As we step into 2025, one thing is clear: the world of finance and global markets is undergoing a monumental shift. From the collapse of the yen carry trade to the rise of precious metals like gold and silver, we’re witnessing a transformation that could reshape economies and geopolitical landscapes. Let’s break down the key points that are driving this reset, and why 2025 may be remembered as one of the most consequential years in recent history.

The Shifting Dynamics of Global Power

In the 18th and 19th centuries, Europe and Great Britain were the industrial giants. They controlled pricing mechanisms for crucial commodities, and their dominance set the tone for global trade. But that was then, and this is now. As we enter the 21st century, the United States and China have emerged as the true industrial powers. And with that shift comes a fundamental change in how commodities, especially precious metals, are priced.

This change is particularly evident in the gold and silver markets, where the long-standing dominance of Europe and the LBMA (London Bullion Market Association) is being challenged. China and the U.S. have started to assert more control over these strategic commodities, signaling that the era of European dominance in pricing is coming to an end.

The End of the Yen Carry Trade

One of the most significant shifts in global finance has been the end of the Japanese yen carry trade. This trade had been a cornerstone of the international financial system, allowing investors to borrow cheap yen to fund investments in higher-yielding assets. However, as Japan’s central bank starts to normalize its monetary policy, the days of easy yen borrowing are over. This shift is crucial because it takes away one of the primary tools used by financial institutions to manipulate the short end of the yield curve.

The end of the yen carry trade has far-reaching implications. It signals a shift in global financial power, particularly in the U.S. and Japan. With the Fed’s actions and the Japanese central bank’s rate hikes, both nations are taking control of their respective yield curves. As the yen carry trade unwinds, it forces a rebalancing of global markets, and the United States gains more leverage over the international financial system.

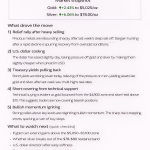

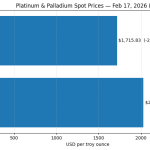

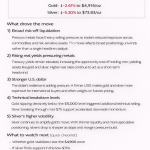

The Role of Precious Metals: Gold, Silver, and Copper

Another key aspect of the great reset is the rise of precious metals, particularly gold and silver. In 2025, we witnessed a significant surge in these markets, indicating a shift away from traditional fiat currencies. With the U.S. and China pulling precious metals off the market and reducing the influence of the LBMA, the pricing mechanisms for gold and silver are being decentralized.

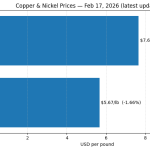

Silver, in particular, has been at the forefront of this transformation. With the shift in market dynamics, we’re seeing a tug-of-war between the U.S. and China over silver. As both nations work to secure their positions in the precious metals market, they are fundamentally changing the way these assets are priced. This battle is only the beginning, as copper, aluminum, and other strategic metals are poised to follow suit.

The Geopolitical Landscape: From Venezuela to the Gulf of America

The great reset isn’t just about economic forces—it’s also about geopolitics. In 2025, the United States took steps to solidify its position in the Western Hemisphere. One of the key moves was the confrontation with Venezuela, where President Maduro’s control was challenged. The U.S. didn’t just go after Venezuela for its oil; it was part of a broader strategy to assert control over global commodity flows.

The implications of this are far-reaching. By cutting off Venezuela’s influence in the precious metals market, the U.S. has successfully taken control of a crucial part of the global supply chain. This move also signals a broader shift in the international order, as the U.S. begins to assert more influence over Central and South America, cutting off Chinese and Russian influence in the region.

The Future: Copper and the “Final Boss”

So, what comes next in the great reset? Copper is expected to play a major role. As the world’s demand for copper grows, we are likely to see more battles over its pricing and control. Copper, along with other strategic metals such as aluminum, tin, and nickel, will be crucial to the future of global trade and industry.

But the biggest challenge facing global markets isn’t just copper—it’s oil. Oil remains the most important strategic commodity, and controlling its pricing and supply is critical. As the U.S. and China continue to shift the balance of power in the global commodity markets, oil will be the final battleground in the great reset.

The Big Picture: Understanding the Reset

The events of 2025 are a culmination of years of geopolitical and economic shifts. From the collapse of the yen carry trade to the rise of precious metals and the increasing control of strategic resources, we are witnessing the birth of a new financial order. For those of us watching closely, it’s clear that the world is changing, and 2025 will go down as a pivotal year in history.

As we move forward, it’s crucial to understand the larger context of these changes. The great reset is not just about a few markets or geopolitical conflicts; it’s about a fundamental shift in how the global economy operates. Whether you’re an investor, a policymaker, or simply someone interested in the future of international finance, the events of 2025 will have lasting implications for us all.

In conclusion, 2025 marks the beginning of a significant shift in the global economic and geopolitical landscape. The rise of precious metals, the end of the yen carry trade, and the strategic realignment of key resources all point to a new era of financial power. The U.S. and China are positioning themselves as the new global powers, challenging the old order and reshaping the world’s economic future. Stay tuned, as the story is far from over, and the reset continues to unfold.

For more insights and updates, follow the journey at Natural Resource Stocks. If you need additional information, feel free to reach out to us at andy@naturalresourcestocks.net. We’re here to assist you. Don’t forget to check our daily updates for expert analysis to help you stay ahead of market trends.