Gold and silver coins offer a tangible way to protect wealth against inflation and economic uncertainty. Physical precious metals have gained 15% annually over the past decade, outpacing many traditional investments.

We at Natural Resource Stocks know that learning how to buy gold and silver coins can feel overwhelming for beginners. This guide breaks down everything you need to make smart purchasing decisions and build a solid precious metals portfolio.

Which Gold and Silver Coins Should You Buy

Government Bullion Coins Offer the Best Value

American Silver Eagles and Canadian Maple Leafs dominate the government-issued coin market for good reason. These coins carry premiums of just 8-12% above spot price, which makes them affordable entry points for new investors. The U.S. Mint produces over 40 million Silver Eagles annually, and this creates strong liquidity when you want to sell.

Canadian Maple Leafs contain 99.99% pure silver compared to 99.93% in American Eagles, but both coins trade easily worldwide. American Eagle Gold Coins represent smart investment choices with established market trends, while Gold Canadian Maple Leafs often trade at slightly lower premiums due to higher production volumes. These government-backed coins provide authenticity guarantees that private mint products cannot match.

Numismatic Coins Carry Higher Risks and Costs

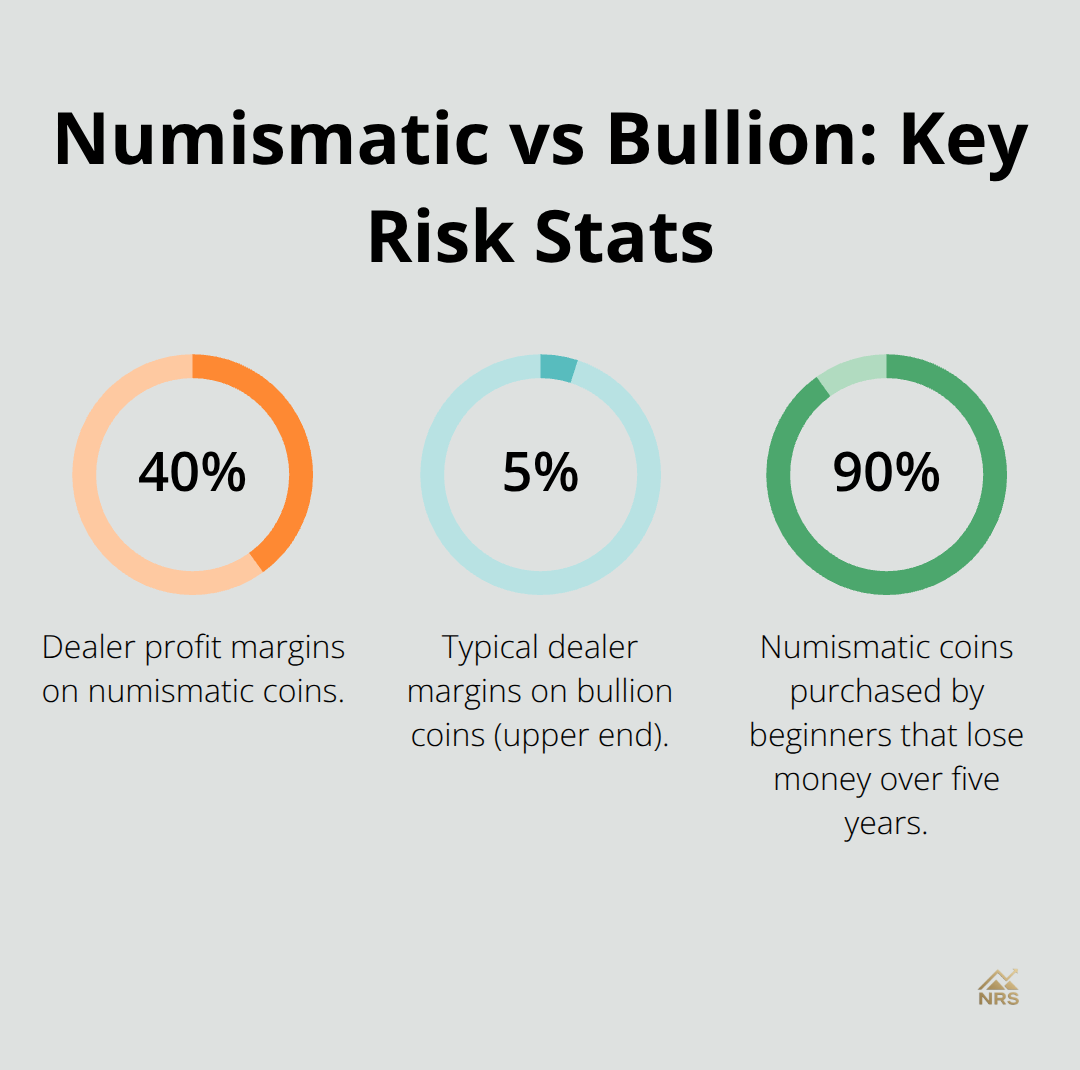

Collectible coins with numismatic value often carry premiums of 50-300% above their metal content. Coin dealers frequently push these products because profit margins exceed 40% (compared to 3-5% on bullion coins). Professional Coin Grading Service data shows that 90% of numismatic coins purchased by beginners lose money over five years.

Morgan Silver Dollars and Walking Liberty Half Dollars appeal to collectors, but their values depend on condition grades that most beginners cannot assess accurately. The grading process requires expertise that takes years to develop, and market manipulation affects rare coin prices more than bullion values.

Fractional Coins Work for Small Budgets

Fractional gold coins like 1/10-ounce American Eagles allow investors with $400-500 budgets to own government-backed gold. These smaller coins carry higher premiums of 12-18% above spot price due to manufacturing costs, but provide flexibility for gradual accumulation.

Silver fractional coins make less sense because full one-ounce coins already cost under $60 at current prices. Start with full-ounce silver coins and move to fractional gold only when your budget cannot accommodate full-ounce gold pieces. The math favors larger denominations whenever possible.

Junk Silver Provides Alternative Entry Points

