Silver markets are moving fast, and 2024 is shaping up to be a pivotal year for investors. We at Natural Resource Stocks are tracking the major shifts in supply, demand, and macroeconomic conditions that will shape silver prices.

This guide breaks down the silver price forecast for 2024, covering everything from interest rate impacts to industrial demand surges. You’ll get the data and insights you need to make informed decisions.

Silver’s 2024 Starting Point

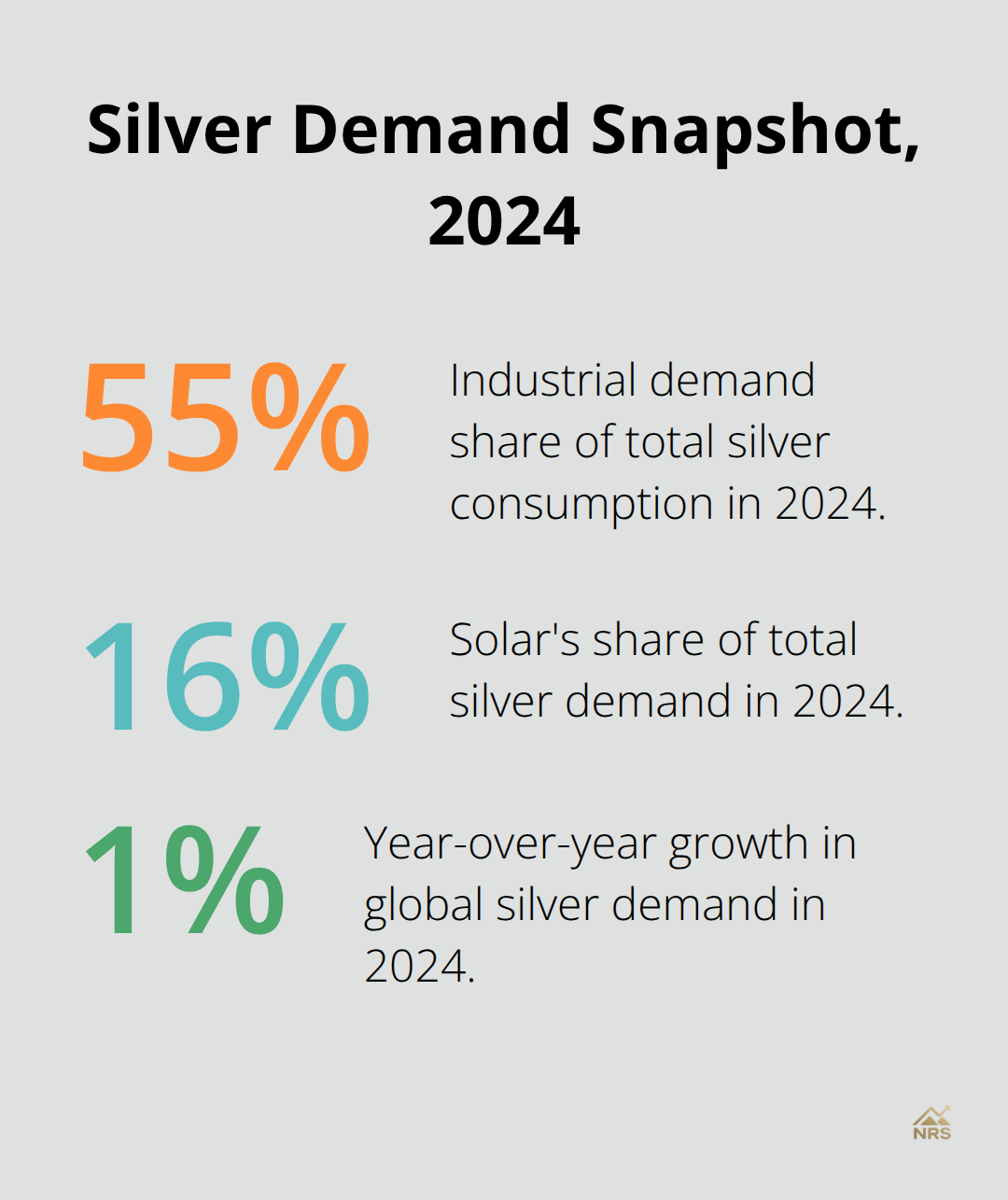

Silver opened 2024 at $23.65 per ounce and closed the year above $28.90, a gain of 21.46 percent according to Sprott Insights. This performance signals momentum heading into deeper structural changes in the market. The Silver Institute reported global silver demand in 2024 at 1.21 billion ounces, up 1 percent year-over-year and the second-highest on record. Industrial demand now accounts for roughly 55 percent of total consumption, with solar alone consuming more than 200 million ounces annually. This shift from a precious metals market to an industrial commodity market is decisive.

