Silver prices surged 23% in 2024, driven by industrial demand and monetary policy shifts. The precious metal now stands at a crossroads as investors weigh economic uncertainties against growing technological applications.

We at Natural Resource Stocks analyze the key factors shaping our Silver XAG price forecast 2025. Federal Reserve decisions, geopolitical tensions, and expanding solar panel production will determine whether silver breaks above $35 per ounce or retreats to support levels.

What Drove Silver’s 2024 Performance

Silver dominated precious metals markets in 2024 with a 115% surge, reaching record highs above $62 per ounce according to recent market data. This explosive performance outpaced gold’s 60% gain and marked the metal’s strongest year since the 1970s bull run. The rally accelerated in December when spot silver touched $62.88, breaking through multiple resistance levels that had capped prices for years.

Supply Constraints Drive Market Fundamentals

Physical silver inventories collapsed across major exchanges, with Shanghai Futures Exchange stocks hitting 715 tons, the lowest level in 9 years. London Bullion Market Association reported silver stocks declined from 31,023 metric tons in June 2022 to just 22,126 metric tons (a 29% inventory drawdown that created severe supply squeezes). This shortage pushed borrowing costs to 200% annualized rates in October. Mine production continues to decline after a decade-long downtrend, particularly across Central and South American operations. Transport companies now ship silver via air freight to meet delivery demands, which highlights the severity of physical shortages.

Industrial Demand Transforms Silver Markets

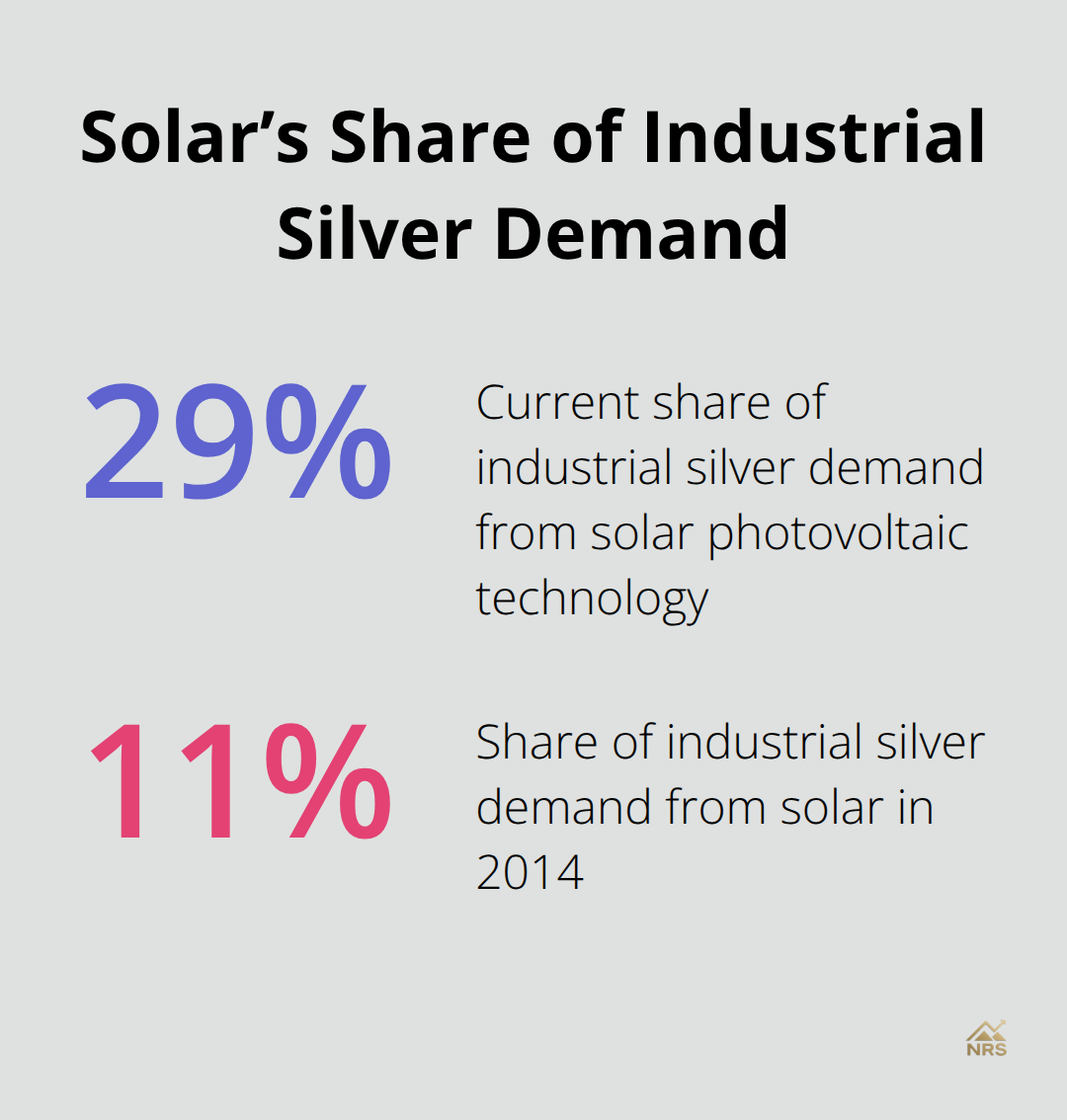

Solar photovoltaic technology now consumes 29% of total industrial silver demand, up from just 11% in 2014 according to Silver Institute data. The European Union’s target of 700 gigawatts solar capacity will require massive silver consumption increases.

