Gold prices surged 27% in 2024, reaching record highs above $2,700 per ounce. Central banks added 800 tons to their reserves while geopolitical tensions drove unprecedented safe-haven demand.

We at Natural Resource Stocks see 2025 as a pivotal year for precious metals investors. Multiple economic factors point toward continued gold strength, but timing and strategy will determine your returns.

What’s Driving Gold’s Historic Rally?

Record-Breaking Price Performance

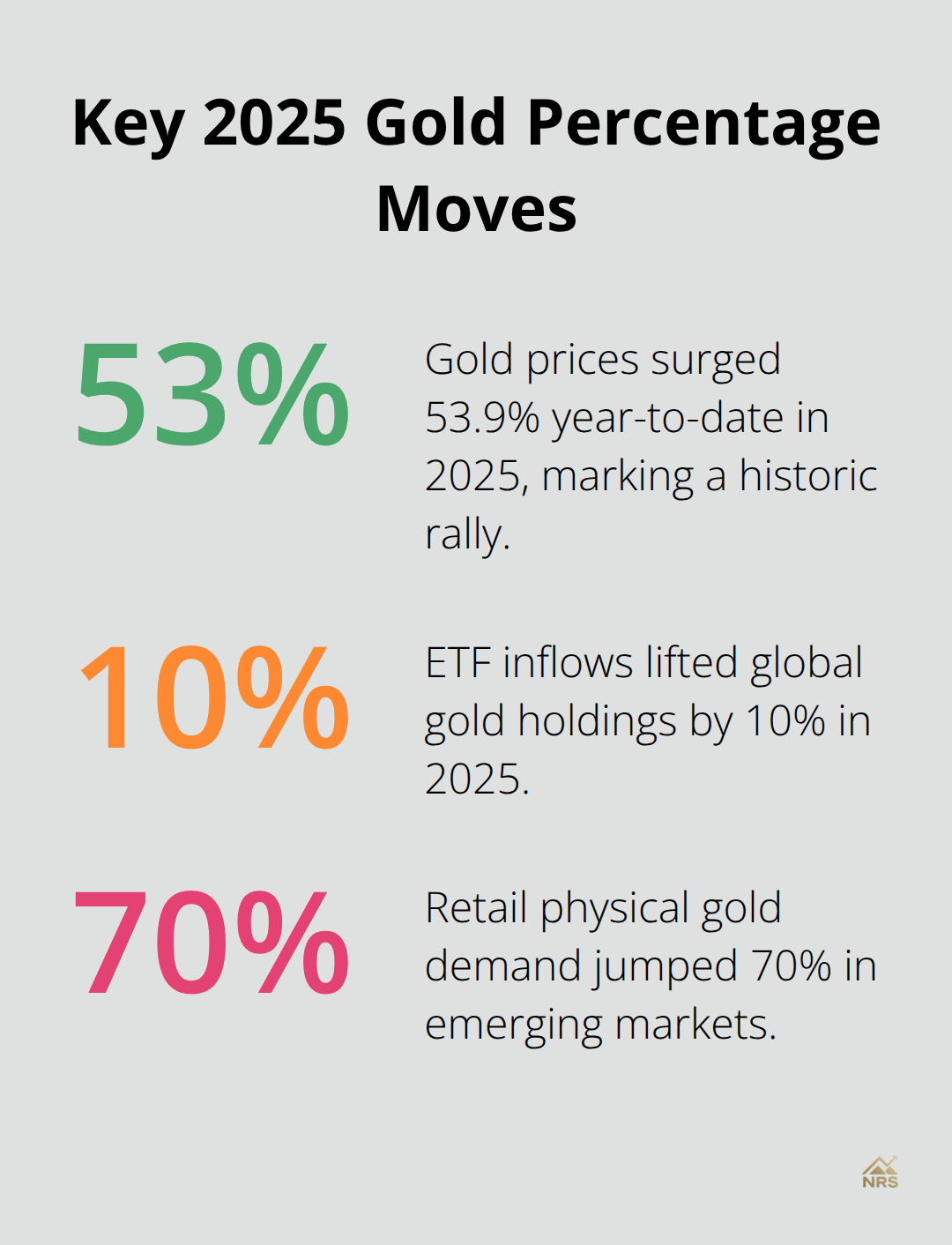

Gold shattered expectations in 2025, with prices that soared 53.9% and reached peaks near $4,400 per ounce in October before prices stabilized below $4,000. This performance dwarfs previous years and signals a fundamental shift in precious metals markets. Morgan Stanley projects prices could hit $4,500 per ounce by mid-2026, while Goldman Sachs sets an even more aggressive target of $4,900 by end-2026. The 10-year Treasury yield dropped from 4.77% to 4.14%, which created favorable conditions for non-yielding assets like gold.

