Industry News Feeds

-

Perenti posts record first-half earnings, eyes stronger second half

by Special Report on February 24, 2026 at 2:58 am

Mining services provider Perenti lifted free cash flow guidance and reported a record $160.1 million in first half underlying earnings. ... Read More The post Perenti posts record first-half earnings, eyes stronger second half appeared first on Stockhead.

-

StockTake: Minerals Exploration uncovers high-grade gold at newly granted...

by Stockhead TV on February 24, 2026 at 2:46 am

Minerals Exploration has launched a follow-up field campaign at its Invincible gold project in New Zealand. ... Read More The post StockTake: Minerals Exploration uncovers high-grade gold at newly granted permit appeared first on Stockhead.

-

Red Mountain Mining moves to secure slice of US domestic antimony supply

by Special Report on February 24, 2026 at 2:25 am

Red Mountain Mining is shoring up its portfolio of US antimony projects as it moves to secure a place in ... Read More The post Red Mountain Mining moves to secure slice of US domestic antimony supply appeared first on Stockhead.

-

New anomalies serve-up camp-scale potential for Loyal Metals at Highway...

by Special Report on February 24, 2026 at 2:19 am

Loyal Metals could have a camp-scale copper-gold system on its hands at the Highway Reward project in Queensland. ... Read More The post New anomalies serve-up camp-scale potential for Loyal Metals at Highway Reward appeared first on Stockhead.

-

Lunch Wrap: Tech gets smacked again, gold rallies and BHP hits record high

by Eddy Sunarto on February 24, 2026 at 2:18 am

The ASX wobbled at lunch as tech sold off again, miners ran hot on gold, and earnings season turned the ... Read More The post Lunch Wrap: Tech gets smacked again, gold rallies and BHP hits record high appeared first on Stockhead.

-

Locksley fires up diamond drill rig in antimony hunt at Mojave

by Special Report on February 24, 2026 at 2:07 am

Locksley Resources has fired up the rig for its maiden diamond drilling program at the high-grade Desert Antimony Mine prospect ... Read More The post Locksley fires up diamond drill rig in antimony hunt at Mojave appeared first on Stockhead.

-

Visible gold reinforces precious metals potential at Argent’s Kempfield

by Special Report on February 24, 2026 at 1:52 am

Visible gold has been observed for the first time at Argent Minerals’ Kempfield polymetallic project in New South Wales. ... Read More The post Visible gold reinforces precious metals potential at Argent’s Kempfield appeared first on Stockhead.

-

StockTake: True North Copper lands $400k Mt Oxide award

by Stockhead TV on February 24, 2026 at 1:35 am

Tylah Tully looks at True North Copper and a $400k award from the Queensland Government to assess re-commercialisation of legacy waste. ... Read More The post StockTake: True North Copper lands $400k Mt Oxide award appeared first on Stockhead.

-

Health Check: Integral says ‘we’re stronger together’ after bumper...

by Tim Boreham on February 24, 2026 at 1:23 am

Integral Diagnostics' merger with fellow radiology provider Capitol Health is screening well, with synergy benefits ahead of plan. ... Read More The post Health Check: Integral says ‘we’re stronger together’ after bumper merger result appeared first on Stockhead.

-

StockTake: Ore Resources partners with traditional owners for Coolgardie...

by Stockhead TV on February 24, 2026 at 1:11 am

Tylah Tully unpacks an agreement between Ore Resources and the traditional owners of its Coolgardie projects in WA which paved ... Read More The post StockTake: Ore Resources partners with traditional owners for Coolgardie Goldfields appeared first on Stockhead.

-

Viking sets course for early tungsten production as high-grade historical...

by Special Report on February 24, 2026 at 12:24 am

Viking has set its sights on early production at the Linka tungsten project in Nevada after a review of historical ... Read More The post Viking sets course for early tungsten production as high-grade historical hits expand Linka footprint appeared first on Stockhead.

-

West Coast Silver scout drilling reveals potential Elizabeth Hill growth...

by Special Report on February 24, 2026 at 12:04 am

Scout drilling at West Coast Silver’s Elizabeth Hill silver project has extended mineralisation and highlighted opportunities outside the historical mine ... Read More The post West Coast Silver scout drilling reveals potential Elizabeth Hill growth opportunities appeared first on Stockhead.

