Buying precious metals online offers convenience, but it also introduces real risks if you’re not careful. Scams, counterfeit products, and unreliable dealers are common problems in this space.

At Natural Resource Stocks, we’ve created this guide to help you navigate these dangers. We’ll show you exactly how to verify dealers, authenticate products, and complete transactions safely.

Who Should You Actually Buy Precious Metals From

The difference between a trustworthy dealer and a scammer often comes down to verifiable credentials and transparent business practices. Start by checking whether a dealer holds accreditation from state and federal authorities. Professional Numismatists Guild membership is a strong indicator of legitimacy, as is a BBB A+ rating. A US-based operation with a physical address matters more than you might think-dealers operating from established locations like Dallas, Texas are far easier to hold accountable than faceless online-only operations.

Transparent Pricing and Real-Time Information

Look for dealers who display current spot prices for Gold, Silver, Platinum, and Palladium in real time, which shows they’re transparent about what you’re actually paying. When a dealer lists spot prices alongside their markup, you can instantly calculate whether their premium is reasonable. Dealers who hide their premiums or use vague language about pricing are signaling that they’re counting on your confusion to inflate margins.

Verified Customer Satisfaction and Scale

Check their customer reviews on independent platforms, not just testimonials on their own website. The scale of a dealer matters too-one that has moved over $13 billion in precious metals has the systems, inventory, and reputation to protect.

Payment Security and Buyback Guarantees

Reputable dealers offer multiple payment methods including ACH transfers, wire transfers, and credit or debit cards, then lock in your final price at checkout so you’re never surprised by hidden fees. They also require ID verification for larger orders or first-time purchases as a fraud prevention measure, not to make your life difficult. Avoid any dealer who pressures you to use wire transfers exclusively or requests payment through unconventional channels.

A solid buyback guarantee is your safety net-it means the dealer will repurchase your metals at transparent pricing if you ever need to liquidate. This guarantee only works if the dealer actually has the capital and willingness to buy back inventory, which separates real dealers from ones that only want your money flowing one direction. Shipping should be fully insured with tracking, and many legitimate dealers offer free shipping on orders over $199 (with predictable flat-rate shipping under that threshold). Some dealers provide same-day pickup in select areas, which eliminates shipping risk entirely if you’re nearby.

Customer Support and Accountability

Customer support availability matters-access via toll-free phone, live chat, and email during business hours shows they’re willing to answer questions before and after your purchase, not vanish once they have your money. A dealer who responds to customer inquiries demonstrates that they stand behind their products and service. With these dealer fundamentals in place, you can now focus on the next critical step: understanding how to authenticate what you’re actually purchasing and verify that the product matches what the dealer claims to sell.

Understanding Pricing and Product Authentication

Spot Price vs. What You Actually Pay

The spot price you see quoted for gold, silver, platinum, or palladium is not what you’ll pay when you buy online. As of December 27, 2025, gold trades at $4,546.37 per ounce, silver at $79.39, platinum at $2,478.90, and palladium at $1,962.38, but these are wholesale prices that only dealers access. When you purchase from a legitimate dealer, you add a premium that covers fabrication, dealer markup, shipping, and insurance. A 1-ounce gold coin carries a different premium than a gold bar of identical weight because coins require more labor-intensive minting and offer better liquidity for future resale. Silver rounds and bars generally have lower premiums per ounce than government-minted silver coins, but coins are easier to sell because buyers instantly recognize them as genuine.

The premium differences across dealers matter more than most buyers realize. Comparing premiums across dealers before checkout can save you hundreds of dollars on larger purchases. One dealer might charge significantly more than another for the identical product, which means you need to lock in your final price at checkout rather than relying on any advertised premium percentage.

