Gold and silver have delivered impressive returns during market turbulence, with gold gaining 25% in 2020 alone while stocks plummeted. These precious metals consistently outpace inflation over decades.

We at Natural Resource Stocks see investing in gold and silver as a proven strategy for wealth protection. Smart investors use multiple approaches to build exposure to these assets.

Why Smart Money Chooses Precious Metals

Economic Crisis Performance That Speaks Volumes

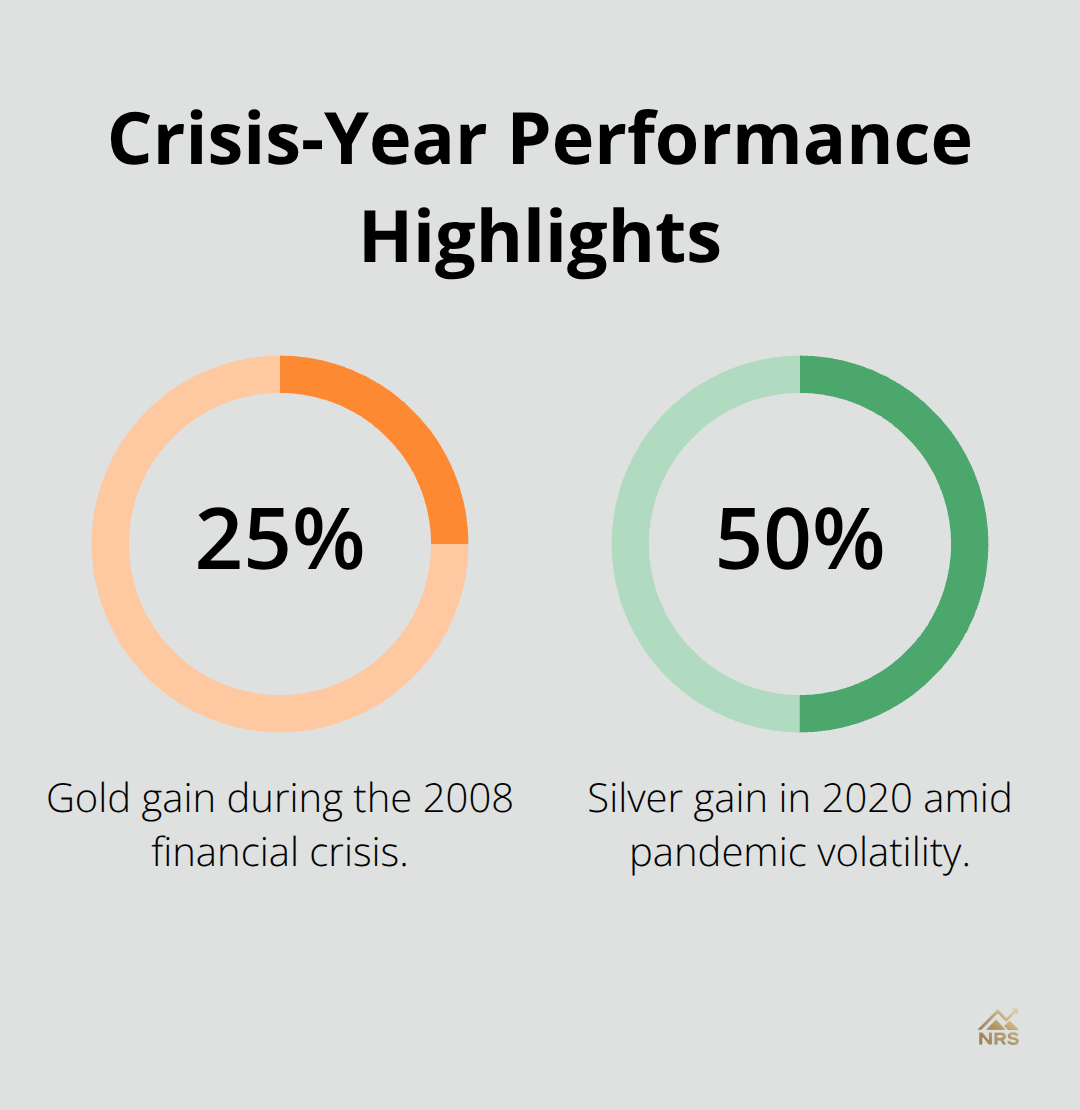

Gold and silver prove their worth when traditional investments fail spectacularly. During the 2008 financial crisis, gold climbed 25% while the S&P 500 dropped 37%. The 2020 pandemic triggered another flight to safety, with gold surging from $1,500 to over $2,000 per ounce in just months.

Silver followed with explosive 50% gains that same year. These metals consistently deliver when stock markets crater and make them essential portfolio insurance. Research from the Chicago Fed shows gold and inflation expectations tend to move together, particularly from 1971 to around 2000.

Inflation Protection That Actually Works

The purchasing power protection that precious metals offer stands unmatched in modern finance. From 1970 to 1980, when inflation ravaged the U.S. economy at double-digit rates, gold prices exploded from $35 to $850 per ounce. Silver jumped from $1.70 to $50 during the same period.