Electric vehicles demand 67-79% more silver than traditional cars, using 25-50 grams per vehicle. Automotive silver consumption will grow at 3.4% annually through 2031, with EVs overtaking internal combustion engines as the primary demand source in 2027.

Technology Sectors Accelerate Silver Consumption

Data centers experienced 5,252% growth in IT power capacity from 2000 to 2025, creating new silver demand streams as governments prioritize digital infrastructure investments. AI technologies and advanced computing systems require silver’s superior electrical conductivity properties. The metal’s role in next-generation batteries and charging infrastructure positions it as essential for the global electrification transition.

These supply-demand imbalances set the stage for continued price volatility as economic factors and monetary policy decisions shape silver’s trajectory into 2025.

Economic Forces That Drive Silver Prices

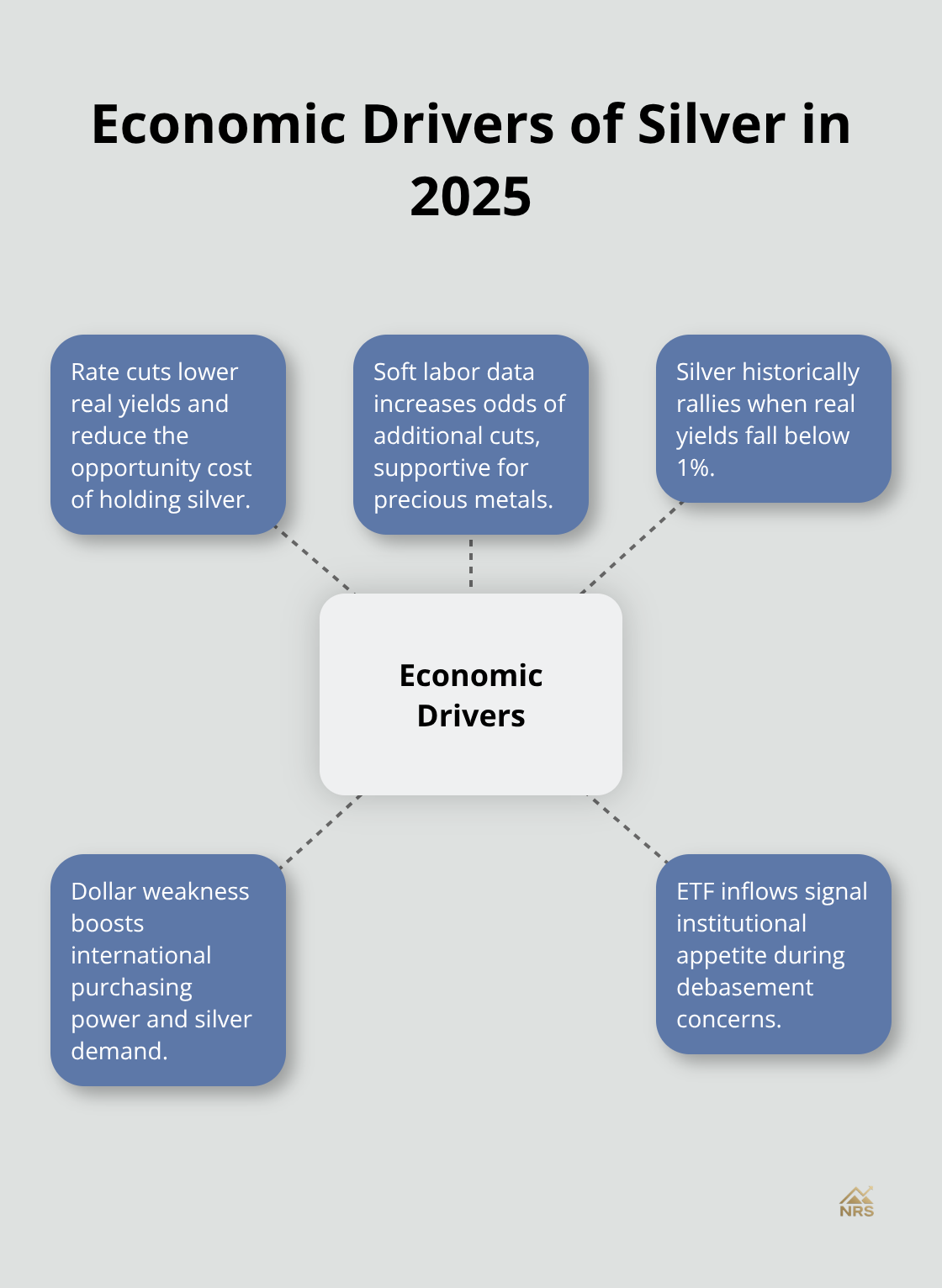

Federal Reserve monetary policy decisions wield enormous influence over silver prices through interest rate adjustments that affect real yields. The December 2024 rate cut pushed silver above $60 as lower rates reduce the opportunity cost of holding non-yielding assets. ADP employment data shows a 32,000 job decline that signals weak labor markets and supports additional Fed rate cuts in 2025. Professional traders watch the 10-year Treasury yield closely because silver historically rallies when real yields fall below 1%.

