Vizsla Silver has captured investor attention as silver prices show renewed strength in 2024. The mining company’s stock performance reflects both sector-wide momentum and company-specific developments.

We at Natural Resource Stocks analyze the key factors shaping this Vizsla Silver stock forecast. Market fundamentals, operational progress, and risk factors will determine the investment outlook ahead.

How Has Vizsla Silver Stock Performed Recently

Stock Performance Dominates Silver Sector

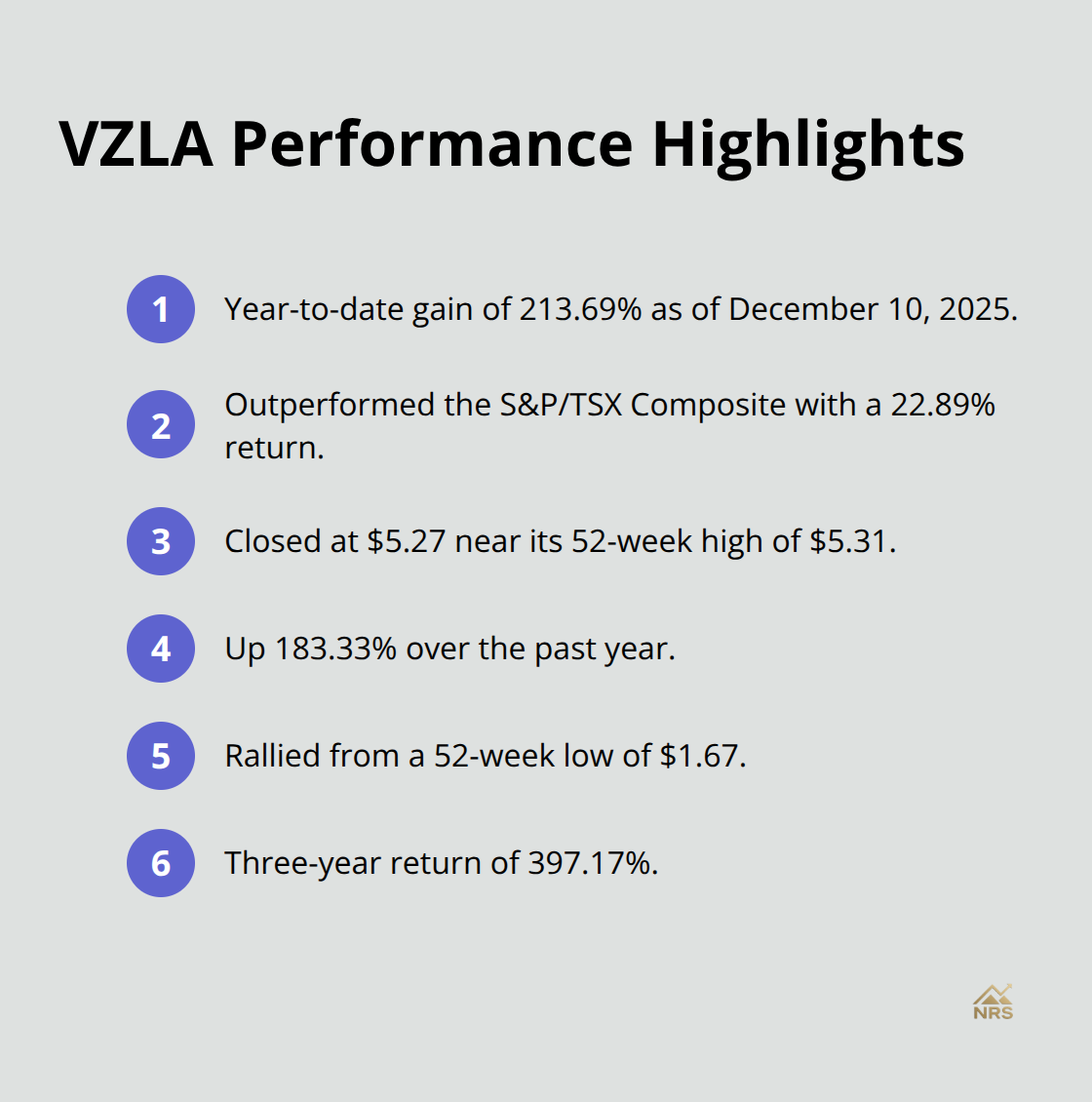

Vizsla Silver stock has delivered exceptional returns with a year-to-date gain of 213.69% as of December 10, 2025. The stock significantly outperformed the S&P/TSX Composite index return of 22.89%. VZLA closed at $5.27, which trades near its 52-week high of $5.31 and represents a massive 183.33% increase over the past year.