Recent data from the Bureau of Labor Statistics shows consumer prices rise 6.2% annually, while gold maintains its real value over decades. A $100 investment in gold in 1971 would buy the same goods today, while that same $100 in cash lost 85% of its purchasing power.

Portfolio Diversification Benefits

Portfolio managers at major institutions like BlackRock create model investment portfolio allocations that can help inform timely allocations and trades. The diversification benefits become obvious during market stress when gold and silver move independently from stocks and bonds.

This independence reduces overall portfolio volatility by up to 15% according to Morningstar research. Smart investors recognize that precious metals act as a counterbalance to traditional assets (especially during economic uncertainty).

These proven benefits explain why institutional investors maintain significant precious metals positions. The next step involves understanding the various methods available to gain exposure to these valuable assets.

How Should You Invest in Gold and Silver

Physical Metals Ownership

Physical gold and silver ownership provides direct control over your precious metals investments without counterparty risk. Gold coins like American Eagles cost around $50-$100 premium over spot price, while silver rounds carry $3-$5 premiums per ounce. JM Bullion offers free shipping on orders over $199, which makes bulk purchases more economical.

Storage costs accumulate quickly. Safety deposit boxes run $50-$300 annually, while home safes cost $500-$3,000 upfront. Insurance typically costs 1-2% of your metals value per year. Physical ownership works best for investors with $50,000+ allocations who can absorb these fixed costs effectively.

Gold and Silver ETF Options

SPDR Gold Trust ETF holds physical gold but charges 0.40% annual fees. iShares Silver Trust carries a 0.50% expense ratio. These ETFs face collectible tax rates up to 28% on long-term gains (higher than stock capital gains rates of 15-20%). The tax disadvantage makes ETFs less attractive for long-term wealth preservation strategies.

VanEck Gold Miners ETF tracks major gold producers and returned 24% in 2020 compared to gold’s 25% gain. Silver miners show even higher volatility, with First Majestic Silver posting 185% gains that same year. These funds provide exposure without physical storage requirements.

Mining Stock Investments

Gold mining stocks like Newmont Corporation amplify price movements and often move 2-3 times more than gold prices themselves. Silver miners demonstrate even greater leverage to underlying metal prices. Mining stocks receive standard capital gains treatment, which makes them tax-advantaged for most investors compared to precious metals ETFs.

Mining companies face operational risks that physical metals avoid. Production costs, labor disputes, and regulatory changes affect stock prices independently of metal values. Smart investors balance these operational risks against the potential for amplified returns.

Digital Platforms and Futures Markets

Digital precious metals platforms like OneGold allow fractional ownership that starts at $1 investments. These platforms eliminate storage costs and minimum investment barriers that physical ownership requires. Futures contracts demand substantial capital, with gold contracts that represent 100 ounces worth $400,000+ at current prices.

CME Group provides volume and open interest data for gold futures markets. A $1 price drop costs futures traders $100 per contract when they use margin. These markets suit professional traders rather than buy-and-hold investors who seek long-term wealth protection.

Each investment method carries distinct advantages and trade-offs that depend on your capital allocation, risk tolerance, and investment timeline. The price movements of these metals respond to specific economic and political factors that smart investors monitor closely. Most financial advisors recommend allocating 5-10% of a portfolio to gold for optimal benefits without overexposure.

