Silver prices have shown remarkable volatility throughout 2024, with XAG trading between $22 and $32 per ounce. Industrial demand from solar panels and electronics continues driving consumption higher.

We at Natural Resource Stocks analyze the key factors shaping our Silver XAG price forecast for the coming year. Federal Reserve policy shifts and inflation trends will play major roles in determining silver’s trajectory.

What’s Driving Silver’s Current Market Performance?

Silver’s Explosive Price Action

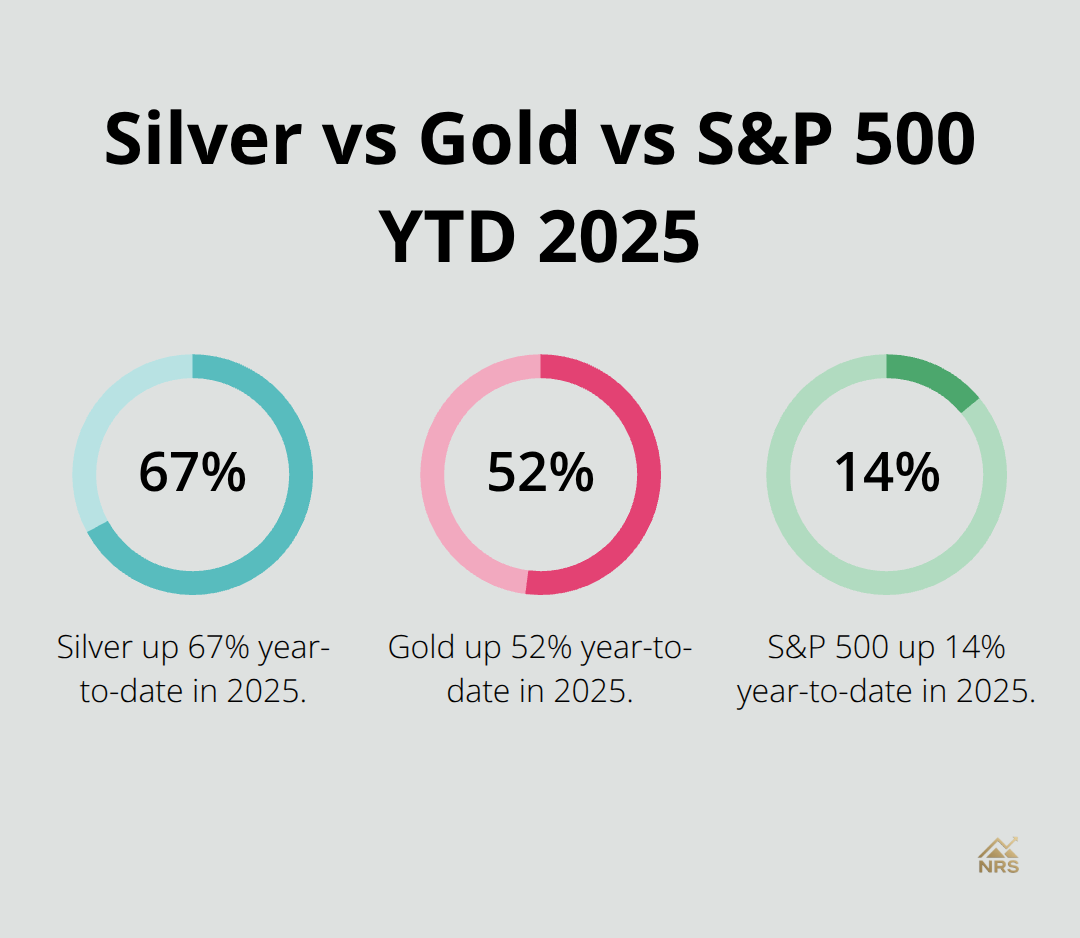

Silver hit a record high of $54.48 on October 17, 2025, with a stunning 67% year-to-date gain that crushed gold’s 52% rise and the S&P 500’s modest 14% increase.

The metal trades around $49.71 today, which shows the volatility that creates both opportunities and risks for investors. This dramatic price movement reflects a fundamental shift in market dynamics. The gold-silver ratio dropped to 78 by October 2025, which signals stronger institutional confidence in silver’s potential.

Supply Deficit Creates Market Tension

The silver market experiences its fifth consecutive structural deficit in 2025. Global silver demand in 2025 is projected to decrease by approximately 4% to around 1.12 billion ounces. Cumulative deficits from 2021 to 2025 will total nearly 820 million ounces, which creates unprecedented market tightness. Global mined silver supply stays flat at 813 million ounces year-over-year, while Mexican and Russian production increases offset lower output from Peru and Indonesia. The average all-in sustaining cost sits at $13.0 per ounce (the lowest since H1 2022), which provides miners with healthy margins of $19.7 per ounce.

