Most investors overlook precious metals when building their portfolios. Yet gold, silver, platinum, and palladium have delivered real returns during stock market crashes and periods of high inflation.

At Natural Resource Stocks, we’ve seen firsthand how precious metals portfolio ideas can strengthen a diversified investment strategy. This guide shows you exactly how to build a balanced allocation that works for your situation.

Why Precious Metals Strengthen Your Portfolio

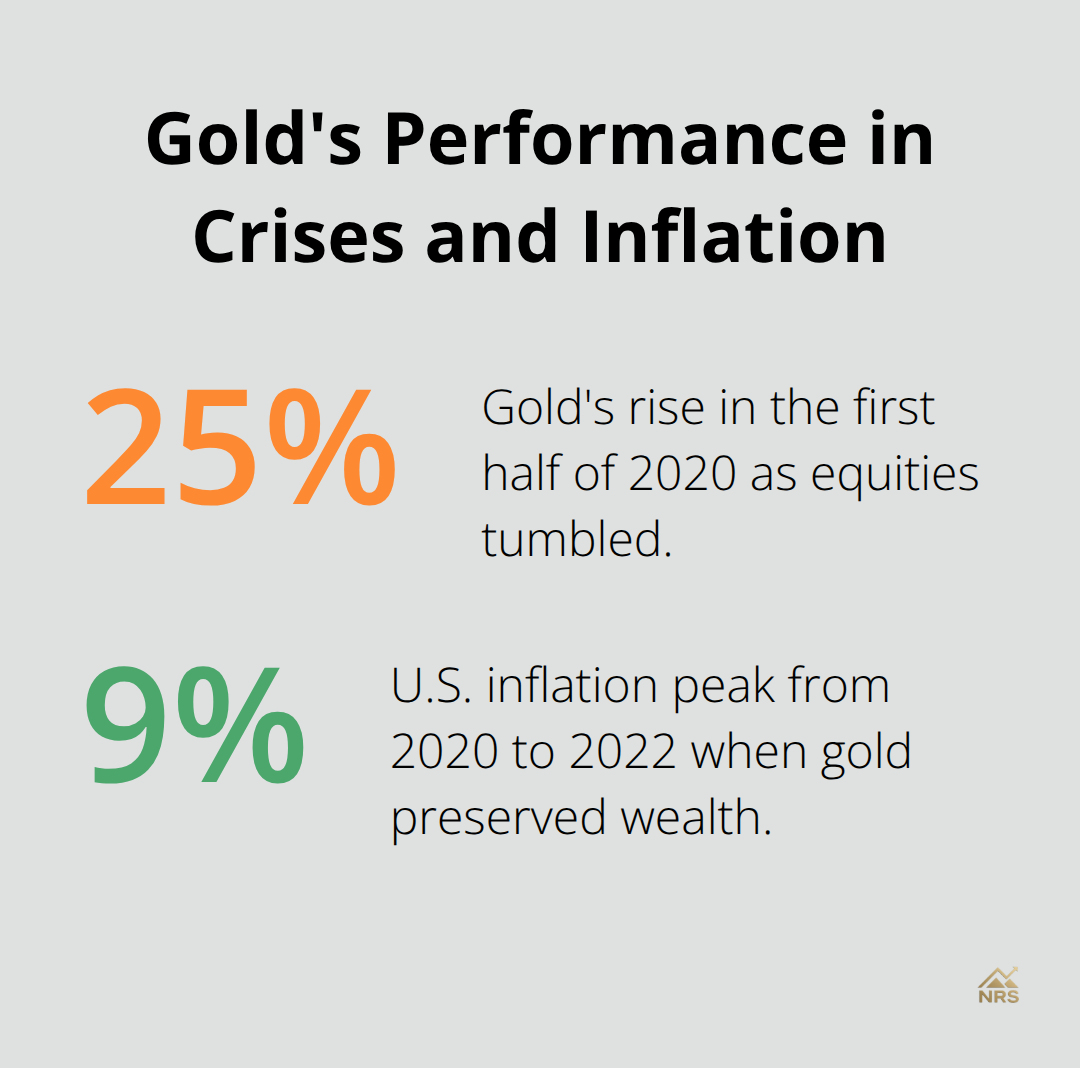

Gold, silver, platinum, and palladium have historically outperformed stocks during market crashes. The 2008 financial crisis saw gold rise 5.5% while the S&P 500 collapsed 37%. During the 2020 pandemic shock, gold gained 25% in the first half of the year as equities tumbled. This pattern repeats across decades of market data.

