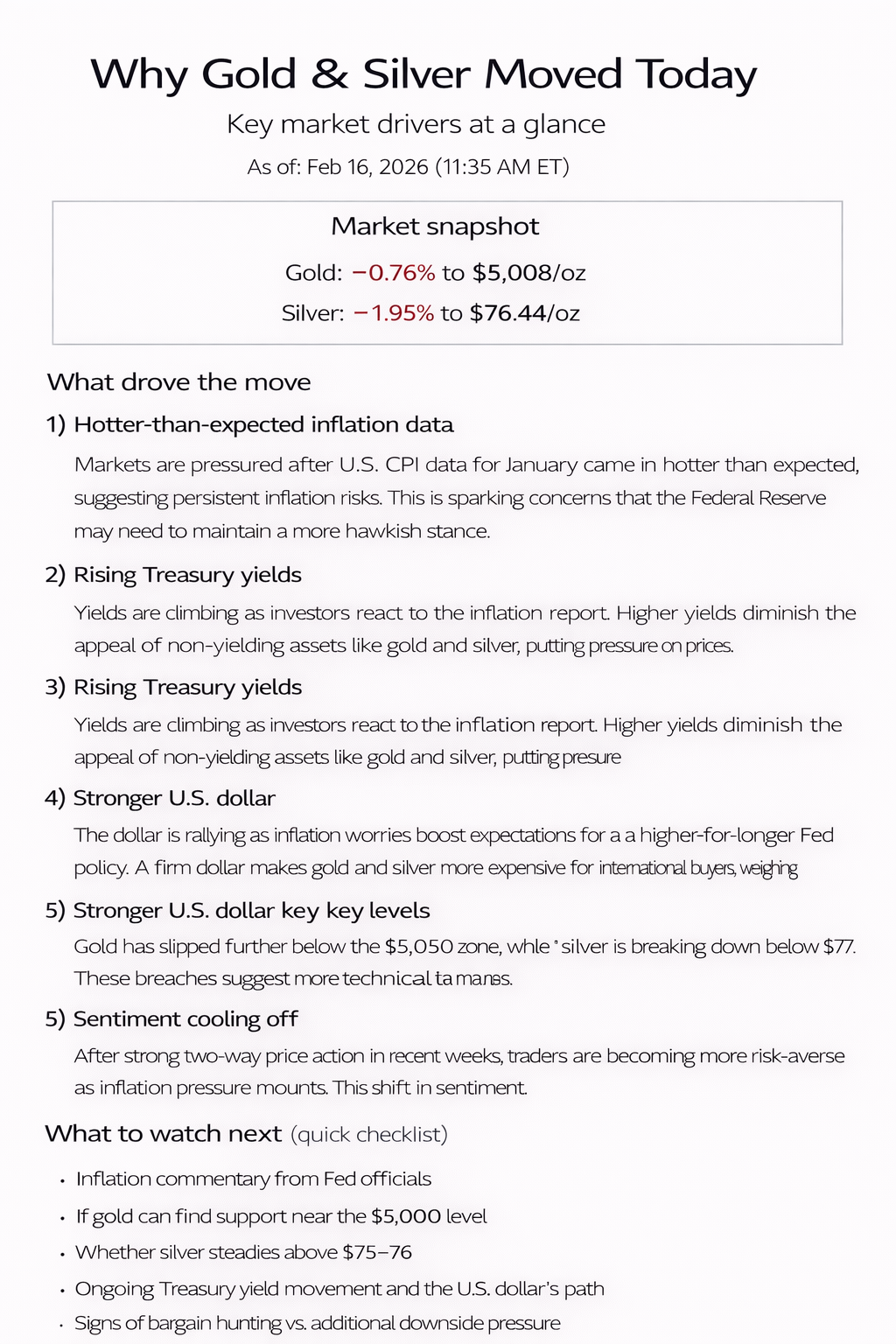

Historically, gold has been considered a safe haven during periods of currency depreciation, and Michael Oliver’s analysis shows that gold’s price is now surging amid the relentless increase in the money supply. According to Oliver, gold’s recent price movement is not a traditional bull market driven by a single crisis, as in previous cycles. Instead, it’s driven by the ongoing devaluation of paper currencies and government debt issues, which are now at the forefront of global financial instability.

