Natural gas remains a dominant force in the global energy mix, powering everything from homes to industrial facilities. Smart investors recognize the sector’s potential for steady returns and dividend income.

We at Natural Resource Stocks have compiled this comprehensive natural gas stocks list to help you navigate the complex energy landscape. The right picks can provide both growth and income in your portfolio.

Which Natural Gas Stocks Deliver the Best Returns?

Pipeline giants dominate the natural gas investment landscape through their steady cash flows and defensive business models. Kinder Morgan operates 83,000 miles of pipelines across North America and generates approximately 95% of its earnings from fee-based contracts that provide predictable income regardless of commodity price swings. Enterprise Products Partners maintains a similar advantage with its 50,000-mile network and has increased distributions for 27 consecutive years, which showcases the reliability of midstream infrastructure investments.

Pipeline Infrastructure Leaders

TC Energy and Enbridge represent the top tier of pipeline operators, with TC Energy’s Keystone and ANR systems that move over 25% of North American natural gas consumption daily. Enbridge’s diversified portfolio spans both oil and gas transportation and delivers a current dividend yield near 6.5% while it maintains investment-grade credit ratings. These companies benefit from long-term contracts that span 15-25 years and insulate them from short-term price volatility that crushes upstream producers.

Production Powerhouses

EQT Corporation stands as America’s largest natural gas producer and pumps over 1.8 billion cubic feet daily from Appalachian shale formations. Chesapeake Energy has transformed from bankruptcy to profitability through aggressive cost-cutting and reduced drilling costs by 40% since 2020 while it maintains production levels above 3 billion cubic feet equivalent per day. ConocoPhillips combines natural gas production with oil operations and generates free cash flow that exceeds $15 billion annually at current commodity prices.

Utility Integration Winners

NextEra Energy derives roughly 30% of its power generation from natural gas facilities positioning the company perfectly for grid reliability as renewable sources expand. Dominion Energy operates extensive natural gas distribution networks that serve 7 million customers across multiple states, while Southern Company’s natural gas plants provide baseload power that supports 9 million electricity customers. These utilities offer dividend yields between 3-4% with rate-regulated revenue streams that provide stability during market turbulence.

The selection of individual stocks requires careful analysis of specific financial metrics and operational performance indicators that separate winners from underperformers.

How Do You Pick Winning Natural Gas Stocks?

