Platinum remains one of the most misunderstood precious metals in investor portfolios, yet 2025 is shaping up to be a pivotal year for the market. At Natural Resource Stocks, we’re tracking significant shifts in supply dynamics, automotive demand, and macroeconomic headwinds that are reshaping price trajectories.

This platinum market analysis 2025 examines the forces driving prices higher and the risks that could derail momentum. We’ll show you where the real opportunities lie for investors willing to look beyond surface-level price movements.

What’s Driving Platinum Prices Higher in 2025

Supply Compression Hits Hard

Platinum’s 49% surge in the first half of 2025 reflects three concrete forces reshaping supply and demand. The World Platinum Investment Council reports that platinum supply fell 4% to 6,999 koz in 2025, marking the lowest output in five years while above-ground inventories dropped to roughly three months of demand coverage. This supply compression hits hardest in South Africa, which produces over half of global platinum. Novus Group data shows PGM output in South Africa fell 24.1% year-over-year in April 2025, with seven of twelve mining divisions declining. That’s not a temporary blip-it signals structural constraints that will persist through the decade.

Recycling pulled less supply than expected, leaving mining companies unable to refill the gap. The shortage tightens physical markets and forces prices higher as above-ground stocks deplete further.

Automotive and Industrial Demand Remain Locked In

Catalytic converters in diesel engines consume roughly 40% of global platinum demand, according to WPIC data. Even as electric vehicles grow, the transition takes years, and current gasoline and hybrid engines still require platinum in catalytic converters. Industrial applications spanning oil refining, chemical processing, and hydrogen fuel-cell production create a durable demand floor that won’t disappear overnight.

China’s platinum jewelry imports hit 11.5 tonnes in April 2025-the highest in a year-as gold prices climbed and investors sought alternatives. That represents a 15% year-over-year increase in jewelry demand from China alone, adding roughly 62 koz of additional demand. Jewelry demand in China is forecast to grow modestly after a long-term decline, with Q1 2025 platinum jewelry processing volumes up 26% year-over-year.

Investment Flows and Valuation Gaps Amplify the Rally

Q1 2025 investment demand surged 300% year-over-year to 461,000 oz, driven by investors seeking assets that central banks cannot print or digitally create amid persistent inflation. China became the dominant buyer, importing substantial quantities of platinum bars and coins as a portfolio diversification strategy, particularly given platinum’s steep discount to gold. The gold-to-platinum ratio sits at 2.49, meaning you need nearly 2.5 oz of platinum to buy 1 oz of gold-far above the 20-year average of 1.3. That valuation gap attracted institutional and retail capital alike.

The World Platinum Investment Council projects consecutive annual deficits averaging 689 koz from 2026 to 2029, roughly 9% of annual demand. These aren’t minor imbalances-they signal ongoing price support. Lease rates on platinum peaked at 22.7% in early 2025, reflecting intense competition for immediate physical supply, before declining to 11.6% by July. Elevated lease rates indicate tight physical markets and tightness that eventually forces prices higher when recycling and above-ground stocks deplete further.

Macroeconomic Tailwinds and Technical Strength

Macroeconomic headwinds-inflation staying above central bank targets, large global budget deficits, and rate cuts despite high inflation-pushed investors toward tangible assets. Platinum captured attention precisely because it lagged gold and silver for 18 years, creating a perceived catch-up opportunity. Price technicals reinforce the bullish case: sustained weekly closes above $1,000 and monthly closes above $1,200 opened the path to $1,420 per ounce and beyond.

These supply constraints, locked-in demand, and valuation gaps set the stage for the investment opportunities that emerge across the platinum sector. Mining companies with strong production profiles stand positioned to capitalize on this structural tightness, while streaming and royalty companies offer alternative exposure to platinum’s upside without direct mining operations.

