Silver is at an inflection point. Industrial demand from solar panels and electronics keeps climbing, while mining production struggles to keep pace with global needs.

At Natural Resource Stocks, we’ve analyzed the data behind the silver long forecast-and the picture is compelling. This guide breaks down supply constraints, price patterns, and what analysts actually expect over the next several years.

Where Silver Supply Falls Behind Demand

Global silver mining produced roughly 1.03 billion ounces in 2024, yet demand exceeded 1.2 billion ounces that same year, creating a structural deficit of 160 to 200 million ounces. This gap has persisted for five consecutive years and shows no sign of closing.

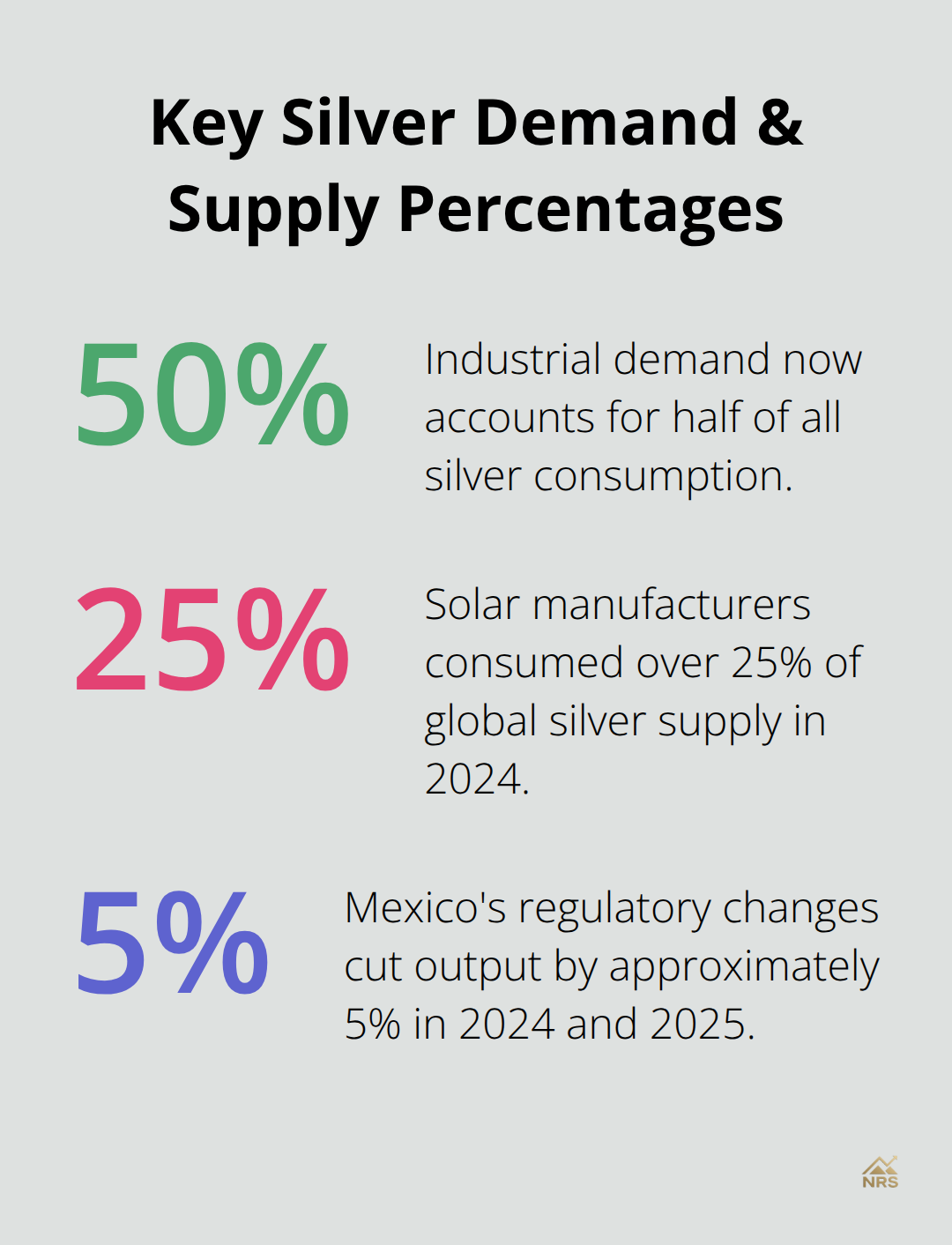

Mexico, Peru, and China lead production, but Mexico’s regulatory changes cut output by approximately 5 percent in 2024 and 2025. Russia faces sanctions that limit its contribution. Meanwhile, primary silver mines age without sufficient replacement projects in the pipeline, meaning supply growth will remain constrained even if prices rise further.

