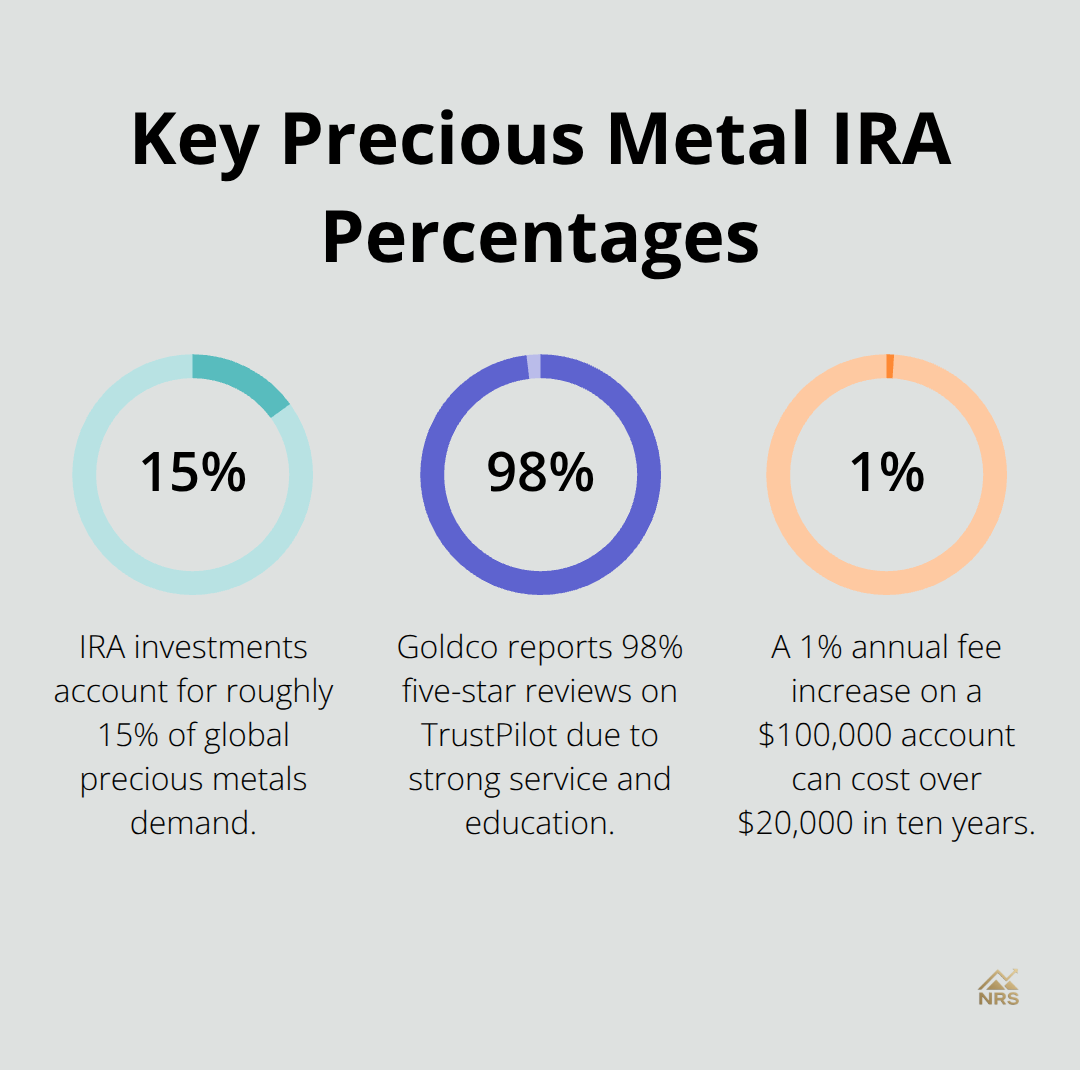

Precious metal IRAs have gained massive popularity as investors seek portfolio protection against inflation and market volatility. The global precious metals market reached $250 billion in 2024, with IRA investments accounting for roughly 15% of total demand.

