GTI Energy: Pioneering Uranium Mining in Wyoming and Beyond

GTI Energy, an Australian-listed resource company, has been making significant strides in the U.S. uranium market. Since transitioning to uranium in 2019, GTI has established a strong presence, with key assets in Utah and Wyoming, particularly in the Powder River Basin. As a company that started its journey with gold, GTI’s shift towards uranium was driven by the increasing demand for nuclear energy and the global energy transition.

The Growing Uranium Market

Uranium, a key fuel for nuclear power, is gaining traction due to its role in reducing carbon emissions and supporting energy security. Historically, the U.S. was once a dominant producer of uranium, with peak production levels reaching over 40 million pounds in the 1980s. However, for nearly two decades, domestic production has been almost non-existent, leaving the U.S. reliant on imports for its annual demand of around 50 million pounds of uranium.

This shift presents a significant opportunity for companies like GTI Energy, which are strategically positioned in some of the most promising uranium-rich regions in the U.S.

GTI’s Key Projects and Partnerships

GTI’s lead project in Wyoming, located in the Powder River Basin, is positioned close to major industry players, including Energy Fuels and UR Energy. These companies have been actively producing uranium, and GTI’s proximity to them further boosts the company’s growth potential. The Great Divide Basin, another project location, is gaining attention for its uranium potential, especially as neighboring projects such as UR Energy’s Sweetwater project are picking up pace.

GTI Energy’s approach involves insitu recovery uranium mining, which is an efficient, low-impact method of extracting uranium. The company has recently upgraded its resource estimate to 8.5 million pounds of uranium, with further exploration targeting an additional 6 to 11 million pounds. This provides a strong foundation for GTI’s future growth in uranium production.

Timeline and Financial Outlook

GTI is making substantial progress toward bringing its uranium projects into production. The company is currently in the midst of a scoping study, which is expected to be completed by mid-2024. The project timeline suggests that, with the necessary funding, GTI could begin uranium production within the next 2 to 3 years.

While financing remains a challenge for many junior mining companies, GTI has managed to maintain support from its investor base. The company is exploring strategic partnerships with neighboring producers to accelerate the development of its uranium assets, reducing the reliance on continual capital raising.

Why Uranium and Why Now?

