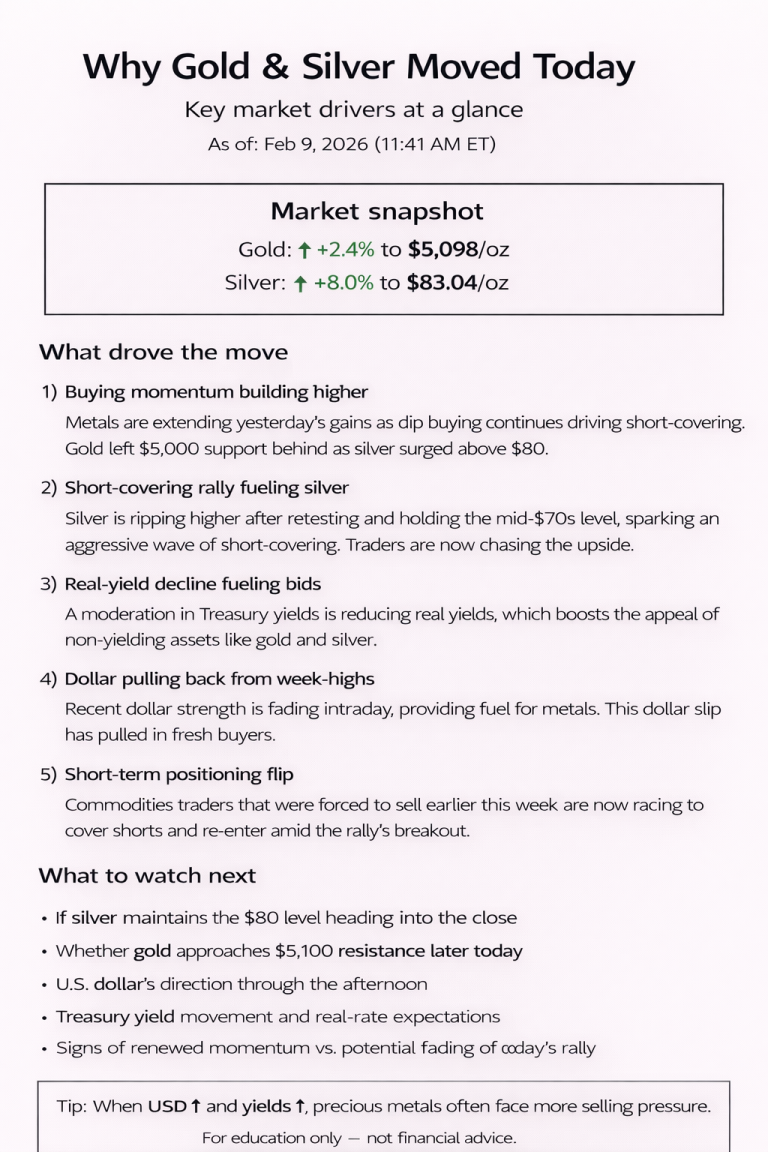

Gold and silver are surging sharply higher today as precious metals regain upside momentum following last week’s volatility. By late morning in New York (around 11:41 AM ET), gold futures jumped to $5,098/oz, up roughly 2.4% on the day, while silver futures rallied to $83.04/oz, gaining about 8.0%, as buyers stepped back in aggressively. (COMEX pricing, Feb 9, 2026)

5 key drivers behind today’s move

1) Momentum buying accelerating higher

Gold and silver are extending last week’s rebound as momentum shifts decisively back to the upside. Gold has reclaimed the $5,000 level, while silver has surged back above $80, triggering fresh buying from traders who were previously sidelined.

2) Short-covering fueling silver’s outsized move

Silver’s sharp rally reflects aggressive short-covering after last week’s liquidation. Once prices held the mid-$70s support zone, sellers were forced to cover, amplifying today’s upside move and pushing silver higher at a much faster pace than gold.

3) Post-volatility positioning reset

After extreme two-way price action last week, markets are transitioning out of liquidation mode. Today’s rally suggests a positioning reset, with traders re-entering metals after forced selling cleared out weaker hands.

4) Real-yield and dollar tailwinds

A moderation in Treasury yields and a pullback in the U.S. dollar are supporting precious metals. Lower real yields improve the appeal of non-yielding assets like gold and silver, while a softer dollar provides additional upside pressure.

5) Key technical levels back in play

Gold’s push back above $5,000 has restored bullish technical momentum, while silver reclaiming the low-$80s shifts focus back to higher resistance levels. These technical breakouts are reinforcing today’s buying interest.

What to watch next (quick checklist)

- Whether gold can hold above $5,000 into the close

- If silver maintains strength above the $80 level

- U.S. dollar direction through the afternoon

- Treasury yield movement and real-rate expectations

- Signs of follow-through buying vs. profit-taking after today’s surge

Bottom line

On Feb 9, 2026, gold and silver are rallying strongly as momentum returns, short-covering accelerates — especially in silver — and macro tailwinds align. Today’s action reflects renewed upside participation after last week’s volatility, not a one-day anomaly, but a market reasserting trend strength.