Rare earth metals power everything from smartphones to wind turbines, making rare earth metals stocks increasingly attractive to investors. China controls 80% of global production, creating both opportunities and risks.

We at Natural Resource Stocks see growing demand from electric vehicles and renewable energy driving prices higher. Smart investors need to understand the unique dynamics of this specialized market.

Why Rare Earth Metals Control Modern Technology

Seventeen elements form the rare earth family, including neodymium for electric vehicle motors, dysprosium for wind turbines, and europium for smartphone screens. These metals possess magnetic and electronic properties that no substitutes can match.

Neodymium magnets deliver 10 times more strength than traditional magnets, which makes electric motors 30% more efficient. Without terbium, LED lights would consume twice the energy. Companies like MP Materials and Lynas Rare Earths control access to these irreplaceable materials.

China’s Strategic Stranglehold

China processes rare earth elements globally despite holding significant reserves. The country consolidated its industry through state-owned Northern Rare Earth Group, which controls prices and export quotas.

When China restricted rare earth exports to Japan in 2010, prices spiked 3,000% within months. The U.S. imposed 25% tariffs on Chinese rare earth magnets (effective 2026), which creates price premiums for Western buyers. Energy Fuels targets 7,000-8,000 metric tons of production by 2026 to reduce dependence on Chinese suppliers.

