The quick read: what happened today?

Platinum and palladium are modestly higher so far today, bouncing as markets juggle a risk-off macro tape with fresh geopolitical nerves. Energy and FX volatility (and what that implies for inflation and rates) is the big “today” driver, while PGM-specific supply/demand themes remain the background fuel.

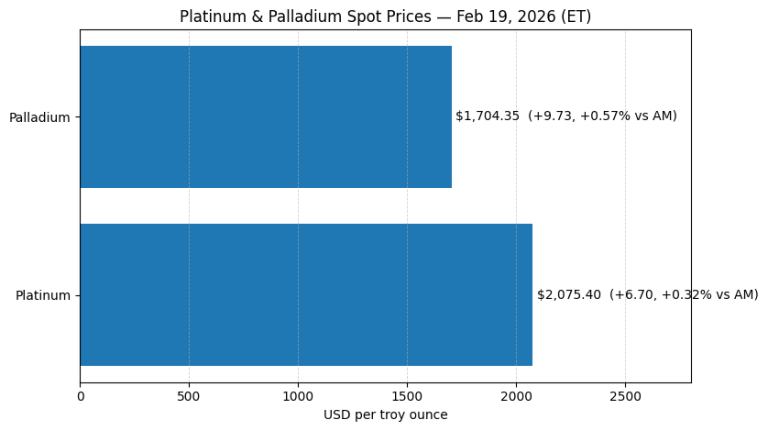

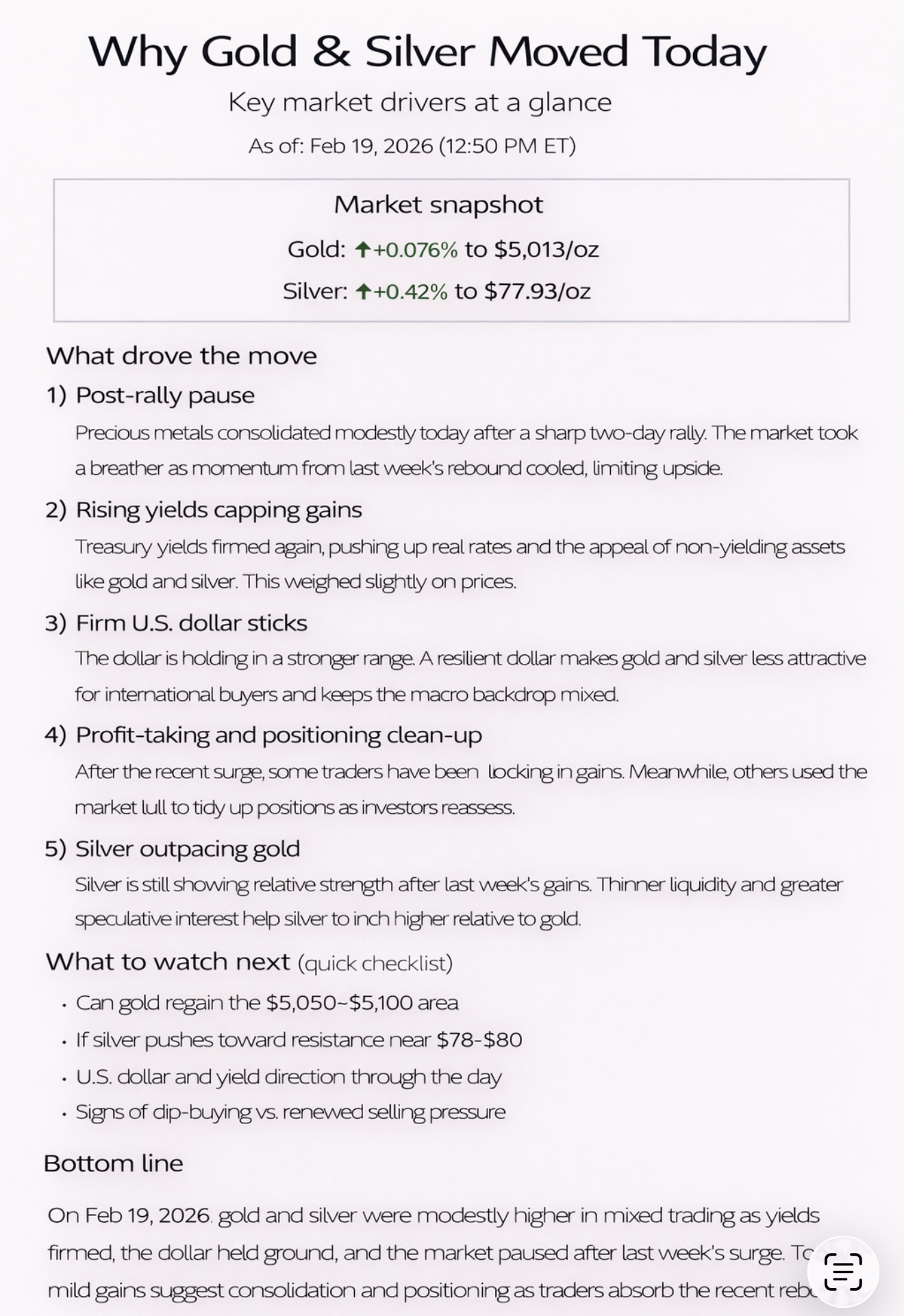

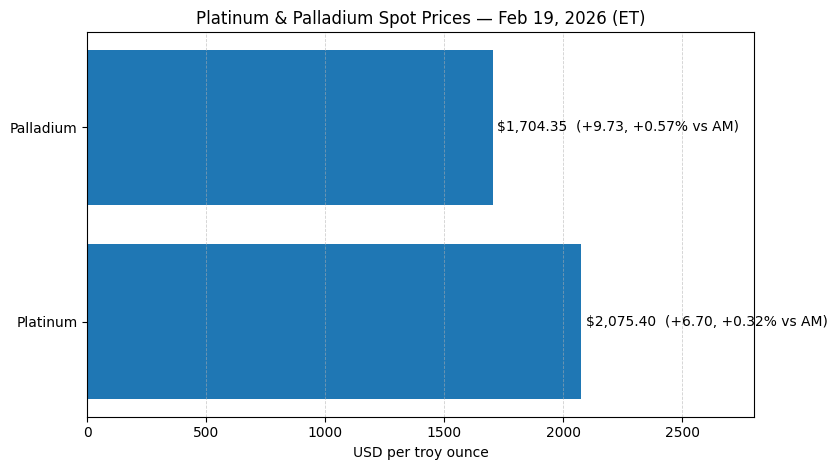

Today’s spot snapshot (USD/oz, ET)

- Platinum:$2,075.40/oz (JM Bullion “as of Feb 19, 2026 at 12:18 PM ET”).

- Earlier snapshot: $2,068.70 (8:07 AM ET) → +$6.70 (+0.32%) so far today.

- Palladium:$1,704.35/oz (JM Bullion “as of Feb 19, 2026 at 12:52 PM ET”).

- Earlier snapshot: $1,694.62 (9:03 AM ET) → +$9.73 (+0.57%) so far today.

6 reasons platinum and palladium are firmer today

1) Geopolitical risk is lifting the “precious” bid

Markets are trading with elevated anxiety around the possibility of a U.S. strike on Iran, and that’s feeding into broader haven demand dynamics (even as risk assets wobble).

2) Oil’s jump is stoking inflation (and rate) nerves

Oil has been moving sharply on the same geopolitical thread, and that can spill into metals via inflation expectations and cross-asset hedging flows.

3) After yesterday’s holiday/liquidity distortion, the tape is “normalizing”

This week’s metals action has been amplified by reduced liquidity from China around Lunar New Year, which can exaggerate selloffs and rebounds—today’s grind higher fits that “liquidity hangover” pattern.

4) Platinum is still trading a tightness narrative under the hood

Even when the daily move is macro-driven, platinum continues to be framed around supply constraints and higher-cost production dynamics—helping dips attract buyers.

5) Palladium remains headline-sensitive and prone to quick swings

Palladium’s volatility is a feature, not a bug—small shifts in risk tone or liquidity can translate into noticeable moves, especially intraday.

6) “Intraday bid” rather than a trend change (so far)

Today’s gains are modest (sub-1% from the morning snapshots), which reads more like stabilization than a full trend reversal after the recent drawdown.

Bottom line

As of early afternoon Feb 19, 2026 (ET), platinum is ~$2,075/oz (+0.32% vs AM) and palladium is ~$1,704/oz (+0.57% vs AM).

Today’s motion is being driven mainly by geopolitics → oil → macro volatility, with PGM supply/demand themes providing the longer-term undertow.