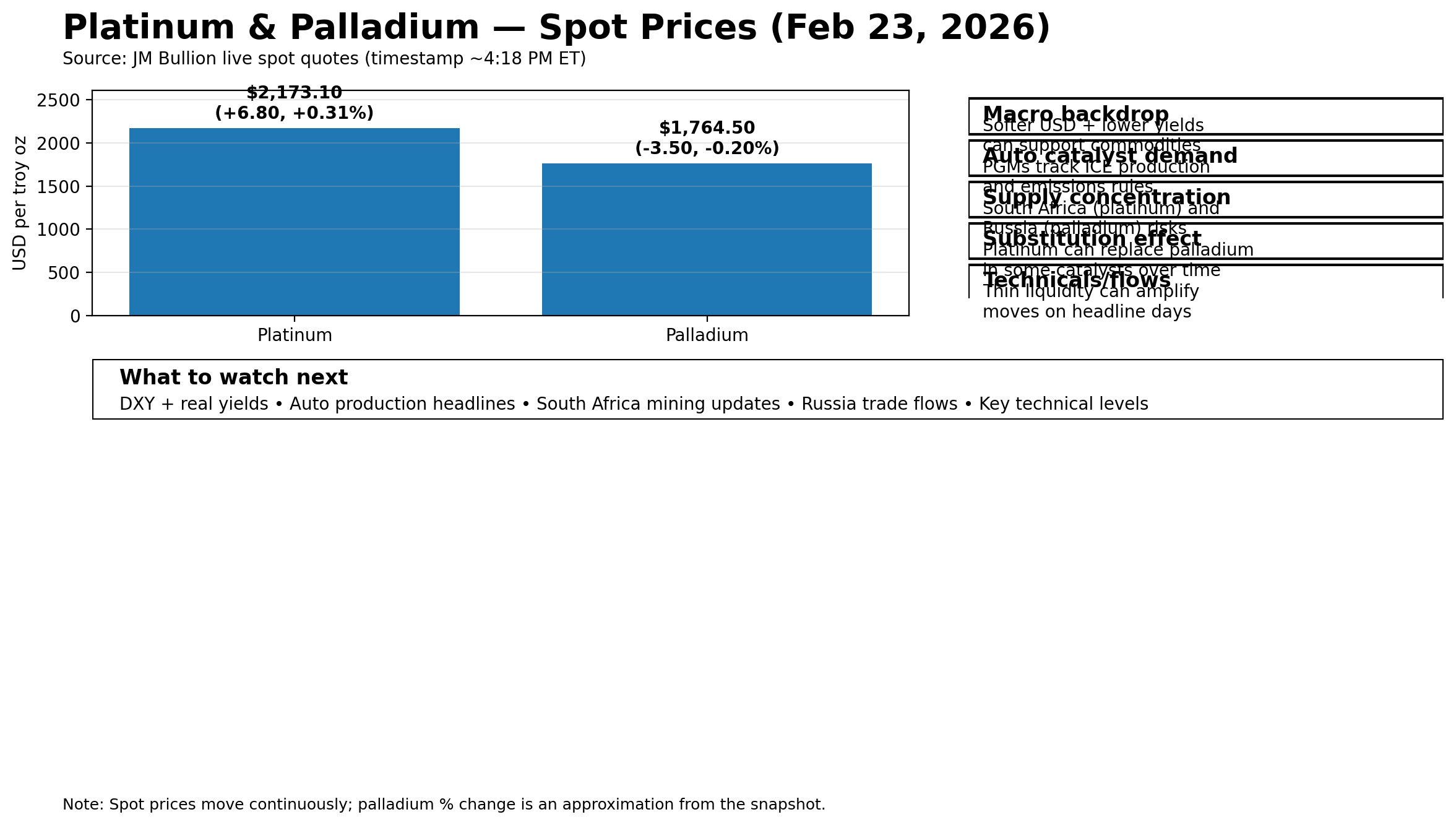

The uranium market has been volatile, but this volatility presents opportunities for savvy investors. While uranium prices spiked to $105 per pound in 2023, the spot price has since retreated. However, long-term contracts in the uranium market have held up well, signaling continued demand for the commodity.

In addition to domestic production challenges, geopolitical factors are also playing a role in the resurgence of uranium mining. The U.S. is taking steps to reduce its reliance on Russian uranium imports, further highlighting the need for domestic uranium production. The growing demand for clean energy, particularly from AI-driven industries and data centers, is also expected to support uranium’s long-term price growth.

The Future of Uranium Mining: Opportunities for Growth

GTI Energy is at the forefront of this opportunity, particularly in the Powder River Basin, where uranium demand is expected to rise. The company’s unique position, with assets close to key industry players, coupled with its focus on insitu recovery, gives it a competitive edge in the U.S. uranium sector.

The long-term outlook for uranium is bullish, driven by the global push for clean energy and the rising demand for nuclear power. As countries like the U.S. and China ramp up efforts to meet energy demands, uranium will be a critical component in their energy mix.

Conclusion: Investing in the Future of Uranium

For investors looking to capitalize on the resurgence of uranium mining in the U.S., GTI Energy offers a unique opportunity. With key projects in Wyoming and Utah, a strong resource base, and strategic partnerships, GTI is well-positioned to benefit from the growth in the uranium sector.

With global energy transitions on the horizon, the demand for uranium is expected to increase. Companies like GTI Energy, which are pioneering efforts in domestic uranium production, will likely play a key role in shaping the future of the U.S. energy landscape.

Investing in GTI Energy

If you’re interested in exploring GTI Energy further, you can find their shares listed on the Australian Stock Exchange (ASX) under the ticker GTI. For those based in the U.S., GTI Energy is also listed on the OTC market under the ticker GTI.

For more information, you can visit the official GTI Energy website at www.gtienergy.au or reach out to their team via email at info@gtienergy.au for any questions or inquiries.