Where Platinum Prices Headed in 2025

Price Volatility and the Gold-to-Platinum Ratio

Platinum’s 49% surge in the first half of 2025 masks deeper volatility that investors need to understand. The World Platinum Investment Council reported platinum trading around $1,355 per ounce by late August 2025, having peaked near $1,736 in October before pulling back. That $381 swing demonstrates how quickly sentiment shifts when investment flows reverse. The gold-to-platinum ratio of 2.49 remains the critical metric to watch-it tells you whether platinum attracts capital or loses ground to its more expensive cousin. When that ratio compresses below 2.0, it signals platinum is outperforming; when it expands above 2.5, it suggests money flows elsewhere. Track this ratio weekly to catch early warning signs for momentum shifts that precede larger price moves.

Chinese Demand Divergence: Investment vs. Jewelry

Chinese physical demand peaked in early June when prices surpassed $1,050 per ounce, according to International Precious Metals Institute analysis, then cooled as price sensitivity increased. China now dominates platinum bar and coin investment, accounting for roughly 80% of total bar and coin demand in 2025. When Chinese buyers step back, global investment demand contracts sharply. Jewelry demand tells a different story-China’s platinum jewelry imports hit 11.5 tonnes in April 2025, the highest in a year, with processing volumes up 26% year-over-year in Q1. This divergence between investment demand (price-sensitive) and jewelry demand (driven by gold price movements and bridal cycles) creates trading opportunities. Monitor Chinese jewelry import data monthly through customs reports; spikes indicate sustained demand that supports prices even when investment flows weaken.

Currency Movements and Physical Market Signals

Currency movements amplified platinum’s 2025 rally but created hidden risks for non-dollar investors. A stronger dollar typically pressures platinum prices since it trades in dollars globally, yet platinum still rallied 49% in the first half despite dollar strength-proof that supply constraints and investment demand overpowered currency headwinds. The London OTC market remained in backwardation throughout 2025, meaning immediate physical supply commanded premiums over future delivery. This persistent backwardation signals genuine scarcity rather than speculative excess.

Lease Rates and Forward Curve Dynamics

Lease rates on platinum peaked at 22.7% in early 2025, reflecting intense competition for immediate physical supply before declining to 11.6% by July. Traders should watch lease rate trends closely: rates above 15% indicate acute tightness and suggest prices could spike further; rates below 10% suggest supply pressure is easing and correction risk rises. The forward curve remained in contango, implying current supplies weren’t extremely tight relative to demand and raising the risk of a blow-off top followed by correction, according to IPMI analysis. This contango structure, combined with declining lease rates by mid-2025, suggested that the October 2025 peak near $1,736 represented local exhaustion rather than a sustainable level.

Risk Management for Platinum Positions

Investors holding platinum positions should establish stop-losses around $1,200 per ounce and take partial profits on rallies above $1,400, protecting against the kind of sharp reversals that plagued platinum in prior decades. These technical levels provide concrete anchors for position management as the market navigates between structural supply deficits and near-term profit-taking. Understanding where platinum prices head requires monitoring these overlapping signals-from Chinese demand patterns to lease rate dynamics to currency movements-rather than relying on any single indicator. The next section examines which mining companies and alternative investment vehicles position you to capitalize on platinum’s structural tightness without betting your portfolio on price direction alone.