Investment Demand Surges Despite Industrial Decline

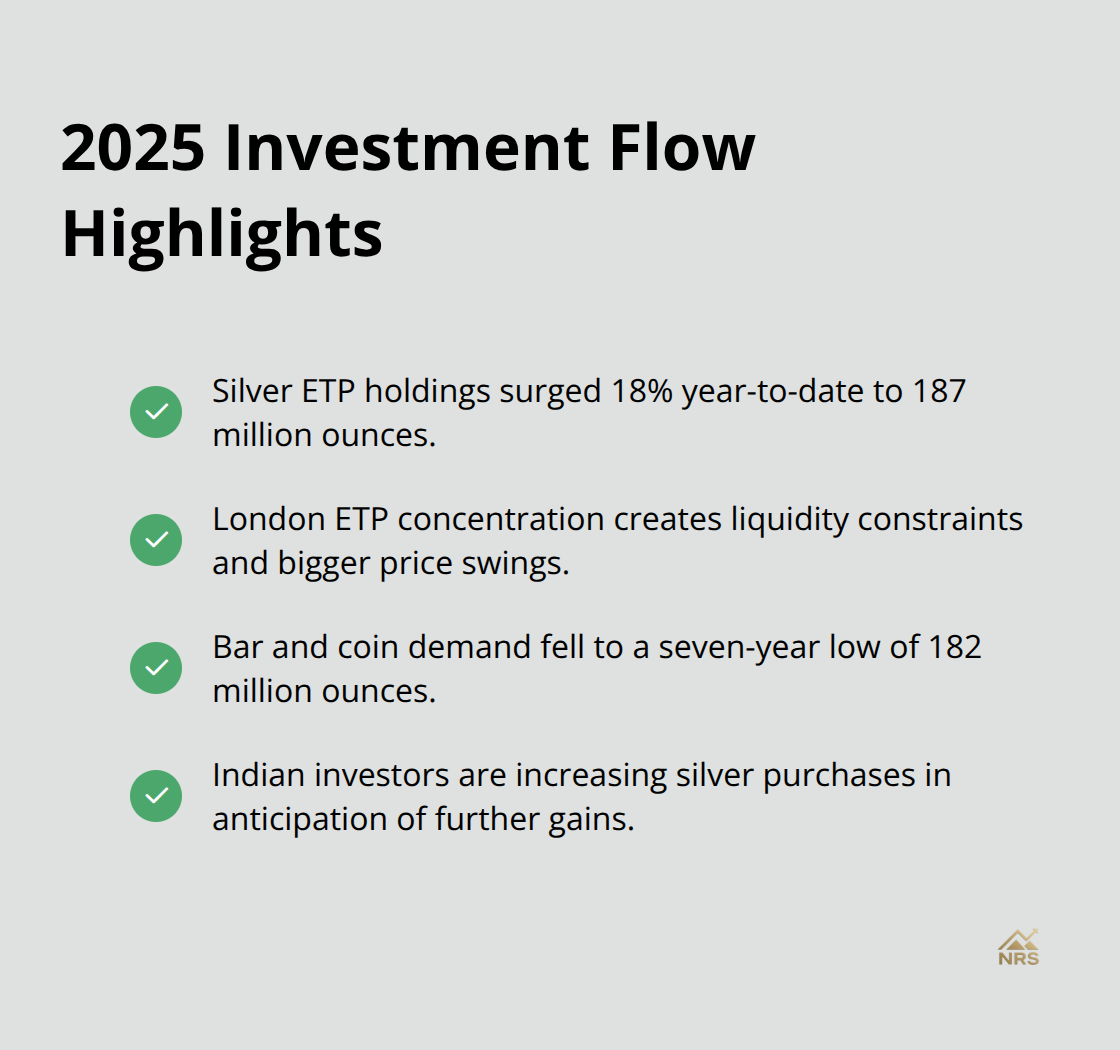

Exchange-traded product holdings jumped roughly 18% year-to-date and reached 187 million ounces as of November 6, 2025. This surge in investment demand contrasts sharply with industrial consumption, which will drop 2% in 2025 due to tariff uncertainties and geopolitical tensions. Photovoltaic silver demand will fall 5% year-over-year despite record-high solar installations, as manufacturers reduce silver usage per module. The liquidity squeeze in London-based silver ETPs amplifies price volatility and creates additional upward pressure on spot prices.