We at Natural Resource Stocks analyzed dozens of precious metal IRA companies to identify the key factors that separate legitimate providers from questionable operators. The right company can save you thousands in fees while providing secure storage and reliable service.

What Separates Quality IRA Providers From Poor Ones

Fee Transparency Determines Your Long-Term Returns

Fee transparency represents the single most important factor when you select a precious metal IRA company. Annual administration fees range from $75 to $300, while storage fees typically cost $100 to $300 yearly (depending on segregated versus non-segregated options). American Hartford Gold charges just $75 annually for accounts under $100,000, while Augusta Precious Metals requires $50,000 minimum investments but provides comprehensive fee disclosure.

Setup fees generally range from $50 to $100, with wire transfer charges that average $25 to $50 per transaction. A 1% increase in annual fees on a $100,000 account costs investors over $20,000 in lost returns over ten years according to industry calculations.

Storage Security Standards Protect Your Assets

IRS-approved depositories must meet strict security requirements, but companies offer different protection levels. Segregated storage costs $150 to $300 annually but provides individual allocation of your metals, while non-segregated storage mixes your assets with other investors at $100 to $250 yearly.

Noble Gold offers unique Texas-based depository options, while most competitors rely on Delaware Depository Service Company facilities. Insurance coverage should protect against theft, natural disasters, and transportation risks. Companies that store metals in non-IRS approved facilities or lack comprehensive insurance create unnecessary risks for your retirement assets.

Educational Resources Reveal Company Quality

Top-tier companies provide extensive investor education rather than high-pressure sales tactics. Birch Gold Group focuses heavily on educational support with transparent pricing information readily available on their website. Goldco maintains a 4.8 TrustPilot rating with 98% five-star reviews, largely due to exceptional customer service and educational materials.

Companies that offer 24/7 customer assistance like Monetary Gold demonstrate superior service commitment. Avoid providers that use aggressive sales tactics or make unrealistic return promises (legitimate companies focus on education rather than pressure). These warning signs often indicate deeper problems with company operations and customer treatment.

Which Companies Lead the Precious Metal IRA Market

Augusta Precious Metals dominates the industry with an A+ Better Business Bureau rating and over a decade of experience that serves high-net-worth investors. Their $50,000 minimum investment requirement filters out casual investors and results in superior service quality with dedicated account representatives. Goldco follows closely with exceptional customer service reflected in their 4.8 TrustPilot rating, while they require no minimum investment to accommodate smaller investors.

Investment Thresholds Shape Your Experience

Minimum investment requirements directly impact service quality and fee structures across the industry. Augusta Precious Metals targets serious investors with their $50,000 threshold, while Orion Metal Exchange welcomes beginners with just $5,000 minimums. American Hartford Gold requires $10,000 minimums and charges no setup or transfer fees (making them attractive for moderate investors). Advantage Gold maintains competitive $10,000 minimums with 4.8 customer ratings on TrustPilot.

Higher minimums typically correlate with better service, lower percentage-based fees, and more personalized support from experienced representatives.

Buyback Guarantees Provide Exit Strategy Confidence

Strong buyback programs separate professional companies from amateur operators in this competitive market. Augusta Precious Metals guarantees repurchase of all IRA-eligible metals at competitive market prices, while Goldco offers lifetime buyback commitments with no additional fees. American Hartford Gold provides transparent buyback prices based on current spot prices plus reasonable spreads. Companies without clear buyback policies or those that charge excessive spreads create liquidity problems when you need to sell. Birch Gold Group offers buyback services with transparent fee structures, while Noble Gold provides guaranteed repurchase options through their Texas depository partnerships.