Central Bank Accumulation Accelerates

Central banks purchased 64 tonnes in September 2025 alone, with Qatar that added 20 tonnes, China 15 tonnes, and Oman 7 tonnes. Goldman Sachs expects monthly purchases to average 80 tonnes through early 2026. The share of gold in official reserves jumped from 15% in 2023 to nearly 20% by 2024 (representing the fastest accumulation in decades). This purchase spree reflects de-dollarization trends and concerns over asset seizures amid geopolitical tensions.

Supply Constraints Meet Explosive Demand

Annual gold supply remains constrained at approximately 5,000 tonnes from mines and recycled sources, while demand has exploded across all sectors. ETF inflows reached 310 tonnes year-to-date in 2025, which represents a 10% increase in global holdings. The U.S. unemployment rate climbed to 4.3% and 1.1 million announced layoffs created additional safe-haven demand. Major new discoveries remain absent and existing operations face higher costs, so supply-demand imbalances will likely persist through 2025.

These market fundamentals create the foundation for gold’s continued strength, but specific economic policies and global events will determine how investors can best position themselves for the opportunities ahead.

What Economic Forces Shape Gold’s 2025 Trajectory

Federal Reserve Policy Creates Primary Price Driver

The Federal Reserve’s monetary policy shifts create the most significant catalyst for gold’s 2025 performance. Interest rates dropped by a quarter percentage point as unemployment reached 4.3% in August, with the Fed under pressure to support weak job markets. The U.S. Dollar Index fell from 109 to 99.5, which made gold 10% cheaper for international buyers and drove immediate demand spikes. Treasury yields will likely decline further given economic headwinds, and gold becomes more attractive than bonds that offer diminished real returns. J.P. Morgan Research forecasts gold will average $3,675 per ounce by Q4 2025, with rates that stay accommodative through 2026.

Geopolitical Tensions Fuel Safe-Haven Flows

Trade wars and international sanctions accelerate gold accumulation as nations seek alternatives to dollar-denominated assets. Countries like Poland, Turkey, and India lead central bank purchases because they want protection from potential asset seizures. Morgan Stanley notes that geopolitical events significantly influence both institutional and retail investor sentiment, with ETF inflows that hit 112 tonnes in a single month during peak tensions. The correlation between global instability and gold prices remains strong, with each major conflict or trade dispute that adds $50-100 per ounce to spot prices. Physical gold demand from retail investors surged 70% in emerging markets (particularly China) as citizens hedge against currency devaluation risks.