How to Gain Platinum Exposure Without Direct Mining Risk

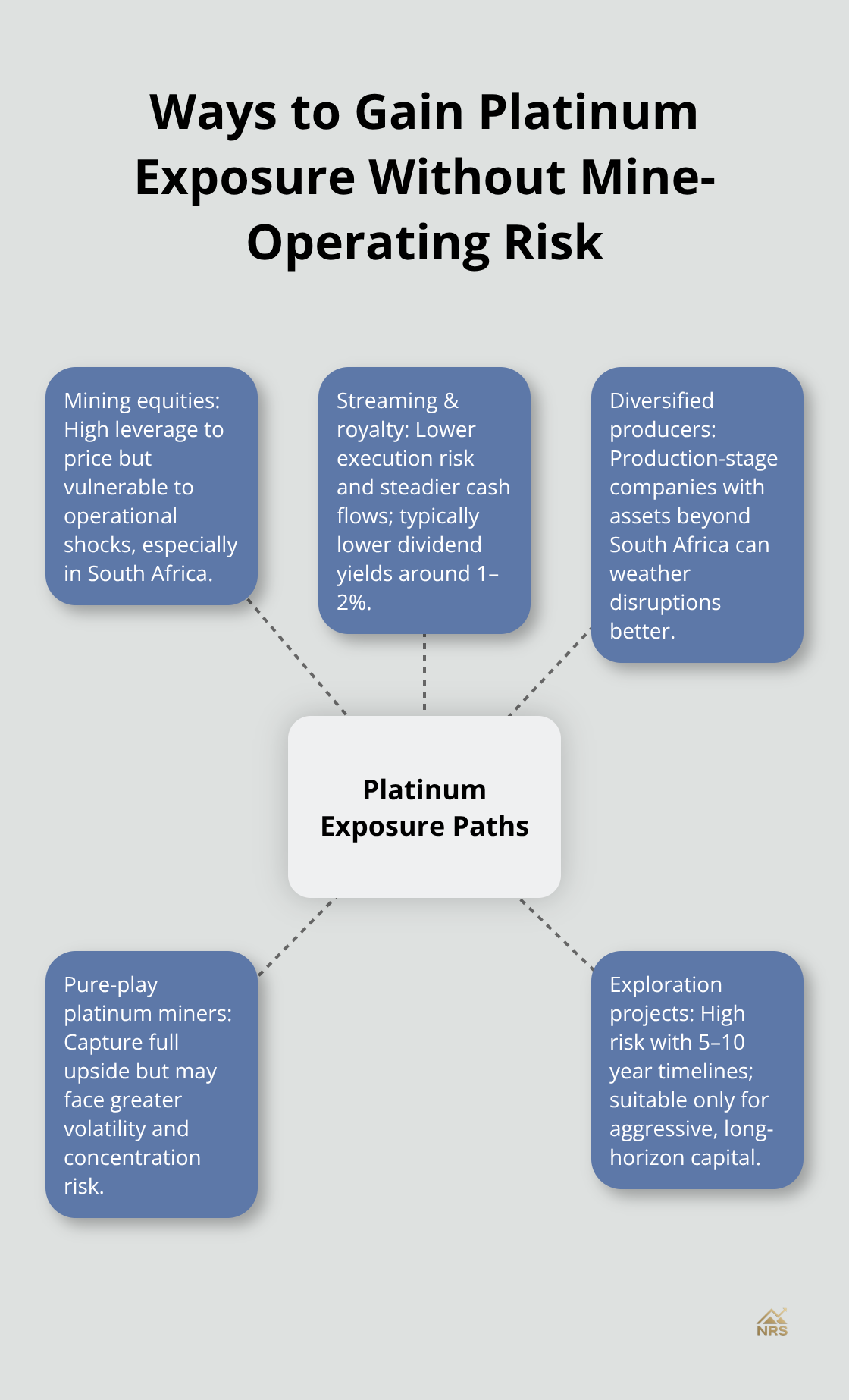

Platinum’s structural deficit and rising lease rates create compelling opportunities, but not all exposure paths carry equal risk. Mining equities offer leverage to platinum prices, yet operational disruptions in South Africa can wipe out gains overnight. Streaming and royalty companies provide steadier cash flows with lower execution risk, while exploration projects offer outsized upside if discovery economics improve. Production-stage mining companies with diversified asset bases outperform single-asset operators during price volatility.

Mining Companies: Production Costs Trump Reserve Size

Impala Platinum and Sibanye-Stillwater, two of South Africa’s largest producers, saw share prices rise 60–80% in the first half of 2025 as platinum surged, yet both face operational headwinds from load-shedding and labor costs that compress margins even at $1,300+ per ounce. Check their quarterly production reports and all-in sustaining costs before investing; companies with first-quartile costs of $850–950 per ounce consistently trade at stronger valuations during upturns. Production costs matter more than reserves alone; companies operating below $800 per ounce all-in sustaining costs will generate exceptional free cash flow at current platinum prices and return capital to shareholders through dividends or buybacks.