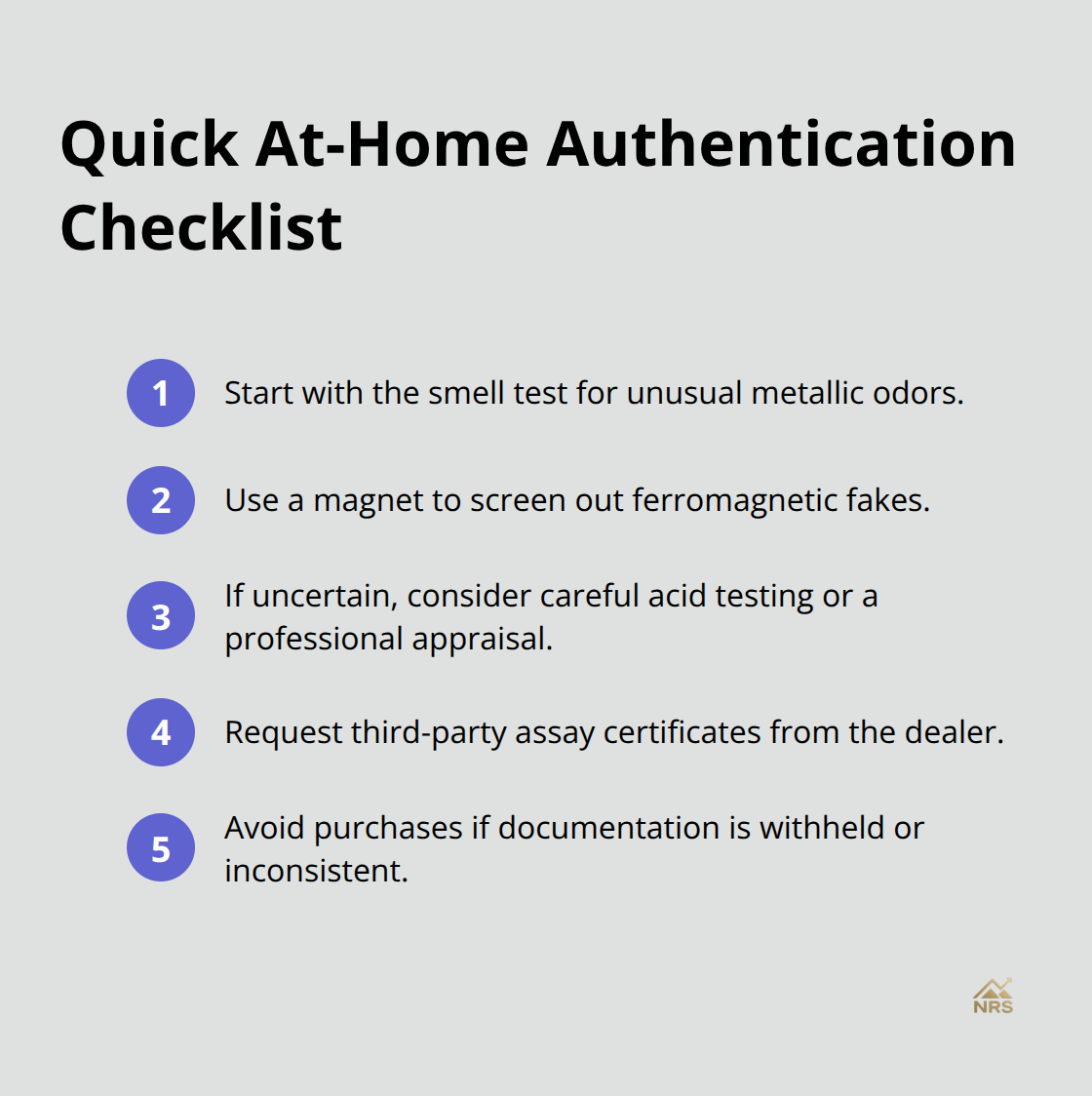

Quick Authentication Tests at Home

Authenticating what arrives at your door requires testing before you trust it. The smell test works as a first filter: genuine precious metals have little to no odor, while base metals smell distinctly metallic. A magnet test follows next-non-magnetic items likely contain precious metals, while anything attracted to a magnet is almost certainly base metal or plated junk. These two quick checks eliminate most counterfeits without requiring any special equipment.

Acid Testing for Definitive Results

If these quick tests leave you uncertain, acid testing provides definitive confirmation but requires care and precision. For silver, you apply Sterling Silver acid to a scratched line on a slate slab and observe the reaction; the color of the streaks confirms authenticity. For gold, you start with 10K acid and work your way up through 14K, 18K, and 22K acids based on how quickly each dissolves the scratched line-the pattern tells you the actual karat weight.