Track Records Reveal Company Reliability

Industry experience and customer satisfaction scores indicate which companies deliver consistent results over time. Advantage Gold maintains strong customer reviews on TrustPilot with a 4.8 overall rating (demonstrating exceptional customer satisfaction). Monetary Gold provides 24/7 customer assistance with an A+ BBB rating that emphasizes their commitment to service excellence. Companies with shorter track records or inconsistent ratings often struggle with operational challenges that affect customer experience. However, even established companies face scrutiny when they fail to maintain transparent operations or competitive fee structures that benefit long-term investors.

Which Warning Signs Should You Avoid

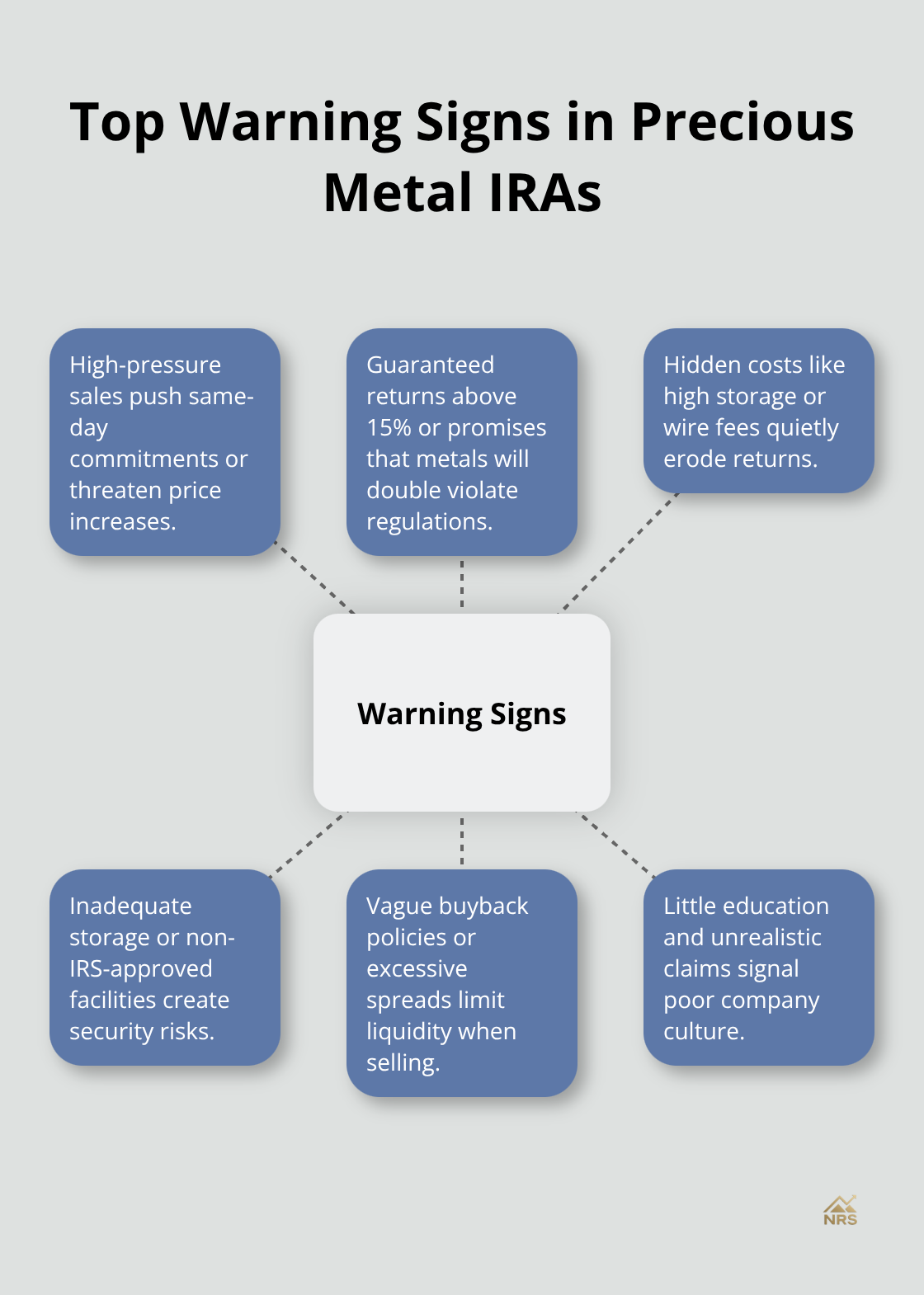

Aggressive sales representatives who pressure you into immediate decisions represent the biggest red flag in the precious metal IRA industry. Legitimate companies like Augusta Precious Metals and Goldco focus on education and allow weeks for decision-making, while questionable operators demand same-day commitments or threaten price increases.

Companies that promise guaranteed returns above 15% annually or claim precious metals will double in value within specific timeframes violate SEC guidelines and indicate fraudulent operations. Advantage Gold maintains their 4.8 TrustPilot rating specifically because they avoid pressure tactics and provide realistic market expectations to potential investors.

Hidden Costs Destroy Investment Returns

Fee disclosure problems plague many precious metal IRA companies that advertise low setup costs while they hide storage, insurance, and transaction charges. American Hartford Gold demonstrates proper transparency when they list their $75 annual fee prominently, while problematic companies bury storage costs of $300-500 annually in fine print documents. Markup schemes on numismatic coins can reach 200% above spot prices compared to bullion markups of 5-10%, yet some providers push expensive collectibles without they explain price differences. Wire transfer fees that exceed $50 per transaction or annual account fees above $300 indicate excessive profit margins that reduce your investment performance.

Inadequate Storage Creates Security Risks

