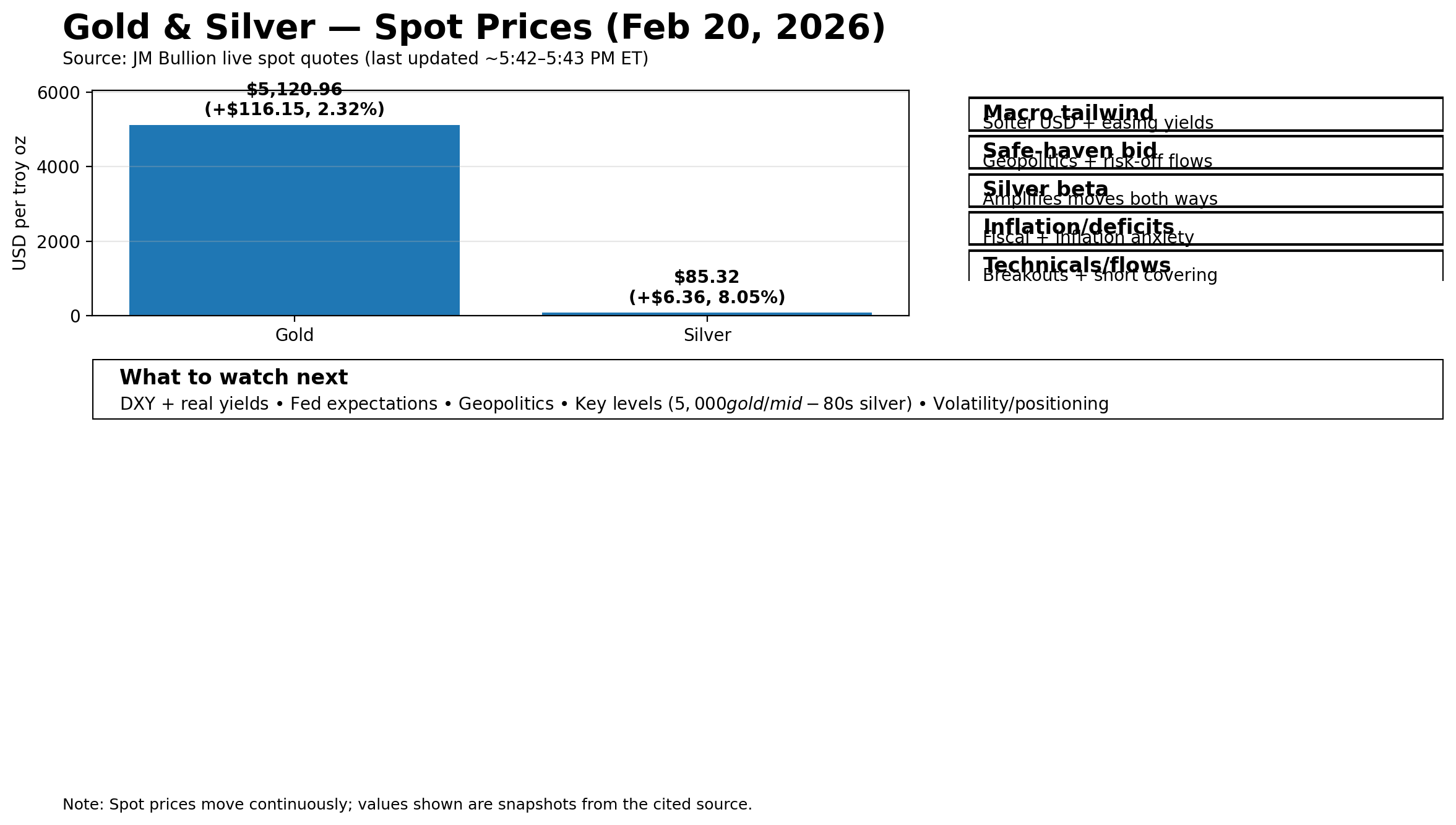

Alasdair MacLeod: Fiat Currency Collapse Gold and Silver

In this episode, Alasdair MacLeod discusses the current state of the global economy, focusing on the devaluation of fiat currencies, stockpiling of precious metals, and historical parallels to the 1929…