When it comes to investing, especially in precious metals, there’s a lot of noise in the media. From recession talks to AI hype, everyone has an opinion about what’s happening in the markets. But Christopher Aaron, founder of iGold Advisor and Elite Private Placements, believes that amidst all the chatter, the one thing that truly matters is price. As someone who has been involved in the precious metals sector since 2007, Christopher has a clear focus on what drives markets—cost and price alone.

The Power of Price: A Price Analyst’s Perspective

Christopher’s investment journey began during the global financial crisis. With a unique position of having some extra cash while working overseas, he took advantage of mining stocks that had fallen by as much as 90%. These stocks, after hitting rock bottom, experienced significant recoveries, resulting in a 10-fold return. His experience in the 2007–2009 crisis solidified his belief that, while stories are plentiful, it’s the price that ultimately determines investment success.

“Stories are interesting, but if the price doesn’t match the narrative, I always defer to the price,” says Christopher, who focuses on the price of gold, silver, Bitcoin, stocks, and individual assets.

The Price of Gold: Key Lessons from the Past

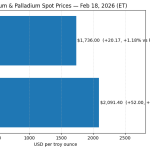

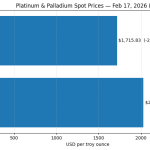

Christopher’s expertise isn’t limited to just price. He has studied market cycles and trends for years. One key lesson he shares is that the historic gold-to-Dow Jones ratio signals shifts in market sentiment. In 1980, gold peaked at $850 an ounce, and the Dow Jones was at 850 points, a one-to-one ratio that suggested investor preference for hard assets. By 1999, during the Nasdaq bubble, the ratio soared to 45, strongly favoring stocks. Understanding these shifts is crucial for predicting where the market may head next.

“Gold has been through multiple cycles, and we’ve seen that when it breaks out of long consolidation phases, it can experience significant growth,” Christopher says. “In the next few years, we could see gold reaching $8,000 or $9,000 per ounce, and that’s only the start of its potential.”

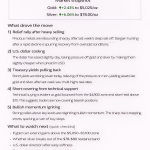

The Breakout: Why the 45-Year Trend in Silver Matters

Christopher’s analysis delves deeply into the Dow-to-gold ratio chart, highlighting a multi-decade trend that is shifting in favor of gold. “This 45-year trend is breaking, and this is something we’ve only seen a handful of times in the last century,” he explains. “In 1930, we saw the prelude to the Great Depression, and in the 1960s, we saw the revaluation of gold. The next phase could be another major shift.”

Silver is also breaking out of a decades-long period of consolidation. “Silver has been in a 45-year consolidation phase,” says Christopher. “Such a breakout could lead to significant growth, possibly reaching $150 per ounce.”

Why the Long Base Equals a Big Move

Christopher believes the longer an asset consolidates, the bigger the potential breakout. Silver’s 45-year base could now lead to significant gains for investors.

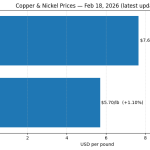

“We’ve seen this with gold, copper, and platinum,” he says. “Once out of consolidation, prices often triple. Silver could do the same.”

Silver’s Future: A Prime Investment Opportunity

Christopher believes silver will outperform most commodities in the coming years. His main takeaway for investors: “We’re at the beginning of a potential silver boom. If you have a long-term view, now is an opportune time to be overweight in silver.”

However, like all investments, there’s risk. Silver is a volatile asset, and while the potential for gains is significant, the market may experience some short-term fluctuations. “If you’re in for the long run, silver could be the best-performing asset in your portfolio,” Christopher says.

The Strategy: Portfolio Building with Precious Metals

Christopher recommends diversifying among physical silver, ETFs, mining stocks, and junior miners. “Junior silver stocks are undervalued and offer high return potential,” he says.

He also explores private placements. “Through Elite Private Placements, we secure better terms with mining firms, giving investors favorable rates and warrants for greater potential future returns.”

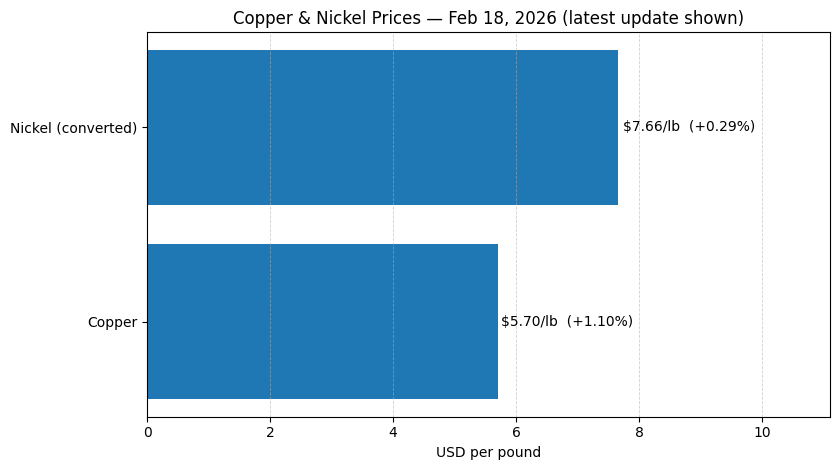

Keeping an Eye on Other Markets

While silver remains Christopher’s primary focus, he also keeps a close watch on other markets. The energy sector, particularly oil, is something he’s watching closely. “Oil has been on a downward trend, but once it breaks above $60 or $65, we could see another leg higher,” he predicts.

AI and space exploration are transformative sectors, but Christopher warns they are currently overvalued. “This is a bubble, like the dot-com era. Survivors will transform our lives,” he says.

Final Thoughts: Staying Focused on What Matters

For Christopher Aaron, price is the most important metric for investors—cutting through complexity, stories, and market noise. By focusing on price and using historical data, he successfully navigates the challenging world of precious metals investing.

He remains cautious yet optimistic about the future of silver and gold. “A breakout is coming that could reshape the precious metals landscape,” he predicts.

To learn more about his analysis of precious metals, visit iGold Advisor and Elite Private Placements. Christopher’s focus on price and market cycles can guide investors looking to build their portfolios in gold, silver, or mining stocks.

Christopher’s approach emphasizes cutting through media noise and market narratives by focusing relentlessly on price. For investors, this philosophy entails using objective data rather than subjective stories to inform decisions. Price analysis, above all, is his most effective tool for investment success.

For expert insights into the precious metals market, including gold, silver, and mining stocks, check out Natural Resource Stocks. Stay informed, track the trends, and make the best decisions for your investment future. If you need more information, feel free to contact us at andy@naturalresourcestocks.net. We’re here to help you out. Check out our daily updates for expert analysis to help you stay ahead of market trends.