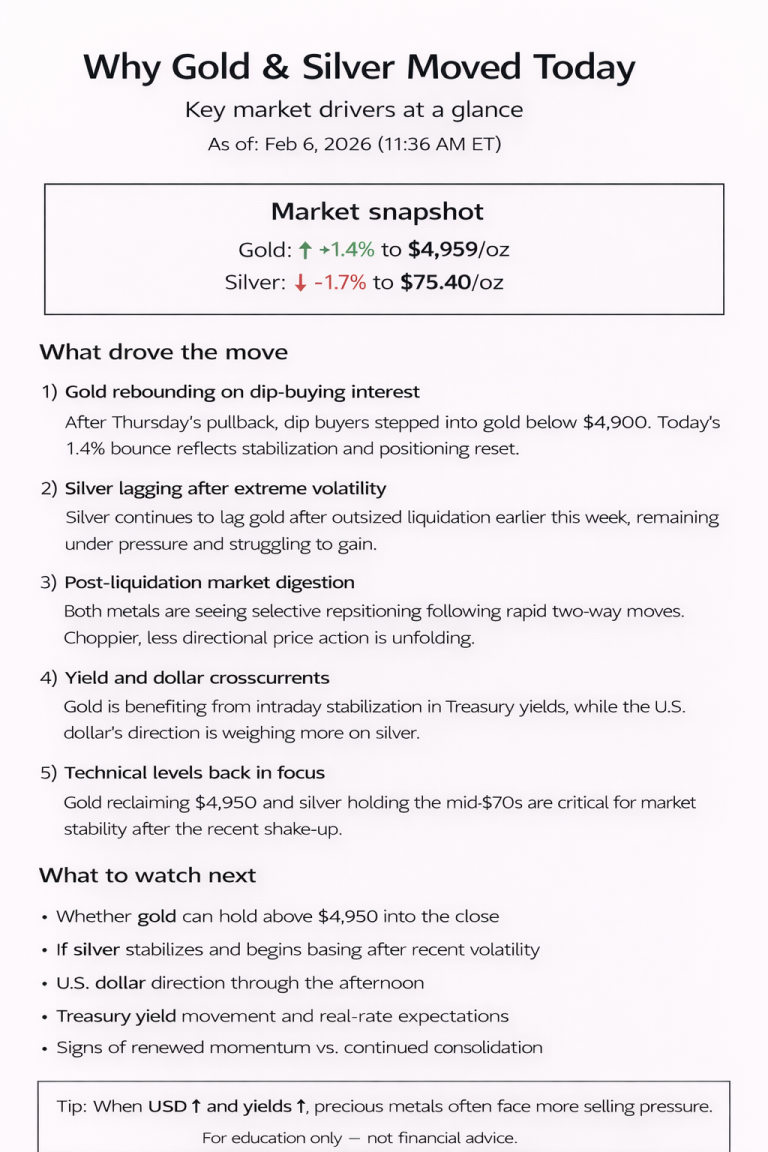

Gold and silver are showing a mixed recovery today following yesterday’s sharp selloff. By late morning in New York (around 11:36 AM ET), gold futures rebounded to $4,959/oz, up about 1.4% on the day, while silver futures slipped modestly to $75.40/oz, down roughly 1.7%, as the metals digest recent volatility. (COMEX pricing, Feb 6, 2026)

5 key drivers behind today’s move

1) Gold rebounding on dip-buying interest

After Thursday’s aggressive pullback, buyers stepped back into gold, viewing sub-$4,900 levels as attractive following the broader uptrend. Today’s bounce reflects dip-buying and stabilization, not a breakout, as the market reassesses positioning.

2) Silver lagging after extreme volatility

Silver remains under pressure after its outsized liquidation earlier this week. While prices are holding above recent lows, silver continues to lag gold, highlighting its higher sensitivity to momentum flows and speculative positioning.

3) Post-liquidation market digestion

Both metals are in a digestion phase after rapid moves in both directions. The market is transitioning from forced selling to more selective positioning, which often leads to choppier, less directional price action.

4) Yield and dollar crosscurrents

Treasury yields and the U.S. dollar remain key short-term drivers. Gold is benefiting from intraday stabilization in rates, while silver remains more exposed to shifts in broader risk sentiment and liquidity conditions.

5) Technical levels back in focus

Gold’s ability to reclaim the $4,950 area has eased immediate downside pressure. For silver, holding the mid-$70s zone is now critical as traders look for signs of stabilization after the recent washout.

What to watch next (quick checklist)

- Whether gold can hold above $4,950 into the close

- If silver stabilizes and begins basing after recent volatility

- U.S. dollar direction through the afternoon

- Treasury yield movement and real-rate expectations

- Signs of renewed momentum vs. continued consolidation

Bottom line

On Feb 6, 2026, gold is rebounding as dip buyers return after yesterday’s sharp selloff, while silver continues to consolidate following extreme volatility. Today’s action reflects stabilization and positioning reset — not a return to runaway momentum, but not a breakdown either.