This performance places VZLA among the top performers in the mining sector. Shares rose from a 52-week low of $1.67, demonstrating remarkable price appreciation. The company’s three-year return of 397.17% shows sustained investor confidence in its silver development strategy and positions it well above broader market returns.

Financial Metrics Reflect Development Stage

VZLA currently reports negative earnings per share of -$0.04, which reflects its pre-production development status rather than operational weakness. The company maintains a robust market capitalization of $1.81 billion with an enterprise value of $1.59 billion. This valuation indicates strong institutional backing despite the current lack of revenue generation.

Recent quarterly estimates show EPS of -$0.01 for the current quarter. Revenue projections for 2026 average $205.9 million, with high estimates reaching $823.6 million. These forecasts depend heavily on successful project development and commodity price assumptions.

Production Capacity Shows Strong Economics

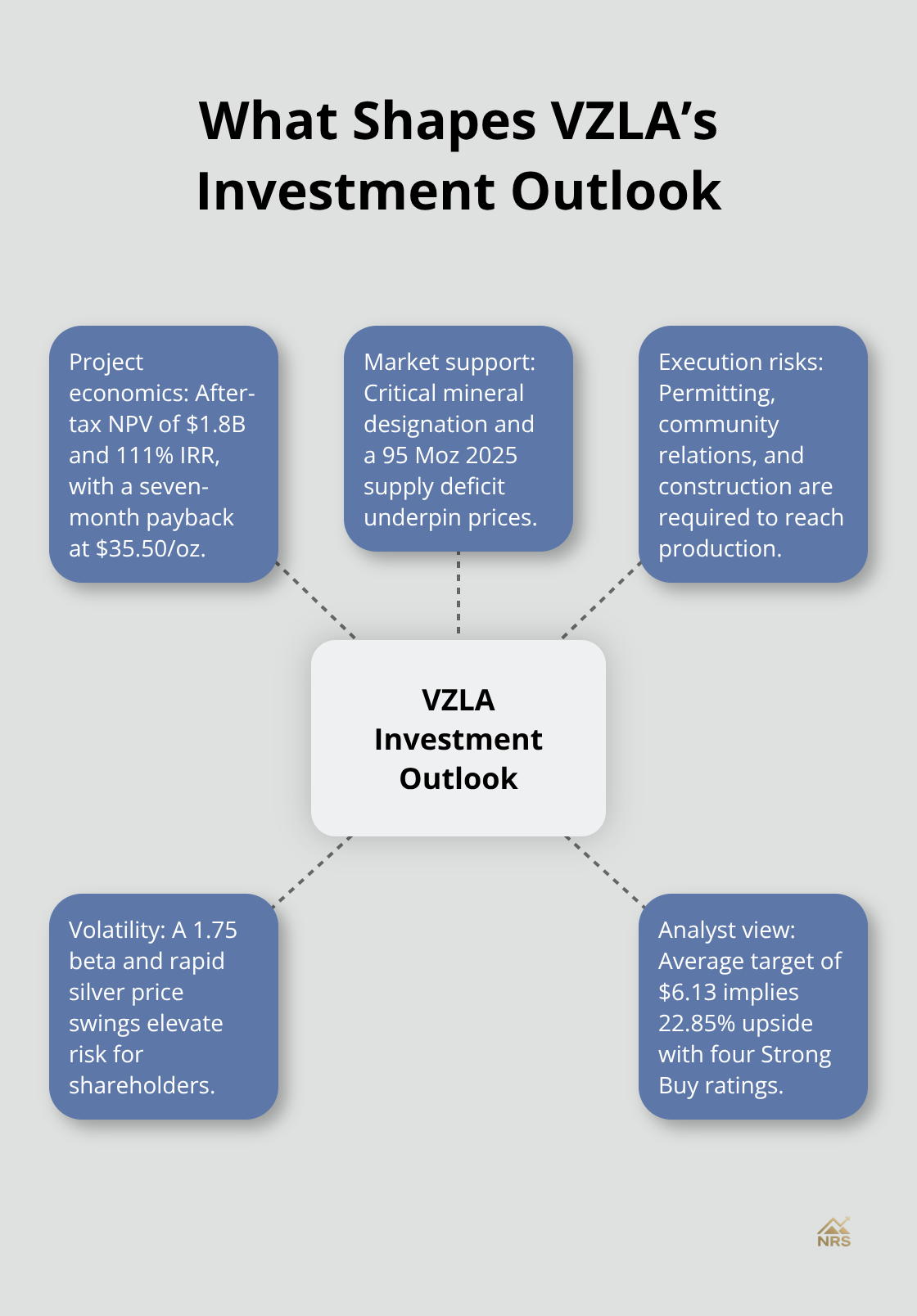

The Panuco Project feasibility study reveals annual production capacity of 17.4 million ounces of silver equivalent over 9.4 years. The project boasts an after-tax NPV of $1.8 billion and an exceptional internal rate of return of 111%. The seven-month payback period (assuming silver prices of $35.50 per ounce) positions VZLA for rapid profitability once production begins.