Silver’s role in solar panels, electric vehicles, and 5G infrastructure means price movements no longer respond primarily to monetary policy or investment sentiment-they respond to the hard reality of how much metal the world needs to build its energy transition.

Industrial Demand Drives the Market

Solar demand makes up about 16 percent of total silver demand in 2024, and this acceleration shapes your portfolio decisions. The global solar industry grew 76 percent in 2023 and expanded 34 percent in 2024, with solar-demand growth surging 158 percent from 2019 to 2023 according to The Silver Institute. Electric vehicles use roughly 25 to 50 grams of silver per unit (depending on size), and global EV production will more than double by 2030. Advanced TOPCon solar technologies require up to 50 percent more silver than traditional panels, meaning demand per installation rises even as unit counts climb. This consumption is not speculative-it ties directly to real manufacturing. Silver prices in 2024 rest on genuine supply constraints meeting accelerating industrial adoption, not on temporary market conditions.

Supply Constraints Tighten the Market

About 70 percent of silver comes as a byproduct of mining other metals like copper, zinc, and lead, which means silver output cannot easily ramp up when prices rise. Global supply has remained largely stagnant since 2014, with an expected 1 percent decline in 2024 according to The Silver Institute.

Cumulative silver consumption has run about 700 million ounces higher than production over the past four years-roughly 10 months of total mine output. LBMA, COMEX, and SHFE inventories have fallen, signaling potential supply tightness that supports higher prices. The gold-silver ratio has widened above 85:1, indicating silver is currently undervalued relative to gold and may appreciate if the ratio reverts toward historical norms. For investors, 2024 offers a window where supply constraints are real and measurable, not theoretical. The market remains relatively small at about 30 billion dollars annually, making prices more volatile and sensitive to small shifts in supply or demand-which creates both risk and opportunity for positioned investors.

What This Means for Price Forecasts

These supply and demand fundamentals set the stage for 2024 price movements. Structural tightness in the physical market, combined with explosive industrial adoption, creates a backdrop where silver prices face upward pressure throughout the year. The next section examines what expert forecasters predict for specific price targets and scenarios.

Silver Price Drivers and Macroeconomic Influences

Interest Rates Shape Silver’s Attractiveness

Interest rates form the invisible hand that shapes silver prices, and 2024 presents a distinct shift from the rate-hiking cycle that defined 2023. When central banks raise rates, the opportunity cost of holding silver increases because investors can earn returns elsewhere. Conversely, lower or stable rates reduce that cost and make silver more attractive as a store of value. The Federal Reserve’s pivot toward potential rate cuts through 2024 fundamentally changes the calculus for silver investors. A softer monetary backdrop weakens the US dollar, which directly boosts silver affordability for international buyers and typically supports higher prices. Bank of America projects silver averaging around $56.25 per ounce through 2024, with the assumption that rate cuts will materialize and real yields remain subdued. This forecast hinges entirely on monetary policy direction, meaning you should monitor Fed communications closely. If the central bank pauses or reverses course on rate cuts, silver faces headwinds regardless of strong industrial demand.

Inflation Acts as a Structural Tailwind

Inflation remains another critical variable that pushes investors toward hard assets as hedges. Rising inflation erodes purchasing power and historically drives demand for precious metals. Silver, with its dual nature as both a precious metal and an industrial commodity, captures inflation protection while also benefiting from the industrial spending that accompanies inflationary environments. For 2024, expect inflation to remain elevated relative to historical averages, which supports silver as a portfolio hedge.

Geopolitical Risks Tighten Physical Supply

Geopolitical tensions inject volatility into silver markets in ways most investors underestimate. Russia and Mexico together account for roughly 20 to 21 percent of global silver production, meaning disruptions in either region reverberate across global supply. Ongoing sanctions on Russia and mining challenges in Mexico create genuine supply risk that transcends normal market cycles. Tariffs and energy shocks ripple through mining operations and refining capacity, tightening the physical market further. These geopolitical factors represent actual constraints on production that support higher prices.

Industrial Demand Drives Long-Term Growth

Industrial demand from solar and electronics sectors remains the dominant price driver, with solar consuming more than 200 million ounces annually and growing. Advanced TOPCon solar technologies require approximately 13 mg of silver per watt, meaning demand per installation rises even as solar capacity additions accelerate. Electric vehicles represent another powerful demand vector, with each unit consuming 25 to 50 grams of silver depending on size and technology. Global EV production will more than double by 2030, creating a structural tailwind for silver demand that extends well beyond 2024. Semiconductors, 5G infrastructure, and emerging AI data-center components add additional demand streams that few investors fully account for. This industrial demand reflects real manufacturing requirements that cannot easily shift to alternative materials.