Electric Vehicle Revolution Drives Demand

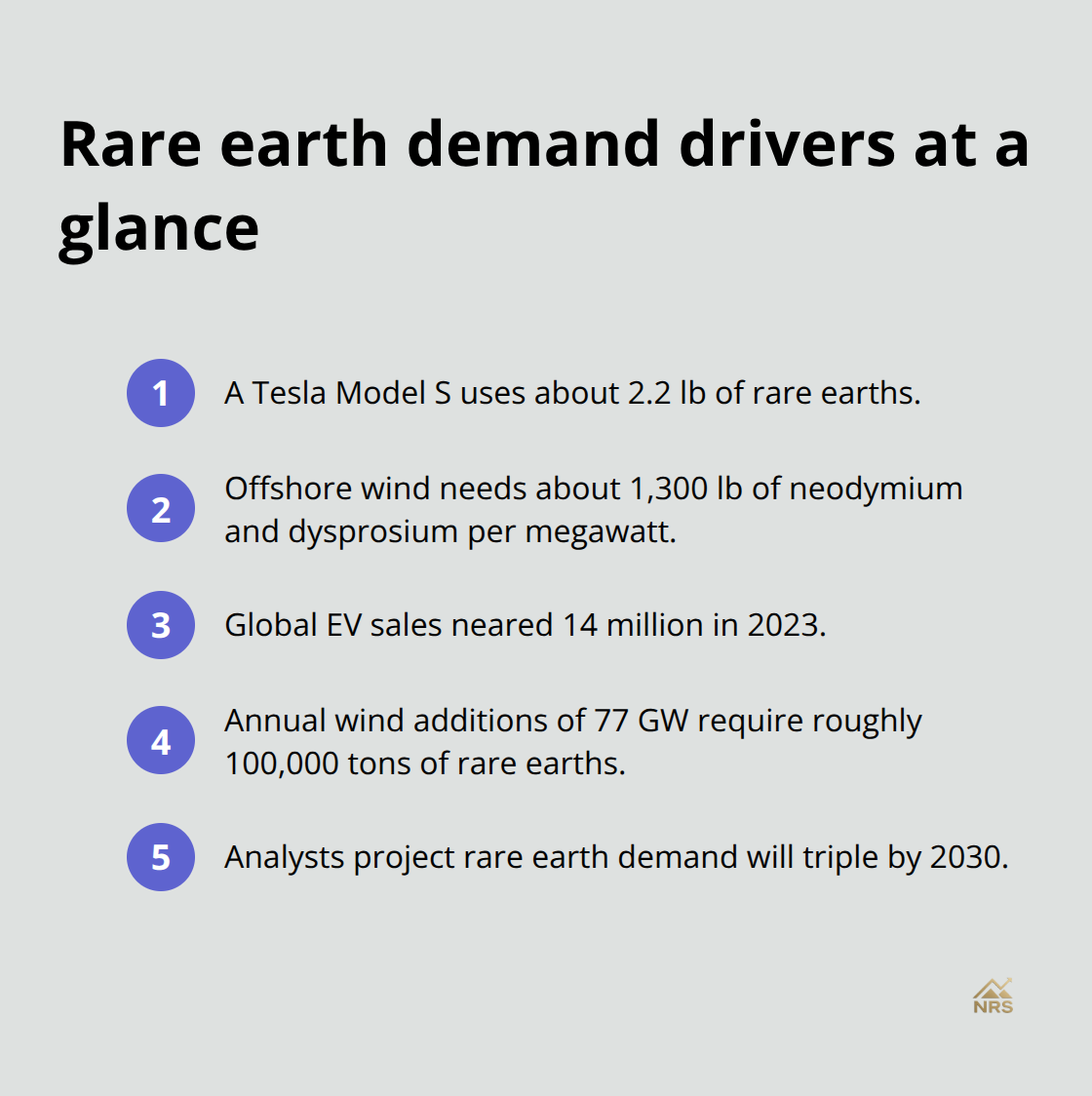

Each Tesla Model S requires 2.2 pounds of rare earths, while offshore wind turbines need 1,300 pounds of neodymium and dysprosium per megawatt. Electric car sales neared 14 million in 2023, with nearly one in five cars sold being electric.

Wind power capacity additions of 77 gigawatts annually demand 100,000 tons of rare earth materials. Analysts project rare earth demand will triple by 2030 as green energy adoption accelerates (driven by climate policies worldwide). Companies with proven reserves and processing capabilities will capture this expanding market.

Investment Opportunities Emerge

This supply-demand imbalance creates significant opportunities for investors who understand which companies can deliver production growth. The next section examines the top rare earth stocks positioned to benefit from this market transformation.

Which Rare Earth Stocks Should You Buy

MP Materials dominates North American production with 84% revenue growth to $57.4 million in Q2 2023, and the company secured contracts with Apple and the Department of Defense. The company controls Mountain Pass mine in California and produces 15% of global rare earth concentrates. Lynas Rare Earths reported a 92% increase in mineral resources at Mount Weld mine, which positions itself as the largest non-Chinese producer with processing facilities in Malaysia.

Energy Fuels targets 7,000-8,000 metric tons annual production by 2026 and produced its first kilogram of high-purity dysprosium oxide. NioCorp Developments secured $10 million from the U.S. DoD for scandium supply chain development. Arafura Resources advances its Nolans project with a 38-year lifespan and 4,440 metric tons annual neodymium-praseodymium capacity.

Direct Stock Investment Strategy

Pure-play stocks offer higher returns but carry concentrated risk. MP Materials trades with premium valuations due to Pentagon partnerships and Apple contracts for recycled magnet materials. Ucore Rare Metals develops processing capabilities in Louisiana with Defense Department support. Mkango Resources focuses on magnet recycling technology.

