Precious metal bullion offers real protection against inflation and currency devaluation. At Natural Resource Stocks, we’ve seen investors increasingly turn to physical gold, silver, platinum, and palladium as core portfolio holdings.

This guide walks you through the practical steps of buying bullion, understanding pricing, and building a strategy that matches your financial goals.

Which Precious Metals Deserve Your Investment Dollars

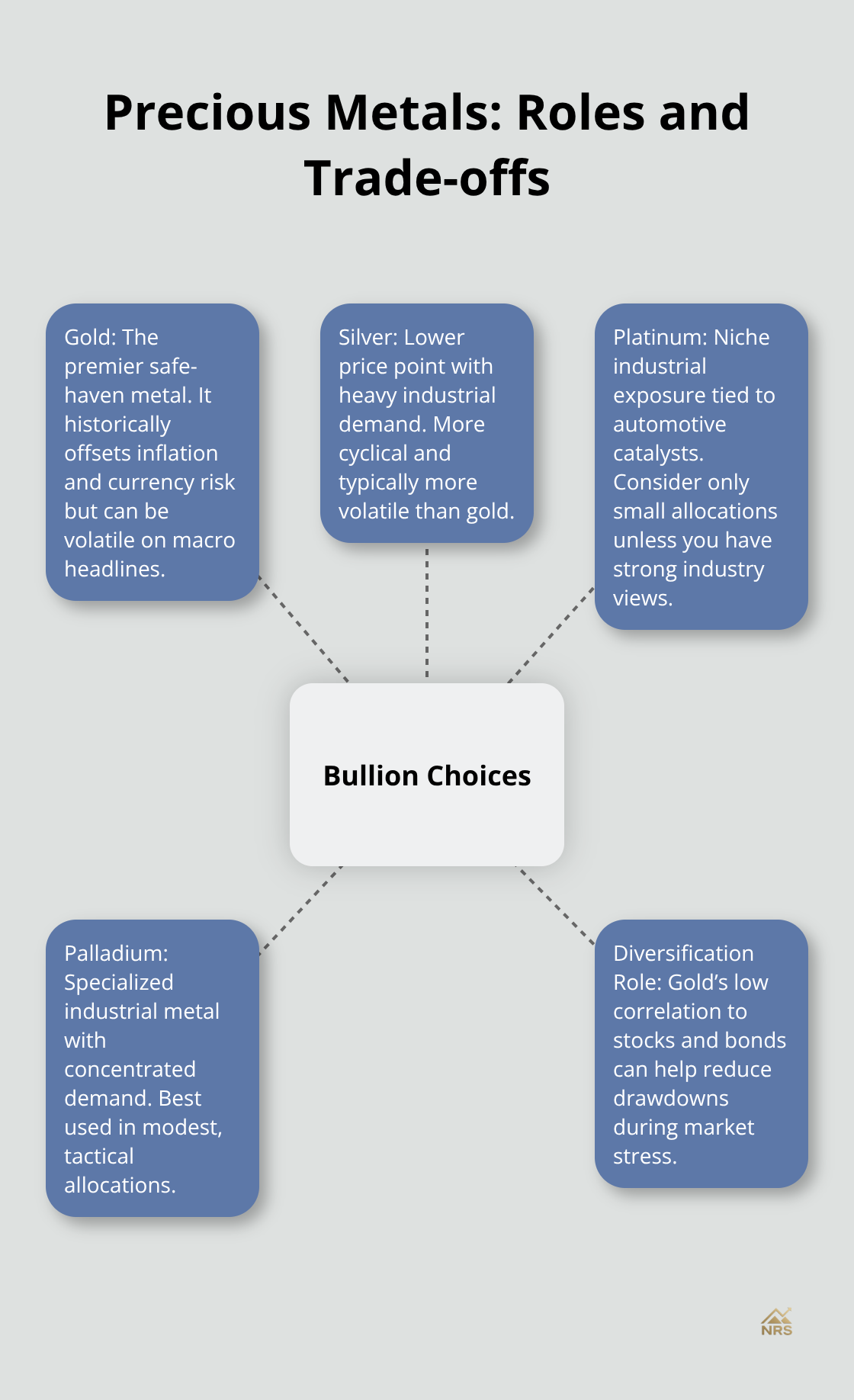

Gold: The Safe-Haven Standard

Gold remains the dominant choice for most bullion investors, and the numbers back this preference. Spot gold recently surged above $4,517 per ounce, marking fresh record highs as central banks worldwide accumulate reserves and geopolitical tensions persist.

