Silver prices swing wildly, and those movements matter far more than most investors realize. At Natural Resource Stocks, we’ve seen how silver price volatility can make or break a portfolio, depending on your strategy.

Whether you hold physical silver, own mining stocks, or trade futures, you need to understand what’s actually driving these price swings. This guide shows you exactly how to read the market and position yourself accordingly.

What Drives Silver Price Volatility

Industrial demand creates immediate price reactions

Industrial demand for silver has surged dramatically in recent years, and this isn’t theoretical. Solar panel installations worldwide reached 2.2 terawatts of capacity by the end of 2024, with each panel consuming roughly 15–20 grams of silver. Electric vehicle production hit 13.6 million units globally in 2024, and each EV battery system requires silver-based components for conductivity and reliability. When solar deployments slow or EV production dips, silver prices fall within weeks because industrial demand reduces orders immediately. The reverse is equally sharp: a sudden surge in semiconductor manufacturing or solar subsidies tightens supply and pushes prices higher almost overnight. This isn’t speculation-it’s direct cause and effect. Track solar installations and EV sales figures quarterly through the International Energy Agency and Bloomberg NEF to anticipate price moves before they happen.

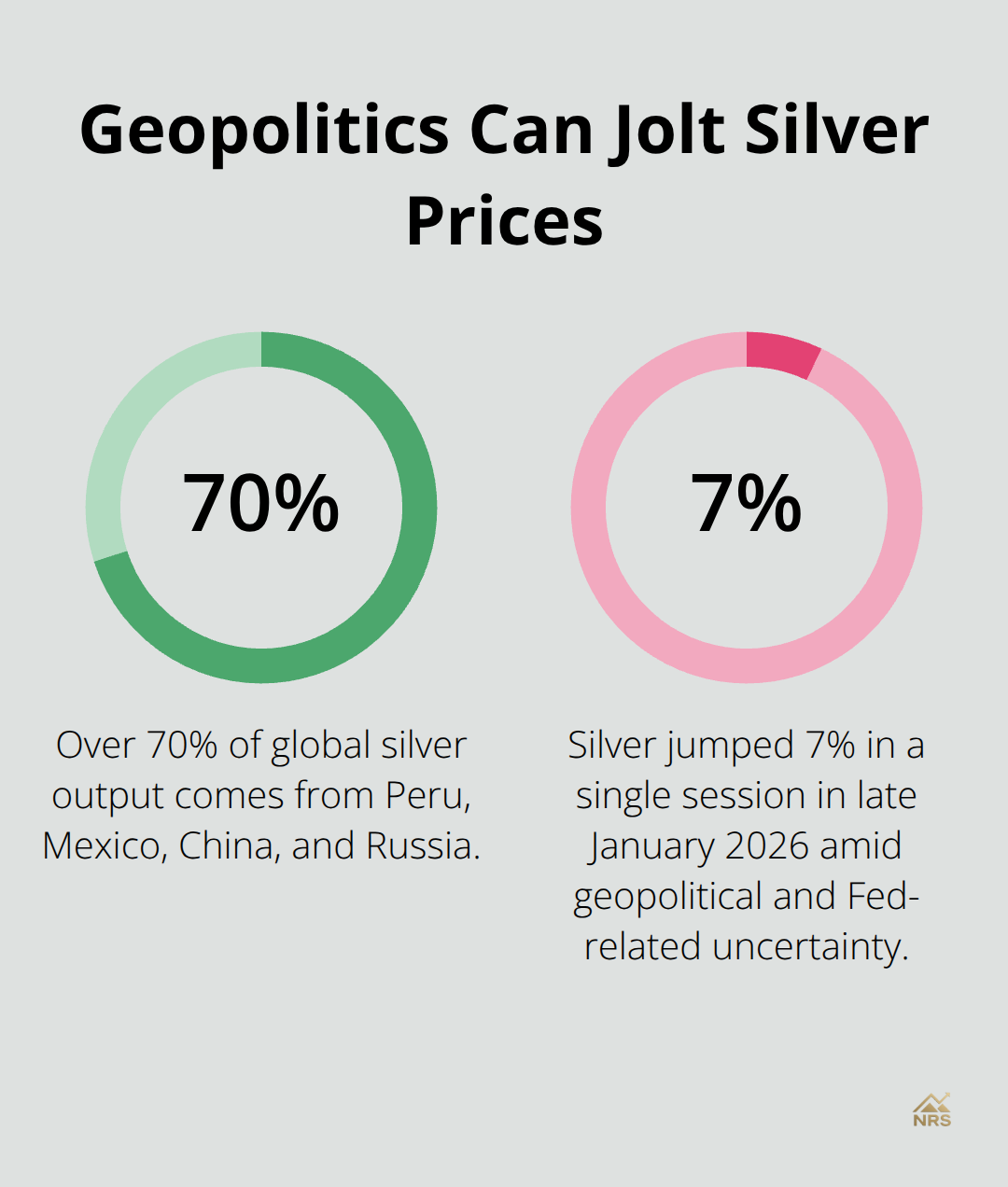

Geopolitical shocks hit silver faster than gold