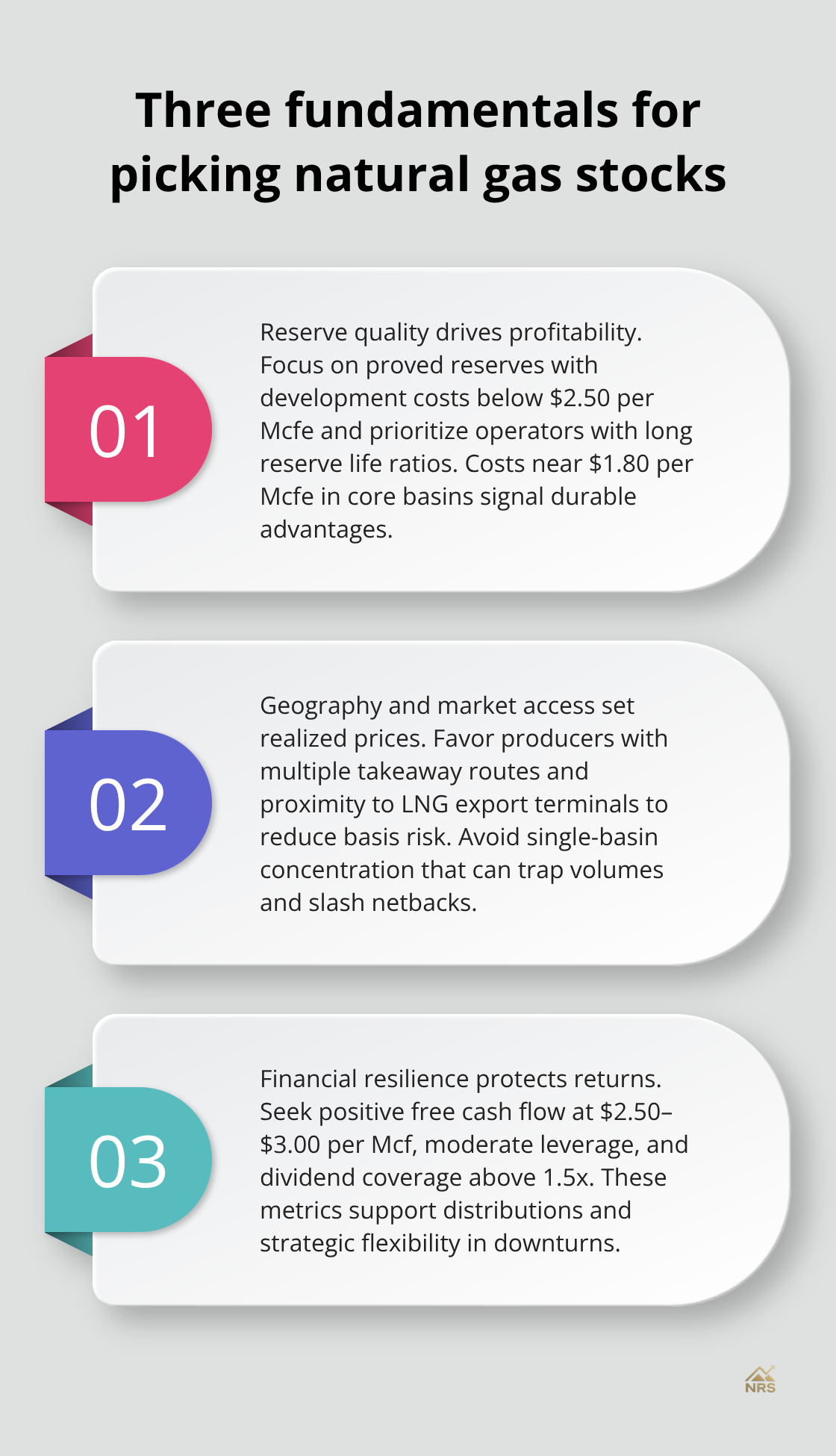

Reserve Quality Separates Winners from Losers

Production capacity means nothing without high-quality reserves that generate profits at current price levels. You should examine proved reserves with development costs below $2.50 per thousand cubic feet equivalent, which represents the breakeven point for most Appalachian producers according to EIA data. Companies like EQT maintain costs around $1.80 per Mcfe in their core Marcellus positions, while weaker operators struggle with costs above $3.00 per Mcfe. Reserve life ratios above 15 years indicate sustainable production platforms, though anything below 10 years signals potential depletion concerns that will pressure future cash flows.

Geographic Concentration Creates Risk

Pipeline access determines profitability more than reserve size, especially for producers trapped in landlocked basins without multiple takeaway options. Kinder Morgan’s network spans 40 states and connects to every major production region, while smaller operators face basis differentials that can slash netback prices by $0.50-1.00 per Mcf during peak production periods. Companies with assets near LNG export terminals capture premium prices, with natural gas reaching $6.38 per MMBtu at Henry Hub during peak periods. You should avoid producers concentrated in single basins like the Haynesville without diversified transportation contracts.

Financial Metrics That Matter Most

Free cash flow at $3.00 per Mcf gas prices separates sustainable operators from bankruptcy candidates, with top-tier companies that maintain positive cash flows even at $2.50 per Mcf. Companies with high debt-to-equity ratios face greater financial risk, while established operators typically maintain lower leverage ratios that provide flexibility for opportunistic acquisitions. Dividend coverage ratios that exceed 1.5x protect distributions during volatile periods (though many producers suspended payouts entirely during the 2020 price collapse when Henry Hub averaged just $2.03 per Mcf).

These fundamental analysis tools help identify quality companies, but broader market forces and industry trends shape the entire natural gas investment landscape in ways that affect even the strongest operators.

What Market Forces Drive Natural Gas Stock Performance?