Gold has gained more than 40 percent year-to-date, with roughly three dozen record closes. The appeal is straightforward: gold performs exceptionally well during periods of economic uncertainty, offering protection against currency devaluation and inflation. The Federal Reserve Bank of Chicago’s research confirms gold protects against bad economic times.

However, gold’s price behavior can be volatile because it trades as a commodity, making fundamentals harder to pinpoint. Most financial advisors recommend limiting gold exposure to less than 3 percent of a diversified portfolio, treating it as insurance rather than a core holding. This conservative approach reflects gold’s temperamental nature-it moves based on macro sentiment rather than underlying business fundamentals.

Silver: Industrial Demand Drives Price Action

Silver trades at approximately $74.61 per ounce, making it far more accessible for smaller investors than gold. More than half of silver demand comes from heavy industry and high-tech applications (smartphones, solar panels, and automotive electronics), according to the World Silver Survey. This industrial dependency makes silver’s price more cyclical than gold; when economies strengthen, silver demand rises accordingly.

Silver’s price volatility typically runs two to three times higher than gold on any given day, creating both trading opportunities and portfolio risk. If you seek diversification beyond gold, silver exposure makes sense, but understand you’re betting partially on global economic strength rather than pure safe-haven characteristics.

Platinum and Palladium: Niche Industrial Plays

Platinum and palladium serve niche roles in bullion portfolios. Platinum trades near $2,383.60 per ounce while palladium sits around $1,807.64 per ounce. These metals lack the historical safe-haven status of gold and face concentrated demand from automotive catalytic converters and industrial applications. Unless you possess specific conviction about industrial demand cycles or automotive production trends, these metals belong in smaller allocations.

Gold remains the superior diversifier with low correlations to stocks and bonds, historically dampening portfolio drawdowns during market stress. This distinction matters as you move forward with selecting a dealer and understanding the mechanics of how to actually purchase bullion.