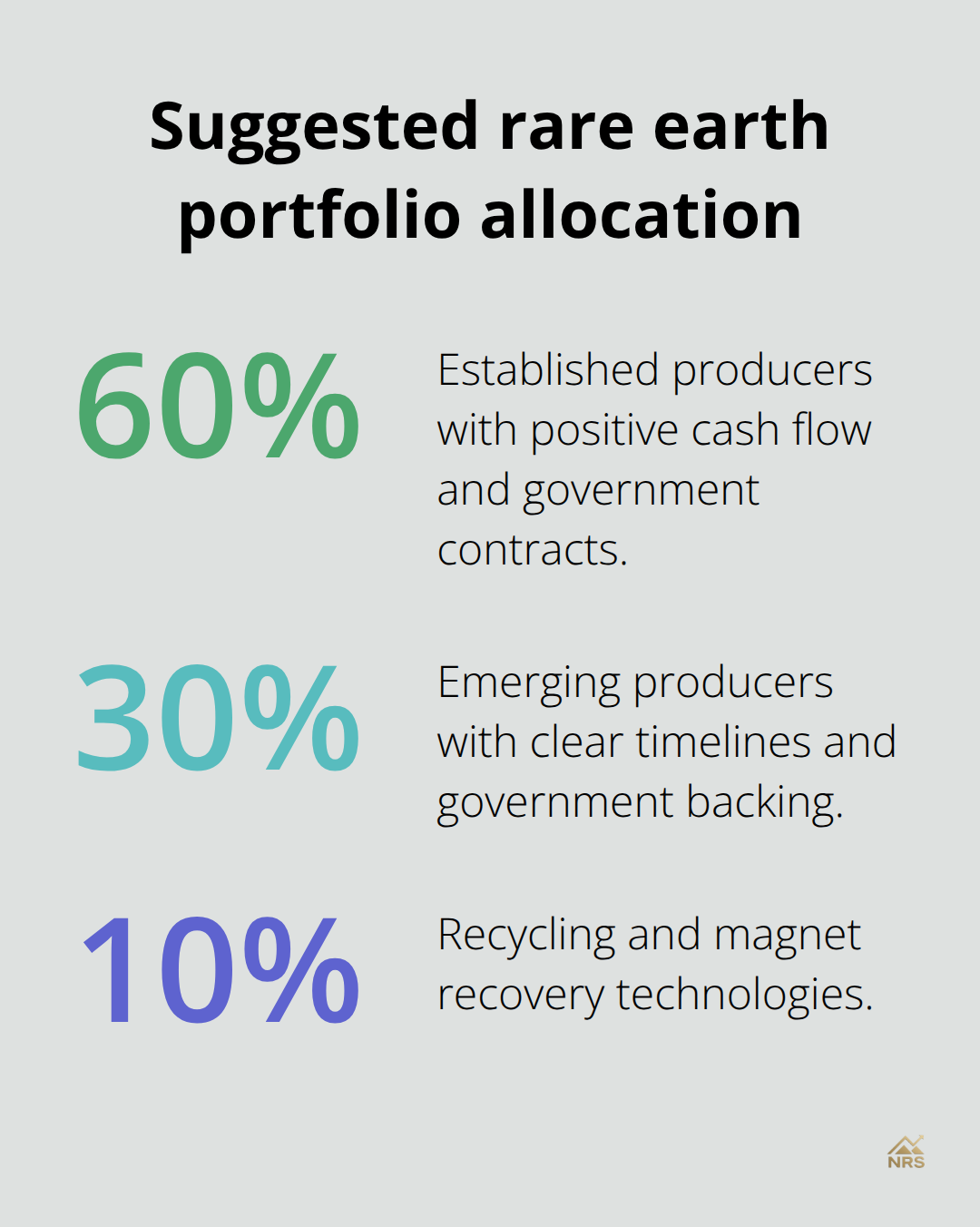

Allocate 60% to established producers like MP Materials and Lynas, 30% to emerging producers with government backing, and 10% to recycling plays. The Canadian government allocated C$3.8 billion for critical minerals (which benefits junior explorers across the sector).

ETF Options for Diversification

VanEck REMX holds global companies with pure-play focus, including miners, refiners and producers. Sprott Critical Materials ETF (SETM) delivered 40% returns with broader exposure to processing companies. ETFs reduce single-company risk but dilute potential returns from top performers.

Direct stock selection beats ETF performance when you identify companies with government contracts and established production capacity. The next section examines the key factors that separate winners from losers in this volatile sector.