Oliver asserts that the gold market’s rise is far from ordinary. It’s poised to be one of the largest bull markets for gold in history, not just because of a sudden crisis but due to a fundamental shift in how monetary systems work. This is the “perfect storm” for gold, and the experts at MSA believe the price of gold could reach $8,500, surpassing previous bull-market highs and reflecting a crisis in fiat currencies that’s likely to escalate.

Silver’s Turn to Shine: The Silver Rush of 2026

While gold has certainly been in the spotlight, silver is now catching up with a dramatic surge, one that could mirror the explosive price increases seen in the late 1970s and 1980s. Michael Oliver predicts that silver is on the brink of an upward breakout, having already broken out of its long-standing range. Silver price action has been heavily suppressed for decades, but now it’s poised for a rapid catch-up to its true value.

Looking at the silver market’s history, Oliver notes that there are significant technical indicators showing that silver is breaking out into a new reality. Silver’s price has been artificially capped for far too long, and as it begins to correct, its price could skyrocket—potentially reaching between $250 and $500 per ounce, a far cry from its current levels.

The Momentum Analysis: More Than Just Charts

What sets Michael Oliver’s predictions apart from traditional technical analysis is his unique approach to momentum. Rather than relying solely on price charts or indicators like RSI, he focuses on momentum structural analysis, which looks at price trends over extended periods and identifies inflection points before they become apparent to the average investor. By applying this to both gold and silver, Oliver’s team at MSA has accurately predicted several market moves, including the recent surge in gold and the upcoming explosion in silver.

Oliver’s momentum analysis suggests that silver’s price could continue to rise dramatically in the next few months, with a timeline pointing toward summer 2026. The surge in silver is not just a flash in the pan—it’s a tectonic shift, and investors who get in now stand to benefit immensely from the coming silver rush.

The Fiat Currency Crisis: A Turning Point for Silver and Gold

One of the most critical elements of Oliver’s analysis is the looming crisis in fiat currencies. As governments across the globe continue to print money and pile on debt, the value of paper currencies is rapidly diminishing. Oliver sees this as an unsustainable trend that will eventually force investors and nations to look to gold and silver as alternatives to traditional currency systems.

In this climate of uncertainty, where governments are printing money to prop up their economies, the appeal of hard assets like gold and silver has never been more pronounced. In fact, Oliver believes that silver, often considered the “poor man’s gold,” is on track to regain its status as a monetary metal, potentially even outpacing gold in terms of value. Countries like India are already reexamining silver’s role in their monetary systems, and Oliver suggests that this trend could spread globally as the fiat system faces more pressure.

A New Reality: Silver and Gold are Set to Lead the Way

As we look toward 2026 and beyond, Michael Oliver’s predictions highlight the growing importance of silver and gold amid a collapsing fiat currency system. With silver poised for a massive breakout and gold continuing to rise amid global economic turmoil, investors are advised to take action before the market fully adjusts.

With the possibility of a complete overhaul of the global monetary system, including the potential return to gold-backed currencies, the time to act is now. While the markets may be experiencing turbulence, those with silver and gold in their portfolios are likely to emerge unscathed—or even ahead—when the dust settles.

Conclusion: Protecting Your Wealth in an Uncertain World

Michael Oliver’s analysis of the silver and gold markets offers a stark warning: the era of fiat currencies is coming to an end. As governments print money to deal with mounting debt, the true value of money is being eroded. The rise of precious metals, especially silver, could be one of the few safe havens in the coming financial upheaval.

If you’re an investor looking to secure your wealth, now is the time to pay attention to silver and gold. With momentum on their side and a global crisis on the horizon, these precious metals are poised for a major move in 2026. The message is clear: hold onto your silver and gold coins—your granddad was right.

Take Action Now: Keep Your Silver and Gold Coins

As the financial landscape continues to shift, don’t be caught off guard. Consider diversifying your portfolio with precious metals like gold and silver, which are set to outperform many other asset classes in the coming years. Stay ahead of the curve by keeping up with Michael Oliver’s Momentum Structural Analysis reports at Natural Resource Stocks, and be ready to act when the next big move happens in the silver and gold markets. For up-to-date market trends and expert guidance, reach out to andy@naturalresourcestocks.net. Stay ahead with our daily updates!