The Future of Silver: Insights from Jim McDonald on Market Opportunities

Silver, often overshadowed by its more famous counterpart, gold, is on the verge of experiencing a significant breakthrough. With the precious metal recently pushing past $30 per ounce, there’s much excitement in the market about the potential for silver to catch up to its historic highs. Jim McDonald, CEO of Kootenay Silver, shares his thoughts on the silver market’s trajectory, offering valuable insights into its future.

Silver’s Potential for Rapid Growth

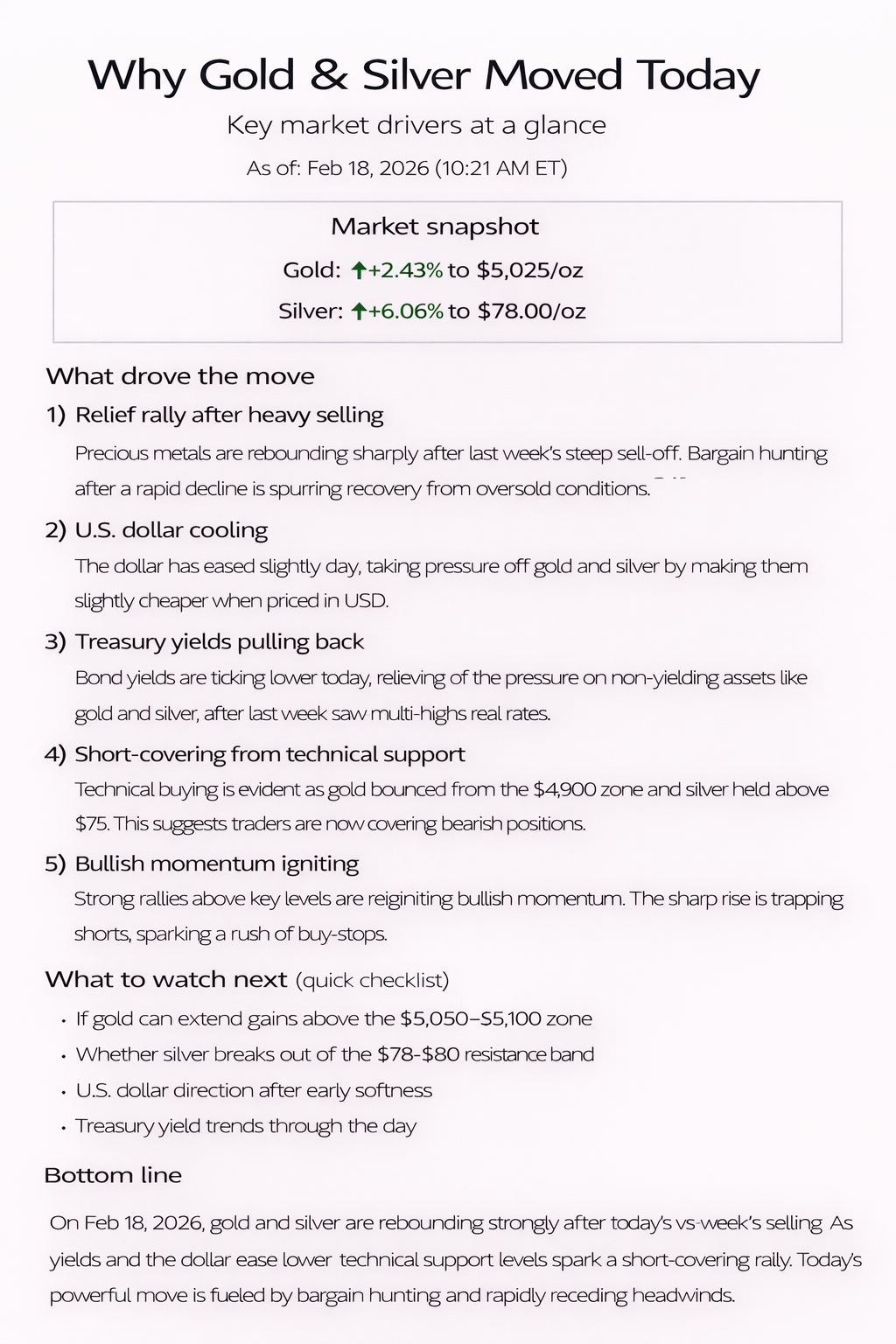

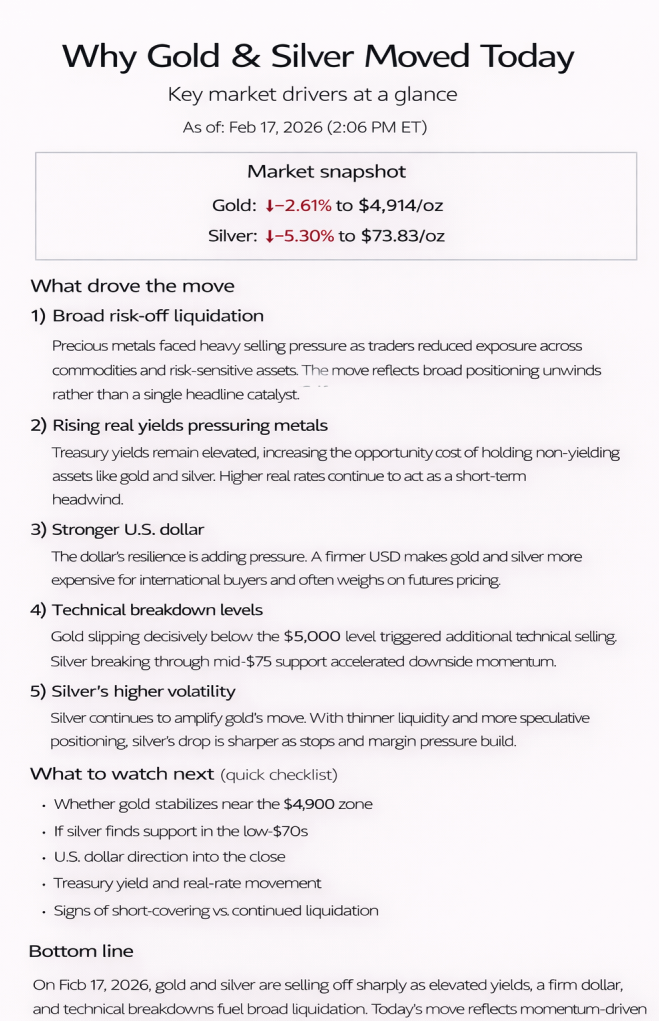

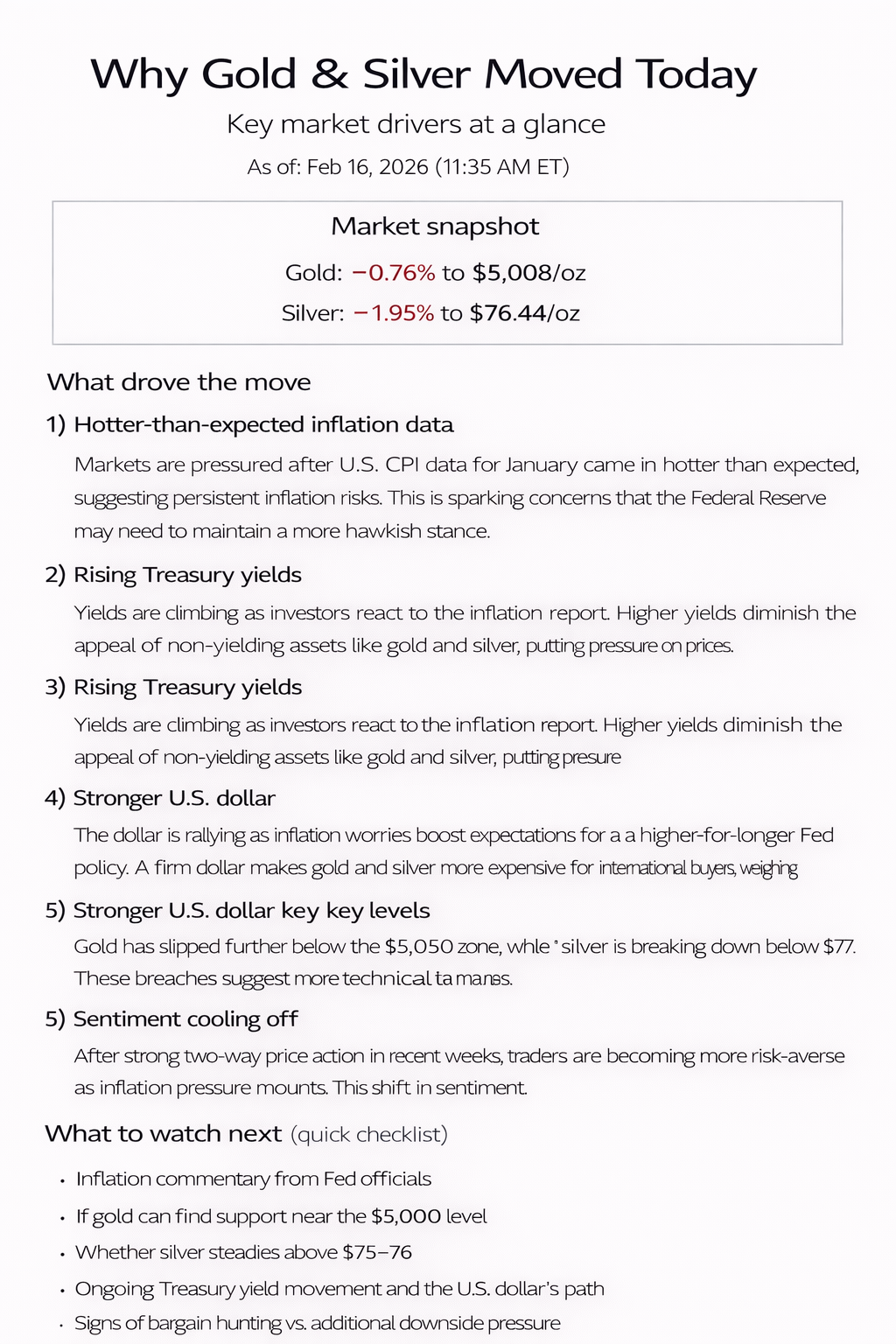

Silver’s market momentum has been building for some time, with McDonald pointing to the ever-tightening supply and increasing industrial demand as major drivers of price growth. While silver is still at 60% of its old highs, the rise of gold prices has historically pulled silver along with it. McDonald is confident that when silver breaks through the $34-$35 mark, the price could soar to $40 quickly, offering substantial gains to investors.

In the last year, the price of silver has jumped from around $22 to over $32 per ounce, highlighting the rapid potential for growth in the coming months. As McDonald explains, this recent spike is merely a precursor to what’s to come. Silver’s long-term prospects are exciting, with much more room for upward movement as it continues to gain traction in the global market.

The Catalysts Behind Silver’s Breakout