The current monetary policy landscape favors precious metals as central banks globally shift toward accommodative stances.

Dollar Weakness Amplifies Silver’s Appeal

Currency debasement concerns drive institutional silver purchases as the dollar faces structural headwinds from fiscal deficits and geopolitical tensions. The December ETF inflows of 200 tons demonstrate institutional appetite when dollar value erodes. Silver benefits disproportionately from dollar weakness because international buyers can purchase more metal with their local currencies. Indian farmers invested heavily in silver during Diwali 2024 when rupee depreciation made physical metal attractive compared to paper assets.

Inflation Expectations Shape Investment Flows

Professional investors monitor the DXY dollar index because silver prices typically move inversely to dollar strength. Safe haven demand surged during recent geopolitical tensions as investors sought alternatives to fiat currencies. The gold-silver ratio at 68 represents silver’s strongest relative performance since 2021, indicating continued outperformance potential as economic uncertainties persist. Market participants view silver as both an industrial metal and inflation hedge, which creates dual demand streams that support price stability during economic turbulence.

These monetary and currency dynamics establish the foundation for technical analysis patterns and price targets that shape silver’s path through 2025.

Where Will Silver Prices Go in 2025

Technical indicators point to $100 per ounce as a realistic target for silver in 2025, with the 50-day Simple Moving Average at $54.50 that provides strong support for continued upward momentum. The metal completed eight consecutive monthly gains through December 2024 and broke through former resistance levels that now serve as support zones. Market experts anticipate silver will surpass $100 by end-2026, with intermediate targets at $65 and $75 based on Fibonacci extensions from the current breakout pattern. The absence of significant resistance above $65 creates a clear path for continued price appreciation, while former resistance at $60 transforms into a critical support level that traders monitor for dip-purchase opportunities.

Professional Analyst Forecasts Signal Bullish Consensus

Paul Williams from Solomon Global emphasizes silver’s dual role as industrial metal and store of value, while Philippe Gijsels from BNP Paribas Fortis describes the current environment as a secular bull market with persistent supply deficits. Historical analysis shows previous silver bull runs drove the gold-silver ratio below 40 (compared to the current 68 level), which suggests substantial upside potential remains. Oxford Economics projects silver as essential for electrification and renewable energy transitions, with automotive demand that will grow 3.4% annually through 2031 as electric vehicles overtake traditional cars in 2027. The Silver Institute forecasts significant demand growth from solar energy expansion, with the European Union’s 700 gigawatt capacity target that requires massive silver consumption increases and will strain already tight inventories.

Key Price Catalysts Shape 2025 Trajectory

Federal Reserve rate cuts provide the primary catalyst for silver’s advance, as lower real yields reduce opportunity costs for non-yield assets and weaken dollar strength. Industrial demand acceleration from data center expansion and AI technology adoption creates structural support for higher prices, while supply constraints from mine production declines and inventory drawdowns maintain upward pressure.

Geopolitical tensions and inflation concerns drive safe haven demand, particularly from institutional investors who added 200 tons to ETF positions in December alone. The metal’s addition to the U.S. critical minerals list enhances strategic importance and government stockpile potential, while India’s 4,000 metric ton annual consumption provides consistent physical demand that supports price floors during market corrections.

Volatility Expectations and Risk Factors

Analysts warn that the silver market may become crowded, which raises concerns about potential corrections despite the phenomenal tailwind from industrial interest. The market creates a fragile environment where profit-taking can lead to rapid reversals in market direction, particularly if overleveraged positions need to unwind quickly. A pullback towards $56.46 would test the resolve of bullish traders who defend the price movement, while increased volatility appears likely as supply chain tightness exacerbates upward pressures on price.

Final Thoughts

Our Silver XAG price forecast 2025 points to substantial upside potential as multiple bullish factors converge. Technical analysis supports targets near $100 per ounce, while supply deficits and industrial demand growth create structural price support. The Federal Reserve’s accommodative stance reduces opportunity costs for precious metals, while geopolitical tensions drive safe haven flows.

Key risks include market crowding and potential profit-taking that could trigger sharp corrections. Overleveraged positions may unwind rapidly if prices retreat below $56 support levels (the critical technical threshold that traders monitor closely). However, the fundamental backdrop remains strong with declining mine production, collapsing inventories, and accelerating demand from solar energy and electric vehicle sectors.

Smart investors should consider dollar-cost averaging into silver positions rather than chase momentum. Mining stocks offer leveraged exposure to price gains, while ETFs provide liquid alternatives to physical ownership. We at Natural Resource Stocks provide comprehensive analysis and expert insights to help investors navigate precious metals markets across natural resource sectors.