Pre-1965 U.S. dimes, quarters, and half dollars contain 90% silver content and trade close to melt value. These coins carry premiums of just 2-4% above silver spot price, making them the most cost-effective way to buy silver. Mercury dimes and Washington quarters from the 1940s-1960s remain readily available through most dealers.

Junk silver offers divisibility advantages during economic stress because smaller denominations facilitate transactions better than one-ounce rounds. However, you must verify dates and calculate silver content, which requires more knowledge than modern bullion purchases.

Once you understand which coins fit your budget and goals, the next step involves finding reputable dealers who sell authentic products at fair prices.

Where Should You Buy Gold and Silver Coins

Authorized Dealers Provide Authentication Guarantees

APMEX, JM Bullion, and Provident Metals rank among the top online precious metals retailers with BBB A+ ratings and over 100,000 customer reviews each. These established dealers source directly from government mints and LBMA-approved refiners, which eliminates counterfeit risks that plague smaller operations. APMEX processes over $3 billion in annual transactions and offers buyback guarantees on all products, while JM Bullion provides free shipment on orders that exceed $199.

Local coin shops offer immediate possession advantages but charge premiums 3-5% higher than online retailers (according to industry data). Verify dealer credentials through Professional Numismatists Guild membership or Better Business Bureau ratings before you purchase. Authorized dealers maintain insurance coverage and return policies that protect buyers from authentication issues.

Online Retailers Beat Local Shop Prices

Online bullion retailers consistently offer lower premiums than brick-and-mortar stores because overhead costs remain minimal. BullionByPost and SD Bullion typically charge 2-4% premiums on gold bars compared to 6-8% at local shops. Volume purchases allow online dealers to negotiate better wholesale rates from mints and pass savings to customers.

Shipment costs add $25-40 per order, but free shipment thresholds make online purchases cost-effective for orders that exceed $200. Most reputable online dealers provide track numbers, insurance, and discrete packages that protect shipments during transit.

Counterfeit Detection Prevents Costly Mistakes

Chinese counterfeit coins flood secondary markets through auction sites and unverified dealers. Fake American Eagles weigh 31.0 grams instead of the correct 31.1 grams, while authentic coins produce distinct sounds when dropped on hard surfaces. XRF test machines used by reputable dealers detect metal composition within 0.1% accuracy and identify counterfeits instantly.