When stock portfolios crater, precious metals tend to hold value or appreciate, making them a genuine stabilizer rather than a theoretical concept.

Real Protection Against Inflation

Inflation erodes purchasing power, and precious metals directly counteract this erosion. The World Gold Council found that gold outperformed many assets during periods of high inflation, helping preserve wealth when currency values weaken. From 2020 to 2022, as inflation surged to 9%, gold delivered meaningful returns that protected against the dollar’s declining value. Silver showed even stronger gains during this period due to industrial demand recovery. This is not speculation-it’s measurable performance during actual inflationary cycles. If you hold cash or bonds during sustained inflation, you lose ground. Precious metals prevent that loss.

The Correlation Advantage That Changes Your Risk Profile

Precious metals move independently from stocks and bonds, a property called low correlation. When the bond market sells off, gold often rises. When equities crash, silver stabilizes your losses. This independence is quantifiable. Historical data shows gold has near-zero correlation to stock returns over long periods, meaning it genuinely reduces portfolio volatility rather than just adding another equity-like bet. A portfolio with 10% precious metals experiences measurably less drawdown during market stress than an all-stock portfolio. This is not about hoping metals perform differently-it is about mathematical portfolio construction. Adding uncorrelated assets mathematically reduces overall risk. A 5% allocation to precious metals can trim your portfolio’s maximum decline during crashes by 1-2 percentage points, a meaningful cushion when markets drop 30-40%.

Why This Matters for Your Next Decision

These three properties-crash protection, inflation resistance, and low correlation-work together to create a portfolio that performs when traditional investments fail. The data proves this works in real markets, not hypothetical scenarios. Your next step involves deciding how much of each metal to hold and which investment vehicles to use.

How Much of Each Metal Should You Hold

Gold as Your Portfolio’s Anchor

Gold deserves the largest allocation within your precious metals bucket because it combines liquidity with genuine portfolio stabilization. Allocate 70-80% of your metals exposure to gold, with the remainder split among silver, platinum, and palladium. This weighting reflects gold’s role as the primary hedge against systemic risk and currency devaluation. Gold trades on every major exchange globally, so you can sell significant quantities without moving the market or waiting weeks for settlement. Central banks purchased roughly 337 tons of gold in recent quarters, which reinforces gold’s status as the ultimate store of value. Most financial advisors recommend limiting gold exposure to less than 3 percent of a diversified portfolio, treating it as insurance rather than a core holding. If your total portfolio is $100,000 and you allocate 10% to precious metals, that means $10,000 goes into metals-with roughly $7,000-$8,000 in gold. This concentration prevents the mistake many investors make of spreading metals too thinly across multiple assets and ending up with positions too small to matter during actual market stress.

Silver’s Dual Purpose in Your Allocation

Silver demands a different role within your allocation. Assign 15-25% of your metals budget to silver because it serves as both a hedge and a growth component. Silver is more cyclical than gold due to its heavy industrial demand across solar panels, electronics, and manufacturing. During economic expansions, silver often outperforms gold on a percentage basis because industrial users increase purchasing alongside investment demand. The World Silver Survey reports that more than half of silver’s demand comes from heavy industry and high technology, meaning silver’s price tightly tracks global economic cycles. Unlike dividend-paying stocks, silver generates zero income while you hold it, so your only return comes from price appreciation. Silver’s lower price per ounce makes it accessible for physical ownership without requiring large capital commitments. A $10,000 metals allocation might include $2,000 in silver, which gives you meaningful exposure without dominating your portfolio.

Platinum and Palladium as Contrarian Positions

Platinum and palladium together should comprise the final 5-10% of your metals allocation. Platinum sits at historically significant discount levels compared to gold, making it volatile and specialist in nature. Palladium similarly depends on catalytic converter demand and industrial applications. These two metals serve as contrarian bets that can outperform during specific supply disruptions or economic cycles, but they lack the broad acceptance and liquidity of gold and silver. A practical starting point allocates $500-$1,000 to platinum and palladium combined within a $10,000 metals position, which gives you diversification without overexposure to niche markets.