What Makes Rare Earth Investments Profitable

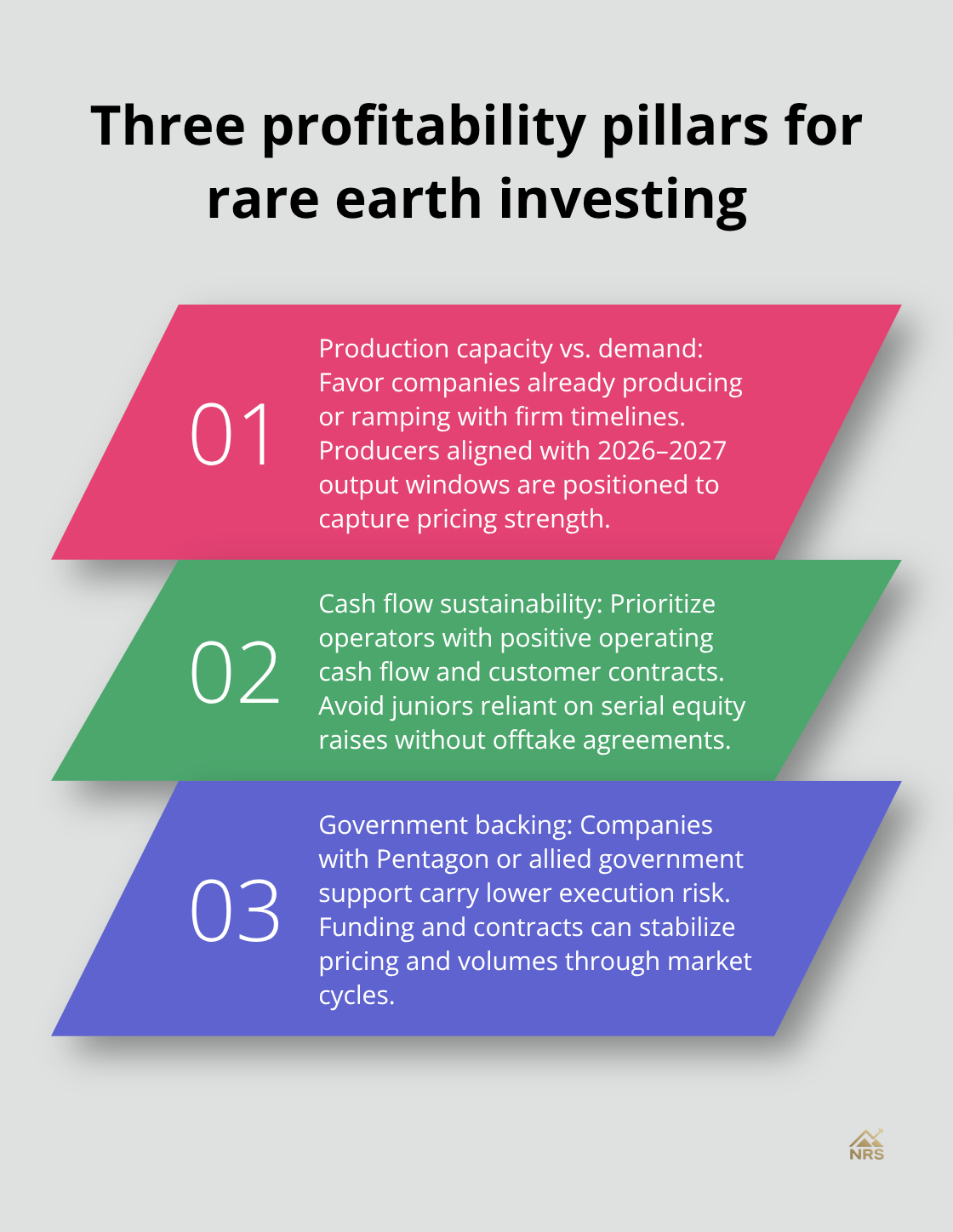

Smart money analyzes three metrics before it buys rare earth stocks: current production capacity versus projected demand, cash flow sustainability, and government backing. Companies with Pentagon contracts carry reduced risk compared to pure speculators, while producers that target 2026-2027 commercial output capture the highest returns. MP Materials generated $57.4 million quarterly revenue with Department of Defense partnerships, while speculative juniors burn cash without guaranteed offtake agreements.

Production Capacity Separates Winners From Losers

Established mines with processing capabilities command premium valuations over exploration projects. Lynas Rare Earths processes 22,000 tons annually through Malaysian facilities, while Energy Fuels targets 7,000-8,000 tons by 2026 with existing uranium infrastructure advantages. Companies that announce production timelines beyond 2028 face financing gaps and regulatory delays that destroy shareholder value.

Track quarterly production reports and capital expenditure guidance to identify operators that scale efficiently versus those that burn investor capital on feasibility studies. Focus on companies with proven reserves and operational processing facilities rather than exploration-stage ventures.

Government Support Determines Success Rates

U.S. Defense Department funding reduces execution risk by 60% compared to private financing alone. NioCorp secured $10 million for scandium development, while Canada allocated C$3.8 billion for critical minerals projects. Companies with government contracts lock in pricing and volumes (which eliminates market volatility concerns).

Australia provided AU$1.25 billion to Iluka Resources for Eneabba refinery construction. Avoid companies dependent on Chinese partnerships or those that lack Western government support, as trade tensions create supply chain disruptions that devastate stock prices when export restrictions tighten.

Financial Health Indicators Matter Most

Cash flow positive companies survive market downturns while cash-burning juniors face dilution or bankruptcy. MP Materials maintains positive operating cash flow with established customer contracts, while many exploration companies depend on equity raises that dilute existing shareholders. Companies with debt-to-equity ratios above 50% struggle during commodity price volatility (particularly in capital-intensive mining operations).

Examine quarterly earnings reports for revenue growth trends and operating margin improvements. Companies that show consistent quarterly revenue increases demonstrate market demand validation and operational efficiency gains.

Final Thoughts

Rare earth metals stocks offer compelling opportunities for investors who understand the sector’s unique dynamics. MP Materials and Lynas Rare Earths lead established producers, while Energy Fuels and NioCorp provide growth potential through government partnerships. The 25% U.S. tariffs on Chinese magnets that start in 2026 create price advantages for Western producers.

Risk management requires diversification across production stages and geographic regions. Investors should allocate 60% to cash-flow positive companies with Pentagon contracts, 30% to emerging producers with government backing, and 10% to recycling technologies. Companies in exploration stages without offtake agreements or government support carry excessive risk.

The long-term outlook remains bullish as electric vehicle sales approach 14 million annually and wind power additions demand 100,000 tons of rare earths yearly. Demand will triple by 2030 while China maintains 80% processing control (which creates sustained supply constraints). We at Natural Resource Stocks track established producers with processing capabilities who capture the highest returns as Western governments prioritize supply chain independence, and Natural Resource Stocks provides expert analysis to help investors navigate this specialized sector.