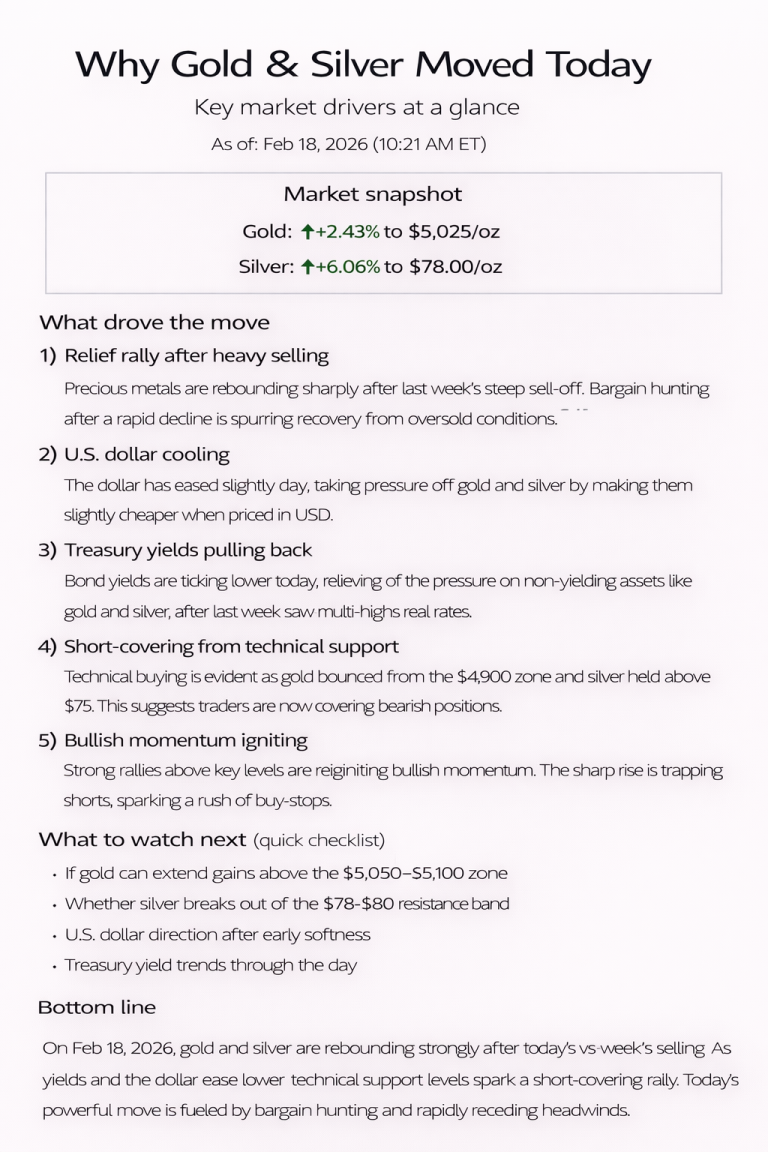

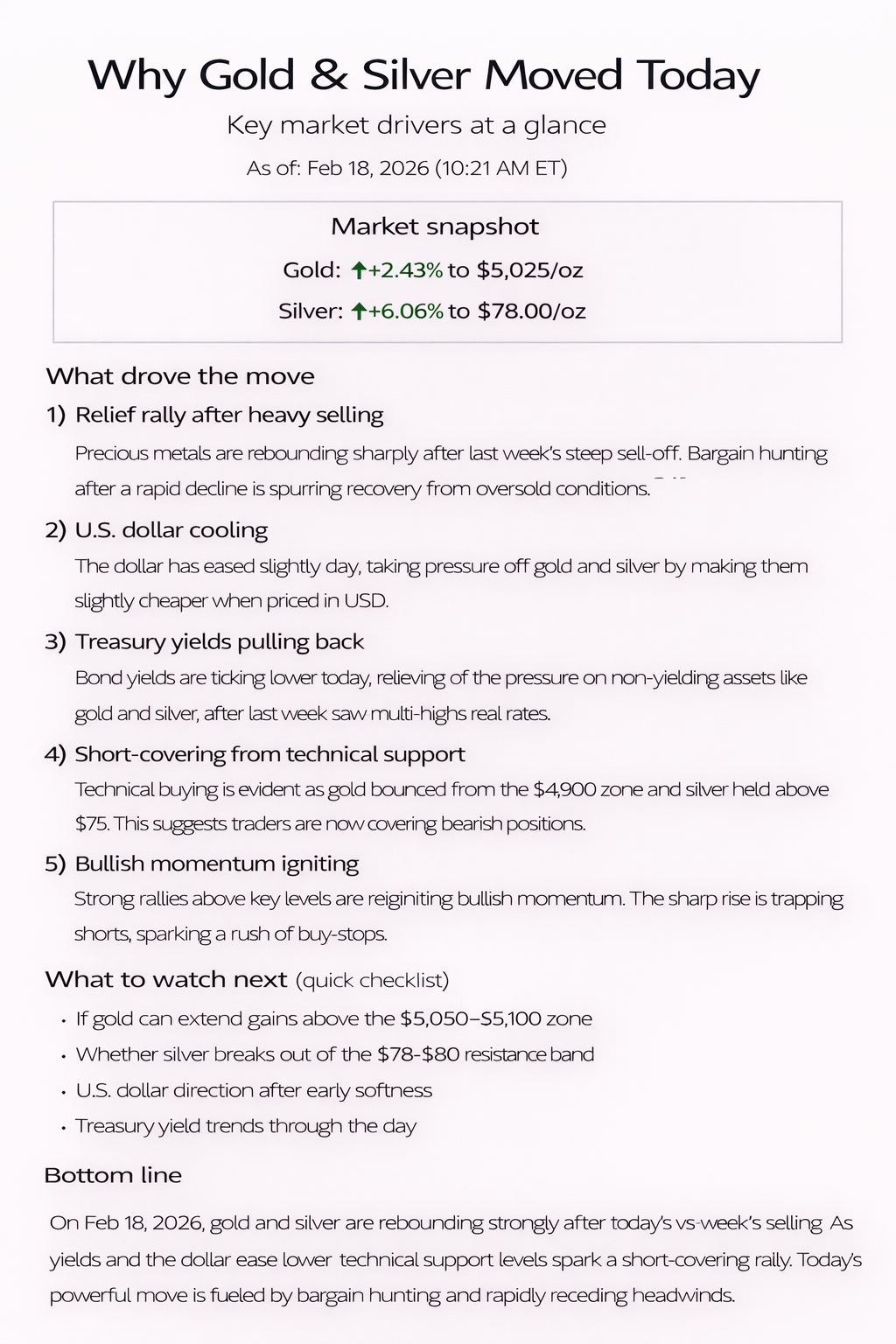

Gold and silver are sharply higher today as buyers step back into the precious metals space following last week’s aggressive liquidation. As of late morning in New York (10:21 AM ET), gold futures are trading at $5,025/oz, up 2.43%, while silver futures have surged to $78.00/oz, up 6.06%. (COMEX pricing, Feb 18, 2026)

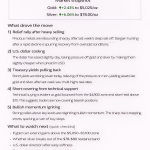

5 key drivers behind today’s move

1) Relief rally after heavy selling

Both metals were deeply oversold after recent downside momentum. Today’s move reflects bargain hunting and a natural rebound after sharp, fast liquidation earlier in the week.

2) Pullback in Treasury yields

Yields have eased slightly, reducing the opportunity cost of holding non-yielding assets like gold and silver. Lower real-rate pressure is giving metals room to recover.

3) U.S. dollar softening

A modest cooling in the dollar is providing additional support. A weaker USD tends to lift commodities priced in dollars, including precious metals.

4) Technical bounce from key support levels

Gold held near the $4,900 zone and pushed back above $5,000, while silver rebounded strongly off the low-$70s. These technical holds triggered short-covering and fresh momentum buying.

5) Silver’s amplified upside

As usual, silver is outperforming gold on the rebound. With thinner liquidity and more speculative positioning, silver’s upside move is accelerating faster than gold’s percentage gain.

What to watch next (quick checklist)

- Whether gold can extend above the $5,050–$5,100 resistance zone

- If silver can sustain momentum toward the $80 level

- U.S. dollar direction into the afternoon

- Treasury yield and real-rate movement

- Signs of follow-through buying vs. profit-taking

Bottom line

On Feb 18, 2026, gold and silver are staging a strong rebound driven by easing yields, a softer dollar, and technical short-covering. Today’s rally reflects a positioning reset after heavy selling — not a new macro shock, but a momentum-driven recovery as buyers re-engage key support levels.