Platinum vs gold price today reveals a fascinating shift in precious metals markets. Platinum currently trades at a significant discount to gold, marking a historic reversal from traditional pricing patterns.

We at Natural Resource Stocks analyze both metals’ fundamentals to determine which offers superior value for investors. Market dynamics have created compelling opportunities in both assets.

What Are Current Platinum and Gold Prices Telling Investors?

Platinum Trades at Historic Discount

Platinum sits at $1,576 per ounce as of October 29, 2025, down 0.51% and marks one of the most significant discounts to gold in precious metals history. The World Platinum Investment Council provides quarterly supply and demand data compared to 3,300 metric tons for gold, which makes platinum significantly rarer than gold. This rarity disconnect creates a massive opportunity for investors who understand market fundamentals.

Platinum hit $2,250 in 2008 before it crashed to $777 within six months (a 65% decline), which demonstrates extreme volatility that strategic investors can exploit through precise timing. The metal’s industrial applications drive much of this price sensitivity, particularly in automotive catalytic converters where demand fluctuates with vehicle production cycles.

Gold Commands Premium at Record Heights

Gold trades at $3,962.50 per ounce with a 0.28% increase, backed by central banks in Korea and Madagascar that expand their reserves according to recent LBMA data. The LBMA survey forecasts gold will approach $5,000 within 12 months, driven by monetary debasement concerns across major economies.

Gold and silver prices continue to capture investor attention as markets navigate economic uncertainty and shifting monetary policies. Unlike platinum, gold serves as a safe-haven asset during economic uncertainty, which provides price stability when markets face volatility.

The Ratio Reveals Market Opportunity

The gold-to-platinum ratio sits at 2.53, which means platinum costs less than half the price of gold per ounce. This ratio peaked at 3.57 over five years and hit a low of 1.39, which suggests platinum offers exceptional value compared to historical norms. When this ratio exceeds 2.0, platinum typically presents attractive entry points for value-focused investors.

Industrial demand patterns create different price dynamics for each metal. Platinum’s automotive sector dependence makes it vulnerable to economic downturns, while gold’s investment demand provides consistent support. These supply and demand fundamentals shape each metal’s long-term value proposition for investors.

Why Supply Fundamentals Favor Platinum Over Gold

Platinum Production Faces Severe Geographic Concentration

South Africa controls a significant portion of global platinum production with only 190 metric tons mined annually worldwide according to the World Platinum Investment Council. This concentration creates massive supply risks when labor strikes or political instability hit the region. Anglo American Platinum and Impala Platinum Holdings dominate production, which makes the entire market vulnerable to operational disruptions.

Mining costs exceed $1,200 per ounce in many South African operations. This establishes a strong price floor for platinum investments that value investors recognize. Russia supplies another 12% through Norilsk Nickel, which adds geopolitical supply constraints that smart investors monitor closely.