Geopolitical tensions disrupt silver supply chains because the metal concentrates in specific regions. Peru, Mexico, China, and Russia account for over 70 percent of global silver production. When export controls tighten-as happened with export licensing restrictions from major producers-prices spike immediately as speculators bet on scarcity. The late January 2026 volatility tied to Fed chair expectations and geopolitical uncertainty around Venezuela’s Maduro and Iran relations pushed silver up 7 percent in a single trading session.

Resolution of tensions can trigger sharp reversals just as quickly. Monitor geopolitical calendars and supply-chain news from mining regions rather than waiting for price confirmation to act.

Macro policy changes drive the largest swings

Interest rate expectations move silver far more violently than industrial demand alone. When the U.S. Federal Reserve signals rate cuts, silver rallies because lower rates reduce the opportunity cost of holding non-yielding assets. The 2025 rally that pushed silver from roughly $29 per ounce at the start of the year to over $80 by late December was fueled primarily by expectations of monetary easing and a weaker U.S. dollar. Rate-hike signals or stronger dollar strength can trigger 10 percent declines in days. The U.S. dollar index serves as your leading indicator-when it weakens, silver typically strengthens. Monitor the Federal Reserve’s policy calendar, inflation data releases, and central bank communications from major economies. These macro catalysts move silver far more than supply-demand fundamentals in the short term, which is why position sizing and stop-loss discipline matter enormously for your capital preservation.

Now that you understand what moves silver prices, the next section examines how these swings affect different types of investors-from those holding physical bars to traders working with futures contracts.