Industrial demand now accounts for half of all silver consumption

Solar manufacturers consumed over 25 percent of global silver supply in 2024, and that share continues to climb. Electric vehicles added roughly 20 percent more silver demand in 2025 compared to the prior year as battery components and wiring harnesses require the metal.

Data centers and AI infrastructure now consume silver in thermal management systems and high-efficiency components, a trend that barely existed five years ago. The Silver Institute projects solar demand alone could nearly double its offtake between 2020 and 2030. This is not cyclical demand that disappears in a recession-it is structural consumption tied to the global energy transition. When industrial users need silver, they purchase it regardless of price, which fundamentally changes market dynamics compared to investment demand that can evaporate quickly.

Physical inventory stress reveals real tightness in the market

COMEX and LBMA inventories have declined sharply, with good-delivery bar availability tightening noticeably. LBMA physical stock levels fell 30 to 40 percent while gold inventories dropped only 3 to 4 percent, according to research from the American Gold Exchange and Sprott Asset Management. Above-ground silver inventories have contracted roughly 500 million ounces. The UK Royal Mint faced silver shortages in 2025, illustrating that physical tightness extends beyond industrial users to official government mints. Investment demand shifted decisively in 2025 after years of outflows: ETF inflows turned positive, futures trading volume spiked during market shocks, and retail buyers re-entered at key price levels around 30 and 50 dollars per ounce.

Central banks now accumulate silver reserves

Russia’s central bank disclosed plans to allocate $535 million over the 2025-2027 period for precious metals including silver, platinum, and palladium, marking a milestone in official reserve diversification away from traditional assets. This move signals that institutional players recognize silver’s value beyond its industrial applications. When governments add silver to their reserves, it removes metal from the available supply pool and reinforces the structural deficit already present in the market. The combination of tight physical inventories, rising central-bank demand, and surging industrial consumption sets the stage for what happens next in the price forecast.

Silver’s Decade-Long Breakout

A Metal Trapped Below 30 Dollars

Silver spent most of the past decade trapped below 30 dollars per ounce, a ceiling it could not break until 2025. From 2015 through 2024, the metal oscillated between roughly 13 and 29 dollars per ounce, frustrating investors who watched gold climb steadily while silver stagnated. That changed dramatically in 2025. Silver surged approximately 120 percent from around 28.92 dollars at the start of the year to roughly 65 dollars per ounce by mid-December, according to Trading Economics data. The metal accelerated sharply in the final months of 2025, hitting an all-time high of 66.88 dollars per ounce in December. This breakout matters because it signals the structural deficit finally overwhelmed the decade-long bearish psychology that capped prices.

Why Silver Outpaced Gold in 2025

Gold and silver move together but not in lockstep, and that relationship reveals hidden value. The gold-silver ratio sits at roughly 80 to 83 ounces of silver per ounce of gold. This structural disconnect means silver trades as though it is far scarcer than mining data actually supports. Silver prices reflect scarcity that production numbers do not justify, which suggests the market undervalues industrial silver demand relative to gold’s pure monetary appeal.

Gold rose roughly 27 percent in 2025, but silver’s 120 percent gain dramatically outpaced it. This outperformance reflects silver’s dual role: it behaves as a monetary hedge like gold during uncertainty, but it also responds to industrial demand signals that gold ignores entirely. When solar installations accelerate or EV production jumps, silver responds immediately. Gold does not. An investor holding only gold missed the structural supply deficit that silver prices began reflecting in 2025.

Monetary Conditions Support Further Upside

The geopolitical backdrop of potential monetary policy shifts, combined with evolving currency dynamics, further supports silver relative to gold because lower real yields reduce the opportunity cost of holding non-yielding precious metals. Trading Economics forecasts silver at 67.88 dollars per ounce within 12 months, implying further upside if deficits persist, while Bank of America projects an average around 56.25 dollars per ounce for 2026 with a high near 65 dollars. The divergence between these forecasts reflects genuine uncertainty about whether investment demand sustains or whether industrial consumption alone carries prices forward.

The Path Forward for Silver Investors

What remains certain is that silver’s decade-long underperformance relative to its supply-demand fundamentals has ended. The question for 2026 is not whether silver holds above 30 dollars, but whether it sustains a move toward 70, 80, or even triple-digit levels if central banks continue accumulating reserves and solar demand accelerates faster than current estimates. This setup positions silver at a critical juncture where industrial necessity meets monetary demand, creating conditions that could trigger sharp price moves in either direction depending on how these competing forces interact over the coming months.

