Silver markets face unprecedented shifts as industrial demand surges while mining output struggles to keep pace. We at Natural Resource Stocks analyze the critical factors driving this silver supply and demand forecast.

The next decade promises significant price volatility as renewable energy expansion collides with constrained production capacity. Smart investors need data-driven insights to navigate these emerging opportunities.

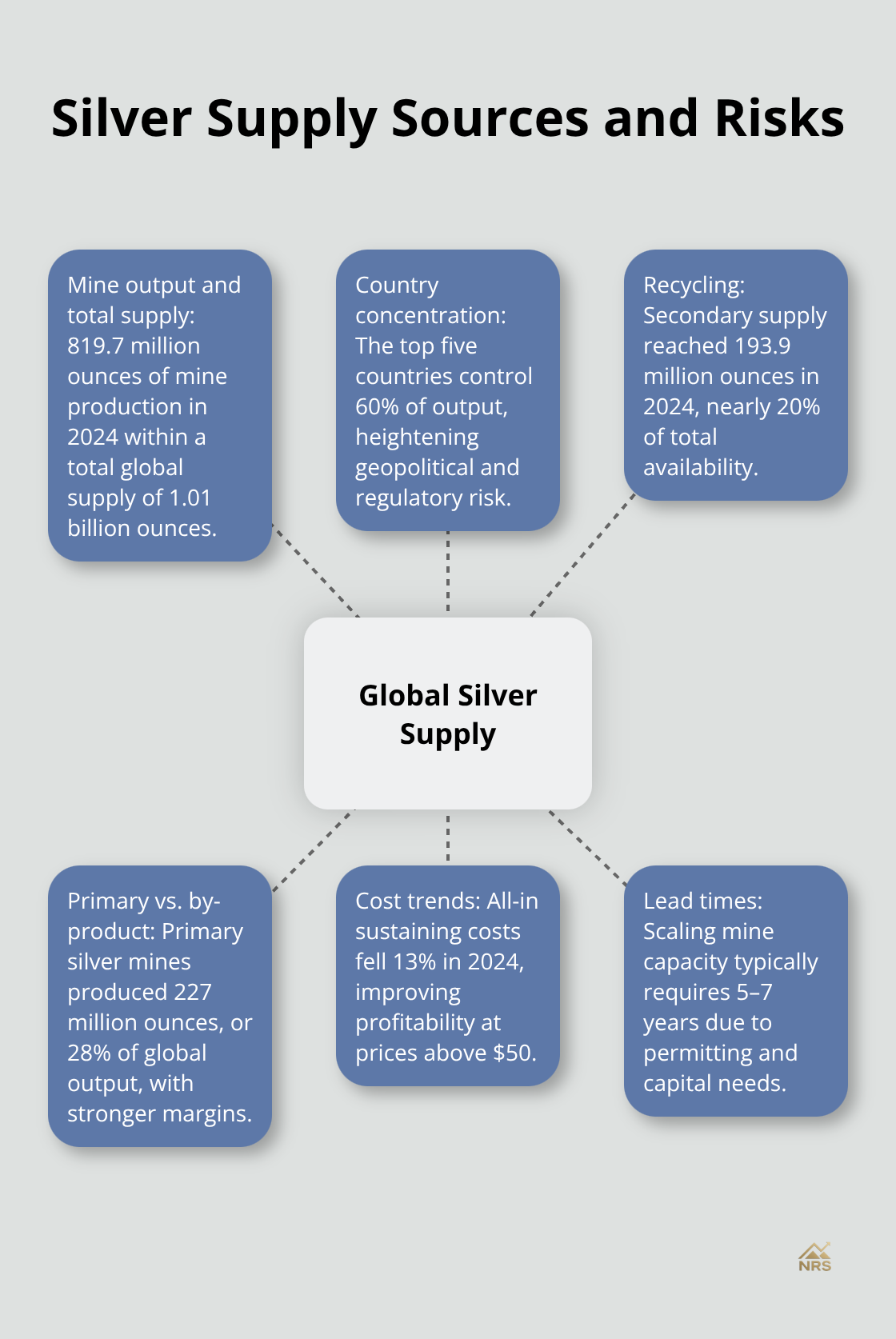

Current Silver Supply Sources and Production Trends

Global silver production rose by 0.9 percent to 819.7 million ounces in 2024, with mine production contributing the majority according to the Silver Institute’s World Silver Survey 2025. Total global silver supply reached 1.01 billion ounces in 2024. Mexico leads production at approximately 190 million ounces annually, followed by China at 110 million ounces, Peru at 100 million ounces, Bolivia at 35 million ounces, and Chile at 33 million ounces.

This concentration creates supply risks since the top five countries control 60% of global output. Mexico’s dominance makes silver particularly vulnerable to regulatory changes or mine disruptions in Latin America. Political instability in these regions directly impacts global silver availability.

Major Mining Countries Drive Production Growth

Mexico increased silver output by 5 million ounces in 2025 due to mine restarts and expanded operations at existing facilities. Australian lead/zinc mines boosted their silver by-product recovery, while Mexico recovered from previous supply disruptions. China maintains steady production despite economic challenges that reduced domestic jewelry demand for three consecutive years.

Primary silver mines generate 227 million ounces (28% of global output) and achieve better profit margins than by-product operations. These dedicated facilities focus exclusively on silver extraction rather than treating it as a secondary metal from gold, lead, or zinc operations.

Secondary Supply Reaches Record Levels

Silver recycling hit a 12-year high of 193.9 million ounces in 2024, representing a 6% increase year-over-year. Industrial scrap recovery drives most growth as electronics manufacturers reclaim silver from circuit boards and solar panels. Silverware recycling surged 11% in Western markets as high prices incentivized selling.

This secondary supply now accounts for nearly 20% of total silver availability, making recycling a critical buffer against mine production shortfalls. Industrial recycling proves more reliable than consumer-driven silverware recovery, which fluctuates with price movements and cultural factors.

Production Costs Drop Despite Market Pressures

Average all-in sustaining costs for silver production decreased 13% in 2024, creating substantial profit margins at current price levels above $50. Mining companies report strong profitability, but expanding production takes 5-7 years due to permitting delays and capital requirements.

This supply lag explains why production growth of just 0.9% in 2024 fails to match industrial demand expansion. The gap between current production capacity and future demand requirements sets the stage for significant market imbalances that will shape industrial consumption patterns.