Energy Transition Creates Massive LNG Opportunities

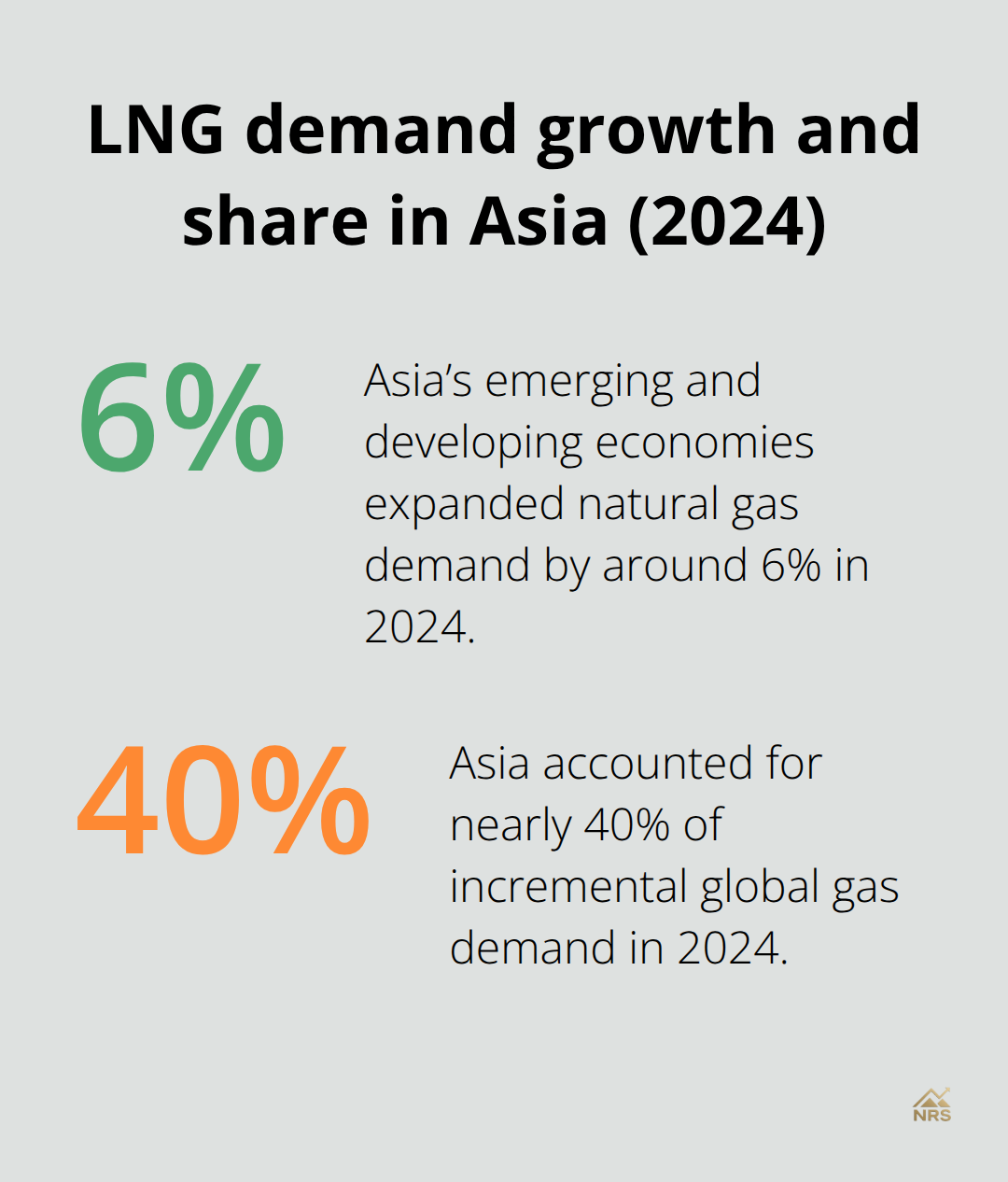

Natural gas demand in emerging market and developing economies in Asia expanded by around 6% in 2024, accounting for nearly 40% of incremental global gas demand. The United States exported 11.9 billion cubic feet per day of LNG in 2024, remaining the world’s largest LNG exporter and creating premium opportunities for companies with export terminal access.

Cheniere Energy captures these premiums through its Sabine Pass and Corpus Christi facilities, which command prices that average $2-4 per MMBtu above Henry Hub during peak export seasons. Companies without LNG exposure face domestic pressure as production outpaces pipeline capacity, with Appalachian producers often trading at $0.50-1.50 discounts to benchmark prices.