McDonald attributes silver’s rising momentum to several factors, notably the growing industrial demand for the metal and its continued use as a monetary asset. As silver continues to serve both functions—being a valuable industrial material and a store of wealth—its market value is expected to rise. Silver, often dubbed “the poor man’s gold,” benefits from this dual demand.

Moreover, McDonald highlights the drastic depletion of above-ground silver stocks, which further contributes to silver’s increasing scarcity and rising prices. He believes we are on the cusp of a breakout, with silver poised to reach $40 and possibly even $50 in the near future.

Opportunities in Silver Stocks

For investors looking to gain exposure to silver, McDonald points to Kootenay Silver as an excellent option. The company’s ongoing drilling projects in Mexico have already led to three discoveries, with another promising discovery in progress. The management team at Kootenay Silver has decades of experience and has proven its ability to find and develop high-grade silver deposits.

Kootenay’s Columba discovery, a high-grade silver vein system, is particularly promising. With near 200 drill holes completed and 50,000 meters of drilling already conducted, the Columba project could prove to be a significant asset for the company. As McDonald mentions, the drilling results, expected to be released soon, will be a game-changer for Kootenay and could lead to a maiden resource estimate by the end of April.

The Mexican Mining Landscape

One of the key advantages of Kootenay Silver is its longstanding presence in Mexico, a country with a rich history of silver mining. While the political climate in Mexico has historically been a source of concern for investors, recent positive changes suggest that the country is becoming more receptive to mining activities.

The new administration has acknowledged the importance of open-pit mining for critical minerals and has introduced favorable regulations for mining companies. McDonald is optimistic about the future of the Mexican mining sector, citing the potential for increased support and incentives for junior mining companies.

The Time to Invest in Silver is Now

As silver prices rise, McDonald advises investors to act quickly, especially given the low equity prices relative to silver’s growing value. Kootenay Silver’s management team has already proven its ability to make successful discoveries, and the company’s exploration efforts in Mexico continue to hold promise. McDonald believes that with the right approach, investors can tap into the growing silver market and reap significant rewards as the metal continues its upward trajectory.

In conclusion, McDonald’s insights into the silver market underscore the growing potential for silver to reach new highs in the coming months. With a solid track record and a clear focus on expanding its silver assets, Kootenay Silver is well-positioned for success as the global demand for silver continues to grow. Investors looking for exposure to silver stocks should keep a close eye on Kootenay Silver as it leads the way in one of the most exciting markets today.

For more information on Kootenay Silver, visit KootenaySilver.com.