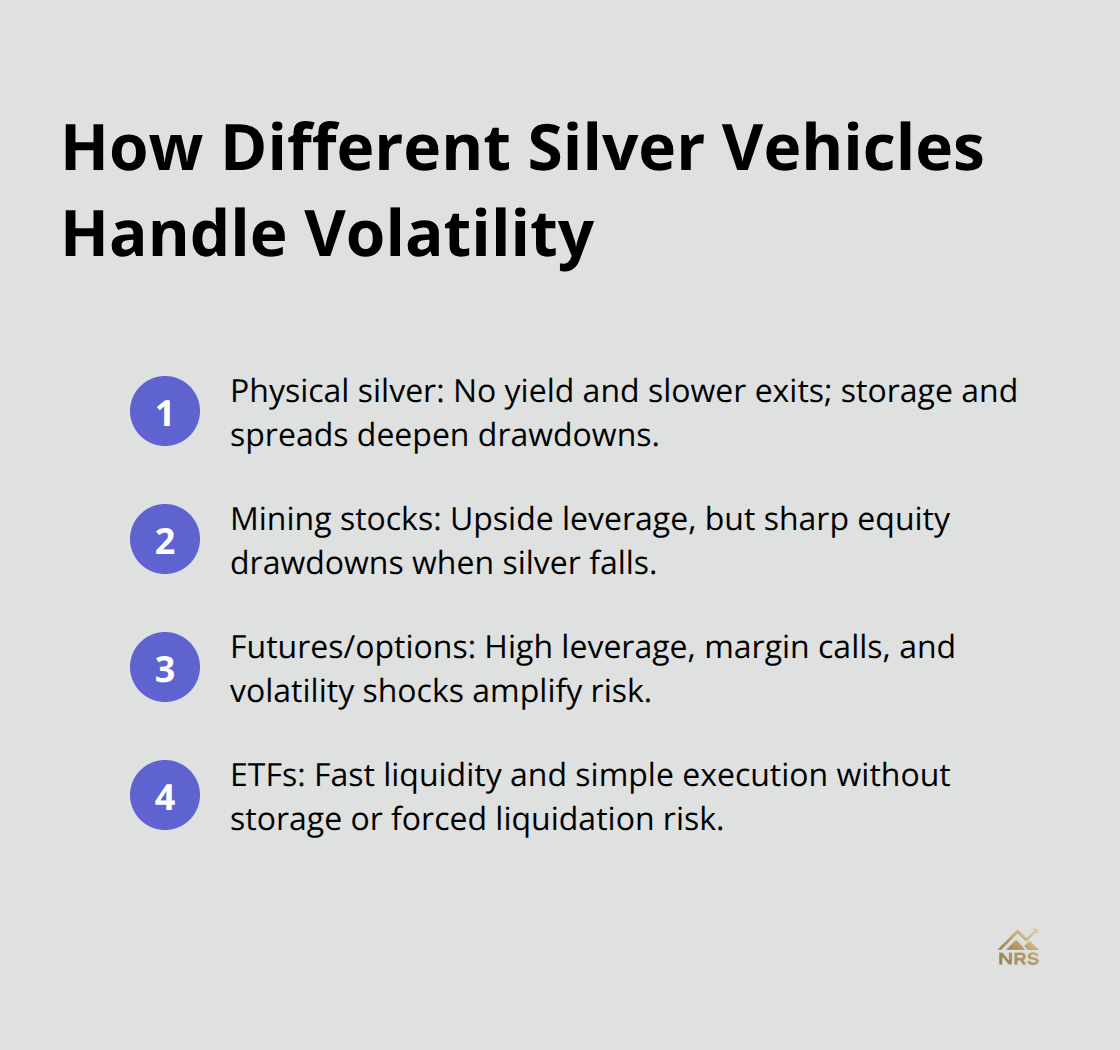

How Silver Price Volatility Hits Your Wallet Differently

Physical silver holders absorb losses with no income buffer

Physical silver holders face a straightforward but brutal reality: price swings erode or boost your purchasing power without any mechanism to offset losses. Unlike dividend-paying stocks, silver generates zero income while you hold it, so your only return comes from price appreciation. The sharp 10 percent single-day drops that occur during macro shocks hit hardest for physical holders because you cannot exit quickly without accepting dealer spreads and storage costs that further reduce your net proceeds.

Storage fees compound losses during downturns-vault storage typically costs 0.5 to 1 percent annually, which means a 10 percent price decline costs you more than a year of storage fees in a single trading session. Set a hard stop-loss price before you buy physical silver, and exit ruthlessly when that level breaks. The January 2026 volatility proved that waiting for a recovery costs more than accepting a loss early. Track the U.S. dollar index weekly because silver weakness almost always precedes dollar strength by days, giving you a leading signal to reduce exposure before sharp drawdowns hit.

Mining stock investors experience amplified swings in both directions

Silver mining stock investors face the opposite problem: amplified gains and amplified losses. When silver rises in value, well-capitalized silver miners like First Majestic Silver often experience larger percentage gains because their profit margins expand dramatically with higher metal prices. Conversely, a decline in silver can trigger significant drawdowns in mining stocks because fixed costs remain constant while revenue collapses. This leverage works against you just as powerfully as it works for you.

The practical implication is clear: mining stocks amplify volatility in both directions, which means you need tighter position sizing and faster exit discipline than physical silver holders require. A 5 percent move in silver can wipe out months of gains in a mining equity position if you hold through a sharp reversal. Try using trailing stop-loss orders set at 15 to 20 percent below recent highs to capture upside while protecting against sudden reversals.

Futures and options traders operate in a leverage-driven risk universe

Futures and options traders operate in an entirely different risk universe where leverage magnifies both scenarios beyond what physical or equity holders experience. A 5 percent move in the silver spot price translates to 20 to 50 percent swings in leveraged futures positions, and margin calls can force liquidation before any recovery occurs. Saxo Bank analysts warned in early 2026 that silver would continue trading violently in both directions, which means options traders face gamma risk where implied volatility spikes can wipe out positions regardless of directional moves.

If you trade futures or options, position size ruthlessly small and use hard stops at 2 to 3 percent of your account risk per trade. The practical reality is that most retail traders lose money in silver derivatives during periods like 2025–2026 when volatility exceeds 60 percent annualized. Stick to physical silver, mining equities, or silver ETFs like SLV or DBS unless you have documented experience with leverage and systematic risk management.