Industrial Demand Drivers Shaping Silver Markets

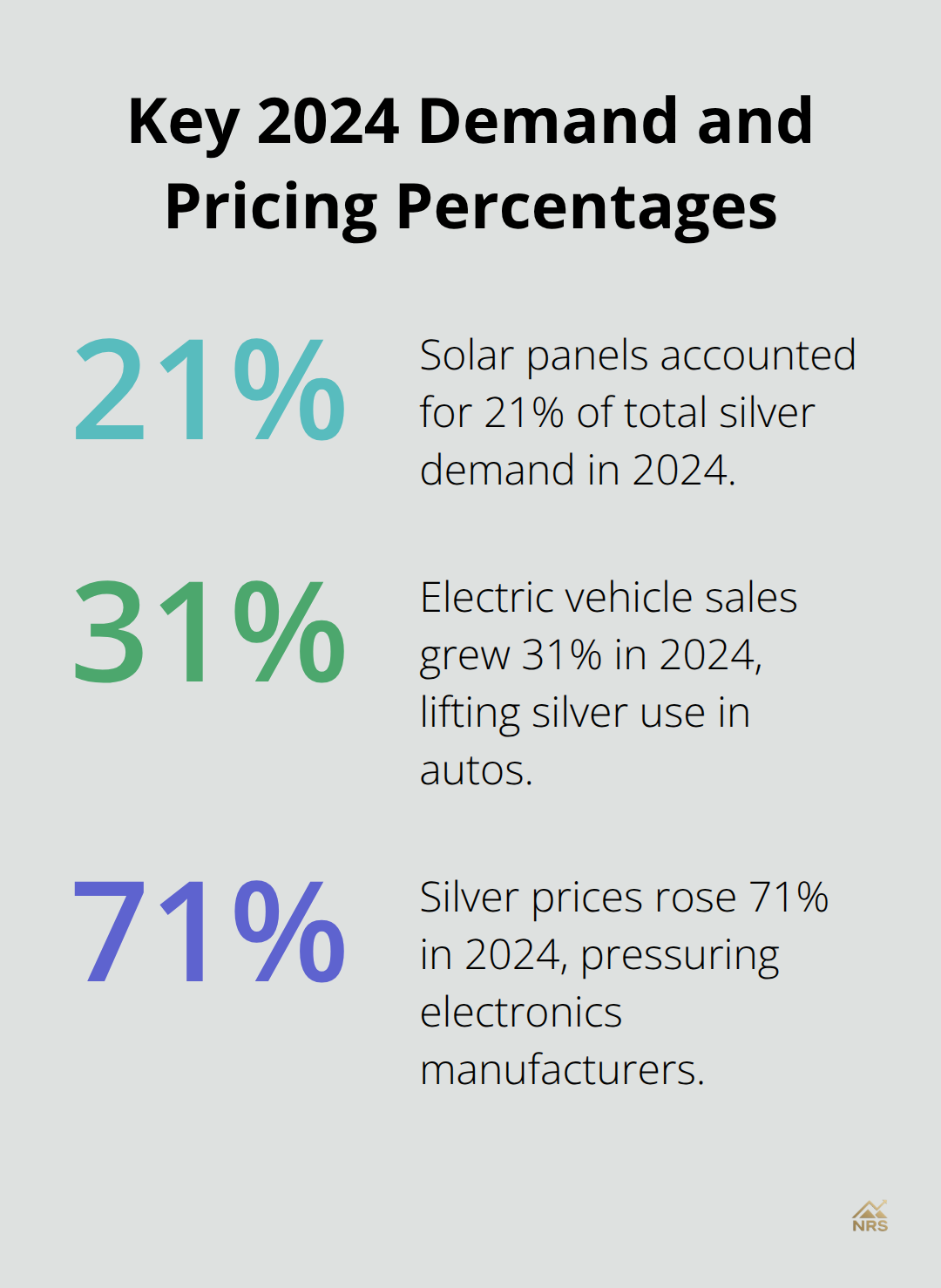

Industrial demand reached record levels in 2024 at 680.5 million ounces, driven primarily by electronics manufacturing and renewable energy expansion. The solar panel industry alone consumed approximately 140 million ounces in 2024, representing 21% of total silver demand according to the Silver Institute’s World Silver Survey. Each solar panel requires 15-20 grams of silver for electrical conductivity, making photovoltaic manufacturing the fastest-growing industrial application. Global solar installations reached 597 GW in 2024, creating massive silver consumption that will intensify as renewable energy targets expand through 2030.

Solar Panel Manufacturing Dominates Growth

Photovoltaic technology consumes silver at unprecedented rates as global capacity additions accelerate. The industry doubled its silver usage between 2022 and 2024, with China leading installations at 216 GW annually. Each gigawatt of solar capacity requires approximately 400,000 ounces of silver, creating direct correlation between renewable energy policies and metal demand. TOPCon and SHJ cell technologies use 1.5 to 2 times more silver than traditional PERC cells, intensifying consumption as manufacturers adopt advanced designs.

Electronics Manufacturing Accelerates Silver Consumption

Smartphone production consumes 0.3 grams of silver per device, while electric vehicles require 25-50 grams compared to just 15-28 grams in traditional cars. The automotive sector’s electrification push drives silver demand higher as EV sales grew 31% in 2024. Computer circuit boards, 5G infrastructure, and AI data centers create additional pressure on silver supplies. Electronics manufacturers face increasing costs as silver prices rose 71% in 2024, forcing companies to optimize usage while maintaining performance standards.