Putting Your Allocation Into Action

This structure-70-80% gold, 15-25% silver, 5-10% platinum and palladium-creates a portfolio that prioritizes stability and liquidity while capturing growth opportunities from industrial metals. The next decision involves choosing how to actually own these metals: physical coins and bars, exchange-traded funds, or mining stocks each offer distinct advantages and trade-offs that shape your returns and your ability to access your capital when you need it.

How to Own Precious Metals Without Overcomplicating It

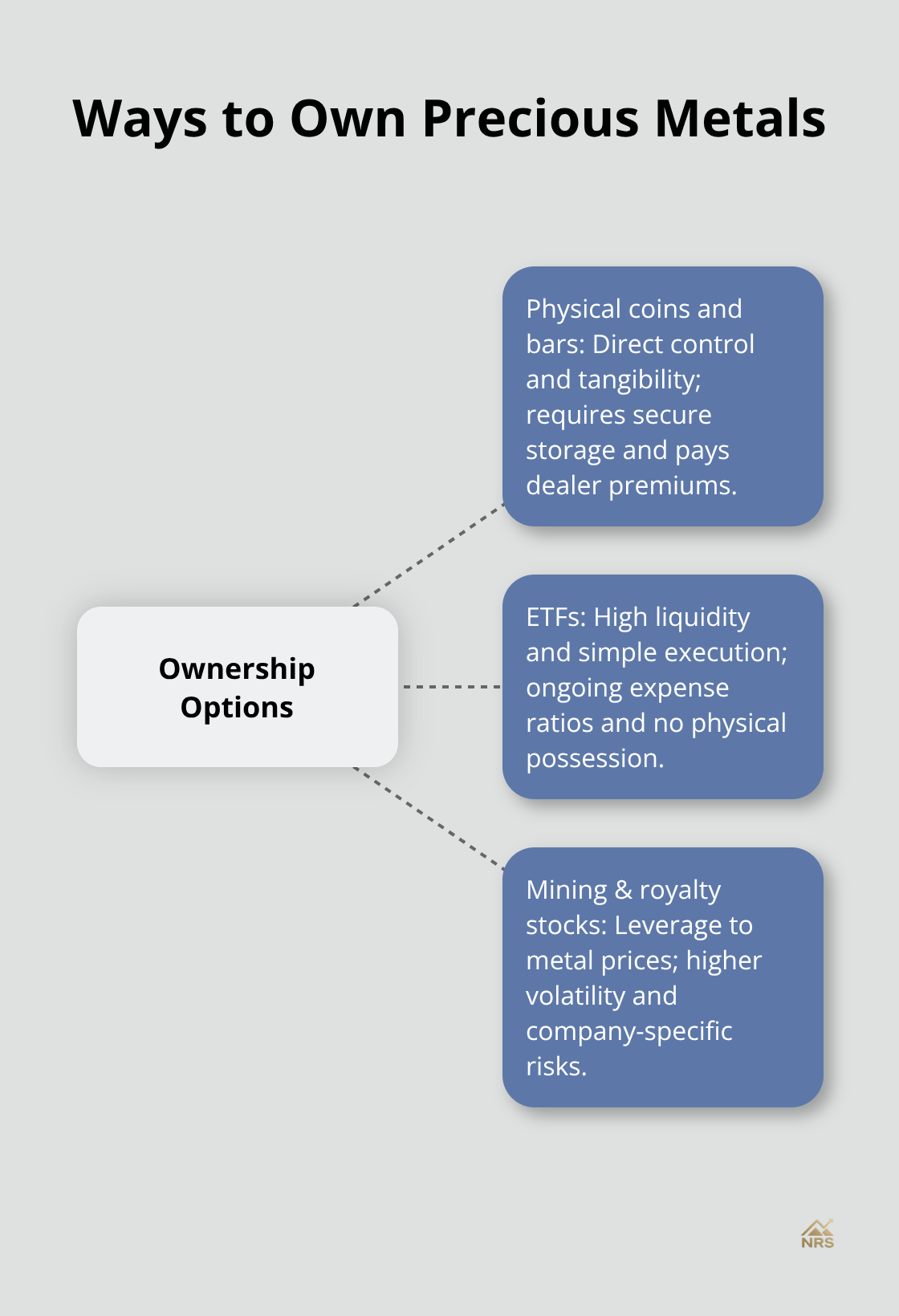

Your allocation structure is set. Now comes the decision that determines whether you actually execute your plan or abandon it after three months: how you physically own these metals. Three distinct paths exist, and each one solves different problems while creating new ones.