Where to Buy Bullion and What to Expect

Selecting a Dealer That Matches Your Needs

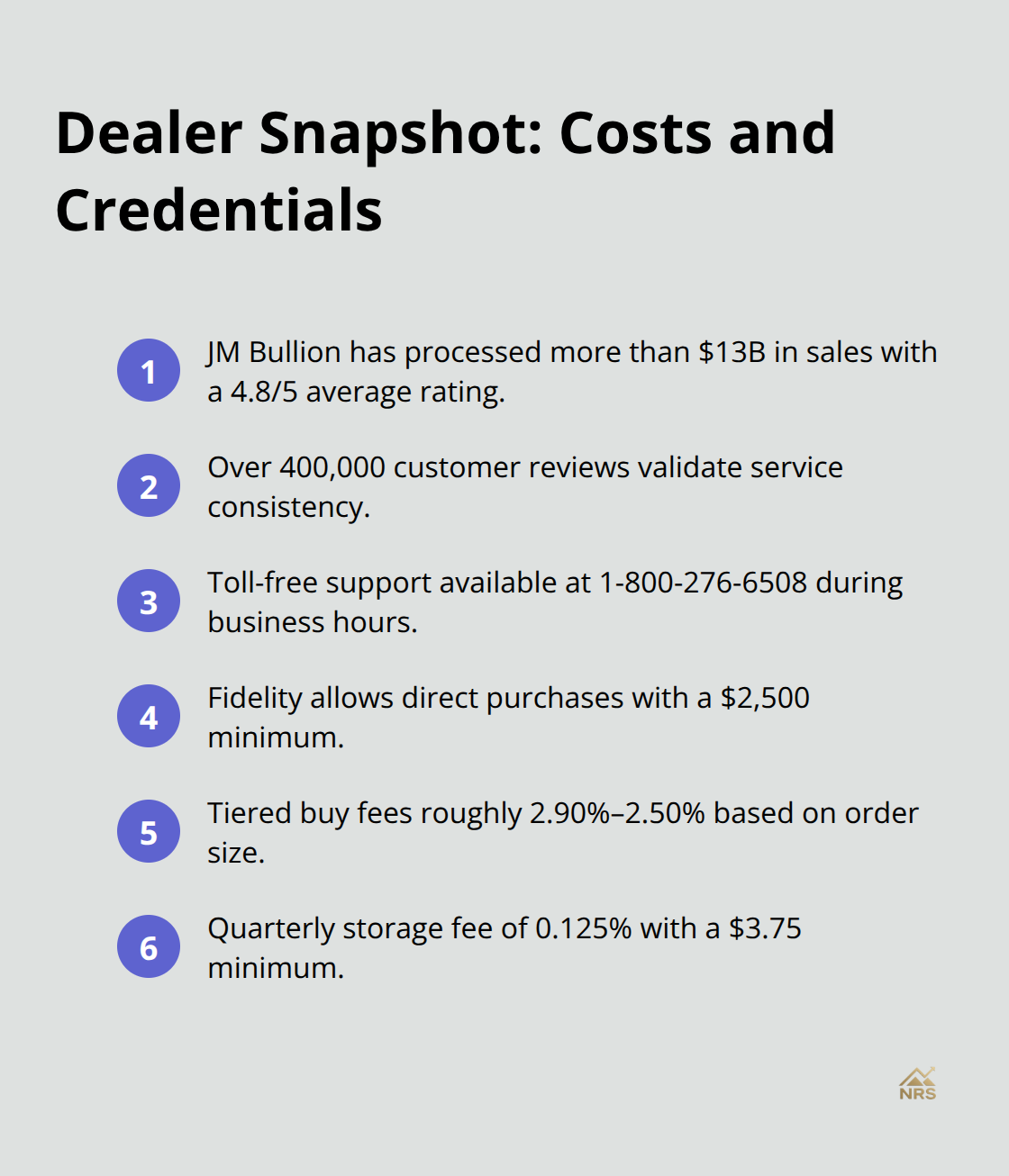

Your choice of dealer directly impacts pricing, fees, and the authenticity of what you receive. JM Bullion operates from Dallas, Texas and has processed more than $13 billion in bullion sales with an average customer rating of 4.8 out of 5 across over 400,000 reviews. They source directly from mints and distributors, inspect inventory before shipping, and offer toll-free support at 1-800-276-6508 during business hours. Fidelity provides another route, allowing direct precious metals purchases with a $2,500 minimum initial investment, though they charge tiered buying fees ranging from roughly 2.90 percent down to 2.50 percent depending on order size, plus a quarterly storage fee of 0.125 percent of total value with a $3.75 minimum.

JM Bullion typically presents lower entry costs for smaller purchases while Fidelity suits investors who prefer integrated account management within an existing brokerage relationship.

Understanding Premiums Above Spot Price

The spot price you see quoted online represents only part of your actual cost. When you purchase a one-ounce gold American Eagle coin at $4,517 per ounce, you pay a premium above spot-typically 3 to 8 percent depending on market conditions and order size. Silver premiums run higher, often 8 to 15 percent above spot, because manufacturing and distribution costs represent a larger percentage of the lower per-ounce price. JM Bullion charges free shipping on orders of $199 or more, with a $9.95 fee on smaller purchases. Fidelity adds a minimum $44 transaction fee plus quarterly storage at 0.125 percent annually, meaning a $25,000 bullion holding costs $31.25 yearly in storage alone before any buying or selling spreads. These costs compound significantly over time, particularly for silver where premiums and storage fees erode returns versus holding the metal at pure spot price.

Storage Options and Counterparty Risk

Physical bullion stored at home requires a safe or safe deposit box plus insurance coverage, adding complexity and ongoing expense. Fidelity stores precious metals through FideliTrade vaults with approximately $1 billion in all-risk coverage from Lloyd’s of London plus $300 million in contingent vault coverage, though these holdings sit outside standard SIPC protection that covers regular securities. Sprott Physical Bullion Trusts like PHYS and PSLV offer an alternative path by providing physical bullion backing with redemption features for actual metal, reducing counterparty risk while maintaining liquidity through stock exchange trading. For investors uncomfortable holding bars and coins personally, closed-end funds with physical redemption strike a practical balance between ownership clarity, liquidity, and mitigated counterparty exposure compared to unallocated certificates or purely digital holdings.