Silver ETFs offer middle ground between liquidity and simplicity

Silver ETFs provide an alternative that avoids both the storage costs of physical silver and the leverage risks of futures contracts. These funds (SLV and DBS being the most widely traded) track spot silver prices and allow you to exit positions within seconds during market hours without dealer spreads. You still absorb price volatility, but you eliminate counterparty risk associated with physical storage and avoid the forced liquidations that plague leveraged traders. ETFs work best for investors who want silver exposure without the operational complexity of vault storage or the discipline required for derivatives trading.

Now that you understand how volatility hits different investor types, the next section reveals specific strategies that help you navigate these swings and protect your capital across all three approaches.

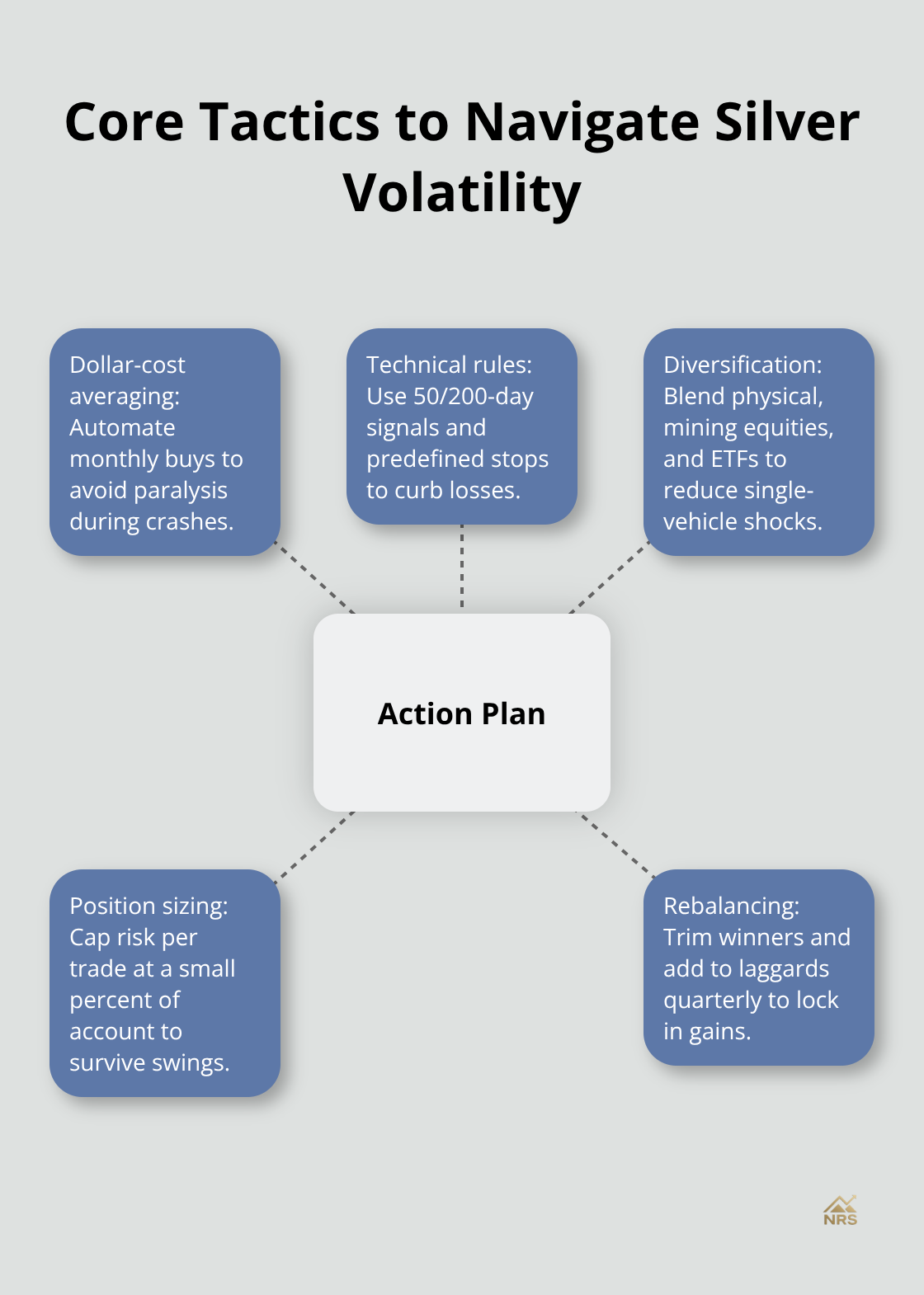

Strategies to Navigate Silver Price Volatility

Dollar-cost averaging removes emotion from entry decisions

Timing silver’s peaks and troughs is impossible, which means you need a mechanical system that removes emotion from entry decisions. Dollar-cost averaging works brutally well for silver because it forces you to buy more when prices crash and less when they spike. Set a fixed dollar amount-say $500 or $1,000 per month-and execute that purchase regardless of price direction. This approach eliminates the paralysis that kills most investors during sharp declines. When silver dropped 10 percent in a single day in late January 2026, most holders froze.

Dollar-cost averaging investors kept buying at lower prices and captured the subsequent 7 percent rally that followed within days.

The math works in your favor over time because you accumulate more ounces during crashes and fewer during peaks, which naturally lowers your average cost basis. Execute purchases through silver ETFs like SLV or DBS rather than physical bullion because transaction costs disappear and you avoid dealer spreads that can eat 2 to 5 percent of your capital. Set up automatic monthly transfers to eliminate the temptation to skip purchases during market weakness.

Technical analysis identifies predictable entry and exit points

Technical analysis works for silver specifically because the metal trades on predictable patterns tied to support and resistance levels established by institutional positioning. The $70 to $75 per ounce range held multiple times during 2025 before the late-year surge, which means traders who recognized those zones had clear entry and exit targets. Use the 50-day and 200-day moving averages as your primary guides-when spot silver closes above the 200-day average, you have confirmation of uptrend strength, and when it falls below the 50-day, sharp reversals typically follow within 3 to 5 trading sessions.