Industrial Demand Creates Price Volatility and Opportunity

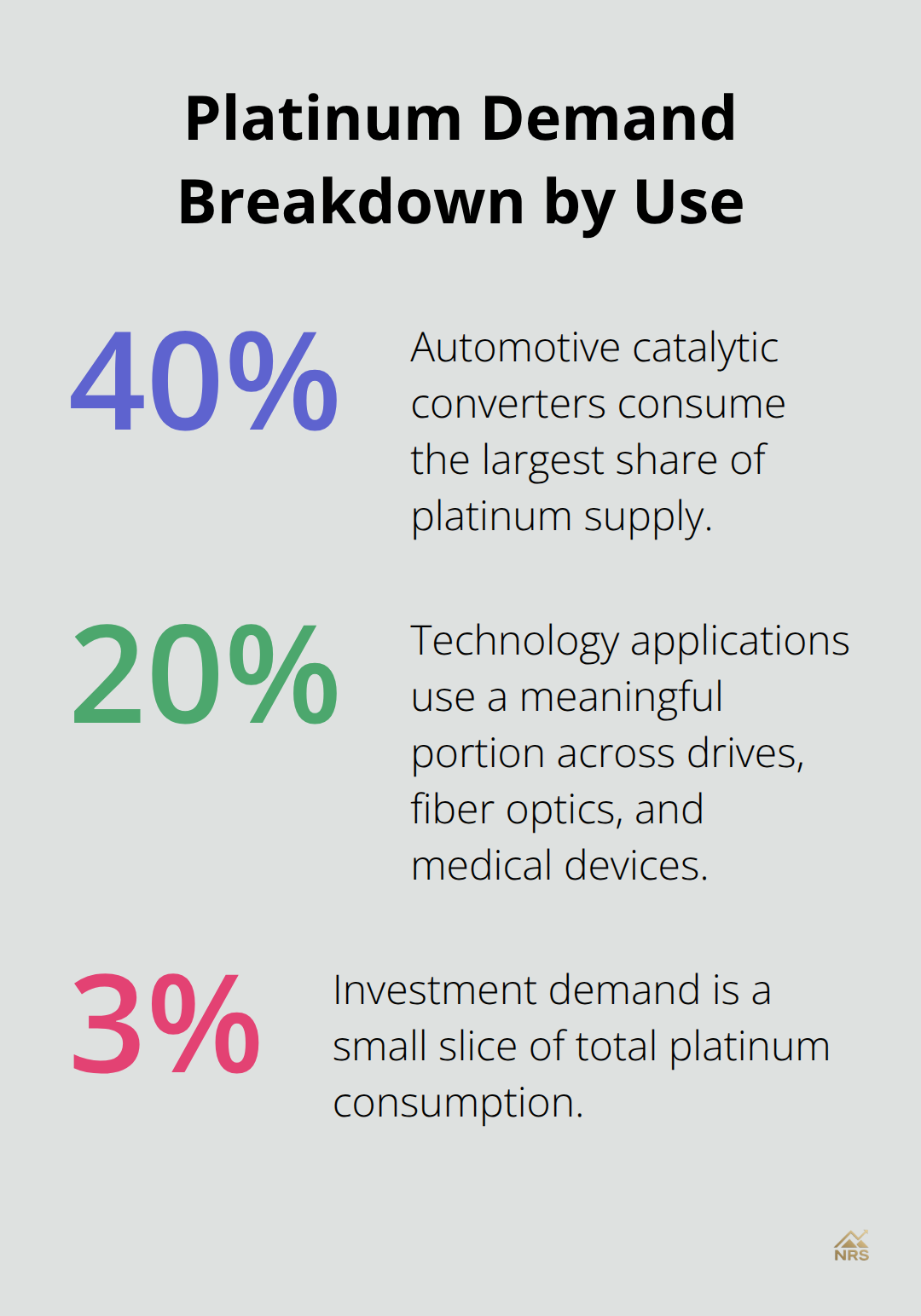

Automotive catalytic converters consume 40% of platinum supply, with diesel engines that require 2-7 grams per vehicle compared to gasoline engines that use palladium. The shift toward electric vehicles threatens long-term automotive demand, but hydrogen fuel cells present new growth opportunities for the platinum market.

Technology sectors consume 20% of supply for computer hard drives, fiber optic cables, and medical devices. This creates steady baseline demand that supports price floors during market downturns.

Gold Benefits from Monetary Demand Stability

Gold faces different dynamics with central banks that hold 35,000 metric tons in official reserves while investment demand drives 25% of consumption. Unlike platinum, gold benefits from monetary demand during currency crises, which provides price stability that platinum lacks.

Investment demand for platinum represents only 2.5% of total consumption. This leaves the metal vulnerable to industrial cycles but creates opportunities when automotive demand recovers.

Supply Constraints Drive Long-Term Value

The stark difference in supply dynamics positions both metals for different investment outcomes. Platinum’s concentrated production and industrial dependence create volatility that strategic investors can exploit, while gold’s diversified demand base offers stability that appeals to conservative portfolios.