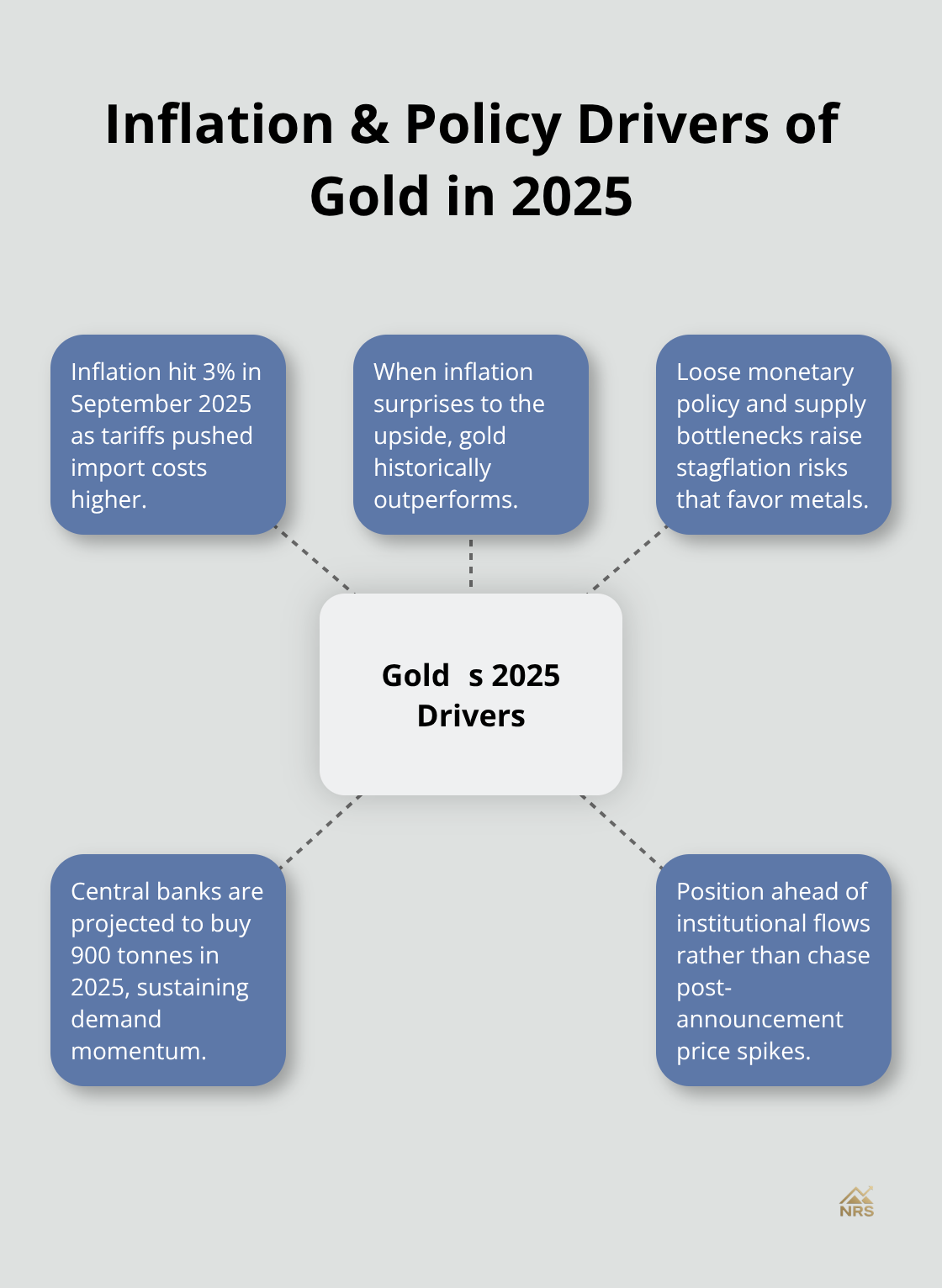

Inflation Pressures Drive Defensive Positions

Inflation rose to 3% in September 2025, fueled by tariff policies that increase import costs across multiple sectors. Historical data shows gold performs exceptionally when inflation surprises to the upside, which current economic conditions suggest will continue. The combination of loose monetary policy and supply chain disruptions creates stagflation risks that favor precious metals over traditional assets.

Central banks understand this dynamic and maintain aggressive purchase schedules, with Goldman Sachs that projects 900 tonnes in total 2025 purchases. Smart investors position themselves ahead of these institutional flows rather than chase prices after major announcements.

These economic forces create multiple pathways for gold appreciation, but investors need specific strategies to capitalize on these trends while managing portfolio risk effectively.

Which Gold Investment Strategy Maximizes Returns

Physical Gold Versus Paper Assets

Physical gold ownership provides maximum price exposure but requires storage costs that average $200-400 annually per $100,000 invested and insurance fees of 0.5-1% yearly. Gold bars offer the lowest premiums at 2-3% above spot price, while coins carry 5-8% premiums. The SPDR Gold Shares ETF remains the most liquid alternative with a 0.40% expense ratio and $60 billion in assets under management.

Mining stocks like Newmont and Barrick Gold typically lag spot gold prices by 20-30% during rallies but offer leverage during major bull runs. Physical gold works best for core positions while ETFs serve tactical trades effectively.

Portfolio Allocation Based on Risk Tolerance

Conservative investors should allocate 5-10% to gold through ETFs like GLD or physical bullion stored in allocated accounts. Moderate risk profiles can increase allocation to 15-20% with a 70-30 split between physical gold and mining stocks. Aggressive investors might reach 25-30% allocation through leveraged gold miners and junior exploration companies.

Strategic allocation maximizes risk-adjusted returns by combining precious metals exposure with proper diversification across asset classes.

