Rare earth elements companies are at the forefront of a booming industry, driven by technological advancements and global demand. At Natural Resource Stocks, we’ve identified the top players and emerging contenders in this critical sector.

Our analysis covers industry leaders, promising newcomers, and the key factors propelling growth in rare earth elements. We’ll explore how these companies are positioning themselves to meet the increasing needs of electric vehicle manufacturers, renewable energy producers, and other high-tech industries.

Leading Rare Earth Elements Companies

The rare earth elements (REE) market is controlled by a select group of key players who have established themselves as industry leaders. These companies spearhead the extraction, processing, and supply of these critical materials.

MP Materials: America’s REE Powerhouse

MP Materials Corp (NYSE: MP) stands out as the largest rare earth elements producer in the Western Hemisphere. The company operates the Mountain Pass mine in California, the only scaled rare earth production site in North America.

MP Materials aims to become a one-stop shop for rare earth magnets through vertical integration. In April 2024, MP was awarded $58.5-million under a competitive solicitation program administered by the Department of Energy for advancing rare earth processing capabilities. This strategic move allows MP Materials to capture a larger portion of the value chain and reduce U.S. dependence on Chinese imports.

Lynas Rare Earths: Australia’s REE Giant

Lynas Rare Earths Ltd (ASX: LYC) holds the title of the largest rare earth producer outside of China. The company operates the Mt. Weld mine in Western Australia and a processing facility in Malaysia. Lynas continues to expand its operations, with plans to increase its production capacity in the coming years.

In a significant development, Lynas secured a $120 million contract from the U.S. Department of Defense in 2024 to construct a heavy rare earths separation facility in Texas. This move aligns with the U.S. government’s strategy to diversify its rare earth supply chain away from China (a move that could potentially benefit companies like Natural Resource Stocks).

Neo Performance Materials: A Global REE Processor

Neo Performance Materials Inc (TSX: NEO) leads global innovation and manufacturing of rare earth and rare metal-based functional materials. While not a miner, Neo plays a vital role in the REE supply chain by processing rare earth materials into high-value, advanced industrial materials.

The company operates facilities in 10 countries, including China, Thailand, Germany, and Canada. In 2024, Neo announced a joint venture with Energy Fuels Inc. to produce rare earth products from monazite sands in the U.S., further diversifying the global rare earth supply chain.

China Northern Rare Earth Group: The Chinese Titan

China Northern Rare Earth Group High-Tech Co Ltd (SHA: 600111) reigns as the world’s largest rare earth producer and processor. The company controls the Bayan Obo mining district in Inner Mongolia, China, which contains an estimated 70% of the world’s known rare earth reserves.

China Northern Rare Earth Group’s dominance in the market underscores China’s control over the global rare earth supply chain, a fact that has sparked geopolitical tension and driven other countries to develop alternative sources.

As we shift our focus to emerging players in the rare earth elements market, it’s clear that the industry landscape is evolving rapidly. New entrants are challenging the status quo and bringing innovative approaches to REE extraction and processing.

Rising Stars in the Rare Earth Elements Market

The rare earth elements (REE) market welcomes new players who challenge the status quo and introduce innovative approaches to extraction and processing. These companies position themselves to capitalize on the growing demand for REEs across various industries.