-

Long Shortz with Cannindah: The first taste of a potential porphyry system

by Stockhead TV on February 23, 2026 at 11:27 pm

Cannindah Resources has found a potential copper-gold porphyry system at its Mt Cannindah project. ... Read More The post Long Shortz with Cannindah: The first taste of a potential porphyry system appeared first on Stockhead.

-

Rockland Resources Closes Private Placements And Acquires The Mckenzie...

by Investing News Network on February 23, 2026 at 10:50 pm

(TheNewswire) Vancouver, British Columbia, February 23, 2026 TheNewswire - Rockland Resources Ltd. (the "Company" or "Rockland") (CSE: RKL,OTC:BERLF) (OTCQB: BERLF) (FSE: GB2) is pleased to provide the following update on the Company's activities. DRILL PROGRAM Rockland continues to drill in at its 100% owned Cole Gold Mines project in the Red lake Mining District, Ontario. The program is now on hole 12 with the first 5 drilled holes in at the lab now and results expected in the […]

-

Soma to Present at the Centurion One Capital 9th Annual Toronto Growth...

by Investing News Network on February 23, 2026 at 10:08 pm

Soma Gold Corp. (TSXV: SOMA,OTC:SMAGF) (WKN: A2P4DU) (OTCQX: SMAGF) (the "Company" or "Soma") is pleased to announce that it will be presenting at the Centurion One Capital 9th Annual Toronto Growth Conference on Thursday, March 5, 2026, in Toronto, Ontario.Geoff Hampson, President and CEO of Soma Gold Corp., will deliver a corporate presentation, participate in panel discussions, and meet with investors to discuss Soma's operational performance, exploration strategy, and growth outlook."We are […]

-

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

by Charlotte McLeod on February 23, 2026 at 10:00 pm

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

-

Investor Update Webcast - FY26 Half Year Financial Results

by Investing News Network on February 23, 2026 at 9:22 pm

Westgold Resources Limited (ASX: WGX,OTC:WGXRF) (TSX: WGX) (Westgold or the Company) will lodge its Half Year Financial Report with the ASX on Thursday, 26 February 2026.Westgold advises that Wayne Bramwell (Managing Director & CEO) and Tommy Heng (Chief Financial Officer), will present the results via webcast on Thursday, 26 February 2026 at 9:00am AWST / 12:00pm AEDT, followed by a Q&A session.To listen to the Webcast live, please click on the link below and register your details. […]

-

Belo Sun Announces Special Meeting of Shareholders Voting Results

by Investing News Network on February 23, 2026 at 9:00 pm

Belo Sun Mining Corp. ("Belo Sun" or the "Company") (TSX:BSX,OTC:BSXGF, OTCQB:BSXGF) is pleased to report that all meeting matters put forth to the shareholders (the "Shareholders"), as voted on by the disinterested shareholders, were duly approved at its special meeting of shareholders held today (the "Meeting"). At the Meeting, the 91.99% of the disinterested Shareholders approved the issuance of up to 56,565,697 common shares of the Company to La Mancha Investments S. à r. l. ("La Mancha") […]

-

Rise and Shine: Everything you need to know before the ASX opens

by Eddy Sunarto on February 23, 2026 at 8:26 pm

Good morning! Here’s everything you need to know before the ASX flings open its doors and begins trading today. ... Read More The post Rise and Shine: Everything you need to know before the ASX opens appeared first on Stockhead.

-

Palamina Corp Invites Shareholders and Investment Community to visit them...

by Investing News Network on February 23, 2026 at 8:00 pm

Visit Palamina Corp (TSXV: PA,OTC:PLMNF) (OTCQB: PLMNF) at Booth #2723 at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Sunday, March 1 to Wednesday, March 4, 2026. About Palamina CorpPalamina is an exploration company with a land bank of gold projects in the Puno Orogenic Gold Belt in southeastern Peru and a land bank of high grade copper-silver assets in southeastern and northeastern Peru. Palamina trades on the […]

-

Litchfield Minerals eyes hot targets in North Australian Craton

by Staff Writer on February 23, 2026 at 7:55 pm

With six projects across over 3200km of under-explored ground, Litchfield has been winning over both investor and blue-chip attention. ... Read More The post Litchfield Minerals eyes hot targets in North Australian Craton appeared first on Stockhead.