Medical Applications Generate Steady Demand

Healthcare applications consume approximately 60 million ounces annually through antimicrobial coatings, surgical instruments, and wound dressings. Silver’s antibacterial properties make it irreplaceable in medical devices (creating price-inelastic demand that continues regardless of market volatility). Dental applications and medical imaging equipment add another 15 million ounces to annual consumption. This sector provides stable baseline demand that supports silver prices during economic downturns when industrial applications might decline.

These industrial demand patterns create structural deficits that investment markets must address through higher prices and allocation strategies.

Investment Demand and Market Dynamics

Exchange-traded fund holdings jumped 18% through November 2025, which signals institutional confidence in silver’s long-term prospects according to market data. The SPDR Gold Trust and iShares Silver Trust accumulated over 600 million ounces combined, while institutional investors reduced their gold-silver ratio positions to 78 in October 2025. This ratio shift indicates professional money managers view silver as undervalued compared to gold, which creates sustained pressure that supports prices above $50 per ounce.

Retail investor liquidations dominated US markets throughout 2025, but Indian demand strengthened significantly with local prices that reached 170,415 rupees per kilogram in October (an 85% annual increase). The costs for silver reached 200% on an annualized basis, which reflects extreme market strain as physical inventories at Shanghai Futures Exchange warehouses dropped to decade lows.

Federal Reserve Policy Creates Investment Momentum

The anticipated quarter-point rate reduction at the December 2025 Federal Reserve meeting enhances silver’s appeal as a non-yield asset. Lower interest rates historically boost precious metals demand, and silver’s dual role as both industrial commodity and monetary hedge positions it for outsized gains. Central bank policies across major economies continue to expand money supply, which drives currency debasement concerns that fuel precious metals allocations.