Building Your Purchasing Strategy

Once you select a dealer and understand the true cost structure, you face a critical decision: whether to buy physical metal outright or gain exposure through funds and trusts. Most experts recommend gaining exposure to gold via an exchange-traded fund (ETF) that tracks the price of physical gold rather than buying actual coins or bars, since ETFs offer greater liquidity and lower transaction costs. SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) rank among the largest gold ETFs, providing the most liquid, tax-efficient, and low-cost ways to invest in gold. However, if you prefer direct ownership and can absorb the premium costs and storage fees, physical bullion purchased from a reputable dealer remains a legitimate pathway. The choice between physical metal, ETFs, and closed-end trusts ultimately depends on your comfort level with counterparty risk, your portfolio size, and how actively you plan to trade your bullion position.

How Much Bullion Should You Actually Own

Calculate Your Allocation Based on Portfolio Size

The most common mistake investors make is treating bullion allocation as a theoretical exercise rather than a concrete decision tied to actual portfolio size and risk tolerance. Financial advisors typically recommend gold allocations between 4% and 15% for improved risk-adjusted returns across portfolio types. If you hold a $100,000 portfolio, 4 percent equals $4,000 in gold-a meaningful position that requires serious thought about storage costs and liquidity needs. If you hold $1 million, 4 percent becomes $40,000, which changes the equation entirely because quarterly storage fees at Fidelity ($37.50 minimum on a $40,000 position) become negligible relative to the holding size. Start with your actual dollar amount, then layer in your specific circumstances.

Adjust Allocation Based on Your Risk Profile

If you face genuine currency devaluation risk or hold assets in unstable jurisdictions, bullion warrants a larger allocation. If you’re building wealth in a stable currency with reasonable interest rates, a moderate allocation makes sense. Silver typically warrants a smaller position than gold because its industrial dependency creates different volatility patterns; cap silver at 1 to 2 percent unless you possess specific conviction about manufacturing demand cycles. Platinum and palladium belong in positions under 1 percent unless you’ve researched automotive production forecasts and hold strong opinions about catalytic converter demand.

Use Dollar-Cost Averaging to Smooth Price Volatility

Dollar-cost averaging into bullion positions reduces timing risk and eliminates the anxiety of buying at peaks. Rather than deploying $10,000 into gold at once, purchase $1,000 monthly across ten months-this approach smooths out the impact of price swings and matches the reality of how most investors accumulate capital anyway. Watch geopolitical developments and Federal Reserve policy announcements closely, as these drive meaningful price moves. When central banks signal rate cuts or tensions escalate in major commodity-producing regions, bullion prices typically respond within days.

Monitor Market Conditions and Adjust Your Timing

Set price alerts on GLD or IAU if you track gold through ETFs, or monitor spot prices directly through JM Bullion’s live charts. The worst time to buy bullion is after it has already surged significantly-that’s when emotional buying peaks and premiums widen. The better approach involves purchasing steadily during periods of relative calm, then holding through inevitable volatility cycles.

Rebalance Annually to Maintain Target Allocation

Rebalance annually by selling a small portion if bullion has outperformed your target allocation, then redeploy proceeds into underweighted positions. This mechanical discipline prevents you from holding oversized bullion positions at market peaks while maintaining the diversification benefits you sought initially. Geopolitical tensions and central bank activity will continue to influence precious metals prices, so your allocation strategy must adapt to changing market conditions.

Final Thoughts

Precious metal bullion protects your wealth against inflation and currency instability through straightforward action. Select a reputable dealer aligned with your portfolio size, understand the true cost structure including premiums and storage fees, and commit to a disciplined allocation strategy rather than emotional buying at market peaks. Dollar-cost averaging smooths volatility and removes the burden of timing perfectly, while annual rebalancing keeps your position from ballooning into an oversized holding when geopolitical tensions spike prices upward.

Gold’s 40 percent year-to-date gain and record closes demonstrate why central banks and institutional investors continue accumulating reserves. Silver offers diversification for those betting on industrial demand cycles, while ETFs like GLD and IAU provide liquidity advantages over physical coins and bars (though direct ownership remains valid if you accept the storage and insurance costs). The long-term case for precious metals strengthens as central banks signal rate cuts and geopolitical risks persist.

Your allocation should reflect your actual circumstances-a $100,000 portfolio with 4 percent in gold means $4,000 deployed strategically, not a theoretical exercise. Explore Natural Resource Stocks for expert analysis on how macroeconomic factors and geopolitical developments influence precious metals prices. Start your allocation today and let time work in your favor.