-

ADX Energy recovers light oil in Austrian flow testing

by Special Report on February 23, 2026 at 7:50 pm

ADX Energy has recovered light oil while testing the Reifling Formation at its Welchau-1 well in Upper Austria, highlighting the ... Read More The post ADX Energy recovers light oil in Austrian flow testing appeared first on Stockhead.

-

China Gold International Invites Shareholders and Investment Community to...

by Investing News Network on February 23, 2026 at 7:33 pm

Visit China Gold International (TSX: CGG,OTC:JINFF) (OTC Pink: JINFF) at Booth #2139 at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Sunday, March 1 to Wednesday, March 4, 2026.About China Gold InternationalChina Gold International Resources is a gold and base metal mining company incorporated in BC, Canada and operates two mines, the CSH Gold Mine in Inner Mongolia, China and the Jiama Copper-Gold Polymetallic […]

-

ASX explorers swarm Queensland’s historical districts in modern-day gold...

by Bart Bogacz on February 23, 2026 at 7:30 pm

ASX explorers are rejuvenating Queensland’s historical mining districts in a modern-day gold and copper rush. ... Read More The post ASX explorers swarm Queensland’s historical districts in modern-day gold and copper hunt appeared first on Stockhead.

-

Sonoro Gold to Participate in PDAC 2026

by Investing News Network on February 23, 2026 at 7:01 pm

Sonoro Gold Corp. (TSXV: SGO,OTC:SMOFF) (OTCQB: SMOFF) (FSE: 23SP) ("Sonoro" or the "Company") is pleased to announce that it will be attending 2026 PDAC at the Metro Toronto Convention Centre (MTCC) from Sunday, March 1 to Wednesday, March 4, 2026.Shareholders and investors are invited to meet the Sonoro team at Booth 2330 in the Investor Exchange, located in the MTCC South building. We also invite you to join President and CEO Kenneth MacLeod at the Corporate Presentations for Investors (CPI) […]

NRS News & Articles

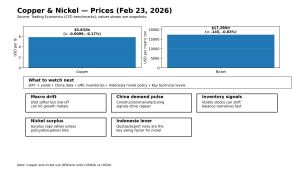

Why copper and nickel prices are moving today: key market drivers (Feb 23, 2026)

Copper and nickel are slightly lower today as traders juggle a mixed macro backdrop (a softer dollar and lower yields) against risk-off sentiment and ongoing debates about demand vs. supply in base metals. Today’s pricing snapshot (Feb 23, 2026): 5 key drivers behind today’s move 1) Macro is supportive… but the tape is risk-off The U.S. dollar index is softer (a typical tailwind for commodities), and the U.S. 10-year yield is lower today—conditions that often help industrial metals at the margin.But broader markets are dealing with heightened uncertainty tied to U.S. tariff headlines and policy whiplash, which can weigh on “growth-sensitive” metals like copper and nickel. 2) Copper remains a “China demand pulse” trade Copper price action still tracks expectations for China’s construction + manufacturing cycle. When the market lacks a clear supply shock, copper often drifts with the daily push/pull of demand expectations—especially around China data and stimulus chatter.

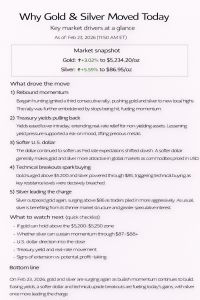

Why Gold & Silver Moved Today (Feb 23, 2026)

Gold and silver are surging higher today as bullish momentum accelerates across the precious metals complex. As of late morning in New York (11:50 AM ET), gold futures are trading at $5,234.20/oz, up $153.30 (+3.02%), while silver futures are at $86.95/oz, up $4.61 (+5.59%) on the session (COMEX pricing, Feb 23, 2026). 5 key drivers behind today’s move 1) Momentum continuation buyingFollowing last week’s strength, buyers stepped in early, extending the rally. Breakout levels attracted fresh participation and reinforced the upside move. 2) Treasury yields pulling backYields eased intraday, reducing real-rate pressure on non-yielding assets. The softer rate backdrop provided additional support for gold and silver. 3) Weaker U.S. dollarThe dollar softened again, offering tailwinds to commodities priced in USD. A weaker currency environment boosted international demand for precious metals. 4) Technical breakouts above resistanceGold held firmly above the $5,200 zone, while silver powered through $85 resistance. These decisive moves

Silver Market Volatility: Navigating Turbulent Waters

Navigate silver market volatility with proven strategies to protect your portfolio and identify investment opportunities in uncertain times.