Explosive Silver Market Predictions Michael Oliver’s Bold Forecasts

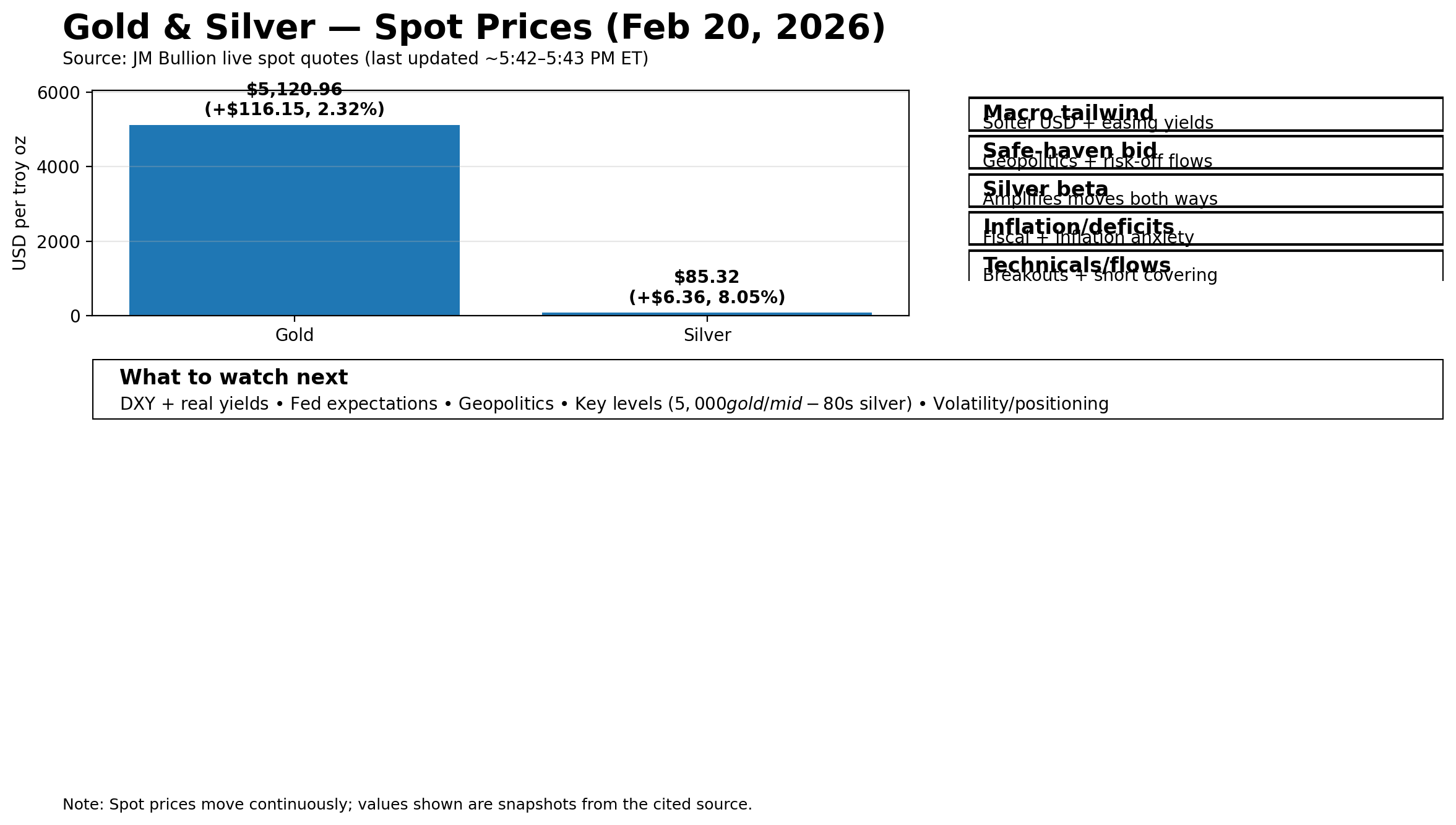

In this episode, Andy interviews Michael Oliver about his impressive insights into the silver market. Michael discusses silver's price movements, his projections for dramatic increases within the next few months,…