Market Timing Indicators

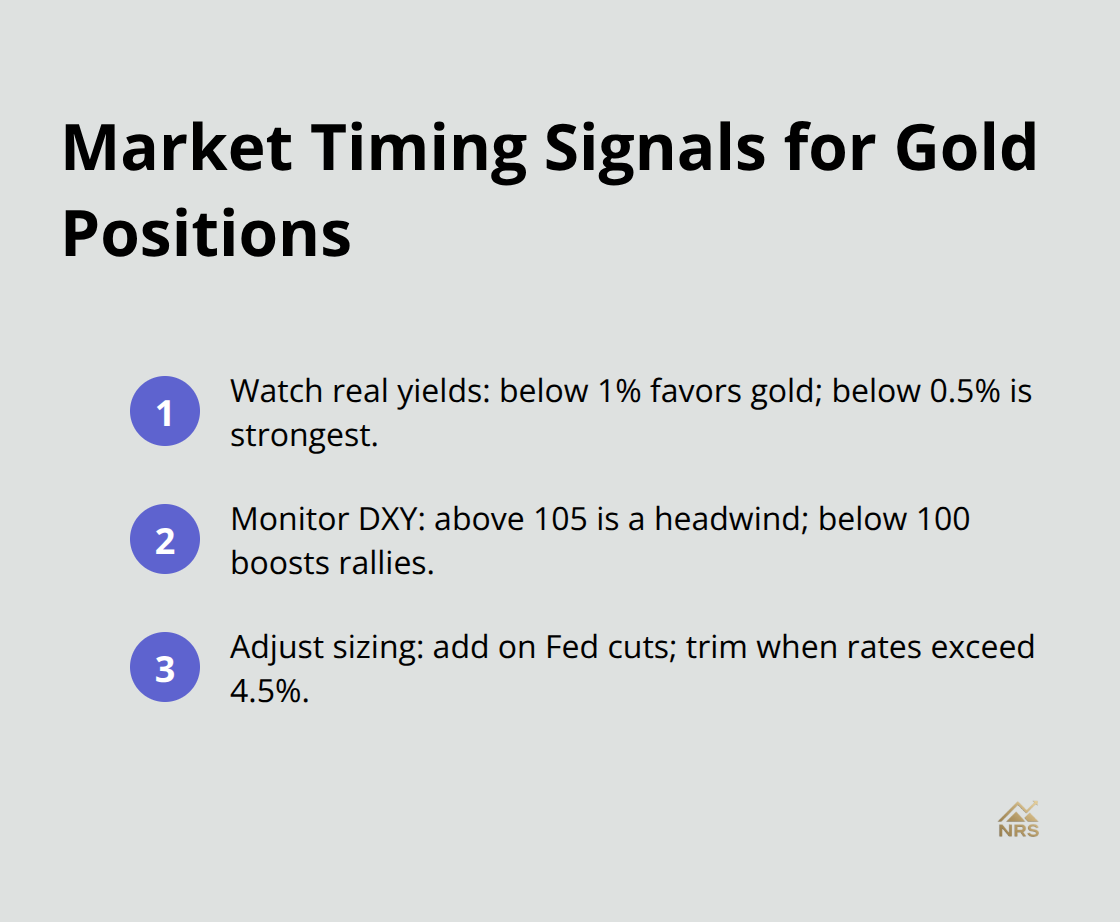

The key signal comes from real yields – when 10-year Treasury yields minus inflation expectations drop below 1%, gold typically outperforms. Current real yields suggest limited upside until they fall below 0.5%.

Dollar strength above 105 on the DXY index creates headwinds, while readings below 100 accelerate gold appreciation (current levels at 99.5 favor continued strength). Position sizing should increase during Federal Reserve rate cuts and decrease when rates rise above 4.5%.

ETF Selection Criteria

Gold ETFs vary significantly in structure and costs. SPDR Gold Shares (GLD) tracks spot prices directly with minimal tracking error. iShares Gold Trust (IAU) offers lower fees at 0.25% but less liquidity. VanEck Vectors Gold Miners ETF (GDX) provides exposure to mining companies with higher volatility but greater upside potential during bull markets.

Final Thoughts

The gold investment outlook for 2025 shows exceptional promise with Goldman Sachs that targets $4,900 per ounce by end-2026 and Morgan Stanley that projects $4,500 by mid-2026. Central banks will purchase 80 tonnes monthly through early 2026, which creates sustained demand pressure against constrained supply. Federal Reserve rate cuts and weakening dollar trends support entry points below $4,000 per ounce with attractive risk-reward ratios.

Investors should establish 5-25% gold allocation based on risk tolerance and combine physical bullion with ETFs like GLD for optimal exposure. Real yields below 1% signal favorable conditions for precious metals outperformance against traditional assets. Gold serves as portfolio insurance against inflation, currency devaluation, and geopolitical instability that threatens financial markets.

The structural shift toward de-dollarization ensures long-term demand from institutional buyers across global markets. We at Natural Resource Stocks recommend that investors position ahead of these trends rather than chase momentum after major price moves. Natural Resource Stocks provides expert analysis and market insights to help investors navigate precious metals opportunities across changing economic conditions.