Positioning for 2024 Opportunities

These macroeconomic forces-lower rates, persistent inflation, geopolitical supply risks, and explosive industrial adoption-converge to create a favorable backdrop for silver prices throughout 2024. The next section examines what expert forecasters predict for specific price targets and scenarios based on these underlying drivers.

Silver Price Forecast for 2024: Expert Predictions and Market Scenarios

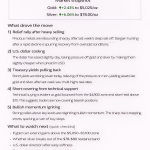

Expert forecasters paint a wide range for silver prices in 2024, and understanding these predictions requires separating noise from actionable data. Bank of America projects silver averaging around $56.25 per ounce through 2024, assuming rate cuts materialize and real yields stay subdued. UBS takes a more conservative stance, targeting near-term silver around $42 per ounce through mid-2026, with potential upside to $44 to $47 per ounce depending on monetary policy shifts. Citi expects a near-term pullback to roughly $42 per ounce before recovery, reflecting skepticism about immediate rate-cut timing. The World Bank forecasts around $41 per ounce, while JP Morgan sits notably higher at $58 per ounce. Saxo Bank projects $60 to $70 per ounce, and Citigroup expects $60 to $72 per ounce, signaling conviction that industrial demand and supply tightness will push prices substantially higher. The wide dispersion matters because it reveals genuine uncertainty about timing and magnitude, not disagreement about direction. Every major forecaster expects higher prices in 2024 compared to 2023 levels, with the divergence centered on how much higher and how fast. For practical purposes, a reasonable target range sits between $40 and $60 per ounce, with upside potential toward $65 to $70 per ounce if supply disruptions accelerate or investment demand surges beyond current expectations.

Base-Case, Bullish, and Bearish Scenarios

A base-case scenario assumes rate cuts materialize gradually through 2024, industrial demand remains steady, and geopolitical risks in Russia and Mexico create supply friction but not outright disruption. Under these conditions, silver trades between $45 and $55 per ounce for most of the year, with seasonal strength during India’s harvest season and Diwali when demand traditionally spikes. A bullish scenario unfolds if the Federal Reserve cuts rates more aggressively than expected, real yields turn significantly negative, or investment flows accelerate as ETF inflows return. TOPCon solar adoption accelerates faster than projected, or supply disruptions tighten LBMA and COMEX inventories further. This scenario targets $55 to $70 per ounce or higher. A bearish scenario emerges only if the Fed maintains higher rates longer than expected, real yields stay elevated, or macroeconomic weakness crushes industrial demand. Even then, structural supply constraints and solar demand provide a floor around $35 to $40 per ounce. The practical implication is clear: downside risk appears limited by industrial demand and supply tightness, while upside risk appears significant if monetary conditions ease.