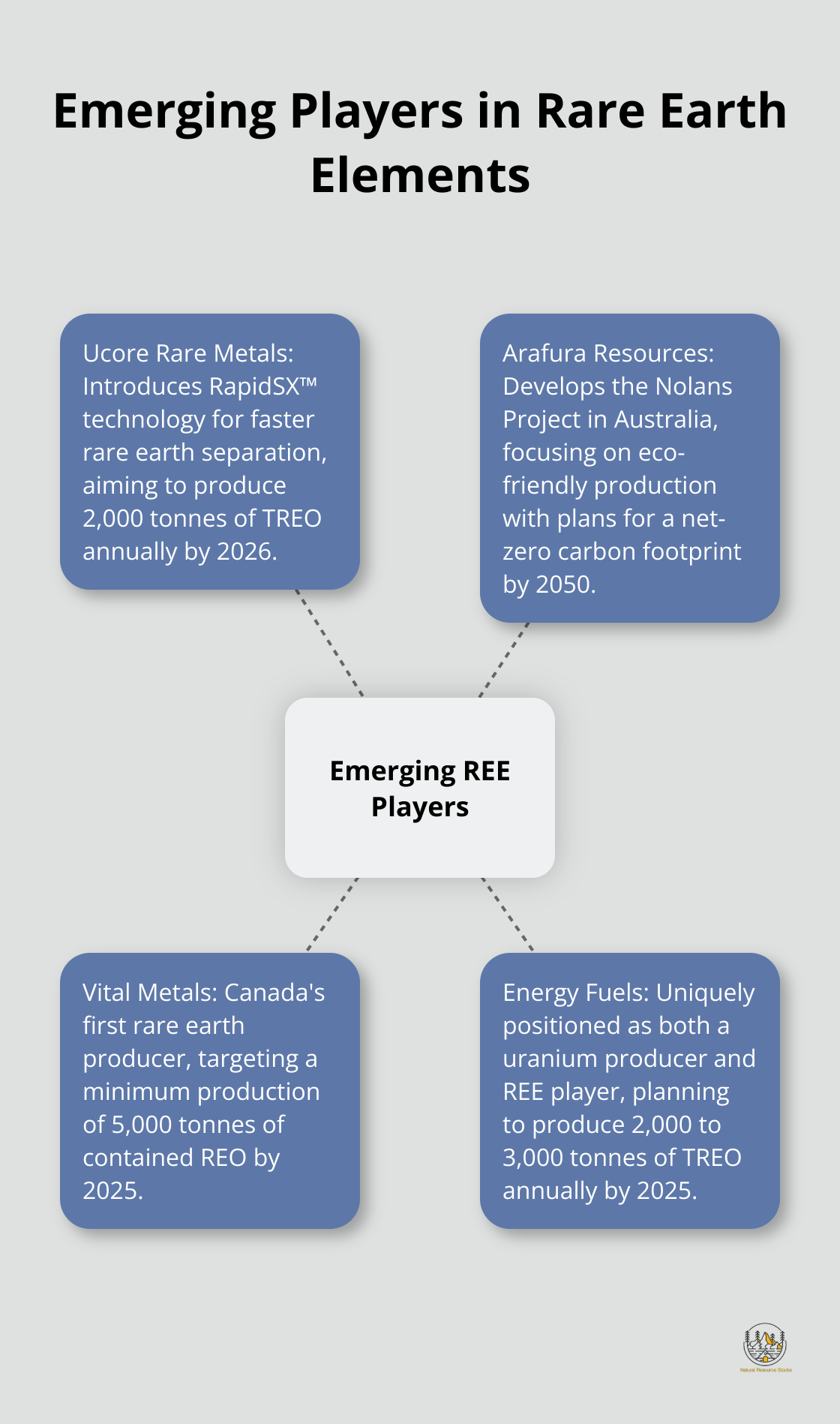

Ucore Rare Metals: Revolutionary Separation Technology

Ucore Rare Metals Inc (TSXV: UCU) introduces its RapidSX™ technology, a groundbreaking rare earth separation process. This technology delivers 3X faster chemical reactions compared to traditional methods. Ucore’s Strategic Metals Complex (SMC) in Alaska plans to produce 2,000 tonnes per year of total rare earth oxides (TREO) by 2026, potentially decreasing North America’s reliance on Chinese imports.

Arafura Resources: Eco-Friendly REE Production

Arafura Resources Limited (ASX: ARU) develops the Nolans Project in Australia’s Northern Territory. The project will produce 4,440 tonnes of NdPr oxide annually, essential for permanent magnets in electric vehicles and wind turbines. Arafura’s commitment to sustainability (including plans for a net-zero carbon footprint by 2050) distinguishes it in the industry.