Storage facilities that lack IRS approval or comprehensive insurance coverage expose your retirement assets to unnecessary risks. The IRS requires all precious metals held in self-directed IRAs to be stored at approved third-party depositories, not at home or in personal safety deposit boxes. Insurance gaps occur during transportation or natural disasters and can result in total asset loss without recourse for recovery. Companies that refuse to specify storage locations or provide insurance documentation typically operate substandard facilities that compromise asset security. Noble Gold stands out with their Texas depository option because they provide detailed facility information and comprehensive insurance coverage that protects against all potential risks.

Unrealistic Performance Claims Signal Fraud

Companies that guarantee specific returns or promise metals will reach predetermined price targets within set timeframes operate outside legal boundaries. State securities regulators have investigated numerous cases where a self-directed IRA was used in an attempt to lend credibility to a fraudulent scheme. Fraudulent operators often claim insider knowledge about future price movements or suggest government policies will force dramatic price increases. These tactics violate federal securities regulations and indicate companies that prioritize sales over investor protection. Understanding what warning signs to avoid when selecting precious metals providers helps protect your retirement investments from fraudulent schemes.

Final Thoughts

The right precious metal IRA companies offer transparent fee structures, secure storage facilities, and exceptional customer service ratings above 4.8 on TrustPilot. Augusta Precious Metals and Goldco lead the industry through clear pricing disclosure, IRS-approved depositories, and comprehensive educational resources. Avoid providers that pressure you into immediate decisions, hide annual storage costs above $300, or promise unrealistic returns.

American Hartford Gold requires $10,000 minimums with transparent fee structures, while Birch Gold Group provides quality service without hidden charges. The best companies offer comprehensive buyback programs and allow weeks for decision-making rather than demanding same-day commitments. Storage security remains paramount since IRS regulations require approved third-party depositories (not home storage or personal safety deposit boxes).

We at Natural Resource Stocks recommend comparing specific fee structures, minimum requirements, and storage options among top-rated providers before making your final decision. Your retirement portfolio benefits from diversification through precious metals when you select reputable companies with proven track records. For comprehensive market analysis and expert insights on precious metals, explore our investment platform that covers metals, energy sectors, and macroeconomic factors affecting resource prices.