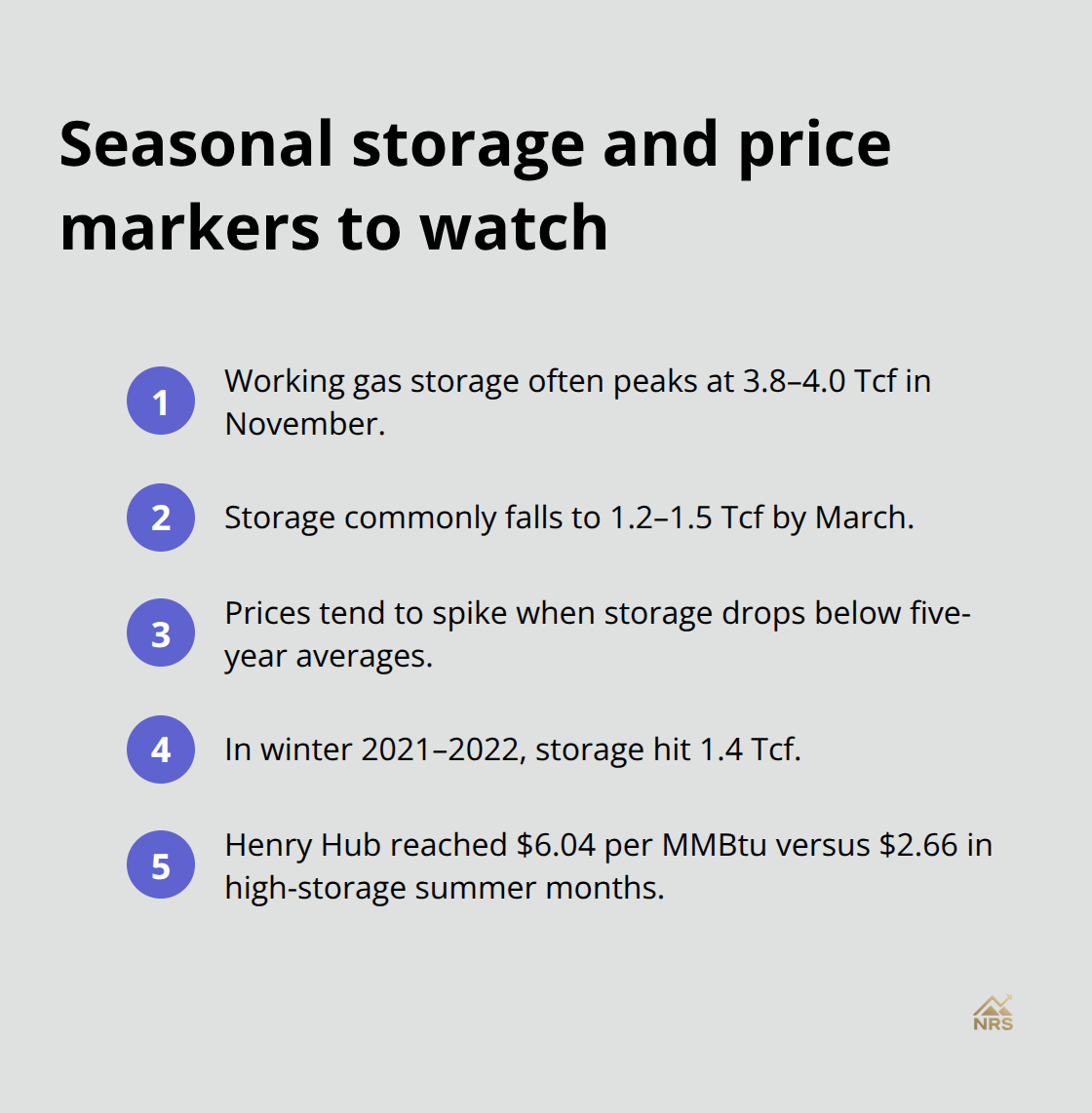

Storage Cycles Generate Predictable Patterns

Natural gas futures storage levels directly impact price volatility and create seasonal investment opportunities that smart investors exploit through strategic timing. Working gas storage typically peaks at 3.8-4.0 trillion cubic feet in November and drops to 1.2-1.5 trillion cubic feet by March, with prices that spike when storage falls below five-year averages.

The 2021-2022 winter season demonstrated this pattern when storage dropped to 1.4 trillion cubic feet and Henry Hub prices reached $6.04 per MMBtu (compared to the $2.66 average during high-storage summer months). Companies with substantial storage assets like Kinder Morgan benefit from these price spreads through seasonal arbitrage opportunities, while producers face margin compression during low-demand periods when storage capacity limits their power to set prices.

Weather Volatility Drives Short-Term Price Swings

Temperature extremes create immediate demand spikes that can double natural gas prices within weeks during severe weather events. The February 2021 Texas freeze pushed Henry Hub prices to $23.86 per MMBtu as heating demand surged and production facilities froze, which created windfall profits for companies with flexible supply contracts.

Hurricane activity in the Gulf of Mexico regularly shuts down 15-20% of U.S. natural gas production, with Hurricane Ida alone reducing output by 1.7 billion cubic feet per day for over two weeks in 2021. Companies with diversified geographic exposure weather these disruptions better than concentrated Gulf Coast operators who face complete production shutdowns during major storms.

Final Thoughts

Natural gas stocks offer compelling investment opportunities across three distinct segments that cater to different risk profiles and return expectations. Pipeline companies like Kinder Morgan and Enterprise Products Partners provide steady dividend income through fee-based contracts, while producers such as EQT Corporation and Chesapeake Energy deliver higher growth potential tied to commodity price movements. Utility companies bridge both worlds with regulated revenue streams and natural gas exposure.

Smart risk management requires diversification across the natural gas value chain rather than concentration in single companies or segments. Position sizes should reflect the higher volatility of upstream producers compared to midstream infrastructure, with pipeline stocks that form the foundation of any natural gas portfolio. Weather events and storage cycles create short-term price swings, but patient investors benefit from the sector’s long-term fundamentals.

The outlook for natural gas remains positive through 2030 as LNG exports expand and domestic demand grows from data centers and industrial facilities (with Asian markets driving 40% of global demand growth). This natural gas stocks list represents the starting point to build a diversified energy portfolio that captures both income and growth opportunities in America’s abundant natural gas resources. We at Natural Resource Stocks provide comprehensive analysis and expert market insights to help investors navigate this dynamic sector.