South Africa’s 24% production decline in early 2025 suggests recovery will lag, making companies with geographic diversification outside South Africa more attractive for the next two years. Look for operators with operations in Zimbabwe, Botswana, or North America where electricity costs and labor dynamics support lower production costs. Dividend yields on platinum mining stocks ranged from 3–5% in mid-2025, well above broader equity markets, rewarding patient investors who avoid panic selling during inevitable pullbacks.

Streaming and Royalty Companies: Lower Risk, Steady Returns

Streaming companies like Wheaton Precious Metals and Franco-Nevada offer a superior alternative because they purchase a percentage of future production at fixed or formula-based prices, isolating you from operational risk while capturing upside from higher platinum prices. Wheaton’s streaming deals on platinum assets generated growing cash flows throughout 2025 without the capital intensity of running mines directly. Streaming companies typically offer lower dividend yields around 1–2% but deliver more stable cash flows that survive platinum price corrections, making them suitable for conservative portfolios seeking platinum exposure without equity volatility.

The gold-to-platinum ratio of 2.49 creates a tactical advantage for equity selection right now. Mining companies exposed to both metals benefit when platinum outperforms gold, yet pure-play platinum miners like Impala capture the full upside without diversification drag.

Exploration Projects: High Risk, Concentrated Upside

Emerging exploration projects in Botswana and Zimbabwe present concentrated bets on major discoveries, but geological risk remains high and capital requirements stretch across 5–10 years before any production arrives. Companies like Platinum Group Metals hold early-stage projects with world-class geology but limited near-term catalysts; these suit aggressive investors with long time horizons only. Track quarterly exploration updates and reserve estimates; if a company’s resource base shrinks year-over-year without offsetting discoveries, the project economics deteriorate fast.

Exploration-stage companies pay no dividends and consume cash, requiring belief in discovery upside to justify holding positions. Only allocate capital you can afford to lose entirely.

Final Thoughts

Platinum’s 2025 performance reflects a fundamental shift in supply-demand dynamics that extends well beyond short-term price swings. We at Natural Resource Stocks track the structural forces reshaping this market: South Africa’s 24% production decline, above-ground inventories falling to three months of demand, and investment flows surging 300% year-over-year in Q1. The World Platinum Investment Council projects consecutive annual deficits averaging 689 koz through 2029, roughly 9% of annual demand, signaling that scarcity will persist for years. This platinum market analysis 2025 reveals that the structural case for higher prices rests on genuine supply constraints, not speculation alone.

Yet investors must acknowledge real risks that could derail momentum. Faster-than-expected EV adoption could compress catalytic converter demand more rapidly than current forecasts suggest, while Chinese investment demand proved price-sensitive, peaking when platinum surpassed $1,050 per ounce before cooling as buyers stepped back. Macroeconomic shocks, geopolitical disruptions, or sharp reversals in central bank policy could trigger profit-taking that erases months of gains in weeks. The October 2025 peak near $1,736 per ounce followed by pullback demonstrates how quickly sentiment shifts when lease rates decline and forward-curve contango signals exhaustion.

Strategic positioning requires matching your risk tolerance to specific exposure vehicles. Mining companies with all-in sustaining costs below $900 per ounce generate exceptional free cash flow at current prices and offer dividend yields of 3–5%, rewarding patient capital, while streaming companies like Wheaton Precious Metals provide steadier returns with lower operational risk. The gold-to-platinum ratio of 2.49 remains your most reliable signal for tactical positioning; compression below 2.0 signals platinum outperformance, while expansion above 2.5 suggests money flows elsewhere. Explore Natural Resource Stocks for expert video content, market analysis, and community insights that help you navigate volatile commodity markets with confidence.