Never attempt acid testing at home if you’re uncomfortable handling chemicals; instead, request documented assay certificates from your dealer before purchasing or have a professional appraiser verify authenticity after arrival. Reputable dealers willingly provide third-party testing certificates because they’re confident in their inventory. If a dealer resists providing authentication documentation or avoids showing how products were tested, that’s a red flag that should stop your purchase immediately.

Dealer Documentation and Certificates

Requesting certificates of authenticity from credible testing methods protects you before money changes hands. Dealers who disclose the exact testing methods they use and provide assay certificates or third-party verification demonstrate transparency about product quality. This documentation becomes especially important for IRA-eligible metals, where you must preserve original packaging and assay documentation to maintain eligibility and resale value.

The authentication process doesn’t end with your purchase-it extends to how you store and eventually liquidate your metals. Understanding what documentation you need to keep and how to verify your holdings over time sets you up for confident transactions when you decide to sell.

Protecting Your Transaction from Start to Finish

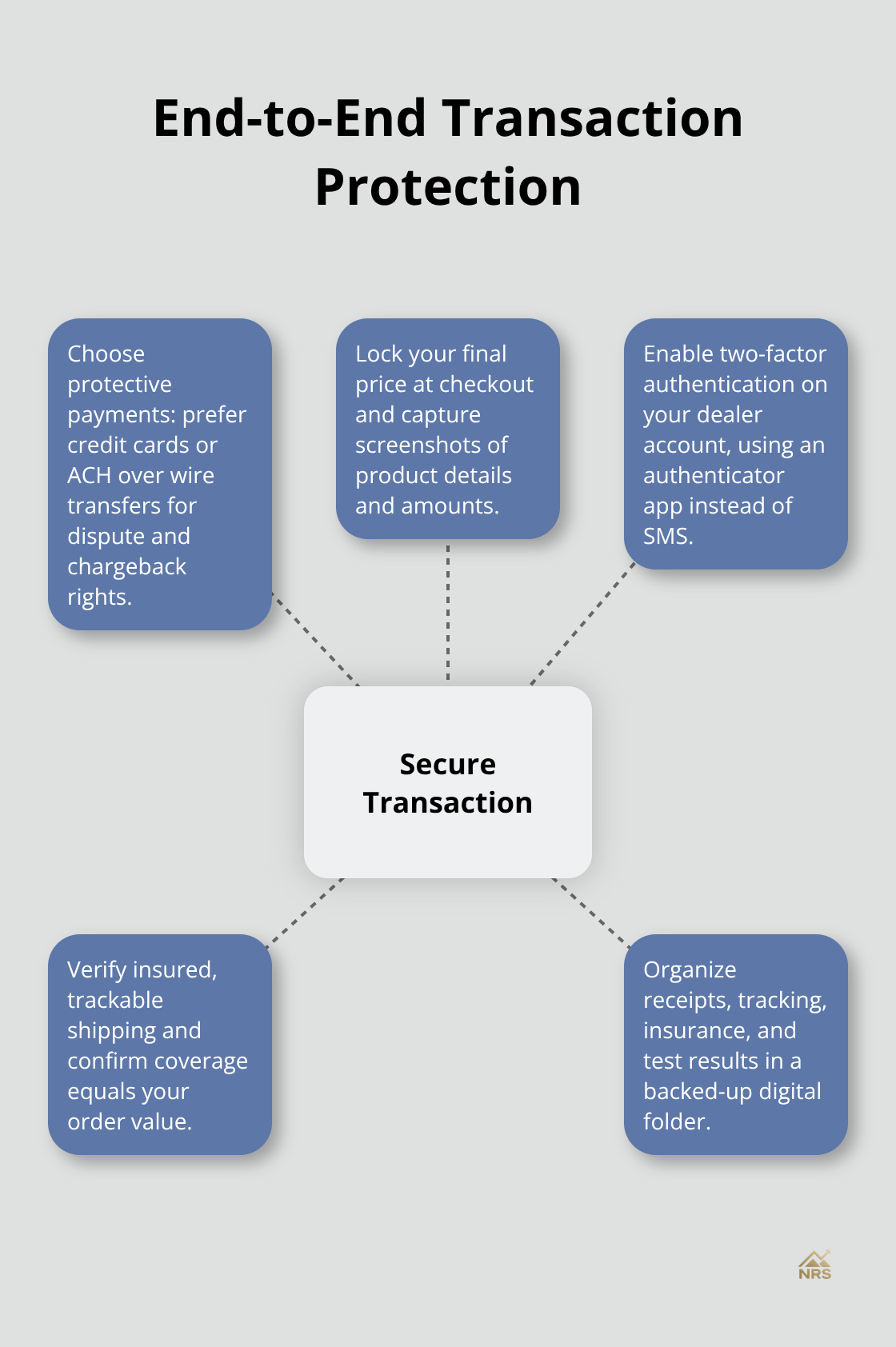

Choose Payment Methods That Protect You

Wire transfers are irreversible, which makes them the scammer’s preferred payment method and your biggest vulnerability if something goes wrong. Use ACH transfers, credit cards, or debit cards instead because they offer dispute resolution and chargeback protection if the dealer fails to deliver or sends counterfeit products. Credit cards provide the strongest buyer protection under federal law, allowing you to contest charges within 60 days if the merchandise never arrives or doesn’t match the description. When a dealer insists on wire transfer as the only payment option, that’s a hard stop-legitimate dealers always offer alternatives because they know their customers deserve protection.

Lock in Your Price and Document Everything

Lock in your final price at checkout before you authorize any payment, and take a screenshot showing the exact amount, product specifications, weight, purity, and mint origin. This documentation proves what you agreed to purchase if disputes arise later. Two-factor authentication sounds like security theater until you realize that your dealer account can be compromised just like your email or bank login. Enable two-factor authentication on your dealer account immediately after creating it, using an authenticator app rather than SMS text messages because SIM swapping attacks can intercept texts.

Verify Shipping and Insurance Coverage