These metrics demonstrate the project’s economic viability under current market conditions. However, actual performance will depend on successful execution of development plans and favorable commodity pricing throughout the mine life. The transition from development to production represents the next critical phase for investor returns.

What Drives Vizsla Silver Forward

Silver Market Fundamentals Support Strong Outlook

Silver reached a record high of $54.48 on October 17, 2025, with a remarkable 67% year-to-date gain through November. This performance surpassed both gold’s 52% rise and the S&P 500’s 14% increase during the same period. Investment demand has strengthened significantly due to macroeconomic uncertainties, with exchange-traded product holdings up 18% and a 187 million ounce increase.

The U.S. government officially designated silver as a critical mineral, which enhances its investment appeal. The gold-to-silver ratio dropped to 78, which indicates institutional preference for silver over gold. The silver market continues to face supply-demand imbalances, with market conditions reflecting ongoing structural challenges and an estimated 95 million ounce shortfall in 2025.

Panuco Project Development Positions Company for Production

Vizsla Silver employs a dual-track development approach that focuses on mine advancement and district-scale exploration at the Panuco Project in Sinaloa, Mexico. The project spans over 7,189 hectares and requires completion of detailed engineering and financial arrangements before construction begins. Silver production has shown strong growth in Q3-2025, with approximately 325,000 ounces produced compared to 192,000 ounces in the previous quarter, creating favorable market conditions.

The company targets resource expansion through infill drilling and upgrades of inferred resources to higher categories. Operational recoveries and resumed projects across Mexico contributed to increased silver production, which indicates supportive regional infrastructure.

Regulatory and Community Factors Shape Timeline

Permitting and community support remain essential prerequisites for advancement toward production. The company must maintain strong local relationships and regulatory compliance to meet development milestones. These operational risks and market volatility factors will determine whether VZLA can capitalize on current silver market strength.

What Are The Key Risks and Upside Potential

Operational Execution Presents Major Challenges

VZLA faces substantial operational risks that investors must evaluate carefully. The company must transition from feasibility study to actual production through successful permitting, community relations, and construction execution at the Panuco Project. Major mining projects experience cost overruns 75% of the time according to industry data. VZLA’s seven-month payback period assumes perfect execution and stable commodity prices, conditions that rarely align in practice.

Labor costs in Mexico have risen 15% annually, while regulatory changes typically delay projects by 12-18 months on average. The company operates with a beta of 1.75, which means VZLA stock moves with 75% more volatility than the broader market. Silver prices fell from $54.48 to current levels within weeks, which demonstrates the rapid price swings that impact mining stocks directly.

Supply Deficit Creates Price Support

Silver mine production has been decreasing, creating a structural supply shortage that supports higher prices. VZLA maintains all-in sustaining costs of $13.00 per ounce, which provides substantial margins at current silver prices above $30. The company’s 111% internal rate of return offers exceptional upside potential if development proceeds smoothly.

Analyst price targets average $6.13, which suggests 22.85% upside potential from current levels. Four Wall Street analysts maintain Strong Buy ratings on VZLA stock. This institutional support provides stability during market turbulence and validates the investment thesis for patient investors.

Market Forces Shape Investment Outlook

Silver’s designation as a critical mineral by the U.S. government reduces regulatory risks while it increases strategic importance. The gold-silver ratio measures the amount of silver it takes to equal the value of an ounce of gold. Exchange-traded product holdings increased 18% in 2025, which demonstrates institutional demand that supports price stability.

Industrial demand faces headwinds from tariff policies, particularly as photovoltaic demand declined 5% year-over-year. However, the structural supply deficit and critical mineral status create a favorable backdrop for silver prices. VZLA benefits directly from these market dynamics through its high-grade silver project in Mexico.

Final Thoughts

The Vizsla Silver stock forecast shows compelling upside potential backed by exceptional project economics and favorable silver market conditions. VZLA’s 111% internal rate of return and seven-month payback period at the Panuco Project position the company for substantial returns once production begins. The structural silver deficit of 95 million ounces in 2025 and critical mineral designation provide strong price support.

Execution risks remain significant as the company transitions from feasibility study to production. The process requires successful permitting, community relations, and construction management (mining projects face cost overruns 75% of the time). VZLA’s 1.75 beta indicates high volatility exposure, while labor costs in Mexico rise and potential regulatory delays add operational uncertainty.

Analyst price targets average $6.13 and suggest 22.85% upside potential from current levels. The risk-reward profile favors patient investors who can withstand commodity price volatility. For comprehensive analysis of natural resource investment opportunities, explore Natural Resource Stocks for expert insights across metals and energy sectors.