Physical Coins and Bars Versus ETFs

Physical coins and bars give you tangible assets you control entirely, but storage costs and dealer premiums erode returns over time. Gold and silver ETFs like GLD, SLV, and IAU offer immediate liquidity and zero storage headaches, with expense ratios ranging from 0.17% to 0.50% annually depending on the fund you choose. Physical coins like American Gold Eagles and Canadian Gold Maple Leafs carry premiums of 2-4% above spot price when you buy them, then narrow to 1-2% when you sell to dealers, making them expensive for frequent trading but perfectly reasonable for long-term positions you hold for years.

Mining Stocks and Royalty Companies

Mining stocks and royalty companies provide leverage to metal prices, meaning a 10% rise in gold can produce a 20-30% gain in the right producer, but you inherit company-specific risk and volatile free cash flows tied directly to production costs. This leverage works both ways-a 10% decline in gold can wipe out 20-30% of your mining stock position, which makes these holdings suitable only for investors who tolerate significant volatility.

A Hybrid Approach That Works

A two-part approach solves the core problem most investors face. Use ETFs for 60-70% of your metals exposure to maintain liquidity and simplicity, then allocate the remaining 30-40% to physical coins for the psychological benefit of owning tangible assets and maintaining optionality during extreme financial stress. This hybrid structure gives you the daily liquidity of ETFs so you can rebalance without waiting for a coin dealer to quote you a price, but you also own enough physical metal that you never feel forced to sell into a market panic.

If your $10,000 metals allocation breaks down to $7,000 in gold, spend roughly $4,200-$4,900 on gold ETFs and $2,100-$2,800 on physical gold coins. This split prevents you from becoming a coin hoarder with no exit strategy while maintaining meaningful physical holdings.

Dollar-Cost Averaging Eliminates Timing Paralysis

Dollar-cost averaging-the practice of investing fixed amounts at regular intervals regardless of price-eliminates the paralysis most people experience when starting a metals position. Invest $500 monthly into your metals allocation for the next 20 months rather than deploying $10,000 today. This approach protects you from the psychological devastation of buying just before a 15-20% price decline, which happens regularly in precious metals. Dollar-cost averaging over five-year periods helps mitigate the risks of market volatility and reduces emotional decision-making compared to timing a single large purchase.

Rebalancing Keeps Your Allocation on Track

Rebalancing quarterly or semi-annually keeps your allocation from drifting as metals prices move. If gold rises 30% in a year while silver stays flat, your 70-30 split becomes 75-25, which means you now carry more risk than intended. Sell some gold, buy some silver, and return to your target. This discipline forces you to sell winners and buy losers, the exact opposite of the human instinct to chase performance. Set calendar reminders for rebalancing rather than waiting for the perfect moment, because the perfect moment never arrives and inaction costs you returns.

Final Thoughts

Three core decisions shape your precious metals portfolio ideas: how much to allocate, which metals to hold, and how to own them. Gold, silver, platinum, and palladium have protected wealth during market crashes, preserved purchasing power through inflation, and moved independently from stocks and bonds. A 70-80% gold allocation anchors your position with liquidity and stability, while silver at 15-25% captures industrial growth and cyclical upside, and platinum and palladium at 5-10% provide diversification without overexposure to niche markets.

ETFs deliver daily liquidity and low costs, while physical coins provide tangible security and optionality during financial stress. A hybrid approach using both eliminates the false choice between convenience and control, and dollar-cost averaging removes the paralysis of timing. Quarterly rebalancing keeps your allocation from drifting as prices move and forces you to sell winners and buy losers, the exact opposite of human instinct but the foundation of long-term returns.

Market conditions will test your commitment when gold rises 30% in a year or silver crashes 20%, yet these moments define your success. Your allocation should not change because headlines shift or fear spikes-it should change only when your life circumstances change or when you deliberately adjust your risk tolerance. Visit Natural Resource Stocks to access in-depth market analysis and expert insights that inform your strategy, then start with a 5-10% allocation to precious metals and execute your plan through disciplined, consistent action.