Physical Silver, ETFs, and Mining Equities

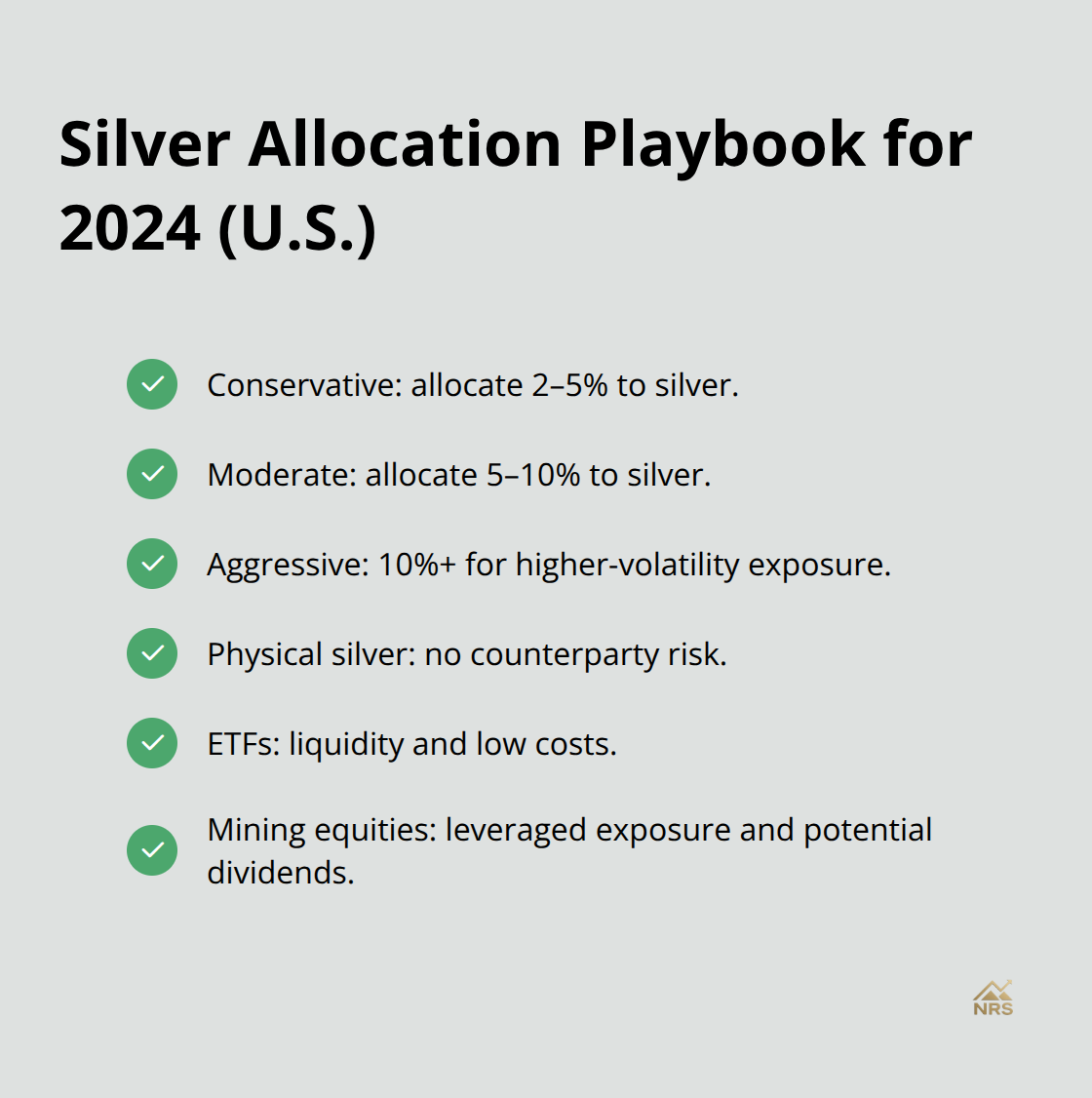

Conservative investors should target a 2 to 5 percent allocation to silver within a diversified portfolio, using dollar-cost averaging to smooth volatility rather than attempting single large purchases. Moderate investors can justify 5 to 10 percent allocations given the structural demand backdrop and supply constraints. Aggressive investors willing to accept higher volatility might pursue 10 percent or larger positions, especially through physical silver or mining equities that offer leverage to price moves.

Physical silver offers no counterparty risk and provides crisis protection alongside price appreciation potential. ETFs like the iShares Silver Trust offer liquidity and low costs for smaller allocations. Mining equities such as Pan American Silver and Wheaton Precious Metals provide leveraged exposure to silver prices while offering dividend income and exploration upside, though they carry higher volatility than the metal itself.

Valuation Signals and Market Positioning

The gold-silver ratio trading above 85:1 suggests silver remains undervalued relative to gold, meaning silver could appreciate faster than gold if the ratio reverts toward historical norms of 60:1 to 70:1. For 2024, the combination of rate-cut expectations, persistent inflation, geopolitical supply risks, and explosive industrial adoption creates a favorable risk-reward profile that justifies meaningful silver exposure. Monitor Fed communications closely, track LBMA inventory levels monthly, and watch for any supply disruptions in Mexico or Russia that could tighten physical markets further. Dollar-cost averaging into silver throughout 2024 captures this asymmetric payoff better than trying to time a single entry point.

Final Thoughts

Silver’s 2024 outlook rests on three pillars that we at Natural Resource Stocks see as decisive: industrial demand that cannot be postponed, supply constraints that cannot be easily overcome, and monetary conditions that favor hard assets. Solar manufacturers consumed over 200 million ounces in 2024, electric vehicle production will double by 2030, and advanced semiconductor applications continue expanding-these are real consumption streams backed by manufacturing commitments and capital expenditure. The silver price forecast 2024 points toward a range of $40 to $60 per ounce under base-case assumptions, with meaningful upside potential if rate cuts accelerate or geopolitical disruptions tighten physical inventories further.

Your investment strategy should reflect this reality by allocating capital through dollar-cost averaging rather than attempting to time a single entry point. Conservative portfolios justify 2 to 5 percent allocations, moderate portfolios 5 to 10 percent, and aggressive portfolios 10 percent or higher, depending on your risk tolerance and time horizon. Physical silver eliminates counterparty risk and provides crisis protection, while ETFs offer liquidity for smaller positions and mining equities like Pan American Silver and Wheaton Precious Metals deliver leveraged exposure with dividend income potential.

Track Federal Reserve communications for rate-cut timing and magnitude, as monetary policy remains the primary short-term price driver throughout 2024. Watch LBMA and COMEX inventory levels monthly to gauge physical market tightness, and monitor geopolitical developments in Russia and Mexico where supply disruptions would tighten markets further. For expert analysis on these trends and deeper insights into macroeconomic factors affecting silver prices, explore Natural Resource Stocks for video content, market analysis, and community perspectives on resource investments.