Purchase only from dealers who guarantee authenticity and offer return policies for questionable products. Avoid private sellers, flea markets, and online auction platforms where counterfeit precious metals are increasingly offered online. Stick with established dealers who stake their reputations on product authenticity.

Verification Steps Protect Your Investment

Test coin weight and dimensions against published specifications before you accept delivery. Genuine American Silver Eagles measure exactly 40.6mm in diameter and 2.98mm thick. Counterfeit coins often fail these basic measurements because precise tooling costs exceed profit margins for most counterfeiters.

Perform the magnet test on suspicious coins – authentic gold and silver show no magnetic attraction. The ping test reveals authenticity through sound quality when you strike coins against hard surfaces. Professional dealers use electronic testing equipment, but these simple tests catch most fakes.

Once you secure authentic coins from reputable sources, proper storage becomes your next priority to protect these valuable assets from theft and damage.

How Should You Store Your Gold and Silver Coins

Home Storage Requires Multiple Security Layers

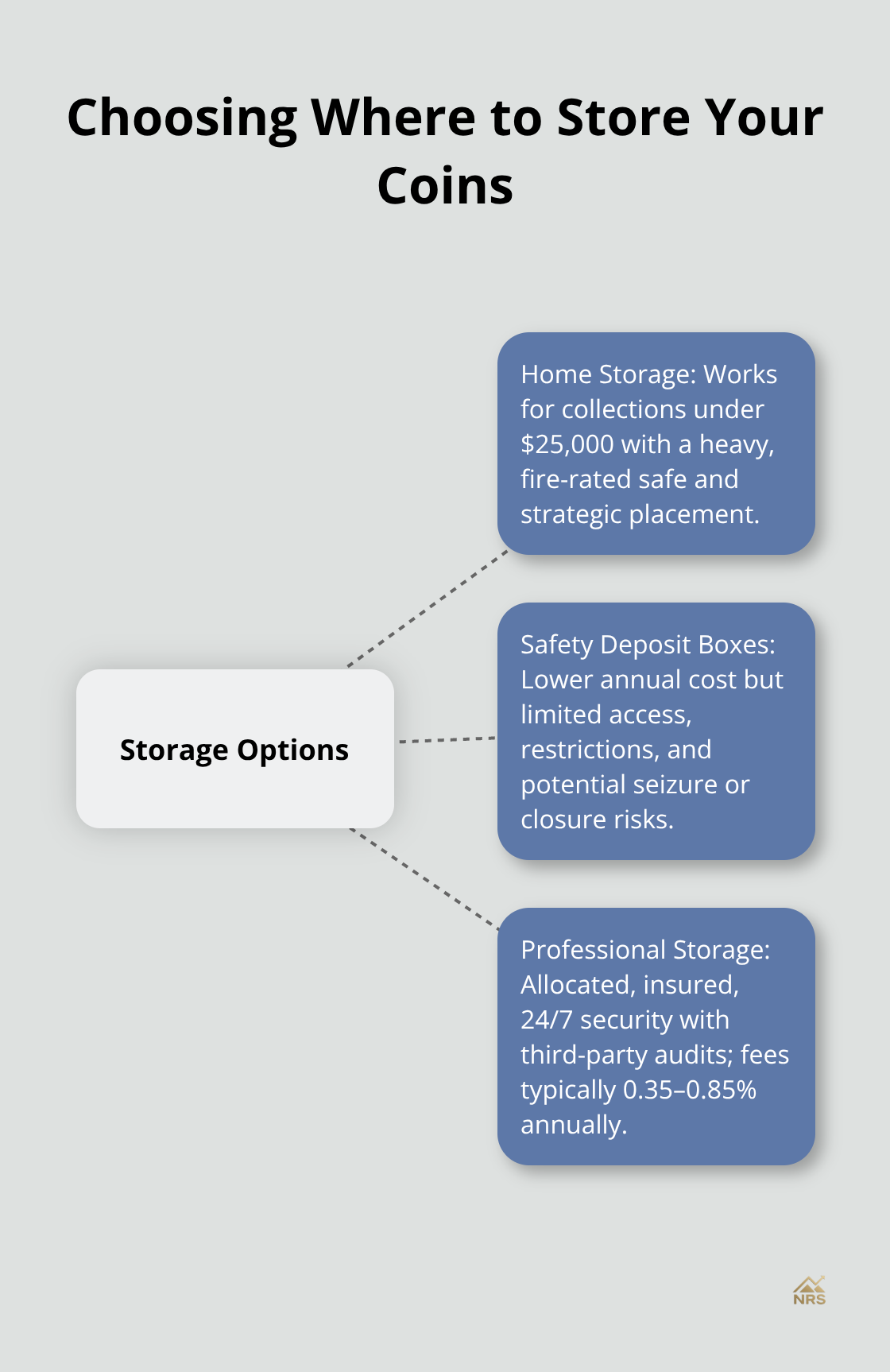

Home storage works for collections under $25,000 but demands serious security investments. A quality fireproof safe requires substantial investment and must weigh significantly to prevent theft. Liberty Safe models provide robust build quality and high fire ratings to protect coins from house fires that destroy most valuables. Install your safe on concrete floors in basements or ground-level rooms where thieves cannot easily remove heavy units.

Homeowner insurance policies typically cover precious metals up to $1,000-2,500 without riders (according to State Farm and Allstate representatives). Purchase separate precious metals insurance through Hugh Wood Inc or Collectibles Insurance Services for full replacement value coverage. These specialized policies cost 0.5-1.5% annually of total collection value but cover theft, fire, and flood damage that standard policies exclude. Never store coins in obvious locations like bedroom closets or office desks where burglars search first.

Bank Safety Deposit Boxes Create Access Problems

Safety deposit boxes cost $50-300 annually but access restrictions make them impractical for active traders. Banks close on weekends and holidays when precious metals markets often experience volatility. Federal regulations allow government seizure of safety deposit box contents during national emergencies, as happened in 1933 when Executive Order 6102 forced citizens to surrender gold holdings.