What Really Moves Gold and Silver Prices

Federal Reserve Policy Creates Price Swings

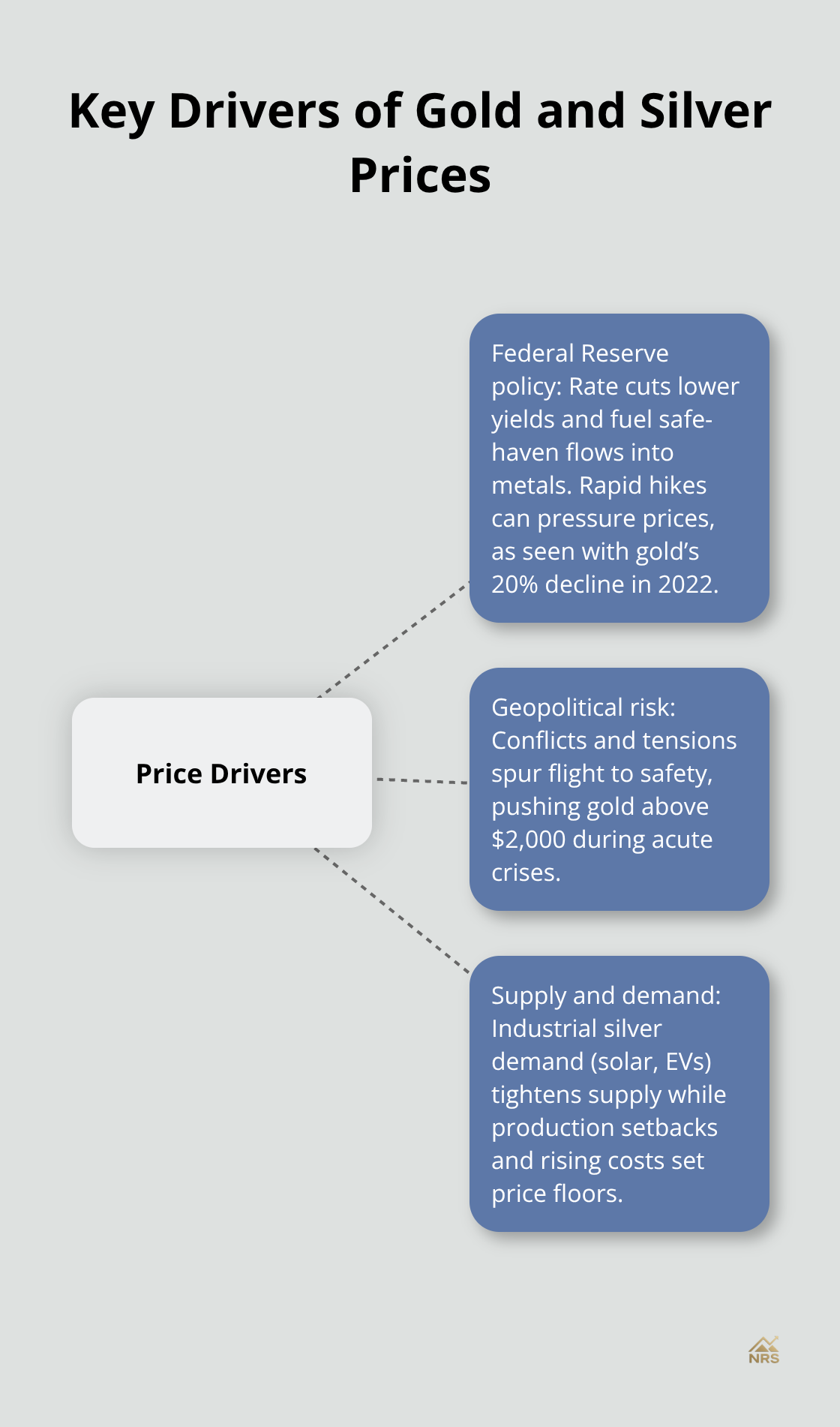

Federal Reserve interest rate decisions drive massive price movements in precious metals markets. When the Fed cuts rates, gold and silver prices typically surge as investors flee low-yielding bonds. The March 2020 emergency rate cuts to near zero triggered gold’s climb from $1,480 to $2,070 within six months.

Silver exploded from $12 to $29 during the same period. Higher interest rates make bonds more attractive than non-yielding metals, which explains gold’s 20% decline in 2022 when the Fed raised rates aggressively.

Smart investors watch Fed meeting minutes and inflation data releases to anticipate rate changes. The 10-year Treasury yield serves as a reliable inverse indicator for gold prices.

Geopolitical Chaos Sends Metals Soaring

Military conflicts and political instability create immediate spikes in precious metals demand. Russia’s invasion of Ukraine in February 2022 pushed gold above $2,000 as investors sought safety from currency debasement risks.

The 2019 U.S.-Iran tensions drove gold up 18% in just three months. Brexit uncertainty added $200 per ounce to gold prices between 2016-2019. China-Taiwan tensions consistently boost Asian precious metals purchases.

Currency crises in Turkey and Argentina demonstrate how local political chaos drives citizens toward gold and silver ownership. Professional traders monitor geopolitical risk calendars and maintain positions ahead of major elections or diplomatic summits.

Supply Shortages Create Price Explosions

Production constraints and industrial demand imbalances determine long-term price trends. Silver’s industrial applications consume significant portions of annual production, with solar panel manufacturing alone requiring 130 million ounces yearly (according to the Silver Institute).

Electric vehicle production demands increasing silver quantities for batteries and electronics. Gold mine production rose fractionally in 2018, up 1% to 3,346.9t. South Africa’s power grid failures reduced gold production 15% in 2023.

Major miners like Newmont report rising extraction costs that set price floors around $1,800 per ounce for profitable operations. Industrial demand for silver in 5G infrastructure and renewable energy creates structural supply deficits that push prices higher over time (particularly in emerging markets).

Final Thoughts

Investing in gold and silver requires strategic planning that balances opportunity with risk management. We at Natural Resource Stocks recommend you allocate 5-15% of your portfolio to precious metals, with physical ownership as your core position and mining stocks for growth potential. Start with established coins like American Eagles or Canadian Maples before you explore mining equities.

Dollar-cost averaging over 12-18 months reduces timing risks and smooths price volatility. Store physical metals in allocated storage or insured depositories rather than home safes. Central bank gold purchases hit 1,136 tonnes in 2022 (the highest level since 1967), while industrial silver demand continues to grow through renewable energy expansion and 5G infrastructure development.

Rising government debt levels and persistent inflation pressures support higher precious metals prices over the next decade. Smart investors position themselves now before institutional demand accelerates further. Natural Resource Stocks provides expert analysis and market insights to help you navigate precious metals investments successfully.