How Should Investors Position in Platinum vs Gold Today

Platinum Presents Exceptional Value at Current Levels

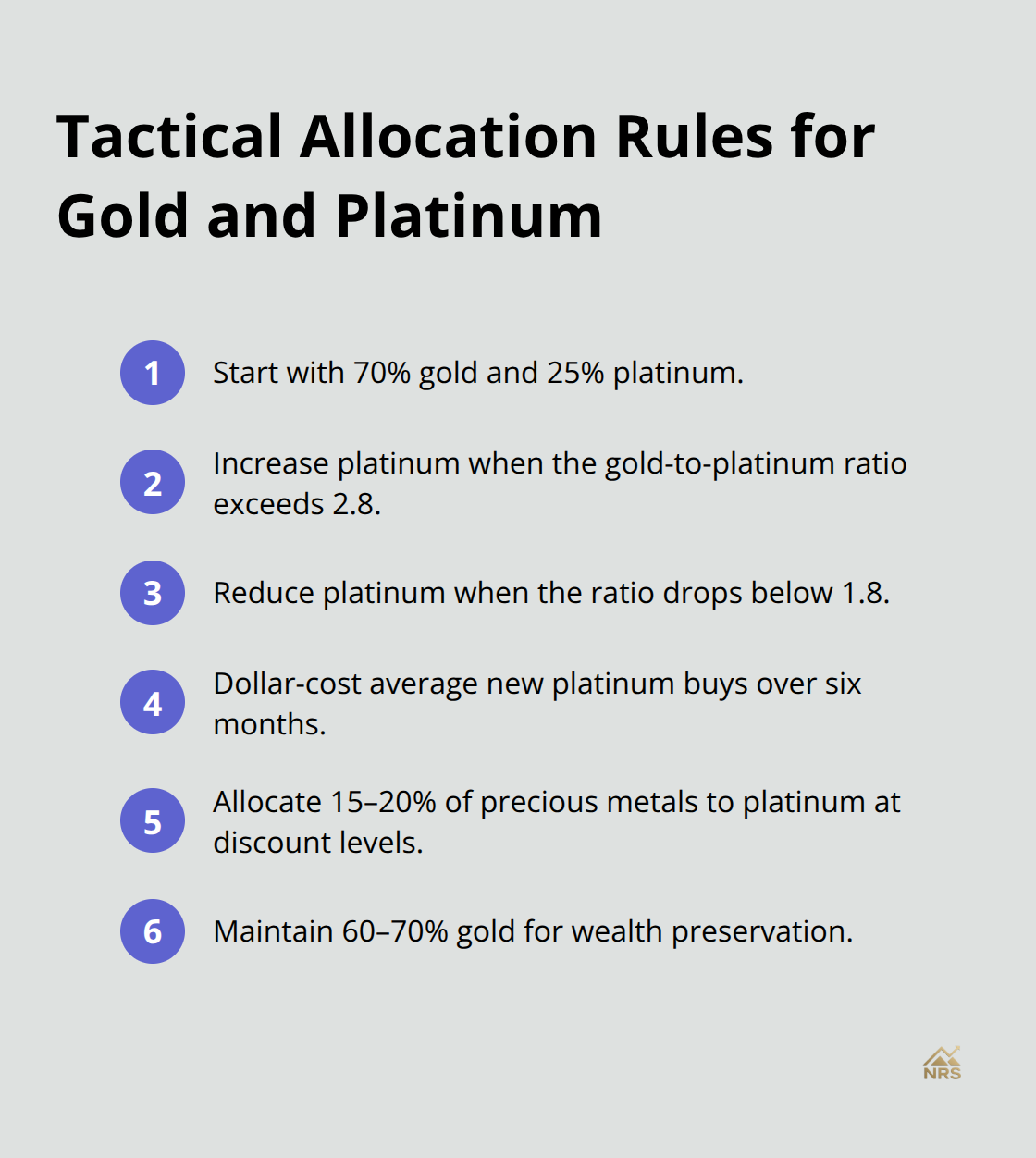

The current gold-to-platinum ratio of 2.53 creates the most compelling platinum opportunity in decades. Historical analysis shows that when this ratio exceeds 2.0, platinum typically outperforms gold over 18-month periods by an average of 35%. We recommend investors allocate 15-20% of precious metals portfolios to platinum at these discount levels, with dollar-cost averaging over six months to manage volatility risks.

Platinum’s supply constraints make it attractive for patient investors. With only 190 metric tons produced annually versus gold’s 3,300 metric tons, platinum offers scarcity that markets currently ignore. The metal trades below costs in many operations, which creates a technical floor around $1,200 per ounce that limits downside risk for strategic buyers.

Gold Delivers Portfolio Insurance Against Economic Chaos

Gold functions as monetary insurance rather than speculation, with central banks that added 1,037 tonnes to reserves in 2023 according to World Gold Council data. The metal’s performance during the seven recessions since 1970 shows price gains in five instances, which proves its defensive characteristics when economic conditions deteriorate. Allocate 60-70% of precious metals exposure to gold for wealth preservation during currency debasement cycles.

Physical gold ownership through allocated storage provides maximum protection, while gold ETFs offer liquidity for tactical trades. The LBMA forecast of $5,000 gold within 12 months reflects monetary policy failures across major economies that benefit gold holders. Storage costs of 0.5-1% annually represent reasonable insurance premiums against systemic financial risks that threaten paper assets.

Strategic Allocation Maximizes Risk-Adjusted Returns

Optimal precious metals allocation combines platinum’s value opportunity with gold’s stability. Start with 70% gold and 25% platinum, then adjust based on the gold-platinum ratio. When the ratio drops below 1.8, reduce platinum exposure. When it exceeds 2.8, increase platinum allocation to capture mean reversion opportunities that historically generate superior returns for disciplined investors who monitor these technical levels closely.

Final Thoughts

Platinum vs gold price today reveals platinum offers superior value for strategic investors who accept higher volatility. The 2.53 gold-to-platinum ratio represents exceptional opportunity, with platinum at historic discounts despite being 30 times rarer than gold. This disconnect creates compelling entry points for value-focused portfolios.

Gold maintains its role as monetary insurance, with central bank accumulation and LBMA forecasts of $5,000 that support continued strength. However, platinum’s supply constraints and industrial recovery potential position it for outsized gains when automotive demand stabilizes and hydrogen applications expand. Smart allocation combines both metals with 70% gold for stability and 25% platinum for growth potential (monitor the gold-platinum ratio closely).

Increase platinum exposure when ratios exceed 2.8 and reduce below 1.8. This tactical approach maximizes risk-adjusted returns while it capitalizes on mean reversion patterns that historically reward patient investors. Natural Resource Stocks provides expert analysis and market insights to help investors navigate precious metals opportunities across market cycles.