These market dynamics set the stage for how broader economic factors will shape silver’s price trajectory in the months ahead.

How Do Economic Forces Shape Silver’s Next Move?

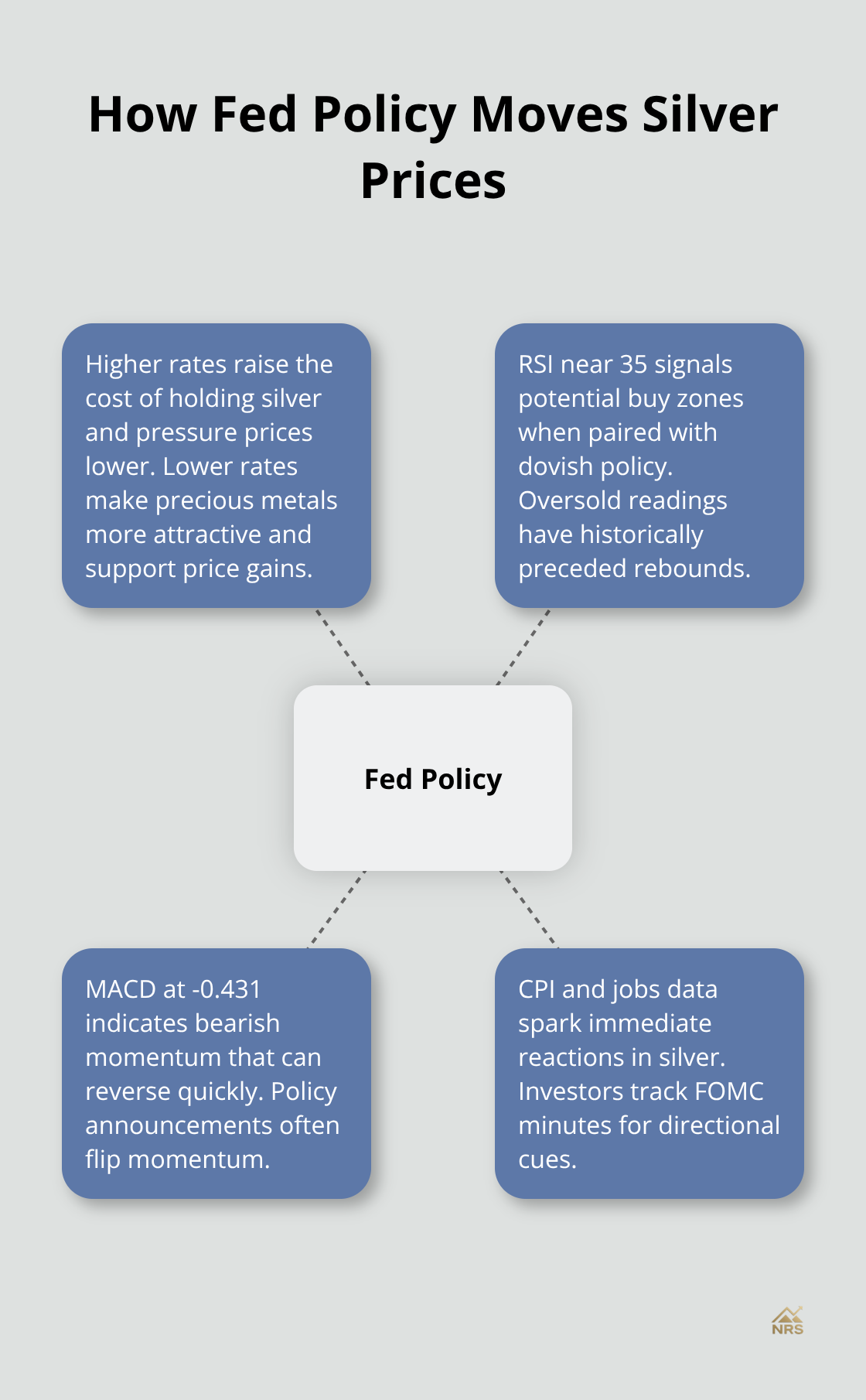

Fed Policy Creates Silver Price Volatility

The Federal Reserve’s interest rate decisions directly impact silver prices through the inverse relationship between rates and precious metals. Rising interest rates increase the cost of holding silver, decreasing prices, while low rates make precious metals more attractive, increasing prices. Current technical indicators show silver’s RSI at 35.13, which approaches oversold territory and historically signals potential buying opportunities when combined with dovish Fed policy. The MACD at -0.431 suggests bearish momentum, but this can reverse quickly with policy announcements. Smart investors monitor Fed meeting minutes and economic data releases like CPI and employment figures, as these drive immediate price reactions in silver markets.