Set hard exit rules before you enter any position: if silver breaks below your identified support level by 2 percent, liquidate immediately rather than waiting for recovery. This discipline separates profitable traders from account-bleeders. The practical reality is that most investors who abandon their technical rules during volatility spikes lose far more than those who stick to predetermined levels.

Diversification across three silver vehicles protects against concentrated losses

Diversification across physical silver, mining stocks, and ETFs protects you because these three vehicles respond differently to volatility spikes. Physical silver holds value but costs money to store. Mining stocks amplify moves but offer leverage to the upside. ETFs provide liquidity without storage friction. Holding 40 percent in physical, 30 percent in a diversified silver mining ETF, and 30 percent in spot-tracking ETFs means no single volatility shock destroys your position.

Rebalance quarterly when allocations drift by more than 5 percent to lock in gains and force yourself to buy weakness automatically. This mechanical approach prevents you from chasing performance during rallies or abandoning positions during crashes. The three-part allocation structure (physical, mining equities, and ETFs) ensures that sharp moves in any single vehicle cannot wipe out your entire silver exposure.

Final Thoughts

Silver price volatility creates opportunity for disciplined investors and destroys capital for those who chase performance or abandon positions during sharp reversals. Industrial demand from solar and EV sectors establishes baseline support, geopolitical shocks trigger sudden spikes, and Federal Reserve decisions move silver far more than supply-demand fundamentals in the short term. Your investment approach must match your tolerance for these swings-physical silver holders need ruthless stop-loss discipline, mining stock investors require tighter position sizing, and futures traders operate in a universe where margin calls force liquidation before recovery occurs.

Mechanical strategies outperform emotional reactions every time. Dollar-cost averaging removes the paralysis that kills investors during crashes, technical analysis using moving averages provides predetermined exit rules before volatility hits, and diversification across physical silver, mining equities, and ETFs ensures no single shock destroys your entire position. Silver will remain volatile because it serves dual roles as both a precious metal and an industrial commodity, which means investors who stick to predetermined rules consistently outperform those who react to price swings.

Your next step is simple: choose one strategy and execute it mechanically by setting your position size and establishing your stop-loss levels. Visit Natural Resource Stocks for detailed commentary on geopolitical impacts, macroeconomic factors, and emerging opportunities in resource markets. Silver’s volatility will test your resolve, but discipline separates winners from account-bleeders.