Most banks prohibit precious metals storage in safety deposit boxes according to rental agreements (though enforcement varies by institution). Bank failures can freeze safety deposit box access for months while FDIC resolves institutional problems. The 2008 financial crisis delayed safety deposit box access at several failed banks for 6-12 months, which prevented owners from accessing their stored valuables during market turmoil.

Professional Storage Facilities Offer Superior Protection

Delaware Depository and Brinks Global Services provide allocated storage where your specific coins remain segregated from other customer assets. These facilities charge 0.35-0.85% annually of stored value and maintain $1 billion+ insurance coverage through Lloyd’s of London. Professional storage facilities operate 24/7 with armed guards, motion sensors, and vault access logs that track every entry.

Allocated storage prevents risks where your coins could be lost among other customer assets during bankruptcy proceedings. Texas Precious Metals Depository and International Depository Services allow account holders to visit and inspect their stored coins with 24-hour advance notice. Choose facilities with third-party audits and segregated storage confirmation to protect against operational fraud that affects pooled storage arrangements.

Final Thoughts

Your first precious metals purchase requires careful planning around three core factors: budget allocation, storage security, and dealer verification. Start with 5-10% of your investment portfolio in physical metals and focus on government-issued coins that offer the best liquidity and lowest premiums. American Silver Eagles and Canadian Maple Leafs provide proven track records with established resale markets.

You should buy gold and silver coins through regular monthly purchases rather than attempt to time market peaks and valleys. Gold prices have increased 52% year-to-date in 2025, while silver jumped 61%, but consistent accumulation smooths out volatility better than lump-sum investments. Professional storage becomes necessary once your collection exceeds $25,000 in value (though home storage works for smaller amounts).

Expand your knowledge through market analysis and expert commentary that tracks geopolitical events that affect precious metals prices. We at Natural Resource Stocks provide insights into macroeconomic factors that drive gold and silver markets. Physical precious metals require patience and discipline, but they provide wealth protection that paper assets cannot match during economic uncertainty.