Dollar Strength and Inflation Create Trading Opportunities

A stronger US dollar typically pressures silver prices lower, which creates strategic entry points for investors. Silver’s current volatility (categorized as high according to Average True Range measurements) means currency fluctuations amplify price swings. Inflation trends matter more than headline numbers – persistent core inflation above 3% historically supports silver prices as a store of value. The metal’s 52-week range between $28.16 and $54.50 demonstrates how economic uncertainty drives extreme price movements. Geopolitical tensions and recession fears push investors toward safe-haven assets, with silver often outperforming during economic stress periods.

Global Growth Patterns Drive Industrial Demand

Emerging market economic expansion directly correlates with silver’s industrial consumption, particularly in electronics and renewable energy sectors. China and India represent massive markets for silver jewelry and industrial applications, which makes their GDP growth rates key indicators for price direction. Silver jewelry demand is forecasted to rise by 5% in 2024 with India leading demand growth. Economic slowdowns in these regions reduce industrial silver demand, while robust growth can increase consumption significantly. The current projection reflects economic uncertainties, but recovery phases historically trigger sharp silver price increases as industrial users rebuild inventory levels.

These economic fundamentals set the foundation for understanding how specific industry sectors will shape silver demand patterns and investment flows throughout the next year.

Where Will Silver Demand Come From Next Year?

Technology Sector Drives Silver Consumption Higher

Technology companies drive significant silver consumption, with industrial demand reaching a record 680.5 million ounces in 2024, rising 4% from the previous year. Smartphone production alone requires roughly 0.35 grams of silver per device, which translates to massive consumption when global production exceeds 1.4 billion units yearly. The shift toward 5G infrastructure and electric vehicle components creates additional silver demand, as these technologies require more conductive materials than traditional applications. Semiconductor manufacturers face supply chain pressures that make silver substitution difficult, which supports consistent industrial demand despite economic uncertainties.

Solar Panel Manufacturing Reduces Silver Usage

Photovoltaic manufacturers will reduce silver consumption by 5% in 2025 despite record-high solar installations worldwide. Each solar panel contains approximately 20 grams of silver, but technological advances allow manufacturers to use thinner silver paste layers without compromising efficiency. Global solar capacity additions reached 346 gigawatts in 2024, yet silver demand from this sector declined due to these efficiency improvements. Solar companies like First Solar and Canadian Solar actively work to minimize silver usage per module (creating downward pressure on industrial demand) even as renewable energy adoption accelerates.

Investment Flows Reshape Silver Market Dynamics

Exchange-traded product holdings surged 18% year-to-date and reached 187 million ounces as of November 6, 2025, which demonstrates strong institutional interest. The concentration of silver-backed ETPs in London creates liquidity constraints that amplify price movements during high-volume trading periods. Bar and coin demand dropped to a seven-year low of 182 million ounces in 2025, while Indian investors increase silver purchases in anticipation of further price gains.

Recycling Market Adds Supply Pressure

The recycling market contributes 13-year highs as silverware collection increases, adding roughly 1% more supply to offset some investment demand pressure. Scrap silver recovery from outdated technologies diminishes, which leads to stricter supplies in the market. Much of the available scrap silver has been exhausted according to The Silver Institute (impacting future supply dynamics). This recycling surge provides additional market supply that competes with mined production and helps balance the structural deficit conditions.

Final Thoughts

Our Silver XAG price forecast targets a range of $45-$60 per ounce for next year, with the fifth consecutive structural deficit of 95 million ounces creating sustained upward pressure. Federal Reserve policy shifts pose the primary risk, as dollar strength could reduce precious metals appeal. Geopolitical tensions and inflation concerns support silver’s safe-haven status despite potential industrial demand weakness.

Smart investors should consider dollar-cost averaging into silver positions when prices dip below $45. The current RSI at 35.13 indicates oversold conditions that historically precede strong rebounds. Physical silver and ETF exposure both offer distinct advantages based on individual investment objectives.

We at Natural Resource Stocks recommend close monitoring of Fed announcements and industrial demand data as these factors drive short-term price volatility. Our precious metals analysis helps investors navigate market uncertainty with data-driven strategies. The combination of supply deficits and investment flows positions silver for potential outperformance in 2026.