Silver Price Forecast: What Analysts Expect and What Moves Markets

Institutional Forecasts Reveal Sharp Disagreement

Forecasts for silver vary widely depending on the analyst’s view of industrial demand, monetary policy, and geopolitical risk. The World Bank projects silver around 41 dollars per ounce, while JPMorgan estimates 58 dollars, and Saxo Bank positions silver in the 60 to 70 dollar range. Citigroup forecasts 60 to 72 dollars per ounce for 2026. These institutional predictions cluster around 55 to 65 dollars, suggesting consensus that silver trades higher than 2025 entry levels but faces resistance before reaching triple digits. Robert Kiyosaki projects 100 to 200 dollars per ounce, and Alan Hibbard from GoldSilver believes silver could trade above 100 dollars per ounce. The gap between mainstream forecasts and contrarian calls reflects real disagreement about whether industrial demand alone sustains higher prices or whether investment panic and central bank accumulation must accelerate to push silver toward triple digits. Trading Economics forecasts 67.88 dollars within 12 months, implying modest upside from current levels, while Bank of America projects an average around 56.25 dollars for 2026 with a high near 65 dollars. The fact that major institutions disagree this sharply matters for investors because it signals genuine uncertainty rather than consensus complacency.

Federal Reserve Policy Determines Silver’s Direction

Silver’s path forward depends almost entirely on whether the Federal Reserve continues monetary accommodation or reverses course. Lower real interest rates reduce the opportunity cost of holding non-yielding assets like silver, which means each rate cut acts as a tailwind for prices. Markets currently price roughly a 25 percent chance of a January rate cut and near-full expectation for a cut by April, according to Trading Economics. If rate cuts materialize as expected, silver should sustain strength because deflation concerns and currency debasement fears drive investment flows into precious metals. Core consumer price inflation rose at its slowest year-over-year pace since early 2021, reinforcing expectations for continued monetary accommodation. Conversely, if the Fed pauses rate cuts and inflation remains sticky, silver faces headwinds because higher real yields make bonds and cash more attractive than a non-yielding metal. The US dollar strength also matters: a weaker dollar makes silver cheaper for international buyers and historically correlates with higher precious metal prices. Geopolitical tensions, including US sanctions on Venezuelan oil shipments and ongoing Russia complications, contribute to risk sentiment that typically lifts safe-haven assets like silver. Watch the Fed funds rate expectations and the USD index closely through the first half of 2026 because these two factors will likely determine whether silver trades toward 70 dollars or retreats toward 50 dollars.

Supply Disruptions Trigger Sharp Price Moves

The structural deficit we identified earlier means any disruption to mine production or refining capacity creates immediate price spikes. Mexico produces a significant portion of global silver supply, and its regulatory environment remains unstable, creating recurring supply risk. Russia’s sanctions limit its contribution to global supply, and older primary mines in Peru and Australia face geological challenges that require higher capital investment to maintain output. If labor strikes hit major Mexican or Peruvian operations, or if geopolitical events disrupt logistics from these regions, silver could spike 10 to 15 percent within days because buyers scramble to secure inventory. This asymmetry means investors should position for upside surprises rather than expecting smooth price appreciation. The tight physical market we described earlier amplifies this effect because inventories cannot buffer supply shocks the way they could during periods of abundant above-ground stock. Central banks now accumulate silver, removing metal from the market at precisely the moment when mining cannot keep pace with industrial demand. This combination creates conditions where even modest supply disruptions trigger sharp price moves.

Final Thoughts

Silver’s structural deficit and surging industrial demand from solar and electronics have fundamentally shifted market dynamics. The metal’s 120 percent gain in 2025 broke a decade-long ceiling and signaled that supply constraints finally overwhelmed bearish psychology. Industrial consumption now accounts for over half of global silver demand, and this consumption pattern will not disappear during downturns because solar manufacturers, EV producers, and data centers require silver regardless of price.

Central banks accumulate reserves at precisely the moment when mining cannot keep pace with demand, which removes metal from available supply. Physical inventories at COMEX and LBMA have tightened sharply, and the UK Royal Mint faced shortages in 2025, illustrating real stress in the physical market. Federal Reserve policy will likely determine silver’s direction over the next 12 months, with rate cuts supporting prices and higher real yields creating headwinds.

For natural resource investors, this silver long forecast presents a critical decision point about positioning for continued upside or waiting for consolidation. We at Natural Resource Stocks provide expert analysis and market insights to help you navigate these dynamics and understand the fundamentals driving prices. Visit Natural Resource Stocks for in-depth commentary on macroeconomic factors, geopolitical impacts, and emerging opportunities in precious metals.