Vital Metals: Canada’s REE Pioneer

Vital Metals Limited (ASX: VML) achieves a significant milestone as Canada’s first rare earth producer. The company’s Nechalacho project in the Northwest Territories started production in 2021, focusing on bastnaesite ore (rich in light rare earth elements). Vital Metals targets a minimum production of 5,000 tonnes of contained REO by 2025, contributing to the diversification of the global REE supply chain.

Energy Fuels: Dual Focus on Uranium and REEs

Energy Fuels Inc (NYSE: UUUU) uniquely positions itself as both a uranium producer and an emerging player in the REE market. The company’s White Mesa Mill in Utah now produces mixed rare earth carbonate from monazite sands. Energy Fuels plans to produce approximately 2,000 to 3,000 tonnes of total rare earth oxides (TREO) per year by 2025, concentrating on both light and heavy rare earths.

These emerging players expand the REE market and drive innovation in extraction and processing techniques. Their efforts prove vital in diversifying the global REE supply chain and reducing dependence on Chinese production.

Investors should conduct thorough due diligence before making investment decisions. Platforms like Natural Resource Stocks offer valuable insights and analysis to help investors navigate the complex REE market landscape.

The rise of these new players signals a shift in the REE industry, with a focus on sustainability, technological innovation, and supply chain diversification. As demand for REEs continues to grow, these companies stand ready to play a significant role in shaping the future of the market. The next section will explore the key factors driving growth in the rare earth elements sector.

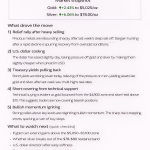

What’s Fueling the Rare Earth Elements Boom?

The rare earth elements (REE) sector experiences unprecedented growth, driven by technological advancements, geopolitical shifts, and increasing demand across multiple industries. This surge reshapes the landscape for REE companies and creates new opportunities for investors.

Electric Vehicles and Green Energy Revolution

The rare earth minerals market is witnessing significant growth due to rising demand across electric vehicles, renewable energy, and consumer electronics. This increasing demand is driving the expansion of the REE sector and creating new opportunities for companies in the industry.

Geopolitical Tensions and Supply Chain Diversification

China’s dominance in the rare earth market and geopolitical tensions are driving global efforts to diversify rare earth supply chains. This shift is creating new opportunities for companies outside of China and prompting governments worldwide to invest in alternative supply sources.

Technological Advancements in REE Processing

Innovations in extraction and processing technologies make rare earth production more efficient and environmentally friendly. Ucore Rare Metals’ RapidSX™ technology reduces separation times by up to 75% compared to traditional methods. This advancement not only increases production capacity but also lowers costs, potentially making previously uneconomical deposits viable.

Another example is the development of bio-leaching techniques by researchers at Purdue University, which use bacteria to extract rare earth elements from electronic waste. This method could recover up to 80% of REEs from discarded electronics, addressing both supply concerns and environmental issues.

These technological breakthroughs open new avenues for REE companies to expand their operations and improve profitability. Investors should keep an eye on companies at the forefront of these innovations, as they may gain a significant competitive advantage in the coming years.

Final Thoughts

The rare earth elements sector transforms as established leaders and innovative newcomers shape its future. MP Materials, Lynas Rare Earths, and other major players dominate the market, while companies like Ucore Rare Metals and Arafura Resources diversify the global supply chain. The surge in demand for electric vehicles and renewable energy technologies creates an unprecedented need for these critical materials.

Geopolitical tensions and the desire to reduce dependence on Chinese supplies spur government initiatives worldwide. These efforts foster the development of alternative sources and present compelling investment opportunities in rare earth elements companies. Technological advancements in extraction and processing methods make production more efficient and environmentally friendly, opening up new possibilities for the industry.

Natural Resource Stocks offers valuable insights and analysis for investors seeking to navigate the intricate world of rare earth elements. Our platform provides expert commentary on market trends, geopolitical factors, and emerging opportunities in the rare earth elements sector (including companies of various sizes). Investors can make informed decisions in this dynamic market with the right information and guidance.