When your order ships, the carrier tracking number becomes your proof of custody-save it and cross-reference it against your order confirmation to verify the weight and item count match what you paid for. Insurance documentation matters more than most buyers realize; fully insured shipments mean the carrier or dealer covers losses if your package disappears, but you need to verify the insurance amount actually covers your purchase value. Some dealers offer free shipping on orders over $199, but confirm whether that includes insurance or if you’re paying extra for coverage. Same-day pickup in select areas eliminates shipping risk entirely and lets you authenticate products before leaving their location, making it worth the travel if you’re within range.

Authenticate upon arrival and Maintain Records

Inspect your package immediately upon arrival and document its condition with photos before opening it, then perform your authentication tests and photograph the results. Keep all documentation together in a single digital folder: order confirmation, payment receipt, tracking information, insurance certificate, authentication test results, and any communications with the dealer. Store this folder in cloud backup so fire or theft at your home doesn’t erase your proof of ownership. If counterfeit metals arrive or the dealer refuses to honor their buyback guarantee, this documentation is your leverage to file a dispute with your credit card company or pursue a chargeback.

Final Thoughts

Buying precious metals online safely requires you to verify your dealer before spending money, authenticate products when they arrive, and document everything for protection. Dealers worth your trust display real-time spot prices, hold state and federal accreditation, maintain BBB ratings, and offer multiple payment methods with buyback guarantees. They respond to customer inquiries and have moved significant volume-over $13 billion in metals-which means they have systems in place to prevent fraud and counterfeit inventory from reaching your door.

Authentication protects you from counterfeits that scammers flood into the market. The smell test and magnet test eliminate most fakes in seconds, while acid testing provides definitive confirmation if you remain uncertain. Request assay certificates before purchase and shift the burden of proof onto the dealer, where it belongs. When your order arrives, inspect the packaging, photograph the condition, run your authentication tests, and keep every document in a secure digital folder that protects you if disputes arise and proves ownership if you liquidate later.

Your payment method determines your legal protection when you buy precious metals online. Credit cards offer the strongest buyer protection under federal law, allowing chargebacks within 60 days if the dealer fails to deliver or sends counterfeits, while wire transfers are irreversible and favor scammers. Start small with recognizable products like 1-ounce government-minted coins, diversify with a mix of gold and silver to balance long-term stability and affordability, and stay informed about market trends that affect precious metal prices. We at Natural Resource Stocks provide expert analysis and market insights to help you make informed decisions about your precious metals strategy and broader natural resource investments-visit Natural Resource Stocks for in-depth commentary on geopolitical impacts, policy changes, and emerging opportunities in metals and energy sectors.