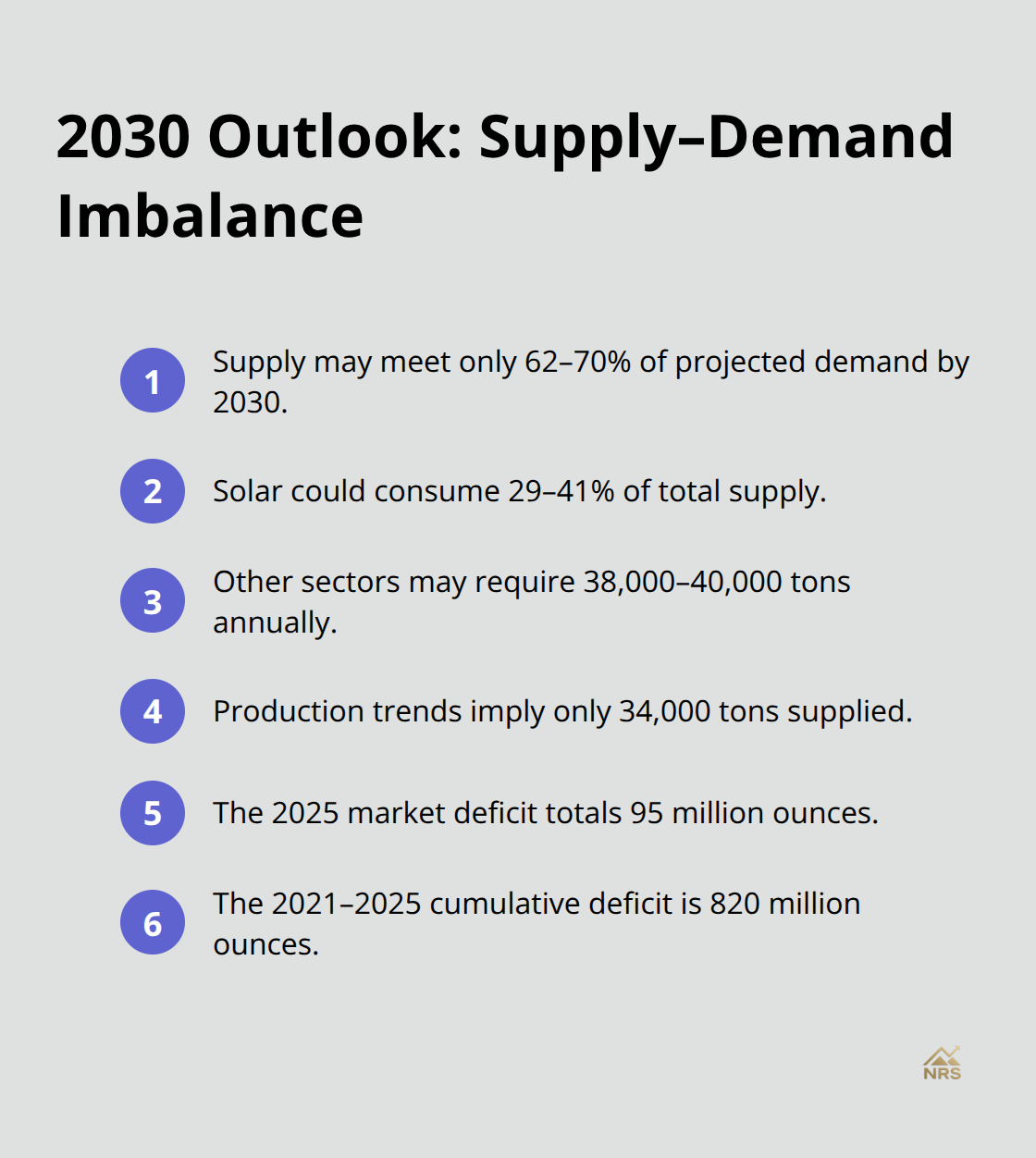

Professional traders target silver over gold when they expect monetary cycles, as silver typically outperforms during dovish policy periods. The cumulative silver deficit from 2021 to 2025 reaches nearly 820 million ounces, which forces investment markets to compete directly with industrial users for limited supplies.

Physical Market Tightness Supports Higher Prices

London Bullion Market Association reserves fell from 31,023 metric tons in June 2022 to 22,126 metric tons in March 2025, which represents a 29% decline that constrains available investment inventory. Bar and coin demand dropped to a seven-year low of 182 million ounces in 2025, but this reduction stems from high prices rather than weak investor interest.

Physical silver premiums increased substantially as dealers struggle to source metal, which creates arbitrage opportunities for investors who hold inventory. The market’s fifth consecutive deficit in 2025 totals 95 million ounces, which forces investment demand to compete with solar panel manufacturers and electronics producers for available supply.

Institutional Holdings Drive Market Structure

Exchange-traded products now hold approximately 1.1 billion ounces of silver, which represents nearly one year of global mine production. These holdings create a floor for silver prices since institutions rarely liquidate positions during temporary market weakness. The concentration of silver in ETF vaults reduces available supply for industrial users and creates additional price support.

Major pension funds and sovereign wealth funds allocated capital to silver as an inflation hedge throughout 2025. This institutional adoption validates silver’s role in professional portfolios and attracts additional capital from asset managers who track institutional flows.

Final Thoughts

The silver supply and demand forecast for the next decade reveals a structural deficit that will reshape investment opportunities. Silver supply may meet only 62-70% of projected demand that reaches 48,000-54,000 tons annually through 2030. Solar industry consumption alone could reach 10,000-14,000 tons annually (representing 29-41% of total supply) while other sectors demand another 38,000-40,000 tons. Current production trends show only 34,000 tons expected if historical growth patterns continue.

This creates a supply gap that exceeds 14,000 tons annually, which investment markets must fill through higher prices. The cumulative deficit from 2021-2025 already totals 820 million ounces and establishes a foundation for sustained price appreciation. Federal Reserve monetary policy, renewable energy mandates, and electronics expansion will drive silver above $100 per ounce within five years.

Mining companies with low-cost operations and recycling facilities positioned near industrial centers offer the strongest profit potential. We at Natural Resource Stocks provide expert analysis and market insights to help investors capitalize on these opportunities in metals and energy sectors. Smart investors who position themselves now will benefit from the structural imbalances that define silver markets through 2030.